Business

UK government borrowing lower than expected in July

Business reporter, BBC News

Getty Images

Getty ImagesUK government borrowing was lower than expected in July, following a rise in tax and National Insurance receipts.

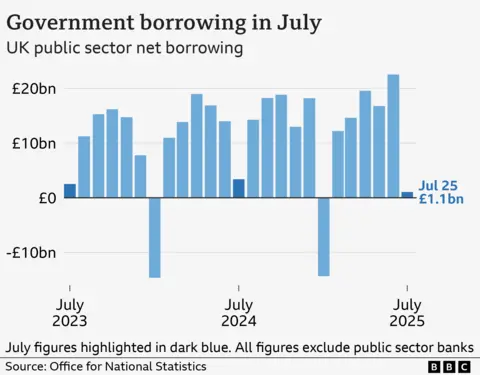

Borrowing – the difference between public spending and tax income – was £1.1bn in July, which was £2.3bn less than the same month last year, the Office for National Statistics (ONS) said.

It was the lowest July figure for three years, the ONS said, and was helped by a rise in self-assessed income tax payments.

Despite the lower-than-expected figure, analysts said the chancellor was still likely to have to raise taxes in the autumn Budget to meet her tax and spending rules.

Borrowing over the first four months of the financial year has now reached £60bn, the ONS said, which is up £6.7bn from the same period last year.

That total for the year so far is in line with what the Office for Budget Responsibility (OBR), the official independent forecaster, had predicted in March.

July saw income tax receipts rise by £4.5bn, the ONS said, and there was also an increase from National Insurance (NI) contributions. The rate of employers’ NI contributions was increased by the government in April.

Speaking to the BBC’s Today programme, Paul Dales, chief UK economist at Capital Economics, said the latest figures did not change the “predicament” Chancellor Rachel Reeves faces over what she will do in the Budget.

“We think she’s on track to miss her fiscal rule by something like £17bn which means she’ll need to raise that amount of money, or if she wants the same buffer against the fiscal rule as back in March of £10bn she might have to raise something like £27bn in the Budget, which is quite a big task.”

The chancellor is following two main self-imposed rules for government finances:

- day-to-day government costs will be paid for by tax income, rather than borrowing

- to get debt falling as a share of national income by the end of this parliament in 2029-30

Dennis Tatarkov, senior economist at KPMG UK, said the “longer-term picture for public finances remains challenging”.

“The coming Budget is likely to focus on addressing any potential shortfall against current fiscal targets, which we estimate at £26.2bn. However, the assessment of the shortfall crucially depends on changes to the OBR’s forecast.”

Darren Jones, Chief Secretary to the Treasury, said: “Far too much taxpayer money is spent on interest payments for the longstanding national debt.

“That’s why we’re driving down government borrowing over the course of the parliament – so working people don’t have to foot the bill and we can invest in better schools, hospitals, and services for working families.”

Business

Anthropic officially designated a supply chain risk by Pentagon

The supply chain risk designation of the artificial intelligence firm is a first for a US company.

Source link

Business

FDA official calls UniQure’s gene therapy a ‘failed’ treatment for Huntington’s disease

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

UniQure needs to run another study to prove that its gene therapy “actually helps people with Huntington’s disease,” a senior U.S. Food and Drug Administration official said on a call with reporters Thursday.

The official, who requested anonymity before discussing sensitive information, confirmed the agency has asked the company to run a placebo controlled trial of its treatment, which is administered directly into the brain. UniQure has said that type of study isn’t ethical because it would require putting people under general anesthesia for hours, a characterization the official disputed.

“So what is really going on? UniQure is the latest company to make a failed therapy for Huntington’s patients,” the official said. “They likely acknowledge or understand at some deep level that their trial failed years ago, and instead of doing the right thing and running the correct clinical study, UniQure is performing a distorted or manipulated comparison in the mind of FDA.”

The comments mark the latest development in a messy public spat between UniQure and the FDA, and as the agency comes under fire for a number of recent drug approval application rejections, including some where companies have accused it of going back on previous guidance. FDA Commissioner Marty Makary in an interview with CNBC’s Becky Quick last week seemingly criticized UniQure’s gene therapy for Huntington’s disease. Makary didn’t name UniQure but described its treatment.

UniQure then accused the FDA of reversing its stance that the company’s clinical trial data would be sufficient to seek approval. UniQure’s study used an outside database to measure how patients with Huntington’s disease might decline without treatment, known as an external control. UniQure has said it wouldn’t be feasible to run a true randomized, double-blind placebo-controlled study, considered the gold standard, because it wouldn’t be ethical to make people undergo a sham hours-long brain surgery.

The FDA official said the agency “never agreed to accept this distorted comparison” and the FDA “never makes such assurances.” Instead, the “FDA will always say, ‘Well, we have to see the data when we get it.'”

UniQure didn’t immediately comment.

The company’s stock rose more than 10% on Thursday and has fallen 58% this year as of Thursday afternoon.

Business

US mortgage rates rise to 6% after three-week slide as oil-driven bond yields climb – The Times of India

The average long-term US mortgage rate edged higher this week, ending a three-week decline as bond yields rose amid oil-price pressures linked to the war with Iran.The benchmark 30-year fixed mortgage rate increased to 6% from 5.98% last week, mortgage buyer Freddie Mac said on Thursday. A year ago, the average rate stood at 6.63%, AP reported.The modest uptick breaks a three-week slide in borrowing costs, with mortgage rates having hovered close to the 6% mark for most of this year. Last week’s average had marked the first time the rate dipped below 6% since September 2022, reaching its lowest level in nearly three and a half years.Mortgage rates are influenced by several factors, including the Federal Reserve’s interest-rate policy, investor expectations about inflation and economic growth, and movements in the bond market.They typically track the direction of the 10-year US Treasury yield, which lenders use as a benchmark for pricing home loans.The 10-year Treasury yield rose to 4.14% at midday Thursday, up from around 4% a week earlier.Treasury yields have moved higher in recent days as rising oil prices added fresh inflation concerns, potentially complicating the Federal Reserve’s plans to cut interest rates.

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business6 days ago

Business6 days agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion7 days ago

Fashion7 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026