Business

The Credit Card ‘Swipe Trap’: 5 Hidden Financial Risks You Must Watch Out For

Last Updated:

Overspending on credit cards can hurt finances. Spending Rs 40,000 out of a Rs 50,000 limit may reduce credit score and even lead to a lower card limit

Spending must remain within limits, and expenses should be tracked using a budgeting app. (Representative/Shutterstock)

Credit and debit cards, often referred to as plastic money, have revolutionised the shopping experience, making it incredibly easy and convenient. Credit cards, in particular, allow consumers to purchase their favourite items instantly, even without sufficient funds in their accounts. However, this convenience comes with potential financial pitfalls. If not managed properly, credit cards can become a financial burden. Understanding these risks can help individuals avoid such traps.

High Interest Rates Can Trap You In Debt

One of the primary dangers of credit cards is the high interest rates.

- Consider the case of Rahul, who borrowed Rs 10,000 with the intention of repaying it the following month. However, with interest rates ranging between 18-36%, his debt ballooned to Rs 15,000 within six months, trapping him in a cycle of debt.

- This illustrates the danger of carrying an outstanding balance on a credit card, where high interest rates can turn a small debt into a substantial one.

- To avoid this, it is crucial to pay the full bill each month and prioritise clearing the card with the highest interest rate first. Additionally, opting for the EMI (Equated Monthly Installment) option, while checking the interest calculator, can be beneficial.

The Ghost Of Late Payments

- Late payments pose another significant risk, as they can negatively impact credit scores for up to seven years. This can affect not only the ability to secure loans but also job prospects and rental applications.

- Setting up auto-payment and calendar reminders can help avoid late payments. At the very least, paying the minimum amount on time is essential, though full payment is always preferable.

The Danger Of Overspending

- Overspending is a common issue with credit cards. For example, if the card limit is Rs 50,000 and Rs 40,000 is spent, it could lead to a reduced credit score and a lowered card limit.

- Spending more than 30% of the credit limit can label a person as ‘high risk’ to banks.

- To prevent this, it is advisable to follow the 30% rule, using budget apps and distinguishing between needs and wants.

The ‘Greed Trap’ Of Credit Card Rewards

- Many people end up shopping more than needed just to earn cashback. Rewards worth Rs 2,000 often lead to an extra spend of Rs 20,000.

- The lure of points, miles, or cashback creates an illusion of savings — when in reality, it’s overspending.

- To prevention this, rewards should be treated as a bonus, not a goal. Spending must remain within limits, and expenses should be tracked using a budgeting app.

The Hidden Ghost Of Secret Charges

- Credit cards often include hidden charges. For instance, Vikram used his card during an overseas trip and was shocked to see an additional bill of Rs 5,000 — comprising a 3% foreign transaction fee, annual fee, and late payment charge.

- Annual fees, overlimit penalties, and currency conversion costs are among the many charges that often go unnoticed.

- To prevent this, the fine print must be reviewed carefully before selecting a card. Monthly statements should be checked for unexplained charges, and opting for a no-fee card is advisable.

Follow These 3 Golden Credit Card Rules

To be a savvy credit card user, one should follow these three golden rules:

- Track every transaction with apps like Mint or PhonePe,

- Create an emergency fund instead of relying on credit cards,

- Stay informed about RBI guidelines, which cap interest rates at 36%. Smart usage is the key to avoiding financial pitfalls.

October 27, 2025, 17:22 IST

Read More

Business

‘Holistic And Forward-Looking’: Piyush Goyal Says Budget 2026 Reflects Future-Ready India

Last Updated:

Piyush Goyal termed the Budget “economically and fundamentally very strong”, and stated that it “reflects the aspirations of the youth of the country”.

Minister of Commerce and Industry Piyush Goyal. (File photo)

Union Minister Piyush Goyal on Sunday termed Budget 2026 “futuristic and holistic”, and stated that it “reflects the aspirations of the youth of the country and is forward-looking”.

Speaking exclusively to CNN-News18 on Budget 2026, presented by Finance Minister Nirmala Sitharaman, Goyal said, “This is a fabulous budget and it is very futuristic. The Budget 2026 has covered all sectors including technology, infrastructure, etc.”

“The technology sector has been given a thrust. The budget focuses on infrastructure. It is a holistic and forward-looking budget refecting future ready Bharat,” he said, adding, “The budget meets the aspirations of the youth and new India.”

Stating that the Budget is economically and fundamentally very strong, the Union Minister said, “Farmers, animal husbandry and labour-intensive sectors get a major push as this Budget focuses on investment, value addition and jobs.”

#Exclusive | “The Budget is economically and fundamentally very strong,”Preparing India for Viksit Bharat. Farmers, animal husbandry and labour-intensive sectors get a major push as the Budget focuses on investment, value addition and jobs.@Parikshitl in an exclusive… pic.twitter.com/tJr2SItcaW

— News18 (@CNNnews18) February 1, 2026

‘Budget 2026 Is Human-Centric’: PM Modi

Prime Minister Narendra Modi on Sunday said that the Union Budget 2026 is “human-centric and strengthens India’s foundation with path-breaking reforms.” The Prime Minister also described it as historic and a catalyst for accelerating the country’s reform trajectory and long-term growth.

Following the presentation of the Budget in Parliament, PM Modi said the proposals would energise the economy, empower citizens and give India’s youth fresh opportunities to scale new heights.

“This budget brings the dreams of the present to life and strengthens the foundation of India’s bright future. This budget is a strong foundation for our high-flying aspirations of a developed India by 2047,” he said.

Calling the government’s reform agenda a “Reform Express”, the Prime Minister added, “The reform express that India is riding today will gain new energy and new momentum from this budget.”

February 01, 2026, 19:01 IST

Read More

Business

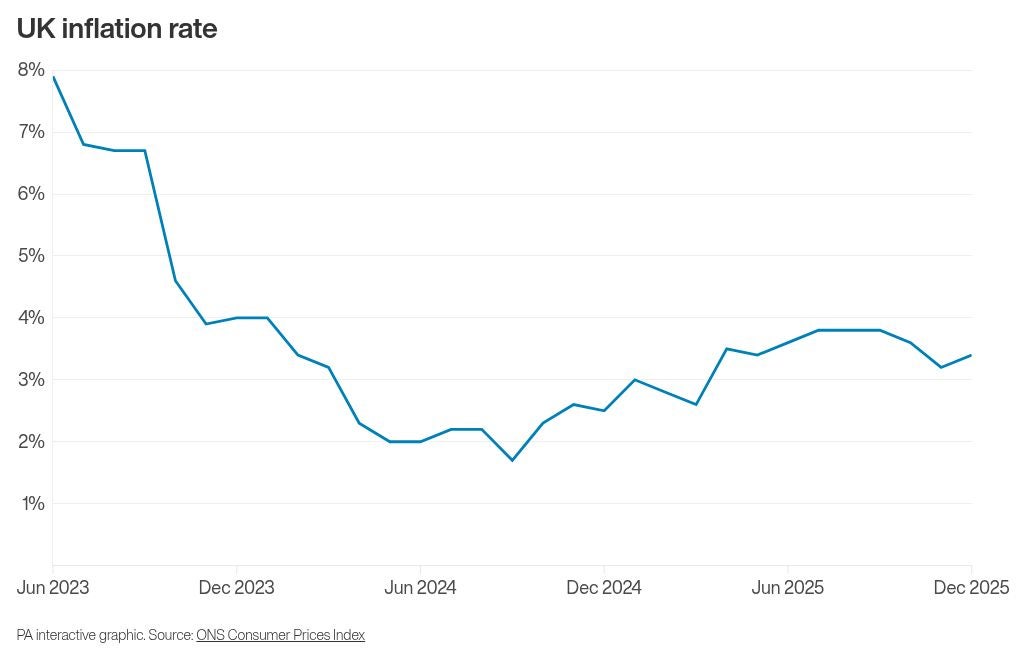

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns