Business

Silver prices soar! White metal adds over Rs 85,000 so far in 2026; is it the right time to buy? – The Times of India

Silver made a stellar debut in 2026, soaring over 35%, or nearly Rs 85,000 per kg, investors rush towards the precious metal amid tightening supplies and escalating geopolitical tensions involving the US, Iran and Greenland. The white metal’s momentum further strengthened after MCX silver futures decisively crossed the Rs 3 lakh per kg milestone. During the latest trading session, prices advanced by more than 2.5%, rising nearly Rs 8,000 to settle at Rs 3,19,949 per kg. The fresh uptick followed renewed strains between the US and the European Union after US President Donald Trump threatened to acquire Greenland and impose punitive tariffs on Europe. Here’s what experts are sayingAamir Makda, commodity and currency analyst at Choice Broking, told ET, “silver at $94 per troy ounce, a level once considered unthinkable, is driven by a “perfect storm” of industrial scarcity and geopolitical shifts. Looking at Technical charts, we are expecting further upward momentum in Silver and immediate support would be at 20-DEMA level placed at Rs 255,100,” Makda, however, flagged early signs of fatigue in the rally. “Although in recent sessions, with a price up move, a bearish RSI divergence has emerged, and it is a classic “Red flag” warning,” he said, explaining that while prices are making new highs, the underlying momentum is weakening. He also highlighted a drop in open interest to 9,850 lots in the March contract, even as prices climbed, indicating long unwinding in silver. Traders holding long positions, he said, should consider booking profits at current levels. Jigar Trivedi, senior analyst at Reliance Securities, said the market may now enter a phase of time-based consolidation. While he acknowledged the possibility of near-term consolidation, Trivedi said the prevailing political and geopolitical environment could still push prices higher, potentially towards the psychological level of $100 per ounce. He noted that the broader international trend remains firmly bullish, though the risk–reward equation currently stands evenly balanced at 1:1 after the sharp rise over the past 13–14 months. In rupee terms, he identified Rs 3,30,000 per kg as the next important resistance. From an investment lens, the recent breakout is being seen as part of a longer-term structural trend rather than a short-lived spike. Justin Khoo, Senior Market Analyst at VT Market, said the move is supported by supply constraints and strong industrial demand, particularly from solar energy, electronics and electric vehicle segments. While elevated prices increase volatility, he said investors should focus on strategic positioning instead of chasing record highs. Tactical profit-taking may suit short-term traders, but for long-term investors, he said silver continues to act as a hedge against inflation and market uncertainty. Khoo added that the broader approach should be to buy on meaningful declines while maintaining core holdings, with risk management remaining central. Although the trend still points to further upside, disciplined entry and exit strategies are increasingly important at current levels. Akshat Garg, head of research and product at Choice Wealth, said new investors could consider silver ETFs as part of a diversified multi-asset portfolio to tap into the metal’s structural strengths. Existing investors, he said, should avoid exiting at current levels, as the underlying support remains intact.Garg further added citing experts that new investors should allocate 5–10% to silver and gold ETFs within a broader portfolio, viewing the exposure as diversification rather than a momentum-driven trade. Existing holders, he said, should remain invested through volatility, as institutional flows, ETF participation and long-term fundamentals continue to provide support through 2026. Analysts also point to silver’s dual identity as both a monetary hedge and an industrial commodity. With more than half of demand now coming from sectors such as solar power, electric vehicles, data centres and electrification, and with supply constrained by limited mine output and recycling, the market remains tight. This structure, they say, positions silver to potentially outperform gold during growth phases while still offering protection during volatile periods.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Bank of England must ‘be very alert’ to Trump tensions, says governor

The governor of the Bank of England has said the central bank has “to be very alert” to the potential impact from heightened geopolitical tensions as President Donald Trump seeks to seize control of Greenland.

Andrew Bailey told MPs at Parliament’s Treasury Committee that the tensions would have consequences for global financial stability.

However, he highlighted that the Bank believes global financial markets have been “more muted” in response to Mr Trump’s plans and his threats to hit opposing countries with tariffs.

Earlier this week, the President said the UK and other countries pushing back would face 10% tariffs on all products from next month, with this to increase to 25% from June 1, until a deal is reached for Washington to purchase Greenland.

On Tuesday, Mr Bailey said: “The level of geopolitical uncertainty and geopolitical issues is a big consideration because they can have financial stability consequences.

“Let me put that in a bit of context in two respects. One, having said that, growth in the world economy was a lot more stable than we thought it would be.

“The second point is about financial markets and is a fairly similar point, that we worry considerably about how markets react to those things.

“Market reactions have actually been more muted than we would have feared and expected.

“Overriding those points, I take neither of those as a point of assurance. We have to be very alert to these things.”

Financial markets have been weaker so far this week as investors and traders digest Mr Trump’s tariff threats, which would cause further trade disruption.

The FTSE 100 Index dropped by around 120 points soon after opening on Tuesday, falling by 1.2% to 10,075 points.

This followed a 0.4% fall on Monday while Germany’s Dax and France’s Cac 40 also slid in value.

Business

Global markets rattled as Trump issues Greenland threats

Global stock markets experienced significant declines as tensions escalated following Donald Trump’s renewed threats to acquire Greenland.

The FTSE 100 Index plunged over 120 points, shedding 1.3 per cent to reach 10068.4 shortly after opening on Tuesday, compounding a 0.4 per cent decline from Monday.

Across Europe, major indices also registered substantial losses, with Germany’s Dax down 1 per cent and France’s Cac 40 off 0.9 per cent in early trading, mirroring sharp overnight declines in Asia.

The controversy began on Saturday when Mr Trump threatened to impose tariffs of up to 25 per cent on nations, including the UK, that do not back his Greenland acquisition plans.

Mr Trump, who is en route to Davos, Switzerland, for the World Economic Forum, intensified his rhetoric concerning the acquisition of the Arctic territory.

Through a series of posts on his Truth Social platform overnight on Tuesday, he further articulated his desire to take over Greenland, a territory belonging to America’s Nato ally, Denmark.

US financial markets were closed on Monday for Martin Luther King Jr Day, but futures trading pointed to steep falls when equity trading reopens on Tuesday.

Gold prices soared to another new record as investors sought out the safe haven asset, hitting $4,728 (£3,507) per ounce during morning trading on Tuesday.

Kathleen Brooks, a research director at XTB, said: “What happens next for financial markets will ultimately depend on President Trump’s actions in the coming days.

“The president posted a picture of himself holding a US flag on Greenland, suggesting that the territory will be owned by the US this year.

“However, he also said that he will hold a Greenland meeting at Davos, after a good conversation with the Nato secretary general and former Dutch PM Mark Rutte.

“For now, Trump is sticking to his guns and said that there is ‘no going back’ on his Greenland pledge.

“Thus, the meeting in Davos later this week will be critical.”

Yields on UK Government bonds, also known as gilts, edged higher amid a wider sell-off as Japan’s government bonds plunged, triggered by news of a snap election to be held on 8 February.

The pound continued to rise against a weak US dollar, up 0.4 per cent at $1.348, but was 0.3 per cent lower at €1.15.

Business

Budget 2026: Why standard deduction should be hiked under the new income tax regime – explained – The Times of India

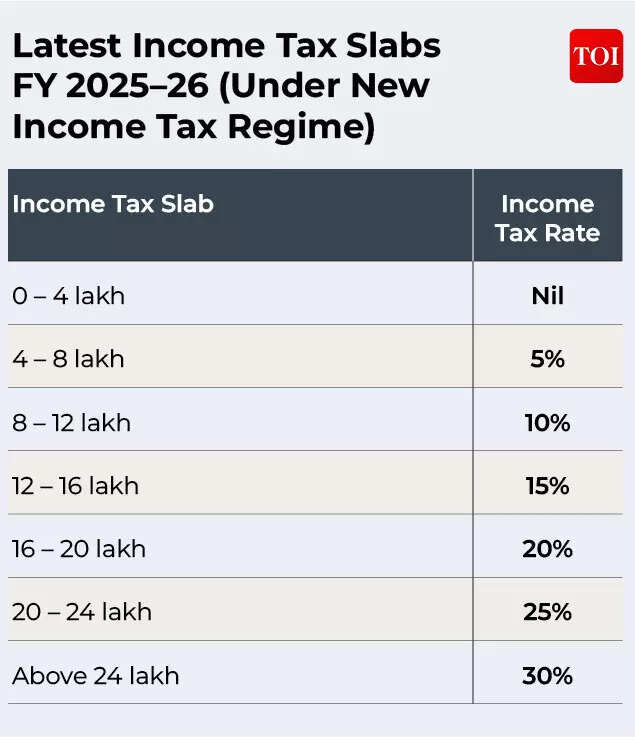

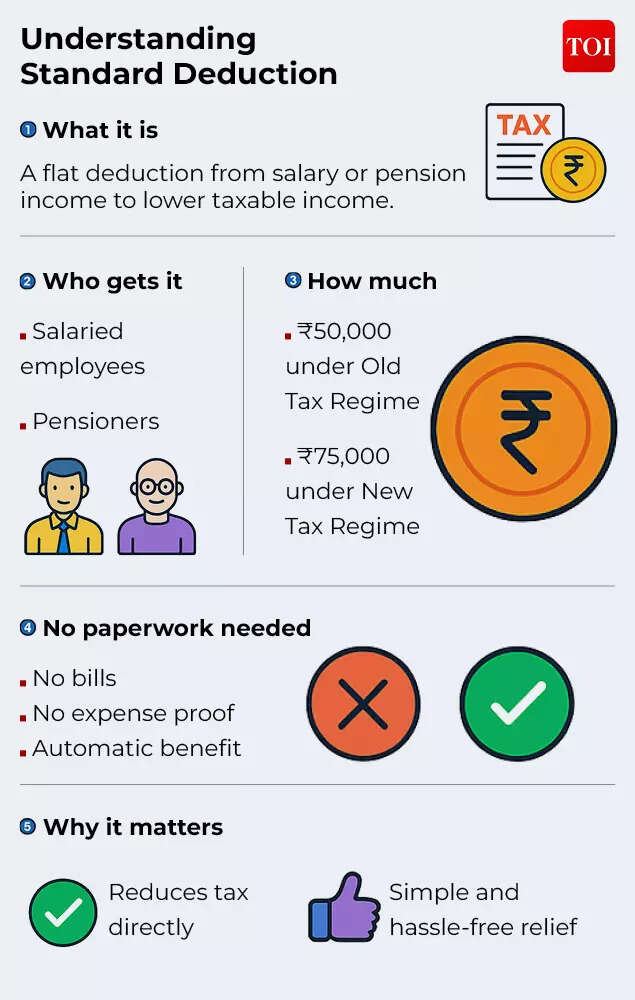

Budget 2026 income tax expectations: Standard deduction is seen as a much needed relief for taxpayers – it’s a simple, straightforward deduction from your gross income – a fixed amount that allows salaried taxpayers and pensioners to reduce their tax outgo.With the Union Budget 2026 set to be presented by Finance Minister Nirmala Sitharaman on February 1, taxpayers are wondering if this relief will see a hike, especially in the new income tax regime.The standard deduction limit varies depending on the tax regime that salaried taxpayers opt for: under the old income tax regime it has stayed at Rs 50,000 for several years, and under the new income tax regime it was hiked to Rs 75,000 in 2024. As the government pushes for the adoption of the new income tax regime, any major changes including those in standard deduction limits, are expected only in that regime.Over the last few years, several income tax slab and rate changes have been introduced in the new regime to make it more attractive for salaried individuals. Last year, FM Sitharaman made income up to Rs 12 lakh tax free (Rs 12.75 lakh for salaried taxpayers who get the benefit of Rs 75,000 standard deduction). As per government data, for FY 2023-24, 72% of taxpayers had opted for the new regime – a figure that will likely go up after last year’s tax relief under the new regime.

Latest Income Tax Slabs FY 2025–26 (Under New Income Tax Regime)

So, should the standard deduction limit be raised from Rs 75,000? Most tax experts surveyed by Times of India Online are of the view that a hike in standard deduction under the new income tax regime should be considered by the government.

Why Standard Deduction Should Be Hiked

The case for a hike in standard deduction limits is simple: the new income tax regime does not offer benefits of most deductions and exemptions that are available under the old income tax regime. Hiking this limit will push more people to opt to the clutter-free new income tax regime. Some experts also advocate linking standard deduction limits to inflation, hence ensuring that the limit is in line with the rising cost of living.Preeti Sharma, Partner – Tax and Regulatory Services at BDO India tells TOI, “Under the new tax regime, salaried taxpayers currently enjoy a standard deduction of Rs 75,000, raised from Rs 50,000 in Budget 2025. This increase has provided some relief, especially since most exemptions and deductions are not available under the new tax regime. However, rising inflation and higher day-to-day expenses have reduced the disposable income of salaried households. A further increase in the standard deduction would help employees manage these rising costs.”Radhika Viswanathan, Executive Director at Deloitte India sees a case for standard deduction to be hiked to as much as Rs 1.25 lakh!“There is a strong case for further enhancing the standard deduction under the new tax regime since no other major deductions or exemptions are available to the salaried class. While the current limit stands at Rs 75,000, the government could consider increasing it to Rs 1 lakh to 1.25 lakh. An increase would provide meaningful relief, support middle-class taxpayers, and preserve the simplicity of the regime without reintroducing multiple deduction-linked compliances,” she tells TOI.

What is Standard Deduction?

Chander Talreja, Partner, Vialto Partners makes an important point: introduction of new labour codes may reduce take home pay, and an increase in standard deduction may help offset that.“This Budget will focus on how to further accelerate adoption of the new personal tax regime by the taxpayers. On the one hand, the scope for further rationalization of tax slabs or the introduction of reduced tax rates and additional rebates is limited, as these were revised last year only. On the other hand, introducing new deductions or exemptions under the new personal tax regime may not be feasible, given that the regime is designed to operate without such provisions, and any deviation could dilute its core objective,” he says.According to Talreja, this effectively leaves the government with one viable option – enhancement of the standard deduction. The existing limit is Rs 75,000 under the new personal tax regime which may be increased by at least Rs 15,000 to address rising cost-of-living pressures.“Moreover, the said increase in standard deduction may also be crucial with the introduction of the new Labour Codes. With the definition of “Wages” the contribution towards provident fund may go up which may consequently reduce the take-home pay for individuals. Some relief in the form of increased standard deduction may help to offset this impact,” he says.Tanu Gupta, Partner at Mainstay Tax Advisors LLP also finds merit in increasing the standard deduction limit. “In last year’s Budget, the government revised the income tax slabs under the new tax regime and enhanced the rebate under Section 87A, effectively providing tax relief for income up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers). The objective was to increase disposable income, thereby boosting consumption. This was further supplemented during the year by reductions in GST on several items,” she tells TOI.However, the standard deduction, which was increased from Rs 50,000 to Rs 75,000 in Union Budget 2024 under the new tax regime, has since remained unchanged, she says. “There is merit in automatically adjusting this limit each year for inflation, in a manner similar to the government’s periodic revision of Dearness Allowance for its employees.Given the limited number of exemptions and deductions available under the new tax regime, such simplicity – combined with automatic inflation adjustment – would make the regime even more straightforward and taxpayer-friendly,” she adds.Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax at KPMG in India is also of the view that since salaried taxpayers do not have any avenue to claim deduction for increased cost of living / other expenses (unlike a person earning business income) there is an ongoing expectation that the standard deduction is enhanced periodically keeping in mind the rate of inflation prevailing in the economy.

Why the government may not hike standard deduction limit

However, some experts note that the government will have limited fiscal room to hike standard deduction after last year’s tax slab changes under the new income tax regime and sweeping GST rate cuts. There is also the rationale that the government may await data on how many taxpayers opt for the new tax regime as per FY 2025-26 slabs before looking to incentivise it further.Richa Sawhney, Partner, Tax at Grant Thornton Bharat explains that salaried taxpayers often feel that they end up paying more taxes than taxpayers with business income, due to limited avenues of deductions available from salary income.

Why Standard Deduction Should Be Hiked & Why It May Not Be

Standard deduction is one of the limited deductions available to salaried taxpayers, which aims to compensate them for employment‑related expenses, without requiring proof of claim. “Salaried taxpayers do feel that the current limit of Rs 75,000 is inadequate and a hike is surely on their budget wishlist . However, considering that the standard deduction was enhanced last year, increasing it further this year may not be feasible for the government. More-so, when the softening of gross non corporate tax collections is evident post the slab rate reforms carried out last year,” she says.Surabhi Marwah, Tax Partner, EY India also says that a further hike in the standard deduction appears unlikely in the near term. “In Budget 2024, the government increased the standard deduction under the new tax regime to Rs 75,000 for salaried taxpayers, while the old regime continues to offer Rs 50,000. This differential already provides a clear incentive for taxpayers to shift to the new regime,” she tells TOI.“With the Income-tax Act 2025 focusing on structural simplification, the priority now seems to be on wider adoption of the revised framework rather than introducing additional reliefs,” she adds.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment7 days ago

Entertainment7 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports5 days ago

Sports5 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business4 days ago

Business4 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Fashion3 days ago

Fashion3 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Tech5 days ago

Tech5 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Politics3 days ago

Politics3 days agoSaudi King Salman leaves hospital after medical tests

-

Tech6 days ago

Tech6 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI