Business

‘The next protein’: Fiber is shaping up to be the latest grocery obsession

Cases of Pepsi soda are displayed at a Costco Wholesale store on Nov. 13, 2025 in Simi Valley, California.

Kevin Carter | Getty Images

One of this year’s top food trends is facing some tough competition.

Protein captivated consumers and food companies in 2025, but fiber is increasingly stealing the scene as people place an increasing emphasis on promoting gut health.

It’s taken hold on social media, where “fibermaxxing” — or the concept of increasing fiber intake through whole foods like fruits and legumes — has seen thousands of posts.

“Fiber is finally getting a spotlight, which is a great thing because it’s a nutrient that people need,” said Stephanie Mattucci, principal strategist at food research company Mintel.

Currently, 90% of women and 97% of men in the U.S. are not meeting their daily fiber requirements, Mattucci said. For most Americans, that recommended range usually falls somewhere between 25 grams and 38 grams of fiber per day, she added.

But more people are beginning to take notice of those gaps.

According to Mattucci, 22% of consumers in the U.S. said high fiber content was one of their top three important factors when shopping for food — up from just 17% in 2021.

Wall Street’s companies are taking note, too. On an earnings call with analysts in October, PepsiCo CEO Ramon Laguarta said fiber was emerging at the forefront of the company’s product goals as it looked ahead to 2026.

“I think fiber will be the next protein,” Laguarta said. “Consumers are starting to understand that fiber is the benefit that they need. It’s actually an efficiency in U.S. consumers’ diets, and that will be elevated.”

In February, the company is going a step farther and plans to launch Smartfood Fiber Pop, featuring six grams of protein per serving, and SunChips Fiber, incorporating fiber variants like whole grains and black beans, Pepsi’s chief science officer, Tara Glasgow, told CNBC exclusively.

Smartfood Fiber Pop and Sun Chips Fiber snacks.

Source: Pepsico

And there’s a reason companies are broadening their offerings. Research firm Datassential found that fiber is on track to be the “next big health trend following on the heels of protein” in its 2026 trends report.

Of the consumers the firm surveyed, 54% said they are interested in foods and beverages that are high in fiber. That number is even higher — reaching 60% — among members of Generation Z, who are pioneering the “fibermaxxing” trend on social media.

And 42% of consumers said they believe the attribute of “high fiber” on a nutrition label of any food or beverage product is important to defining that product as “healthy,” according to Datassential.

It’s that momentum that landed fiber as one of Whole Foods Market’s top trends for 2026.

The gut health craze

Watching fiber intake isn’t new, experts note, but it’s often been associated with older people who require it for health reasons as they age.

“When I think of fiber, I immediately think of my grandfather. Every day, he had his little baggie of All-Bran, and he brought it everywhere he went, probably out of necessity,” Mintel’s Mattucci said, citing the slowing of digestive tracts as people age.

Still, something has shifted as consumers of all ages have started placing more emphasis on promoting gut health and digestive wellness — and fiber entered the spotlight.

The emphasis on diversity of fiber intake and finding it in everyday whole foods rather than through supplements or powders is part of what’s allowing it to find popularity and align with current culture, according to Angela Salas, a senior dietitian at the University of California, Davis.

The two types of fiber — soluble and insoluble — work together to keep people fuller for longer, improve digestion, and lower blood pressure and cholesterol, Salas said. In some ways, fiber could mimic the effects of weight-loss drugs because it takes longer to break down food and therefore sits in the stomach for longer, she said, which could be a factor for its recent popularity.

“These nutrients have always been around and always kind of shifts, I think, from the food industry saying, ‘What can we highlight? What do people want to be focusing on so that we can continue to sell the same product, just slightly altered?'” Salas said.

Still, Kate Pelletier, a registered dietitian nutritionist at the University of Michigan Health, said it’s important to note that fiber is not sufficient as an alternative to GLP-1 drugs, and a balanced plate is the best way to stay healthy.

Pelletier said fiber’s use as a “street sweeper” for the body is likely one of the reasons it’s been thrust back into the spotlight.

“There’s been a really big shift into more natural plants instead of popping a supplement or using a protein powder,” Pelletier said. “We can get the benefit of fiber from thinking about adding more wholesome foods into our diet, versus typical diet culture [which] focuses on taking out X, Y or Z.”

Promoting high-fiber products

Food and beverage companies are jumping on the momentum, too.

Earlier this year, Coca-Cola launched its prebiotic soda, Simply Pop, with six grams of prebiotic fiber in five flavors to encourage gut health. Nestlé unveiled a new protein shake in June with four grams of prebiotic fiber designed specifically to support the digestive health of adults on GLP-1 medications.

Other companies like Olipop have also entered the prebiotic soda market, boasting recipes that promote gut health, while smaller businesses, like Floura protein bars and Sola Bagels, have also begun selling fiber-rich products.

Olipop soda at a store in San Francisco, California, US, on Monday, March 17, 2025. Olipop Inc., the high-fiber, lower-sugar soda startup, raised $50 million in a Series C funding round at a valuation of $1.85 billion.

David Paul Morris | Bloomberg | Getty Images

Pepsi’s Glasgow told CNBC the company is taking every opportunity to explore consumers’ newfound interest in fiber. Glasgow said the research and development team’s work starts in science and follows trends to keep up with their audience’s evolving tastes.

Pepsi already has products on the market that specifically boast high fiber content, like its prebiotic cola and Quaker oatmeal. As consumers start to explore the previously “sleepy little nutrient,” Glasgow said, Pepsi is innovating new products across its beverages and food brands.

“We hear it from consumers as well that they’re becoming more knowledgeable about nutrition and their nutrition needs,” Glasgow said. “And I think that’s where the excitement is coming from. I feel it growing.”

Glasgow said the company, which already launched successful protein-packed products this year, is moving toward products that incorporate multiple sources of gut-healthy ingredients.

“We saw protein grow in a big way in the last couple years,” Glasgow said. “I think [consumers] are then expanding their view, and they realize there’s not one ingredient alone that is the silver bullet. It’s about getting the right ingredients all together.”

For some, fiber isn’t just a trend.

Naomi Aganekwu, a 27-year-old content creator, said she started incorporating fiber more intentionally into her diet last year. Now, she makes sure each meal she eats has at least five to 10 grams of fiber through foods like beans, lentils and chia seed puddings.

Aganekwu said she’s seeing results from incorporating fiber into her diet, like being satiated after meals and seeing her hormonal acne reduce. And as she’s championing fiber, she’s seeing the people around her do the same, especially among her generation.

It’s become personal for Aganekwu, too, whose father died earlier this year of colon cancer. Some research has shown fiber could prevent colorectal cancer in addition to promoting overall health, according to the National Institutes of Health.

“You don’t want to wait until you’re 60 or 70 and you’re dealing with more diagnoses,” she said. “There’s a lot that you can do, even just in your everyday choices, down to what you’re putting on your plate, that can directly impact your chances or decrease your chances of developing critical diseases.”

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

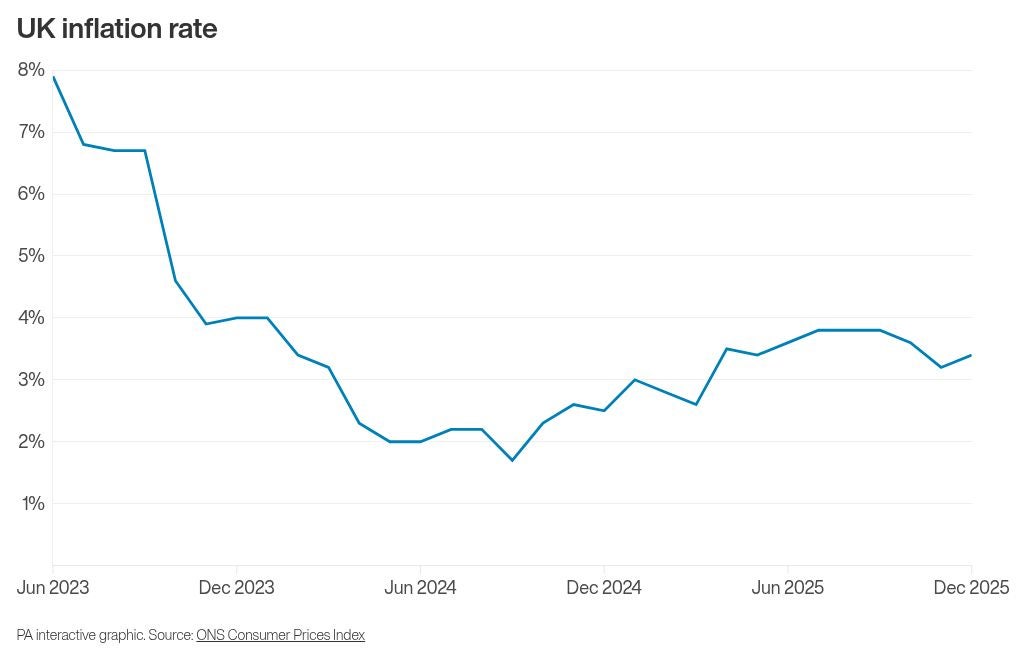

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’