Business

UK inflation: What is the rate and why are prices still rising?

BBC

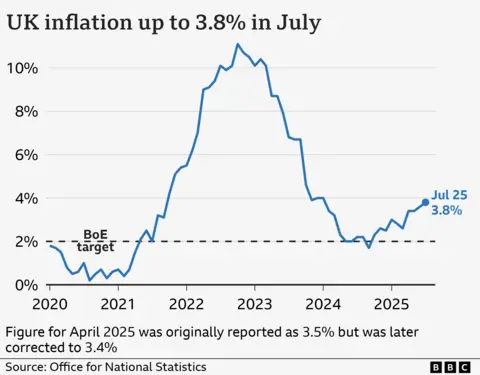

BBCPrices in the UK rose by 3.8% in the 12 months to July, driven by higher air fares, as well as increases in the cost of food.

It means inflation remains above the Bank of England’s 2% target.

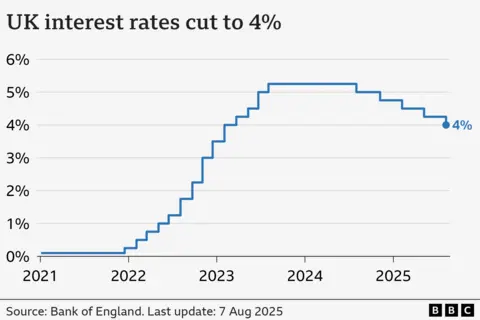

The Bank moves interest rates up and down to try to keep inflation at that level, and has cut interest rates five times since August 2024.

What is inflation?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

This virtual “basket of goods” is regularly updated to reflect shopping trends, with virtual reality headsets and yoga mats added in 2025, and local newspaper adverts removed.

The ONS monitors price changes over the previous 12 months to calculate inflation.

The main inflation measure is called the Consumer Prices Index (CPI), and the latest figure is published every month.

CPI was 3.8% in the year to July 2025, up from 3.6% in the 12 months to June. The July 2025 figure is the highest recorded since January 2024, when the rate was 4.0%.

The Bank also considers other measures such as “core inflation” when deciding whether and how to change rates.

This doesn’t include food or energy prices because they tend to be very volatile, so can be a better indication of longer term trends.

Core CPI was 3.8% in the 12 months to July, up slightly from 3.7% recorded in the year to June.

Why are prices still rising?

Inflation has fallen significantly since hitting 11.1% in October 2022, which was the highest rate for 40 years.

But that doesn’t mean prices are falling – just that they are rising less quickly.

Inflation soared in 2022 because oil and gas were in greater demand after the Covid pandemic, and energy prices surged again when Russia invaded Ukraine.

It then remained well above the 2% target partly because of higher food prices.

These continue to be a significant factor in the current inflation figures.

Inflation for food and non-alcoholic beverages was 4.9% in the year to July, up from 4.5% in the year to June.

Beef, sugar, chocolate, instant coffee and fruit juice saw significant price rises.

But the main factor driving the July inflation figure was higher air fares, which saw the largest July increase since the ONS began collecting that data on a monthly basis in 2001.

In addition, fuel prices fell only slightly between May and June 2025, compared to a larger drop in the same period in 2024.

Why does putting up interest rates help to lower inflation?

When inflation was well above its 2% target, the Bank of England increased interest rates to 5.25%, a 16-year high.

The idea is that if you make borrowing more expensive, people have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

But it is a balancing act – increasing borrowing costs risks harming the economy.

For example, homeowners face higher mortgage repayments, which can outweigh better savings deals.

Businesses also borrow less, making them less likely to create jobs. Some may cut staff and reduce investment.

In recent months inflation has remained above the Bank’s target at the same time as the economy has remained relatively flat and the jobs market has softened.

Therefore, the Bank has chosen to cut rates, despite high inflation, in an attempt to encourage people to spend more and get businesses to invest and create jobs to boost the economy.

What is happening to UK interest rates and when will they go down again?

The Bank of England began cutting rates in August 2024, and made five cuts to bring the rate down to 4%.

Bank of England governor Andrew Bailey had said that future cuts will be made gradually and carefully.

The August interest rate decision was extremely close, with the committee voting 5-4 to cut rates by a quarter percentage point.

It followed an unprecedented second vote by the Bank’s policymakers, as one economist wanted a larger cut of half a percentage point.

This suggests future interest rate decisions could also be finely balanced.

Inflation is now expected to peak at 4% in September, the Bank said in its latest Monetary Policy Report. That is twice the Bank’s target rate and above the 3.8% high it predicted in its previous report in May.

A further interest rate cut had been expected at the Bank’s meeting in November, but analysts are now less sure this will happen given the closeness of the August vote.

The Bank also has to consider the wider global economy. Mr Bailey has repeatedly warned about the unpredictable impact of US tariffs, and conflict in Israel and Iran has also created uncertainty.

Are wages keeping up with inflation?

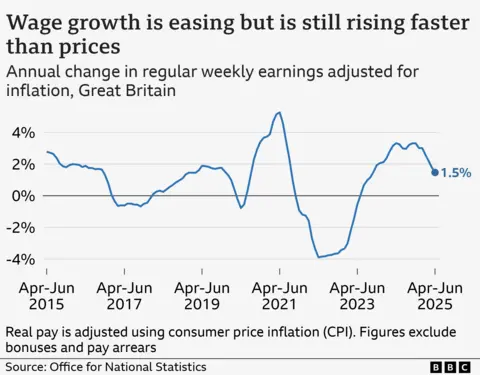

Annual average regular earnings growth was 5.7% for the public sector and 4.8% for the private sector.

Meanwhile, separate ONS figures showed the number of vacancies fell again to 718,000 for the May to July period, marking three continuous years of falling job openings.

The unemployment rate was 4.7% in the three months to July – the same as the three months to April.

This marked the highest level of unemployment since June 2021, and is also likely to factor into the Bank of England’s decision whether to cut rates again.

What is happening to inflation and interest rates in Europe and the US?

The US and EU countries have also been trying to limit price increases.

The inflation rate for countries using the euro was 2.1% in August, according to an early estimate.

In June 2024, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first fall in five years.

By July 2025, after several further cuts, its key rate stood at 2%.

Inflation in the US held steady at 2.7% in July, remaining above the US central bank’s 2% target.

After a string of cuts in the latter part of 2024, the US central bank again chose not to change rates at its July 2025 meeting, the fifth hold in a row.

That leaves its key interest rate unchanged in a range of 4.25% to 4.5%.

The Federal Reserve has repeatedly come under attack from President Trump, who wants to see further interest rate cuts.

Business

70% of adults without a licence say learning to drive is unaffordable

Some seven in 10 British adults without a full driving licence say learning to drive is currently unaffordable, according to a survey.

The figure is even higher among younger people, with 76% of 18 to 29-year-olds without a licence saying driving lessons are financially out of reach, the poll for car insurer Prima found.

Overall, 38% said the cost of driving lessons was the biggest deterrent to learning to drive.

Some 32% were put off by the price of buying a car and 15% said the cost of car insurance was the main barrier to learning to drive.

Almost half (45%) said they would consider learning to drive if it became significantly cheaper.

Nick Ielpo, UK country manager at Prima, said: “For a growing number of people, driving is no longer a symbol of freedom – it’s a financial stretch too far.

“Between lessons, buying a car and insuring it, the upfront and ongoing costs are pricing many people out before they even start.”

Find Out Now surveyed 1,134 adults who do not hold a full driving licence between January 21 and 23.

Business

Go Digit General Insurance gets GST demand notice of Rs 170 cr – The Times of India

Go Digit General Insurance on Saturday said it has received a demand notice of about Rs 170 crore for short payment of goods and services tax (GST) for nearly five years. The company has received an order copy from the Office of the Commissioner of GST & Central Excise, Chennai South Commissionerate on March 6, confirming GST demand of Rs 154.80 crore levying penalty of Rs 15.48 crore and Interest u/s 50 of CGST Act, 2017 for the period July 2017 to March 2022, the insurer said in a regulatory filing. The company is in the process of evaluating the legal advice on the implications and would file an appeal, it said.

Business

Iran war threatens $11.7 trillion global travel industry as passengers get caught in crossfire

Zoey Gong, a Chinese medicine food therapist, was days away from boarding an Emirates flight from Paris to Shanghai via Dubai, United Arab Emirates, when the U.S. and Israel attacked Iran last Saturday.

Gong, 30, had her flight plans derailed as a result, and she told CNBC that she had to pay $1,600 to get to Shanghai, more than double the price of her original ticket.

She’s one of millions of travelers swept up in war and other conflicts from Iran to Mexico this year, problems that are threatening the global tourism industry that’s worth an estimated $11.7 trillion to the world’s economy, according to industry group World Travel & Tourism Council. It’s showing that people who are far from falling missiles, drone attacks and other geopolitical flashpoints aren’t immune to ripple effects.

‘Aviation quagmire’

Stranded passengers wait with their luggage outside the Hazrat Shahjalal International Airport in Dhaka on March 3, 2026 after carriers cancelled flights amid the Middle East conflict.

Munir Uz Zaman | Afp | Getty Images

The U.S.-Israel attack on Iran set off massive aviation, travel, and safety crises.

More than a million people around the world were stranded because of airspace closures that have grounded over 20,000 flights since Saturday, according to aviation data firm Cirium. Some were also stuck on cruise ships. Inquiries for more expensive “cancel for any reason” travel insurance policies surged 18-fold this week, said Chrissy Valdez, senior director of operations for Squaremouth, an online insurance marketplace.

Since the Feb. 28 attacks on Iran, that country has launched retaliatory strikes on the United Arab Emirates — home to Dubai International Airport, the world’s busiest for international passenger traffic, according to Airports Council International — as well as Qatar, Jordan, Israel and Cyprus. The back-and-forth attacks have left airlines with little recourse to repatriate travelers.

Days after the attack, the U.S. State Department told citizens in a large part of the region to leave immediately, with few options at hand. The department said it is organizing charter flights for U.S. citizens who want to return from Saudi Arabia, Israel, UAE and Qatar.

“This has spiraled into an aviation quagmire,” said Henry Harteveldt, a former airline executive and founder of travel consulting firm Atmosphere Research Group.

Other sectors of the travel industry are also dealing with the war’s impact. Debris rained down near Accor‘s Fairmont The Palm Hotel in Dubai over the weekend. The company said four people were injured, but none were guests, visitors, or staff. Meanwhile, the iconic Burj Al Arab hotel had a fire earlier this week after it was hit by debris from an Iranian drone.

(L to R) The Malta-flagged cruise ships Aroya Manara and MSC Euribia are anchored at the port of Dubai on March 4, 2026.

Giuseppe Cacace | AFP | Getty Images

MSC Cruises’ more than 6,300-passenger MSC Euribia ship has been stranded in Dubai and the company is trying to get flights for affected guests, it said. “We are requesting priority for our guests from our partners,” the company said in a statement.

“In order to speed up the repatriation, we are working on other options such as chartering flights” from Dubai, Abu Dhabi, UAE, or Muscat, Oman, but the situation on board “remains calm,” the cruise company said.

Earlier this week, MSC said it would cancel its remaining sailings from Dubai for the winter. “We understand that this will be disappointing, but we are sure that guests impacted will understand this decision,” it said.

Putting aside the Covid-19 health crisis that ground most international travel to a halt, Harteveldt called this week “the most chaotic event we’ve seen frankly since 9/11 when the U.S. chose to close its airspace. We haven’t seen anything that has had such a long and geographically widespread impact on travel.”

Global conflicts

Flightradar24 still of flight traffic across the Middle East on March 4th, 2026.

Source: Flightradar24.com

The Iran war is the most severe military conflict this year, but it’s one of a series of obstacles that have threatened travel demand and profits for hotels, airlines and cruise companies, as well as local economies that depend heavily on travel, especially international tourists, who tend to spend more than local visitors.

Three days into 2026, the U.S. struck Venezuela and captured its president, Nicolás Maduro, and his wife, Cilia Flores. The attack prompted the U.S. to close airspace throughout the Caribbean, stranding travelers, many at pricey resorts and home rentals they had booked for the holidays.

Then in February, flights were grounded in parts of Mexico, including in the coastal resort city of Puerto Vallarta and in Guadalajara, after violence broke out following the Mexican army’s killing of a cartel leader.

Executives have already had to make costly changes: rerouting or cancelling sailings, issuing flexible booking and refund policies, grounding planes and changing flight plans altogether, or discounting hotel rooms.

The cost of these conflicts is still being tallied, including for fuel, one of the biggest expenses for cruise companies and airlines, along with labor, and is usually passed along to consumers, but signs are emerging on how customers will be affected.

First: Pricier tickets and stays are in the cards.

Higher airfare

United Airlines CEO Scott Kirby said on Thursday that jet-fuel prices, which have surged 60% since the U.S. and Israel’s first strikes on Iran last week, would hit first-quarter results, if not the second quarter as well. That will likely translate quickly to higher airfare, he added.

Despite the higher fuel, which accounted for 20% of United’s operating expenses last year, according to a securities filing, with few flights operating in the Middle East, bookings have jumped from regions like Australia for United flights because it offers different routes to the U.S., he said.

Speaking outside an event at Harvard University, Kirby said that demand overall has remained resilient since the conflict broke out.

Airlines around the world have been forced to take longer, more costly routes because of airspace closures.

Australian carrier Qantas, for example, told CNBC that its flight from Perth, Australia, to London will now take a route that requires it to refuel in Singapore, though that will also allow it to pick up another roughly 60 passengers.

Best year ever?

Passengers look at departure screens showing cancelled flights to Puerto Vallarta at Benito Juarez International Airport after authorities reinforced security following roadblocks and arson attacks carried out by organized crime in several states, after a military operation in which a government source said Mexican drug lord Nemesio Oseguera, known as “El Mencho,” was killed in Jalisco state, in Mexico City, Mexico, February 22, 2026.

Luis Cortes | Reuters

Travel executives started off 2026 as they often do: upbeat. Some airline executives, including those at the most profitable U.S. carriers, Delta Air Lines and United, forecast record earnings within reach this year.

The war and other incidents erupted as the travel industry has been leaning on premium options to woo wealthier customers, who make up a greater share of spending overall. Losing the base for more expensive trips could be extra disadvantageous to those companies and local economies.

In Mexico, for example, tourism makes up close to 9% of the economy and international tourist arrivals rose 13.6% last year to 98.2 million people, who spent close to $35 billion, according to the country’s Tourism Ministry.

Now, airlines are pulling back on traveling to Puerto Vallarta, at least from the United States in the near term. Delta cut routes from April 3 through the end of the month to the city, except for once-daily flights from Los Angeles and Atlanta, according to the Cranky Network Weekly newsletter, which covers the airline industry’s network changes. Alaska Airlines and Southwest Airlines also cut service in March.

“Perhaps people will forget about the PVR [Puerto Vallarta International Airport] concerns now that headlines will shift to the Middle East and bookings will rebound, but we will be watching capacity changes as leading indicators,” Brett Snyder and Courtney Miller, the newsletter’s authors, said in the March 1 edition.

Smoke billows amid a wave of violence, with torched vehicles and gunmen blocking highways in more than half a dozen states, following a military operation in which a government source said Mexican drug lord Nemesio Oseguera, known as “El Mencho,” was killed, in Puerto Vallarta, Jalisco, Mexico, February 22, 2026.

@morelifediares via Instagram | Reuters

The recent issues also come three months ahead of the FIFA World Cup, which is set to be hosted by cities in Canada, Mexico and the United States.

Some hotels in Mexico are starting to notice a change, too.

Victor Razo, manager at the Rivera del Rio hotel in Puerto Vallarta, told CNBC that bookings are down around 10% compared with last year.

“We’ve had some promotions given what had happened,” he said, adding it brought down rates between 10% and 20% ahead of the busy spring break and Holy Week period in the coming month.

He added that the hotel wasn’t near the problems, which included road blockades, and that bookings have since stabilized.

“It’s not like the beginning of the pandemic,” he said. “There is no comparison.”

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Entertainment1 week ago

Entertainment1 week agoPakistan’s semi-final qualification scenario after England defeat New Zealand

-

Business1 week ago

Business1 week agoCNBC To Merge TV And Digital News Operations, Nearly A Dozen Jobs To Be Cut: Report

-

Business1 week ago

Business1 week agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Entertainment1 week ago

Entertainment1 week agoWhat’s new in Pokémon? Every game, update, surprise from 30th anniversary event