Business

Swiggy Q2 Results: Net Loss Widens To Rs 1,092 Crore Vs Rs 626 Crore A Year Ago, Revenue Up 54%

Last Updated:

Swiggy Q2 Results: Its revenue from operations in July-September 2025 jumps 54.4% YoY to Rs 5,561 crore, compared with Rs 3,601 crore in the year-ago period.

Swiggy Q2 Results.

Swiggy Q2 Results: Food delivery major Swiggy on Thursday reported a 74.4% increase YoY in its net loss to Rs 1,092 crore for the second quarter ended September 30, 2025. However, its revenue from operations in July-September 2025 jumped 54.4% YoY to Rs 5,561 crore, compared with Rs 3,601 crore in the year-ago period. The revenue had stood at Rs 4,961 crore in the previous quarter.

Its net loss had stood at Rs 626 crore in the corresponding quarter last year, according to a regulatory filing.

The Bengaluru-based firm had reported a loss of Rs 1,197 crore in the previous quarter, as rapid expansion in its quick commerce vertical Instamart took a toll on the company’s bottom line.

Meanwhile, its total expenses increased nearly 56 per cent YoY to Rs 6,711 crore in the quarter ended September, up from Rs 4,309 crore a year ago and Rs 6,244 crore a quarter ago.

Shares of Swiggy on Thursday fell 0.2% to close at Rs 418 apiece on the NSE.

Meanwhile, Swiggy’s main rival Zomato posted a 63 per cent year-on-year (YoY) decline in quarterly profit at Rs 65 crore in the September quarter, while its revenue rose 183 per cent YoY to Rs 13,590 crore, as its quick commerce vertical Blinkit switched to an inventory ownership model.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

October 30, 2025, 16:46 IST

Read More

Business

WBD tells shareholders Netflix deal is superior to Paramount offer: ‘It was not a hard choice,’ chairman tells CNBC

The Paramount logo is displayed on the water tower at Paramount Studios on December 8, 2025 in Los Angeles, California.

Mario Tama | Getty Images

The Warner Bros. Discovery board on Wednesday said it unanimously recommended that WBD shareholders reject a takeover offer from Paramount Skydance and stick with a “superior” proposal from Netflix.

Last week, Paramount launched a hostile bid for WBD, taking a $30-per-share, all-cash offer directly to shareholders. Paramount Skydance CEO David Ellison has argued that the deal, which equates to an enterprise value of $108.4 billion, is better than Netflix’s and that a Paramount-WBD combination would have better chances of winning regulatory approval.

“Following a careful evaluation of Paramount’s recently launched tender offer, the Board concluded that the offer’s value is inadequate, with significant risks and costs imposed on our shareholders,” Samuel Di Piazza, chair of the Warner Bros. Discovery board, said in a news release. “We are confident that our merger with Netflix represents superior, more certain value for our shareholders and we look forward to delivering on the compelling benefits of our combination.”

The formal rejection, which was expected, potentially sets the stage for a new, higher bid from Paramount. Ellison told CNBC last week he had already informed WBD CEO David Zaslav that the $30-per-share bid isn’t the company’s “best and final” offer. Paramount can announce a new offer, aimed directly at shareholders, at any time.

If Paramount does up its bid, WBD signaled in its rejection it wants more of the funding to come directly from the Ellison family.

The WBD board noted the Paramount bid includes more than $40 billion of financing that is separate from the Ellison family despite Paramount claiming the funding has a “full backstop” from the family. On Tuesday, Jared Kushner’s Affinity Partners exited its involvement in the bid, which also includes roughly $24 billion from Gulf state sovereign wealth funds.

“Despite their own ample resources, as well as multiple assurances by PSKY during our strategic review process that such a commitment was forthcoming — the Ellison family has chosen not to backstop the PSKY offer,” the board said in a letter to shareholders.

Di Piazza told CNBC’s David Faber on “Squawk Box” on Wednesday that the board would have appreciated more involvement from Ellison’s father, billionaire Oracle co-founder Larry Ellison.

“We were not confident that one of the richest people in the world would be there at closing,” Di Piazza said. “Doing a deal is great; closing a deal is better.”

Netflix has proposed a cash-and-stock transaction for WBD’s streaming and studio assets, worth an equity value of $72 billion or enterprise value of roughly $83 billion, including debt. Under that deal, Warner Bros. Discovery’s portfolio of cable networks would be spun out into a separate entity.

“Netflix made a compelling offer — it was heavy in cash, certainty of close, a high termination fee, and they responded to the operating issues that we were concerned about,” Di Piazza told CNBC. “PSKY had every opportunity to deal with that broad range of issues, and they chose not to.”

WBD noted that Netflix’s bid had “no need for any equity financing and robust debt commitments,” given Netflix’s market valuation of more than $400 million.

“It was not a hard choice,” Di Piazza told CNBC.

He also dismissed antitrust questions surrounding both proposals: “Either of these deals can get done. Both of these deals will have to fight their way through the [Department of Justice].”

Di Piazza said the company will hold a shareholder vote in spring or early summer, though he said the date hasn’t been set.

Mario Gabelli, GAMCO Investors CEO and a WBD shareholder, told CNBC’s Becky Quick on Wednesday that while he was previously leaning toward the Paramount offer, “the most important part is to keep it in play,” hoping for more back-and-forth from both bidders.

Netflix on Wednesday said it “welcomes” the Warner Bros. Discovery board’s recommendation.

“This was a competitive process that delivered the best outcome for consumers, creators, stockholders and the broader entertainment industry,” Netflix co-CEO Ted Sarandos said in a statement. “Netflix and Warner Bros. complement each other, and we’re excited to combine our strengths with their theatrical film division, world-class television studio, and the iconic HBO brand, which will continue to focus on prestige television.”

Netflix co-CEO Greg Peters on Wednesday told CNBC the board’s recommendation sends “a pretty clear message.”

“Our deal structure is clean, it’s certain, we’re a scaled company … we’ve got strong investment-grade balance sheet,” Peters told “Squawk Box.”

He similarly dismissed antitrust questions, saying share of U.S. TV viewership is still competitive and that the audiences for Netflix and HBO Max streaming services are complementary.

Peters said if regulators were to take Netflix to court, it would fight for the deal: “We have a good case, and we believe that we should defend that case and make that case strongly.”

Business

Warner Bros Discovery urges shareholders to reject Paramount takeover bid

Warner Bros Discovery has told shareholders to reject a hostile takeover bid from rival Paramount Skydance.

It has pushed back against the approach and stressed it favours a deal from streaming giant Netflix to take control of its movie studios, cable networks and streaming service.

Bosses at Warner Bros, which makes franchises such as Harry Potter and Batman, said the proposed deal from Paramount was “inadequate” and poses a “significant risk” to shareholders.

Samuel Di Piazza Jr, chairman of the Warner Bros board of directors, said: “This offer once again fails to address key concerns that we have consistently communicated to Paramount throughout our extensive engagement and review of their six previous proposals.

“We are confident that our merger with Netflix represents superior, more certain value for our shareholders and we look forward to delivering on the compelling benefits of our combination.”

Paramount lodged a 30 US dollars (£22.50) a share bid for Warner Bros, days after the company agreed to be bought by Netflix in early December in a 72 billion dollar (£54 billion) deal.

Paramount’s offer values Warner Bros at 108.4 billion dollars (£81.3 billion) including debts, trumping Netflix’s 27.75 dollars (£20.81) per share offer, which values Warner Bros at 72 billion dollars or 82.7 billion dollars (£62 billion) including debts.

Netflix agreed to buy the Warner Bros Discovery film and TV studios business whereas Paramount has bid for the whole of Warner Bros.

Earlier on Wednesday, Affinity Partners, the private equity firm owned by US President Donald Trump’s son-in-law Jared Kushner, pulled its backing from Paramount’s bid.

Mr Trump previously warned the Netflix takeover of Warner Bros “could be a problem” because of its combined market share, confirming he would be involved in the decision about whether the US federal government should approve the deal.

Paramount said in its appeal to win over Warner Bros shareholders that its offer would be more likely to pass regulatory scrutiny.

Mr Kushner’s decision to pull his firm’s financial backing is seen as taking away a possible advantage for Paramount to secure Mr Trump’s approval.

Paramount’s bid still has the financial backing of wealth funds run by three governments in the Persian Gulf, widely reported as Saudi Arabia, Abu Dhabi and Qatar.

Paramount earlier revealed it had made six takeover approaches to Warner Bros over 12 weeks, but claimed Warner Bros “never engaged meaningfully”.

Business

Trump sanctions fail to dent flow? India’s oil imports from Russia top cross 1 million barrels a day; show resilience – The Times of India

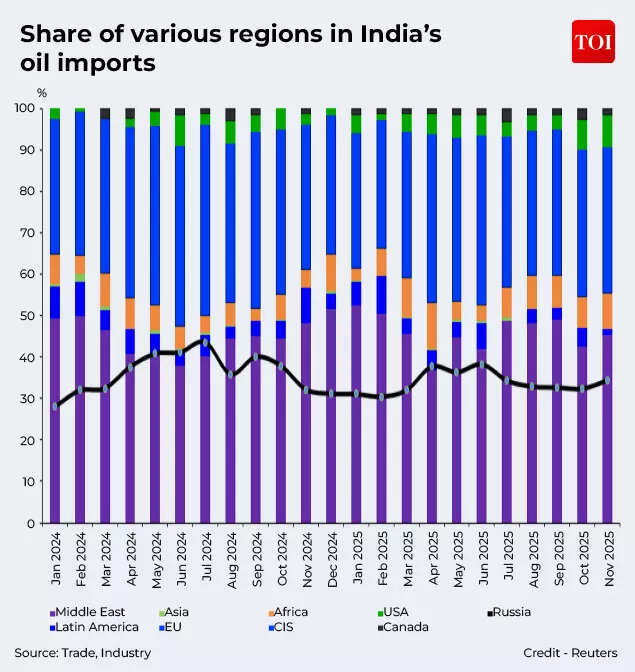

Donald Trump’s sanctions on Russian oil majors don’t seem to have deterred Indian refiners from procuring crude – though non-sanctioned – from Russia. India’s crude oil imports from Russia are showing resilience in December, days after Trump’s sanctions on Russian firms Lukoil and Rosneft kicked in. The bilateral relationship has remained robust despite Western sanctions pressure.India’s imports of Russian oil are expected to cross 1 million barrels per day this December, according to trade and refining sources quoted in a Reuters report. This is against expectations of a significant reduction, as refiners continue purchasing from non-sanctioned entities that provide deep discounts.

India-Russia Crude Oil Trade Intact

* Data from trade sources quoted in the report indicates that India, the world’s third-largest crude importer, received 1.77 million bpd of Russian oil in November, showing a 3.4% increase from October. * Despite expectations of a significant decrease due to Trump’s sanctions on two major Russian producers, December deliveries are anticipated to surpass 1.2 million bpd, based on initial LSEG trade flow data.

Russia continues to be top oil supplier to India

* This figure could reach an average of 1.5 million bpd by month-end, according to a trade source quoted in the report. It is important to note that the surge in India’s December imports from Russia is attributed to buyers rushing to complete transactions before Washington’s November 21 deadline for deals with Rosneft and Lukoil. LSEG data confirms recent arrivals of such shipments at Indian ports.* However, in January, trade sources indicate that import levels might maintain December volumes as new entities not affected by sanctions begin supplying Russian oil cargoes.* Indian refiners find January prices attractive, with discounts of approximately $6 per barrel to dated Brent, which is two to three times larger than in August, according to sources.According to refining sources, January volumes are expected to be below 1 million bpd since Reliance Industries has stopped purchases. LSEG data shows Reliance is receiving at least 10 Russian oil cargoes this month.

Share of various regions in India’s oil imports

Regarding state refiners, Indian Oil Corp maintains Russian oil purchases at pre-sanctions levels, sources told Reuters. Bharat Petroleum has increased its January acquisitions to at least six cargoes, up from two in December, whilst Hindustan Petroleum is negotiating January loadings, sources were quoted as saying.Private refiner Nayara Energy, with majority Russian ownership including Rosneft, exclusively purchases Russian oil after other suppliers withdrew following EU and British sanctions.Reliance and HPCL Mittal Energy have announced that they will not procure Russian oil. Additionally, Mangalore Refinery and Petrochemicals are not procuring Russian oil for January, the report said.India emerged as Russia’s primary seaborne crude purchaser following Western sanctions imposed on Moscow over the Ukraine invasion. However, these purchases became problematic during trade negotiations with the US, as President Donald Trump raised import tariffs on Indian products to 50%.“Thanks to President Trump’s leadership, Russia has been forced to accept deep discounts and fewer buyers for its oil,” a US official said. “These pressures are limiting the Kremlin’s revenues and increasing the financial strain of sustaining its war.”Russian producers are utilising domestic market swaps to maintain oil flows to India whilst adhering to sanctions. This involves exchanging oil intended for local refineries with export volumes handled by non-sanctioned companies, Reuters said.These swaps are a standard practice in Russia for managing domestic supply constraints whilst maintaining export obligations.“There is a possibility that non-sanctioned entities can increase their crude output and shift supplies to export markets and sanctioned barrels can meet Russia’s local demand,” said Prashant Vashisth, vice president at Moody’s affiliate ICRA.

-

Politics7 days ago

Politics7 days agoTrump launches gold card programme for expedited visas with a $1m price tag

-

Business7 days ago

Business7 days agoRivian turns to AI, autonomy to woo investors as EV sales stall

-

Business4 days ago

Business4 days agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Tech1 week ago

Tech1 week agoJennifer Lewis ScD ’91: “Can we make tissues that are made from you, for you?”

-

Sports7 days ago

Sports7 days agoPolice detain Michigan head football coach Sherrone Moore after firing, salacious details emerge: report

-

Tech7 days ago

Tech7 days agoGoogle DeepMind partners with UK government to deliver AI | Computer Weekly

-

Business7 days ago

Business7 days agoCoca-Cola taps COO Henrique Braun to replace James Quincey as CEO in 2026

-

Sports7 days ago

Sports7 days agoU.S. House passes bill to combat stadium drones