Business

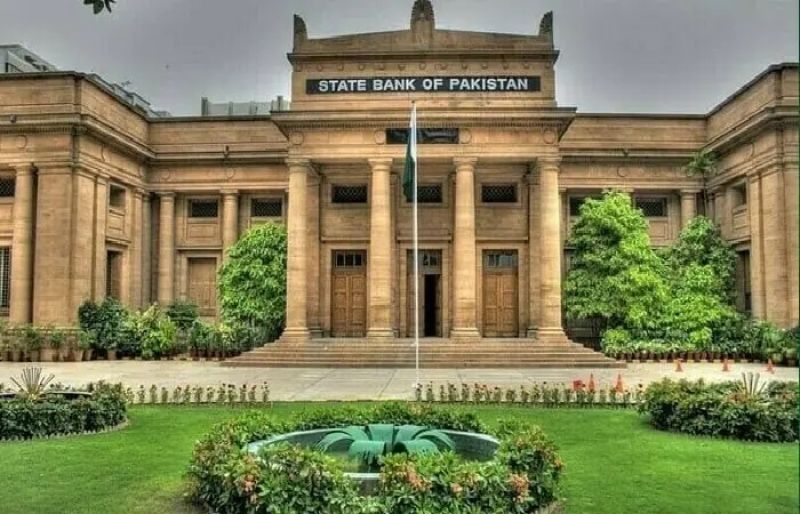

SBP maintains key policy rate at 11% – SUCH TV

The State Bank of Pakistan’s Monetary Policy Committee (MPC) on Monday kept the policy rate unchanged at 11%, extending a pause in monetary easing for a fourth consecutive meeting.

The central bank had earlier reduced the policy rate by 1 percentage point to 11% on May 5, 2025.

Outlook improves but risks linger

The MPC noted that headline inflation rose to 5.6% in September from 3.0% in August, while core inflation remained at 7.3%. The Committee assessed that flood damage to the broader economy has been smaller than previously feared, with crop losses likely contained, minimal supply disruptions, and high-frequency indicators showing firmer momentum.

With the earlier reduction still transmitting through the economy, the MPC judged the real policy rate “adequately positive” to guide inflation toward the 5–7% medium-term target, even as risks persist from volatile global commodities, evolving tariff dynamics that could challenge exports, and potential domestic food-supply frictions.

Since the last meeting, several developments have shaped the outlook. The Pakistan Bureau of Statistics (PBS) revised the Fiscal Year 2025 (FY25) gross domestic product (GDP) growth to 3.0% from 2.7%. Initial estimates for major Kharif crops remained close to last year’s production despite floods. Notably, the State Bank of Pakistan (SBP) foreign exchange (FX) reserves continued to increase even after repayment of a $500 million Eurobond.

Pakistan reached a staff-level agreement with the International Monetary Fund (IMF) on reviews of the Extended Fund Facility (EFF) and the Resilience and Sustainability Facility (RSF).

Meanwhile, inflation expectations of consumers and businesses softened in the latest State Bank of Pakistan–Institute of Business Administration (SBP–IBA) sentiment surveys, while global commodity prices showed mixed trends and heightened oil volatility.

Reserves build as growth momentum forms

Recent high-frequency indicators point to sustained growth momentum, the statement noted. Major Kharif estimates turned out better than expected, corroborated by satellite imagery showing healthier vegetation. Improved input conditions and an expected post-flood yield uptick support better prospects for Rabi crops.

In industry, Large-Scale Manufacturing (LSM) expanded 4.4% year-on-year in July–August Fiscal Year 2026 (FY26), versus a marginal contraction a year earlier.

Stronger sales of automobiles, cement, fertilisers and petroleum, oil and lubricants (POL) products, alongside firmer private-sector credit and improved business sentiment, have lifted the industrial outlook, with spillovers expected into services. On current trends, real GDP growth is now assessed to be in the upper half of the previously projected 3.25%–4.25% range.

The current account (CA) recorded a $110 million surplus in September 2025, limiting the first quarter (Q1) of FY26 deficit to $594 million, broadly in line with expectations. Exports continued to grow moderately, while faster-rising imports widened the trade gap; workers’ remittances remained resilient.

Together with net financial inflows, this lifted SBP FX reserves to $14.5 billion as of October 17. Looking ahead, imports are likely to gain traction with activity, though flood-related import needs seem lower than earlier assumed, and the outlook for remittances has improved.

Overall, the current account deficit (CAD) is projected at 0–1% of GDP in FY26, with FX reserves expected to reach $15.5 billion by December 2025 and around $17.8 billion by June 2026, assuming planned official inflows.

In Q1-FY26, tax collection grew 12.5% year-on-year to Rs2.9 trillion, Rs198 billion below target. Higher SBP profit transfers and Petroleum Development Levy (PDL) receipts should bolster non-tax revenue, according to the statement.

Both the overall balance and the primary balance are likely to post surpluses for the quarter. The MPC expects post-flood rehabilitation to be financed within budgeted resources and reiterated the need for continued fiscal discipline to meet balance targets and secure long-term sustainability.

Broad money (M2) growth decelerated to 12.3% as of October 10, driven by a decline in the banking system’s net domestic assets, mainly due to sharply slower bank credit to non-bank financial institutions (NBFIs).

Net budgetary borrowing remained contained, creating space for the private sector: private-sector credit (PSC) growth rose to 17%, broad-based across working capital, fixed investment and consumer loans, with notable demand from textiles, telecommunications, chemicals, and wholesale/retail trade.

On the liability side, currency in circulation rose year-on-year while deposit growth decelerated, lifting the currency-to-deposit ratio (CDR) to 37.6% and keeping reserve money growth elevated.

The rise in headline inflation to 5.6% in September reflected flood-related food price increases, an uptick in energy prices, and sticky core inflation. Unlike past flood episodes, the food-price surge appears milder than feared, with the Sensitive Price Indicator (SPI) showing slower increases in wheat and allied products, sugar, and perishables.

The MPC nevertheless expects inflation to exceed the 5–7% band for a few months in the second half (H2) of FY26 before reverting to the target range in FY27. Key risks cited by the MPC include global commodity volatility, the timing and magnitude of future energy-price adjustments, and uncertainty around prices of wheat and perishable food items.

Business

8th Pay Commission: Railways to trim costs to accommodate higher wages; maintenance, procurement, energy sectors in focus – The Times of India

Railways is implementing focused cost-cutting initiatives across maintenance, procurement and energy sectors to fortify its financial position before dealing with increased wage expenses anticipated from the Eighth Pay Commission recommendations.Established in January 2024, the Eighth Pay Commission must submit its recommendations within an 18-month timeframe.The previous Seventh Pay Commission led to wage increases of 14-26% for railway staff. Its implementation began in 2016, with tenure concluding in January 2026. The national transporter is currently emphasising expense reduction to enhance operational efficiency over the next two years to prevent financial strain from the forthcoming recommendations.The Seventh Pay Commission increased the wage expenditure by Rs 22,000 crore, including salaries and pensions, whilst the current projection suggests a potential rise of Rs 30,000 crore. “We have planned for the additional fund requirement,” a senior official told Economic Times, stating that internal accruals, combined with projected savings and increased freight revenue, would cover the expenses.Indian Railways recorded an operating ratio (OR) of 98.90% in fiscal 2024-25, resulting in net revenue of Rs 1,341.31 crore. For fiscal 2025-26, the target OR is 98.43% with anticipated net revenue of Rs 3041.31 crore.Officials anticipate annual energy savings of Rs 5,000 crore following network electrification completion.Additionally, yearly payments to Indian Railway Finance Corporation (IRFC) are expected to decrease in fiscal 2027-28, as recent capital expenditure has been funded through gross budgetary support (GBS).Officials confirm no plans for new short-term borrowing. “Annual freight earnings will also rise by Rs 15,000 crore when higher wages need to be paid in 2027-28,” the official stated.The Seventh Pay Commission implemented a 2.57 fitment factor, raising minimum basic pay from Rs 7,000 to Rs 17,990. Central trade unions advocate for a 2.86 fitment factor for the Eighth Pay Commission, potentially increasing the national transporter’s wage bill by over 22%.“Railways will ensure its finances are in a good condition to absorb the hit. Funds would not be an issue,” the official confirmed.The Railways has allocated Rs 1.28 lakh crore for staff costs in 2025-26, increased from Rs 1.17 lakh crore in 2024-25. Additionally, Rs 68,602.69 crore is earmarked for the pension fund in FY26, up from Rs 66,358.69 crore in FY25.

Business

Gold, Silver Prices Jump Sharply This Week; Yellow Metal Surges By Rs 4,000

New Delhi: Gold and silver prices witnessed a sharp surge in the domestic market this week, tracking strong gains in global bullion markets. Gold prices rose by around Rs 4,000 per 10 grams, while silver prices jumped by nearly Rs 17,000 per kilogram. According to data from the India Bullion and Jewellers Association (IBJA), the price of 24-karat gold increased by Rs 4,188 to Rs 1,32,710 per 10 grams, compared to Rs 1,28,592 a week ago.

The price of 22-karat gold climbed to Rs 1,21,562 per 10 grams from Rs 1,17,777, while 18-karat gold rose to Rs 99,533 per 10 grams from Rs 96,444. Silver prices outperformed gold, registering a sharper weekly rise. The price of silver surged by Rs 16,970 to Rs 1,95,180 per kilogram, up from Rs 1,78,210 per kilogram a week earlier.

Earlier on Friday, Silver touched the Rs 2 lakh mark to hit an all-time high of Rs 2,013,88 per kilogram on the Multi-Commodity Exchange (MCX) during the intraday trade. The price of the future contract expiring on March 5, 2026, rose over Rs 2,400 during the day before settling at Rs 2,00462, up Rs 1,520 against the previous session’s closing of Rs 1,98,942.

“Gold and silver ETFs have been quiet heroes of the year, delivering standout returns even as equity markets saw bouts of volatility. Silver, especially, stole the spotlight — a rare combination of booming industrial demand from solar, EVs and electronics, alongside tightening global supply, pushed prices sharply higher,” said Nikunj Saraf, CEO, Choice Wealth.

Gold too held its ground and climbed steadily, supported by persistent central-bank buying and investors seeking safety amid geopolitical and inflation worries, he added. The gold future contract expiring on February 5 surged 1.87 per cent to close at Rs 1,34,948 per 10 grams on MCX on Friday. In the retail market, the 24-carat gold price settled at Rs 132,710 per 10 grams, up over Rs 4,600 from the previous day’s closing of Rs 1,28,596 per 10 grams, according to the IBJA.

The rally in domestic bullion prices is largely driven by continued strength in international markets, with both precious metals hovering close to their all-time highs. On the COMEX, gold was trading at $4,328 per ounce, while silver stood at $62 per ounce.

Business

Nifty 50, Nifty Midcap 150 Emerge As Top Indices In November: Report

New Delhi: Nifty 50 and Nifty Midcap 150 emerged as best-performing indices in November, with a growth of 1.87 per cent and 1.59 per cent, respectively, a report said on Saturday. Meanwhile, Nifty 50 outperformed with a return of 7.27 per cent, 5.87 per cent, and 8.59 per cent over the last 3 months, 6 months, and 1-year period, respectively.

At the same time, the Nifty Midcap 150 continued to show steady traction with gains of 7.93 per cent, 6.01 per cent, and 7.12 per cent across the same 3-month, 6-month, and 1-year periods, Motilal Oswal Mutual Fund said in its report.

The broader market also delivered healthy gains, with the Nifty 500 gaining 0.94 per cent in the previous month, with large and midcap stocks up about 1-2 per cent and smallcaps corrected by around 1-3 per cent. Over the last 3 months, 6 months, and 1 year, the index has consecutively given positive returns of 6.55 per cent, 4.96 per cent and 5.94 per cent, the report noted.

The Nifty Smallcap 250 Index showed mixed momentum, declining 3.36 per cent during the month, while recording a moderate 1.37 per cent gain over the past 3 months. However, returns remained subdued over longer periods, with the index slipping 0.60 per cent over 6 months and 5.55 per cent over the 1-year horizon.

The Nifty Microcap 250 Index also reflected volatility, registering a 2.83 per cent decline in November. According to the report, the Nifty Next 50 Index ended the month with a marginal decline of 0.98 per cent but maintained positive momentum over the medium term with gains of 5.16 over 3 months and 3.56 per cent over 6 months, while delivering −2.25 per cent over the 1 year.

Sector performance remained mixed with IT delivering an increase of 4.74 per cent, Auto 3.60 per cent, Banks 3.42 per cent and Healthcare 2.30 per cent in November. The Defence sector delivered the strongest annual performance with an impressive 19.43 per cent return, emerging as the best-performing segment over the year.

The Auto sector followed closely at 18.85 per cent, the Banking sector also posted a healthy 14.79 per cent gain, and Metals also recorded a strong 13.94 per cent. Healthcare generated 6.40 per cent, indicating steady but moderate expansion.

Realty, on the other hand, slipped further by 4.69 per cent in November and 11.47 per cent in the past year. The broader trend shows a 1–4 per cent decline across these segments during November, reflecting sector-specific pressures and profit-taking after earlier rallies, the report highlighted.

-

Politics6 days ago

Politics6 days agoThailand launches air strikes against Cambodian military: army

-

Sports1 week ago

Sports1 week agoAustralia take control of second Ashes Test | The Express Tribune

-

Fashion6 days ago

Fashion6 days agoGermany’s LuxExperience appoints Francis Belin as new CEO of Mytheresa

-

Politics7 days ago

Politics7 days ago17 found dead in migrant vessel off Crete: coastguard

-

Politics6 days ago

Politics6 days agoZelenskiy says Ukraine’s peace talks with US constructive but not easy

-

Tech1 week ago

Tech1 week agoWIRED Roundup: DOGE Isn’t Dead, Facebook Dating Is Real, and Amazon’s AI Ambitions

-

Business1 week ago

Business1 week agoNetflix to buy Warner Bros. film and streaming assets in $72 billion deal

-

Business3 days ago

Business3 days agoRivian turns to AI, autonomy to woo investors as EV sales stall