Business

What are my rights if my flight is cancelled or delayed?

Getty Images

Getty ImagesHeathrow was among several European airports hit by a cyber-attack affecting an electronic check-in and baggage system.

A number of flights were delayed at the airport on Saturday as a “technical issue” impacted software provided to several airlines.

What are your rights if your journey has been affected, and can you get your money back?

What do airlines have to offer passengers?

When flights are delayed or cancelled, airlines have a duty to look after you.

That includes providing meals and accommodation, if necessary, and getting you to your destination. The airline should organise putting you on an alternative flight, at no extra cost.

Additional losses – such as unused accommodation – might require a claim to a credit card provider, if that was the payment option used.

After that, a claim may need to go to your travel insurance provider. But there is no standard definition of what is covered.

While 94% of policies cover travel abandonment as standard, only 30% include wider travel disruption as standard, according to analysts Defaqto.

If my flight is cancelled, can I get a refund or another flight?

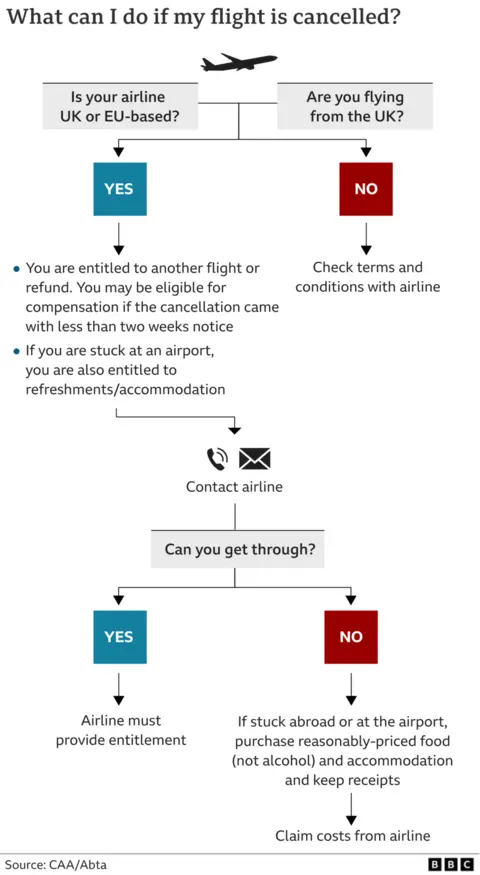

If your flight is covered by UK law, your airline must let you choose between either getting a refund or being booked on to an alternative flight.

That’s regardless of how far in advance the cancellation was made.

You can get your money back for any part of the ticket you have not used.

So, if you booked a return flight and the outbound leg is cancelled, you can get the full cost of the return ticket refunded.

If you still want to travel, your airline must find you an alternative flight.

If another airline is flying to your destination significantly sooner, or there are other suitable modes of transport, then you have a right to be booked on to that alternative transport instead.

If your flight was coming into the UK on a non-UK airline, then you should check the terms and conditions of your booking.

Can I claim extra compensation for disruption?

Disruption caused by things like a fire, bad weather, strikes by airport or air traffic control staff, or other “extraordinary circumstances” does not entitle you to extra compensation.

However, in other circumstances – when it is considered to be the airline’s fault – you have a number of rights under UK law.

These apply as long as you are flying from a UK airport on any airline, arriving at a UK airport on an EU or UK airline, or arriving at an airport in the EU on a UK airline.

What you are entitled to depends on what caused the cancellation and how much notice you are given.

If your flight is cancelled with less than two weeks’ notice, you may be able to claim compensation based on the timings of the alternative flight you are offered.

The amount you are entitled to also depends on how far you were travelling:

- for flights under 1,500km, such as Glasgow to Amsterdam, you can claim up to £220 per person

- for flights of 1,500km to 3,500km, such as East Midlands to Marrakesh, you can claim up to £350 per person

- for flights over 3,500km, such as London to New York, you can claim up to £520 per person

Will the airline pay for food and accommodation?

If you are stuck abroad or at the airport because of a flight cancellation, airlines must also provide you with other assistance.

This includes:

- a reasonable amount of food and drink (often in the form of vouchers)

- a way for you to communicate (often by refunding the cost of calls)

- free accommodation, if you have to stay overnight to fly the next day

- transport to and from the accommodation

If your airline is unable to arrange assistance, you have the right to organise this yourself and claim back the cost later.

The Civil Aviation Authority advises people to keep receipts and not spend more than necessary.

You are entitled to the same assistance as for a cancellation if your flight is delayed by more than two hours for a short-haul flight, three hours for a medium-haul, or four hours for a long-haul.

If you are delayed by more than five hours and no longer want to travel, you can get a full refund.

What are my rights if I have booked a package holiday?

If you booked a package holiday with a company that is an ABTA member and your flight is cancelled, you are entitled to a suitable alternative flight or a full refund.

What if flight delays mean I am late for work?

Airlines will not refund you for loss of earnings.

Travel insurance policies will not usually cover loss of earnings either.

If you think you’re going to be late back at work because of flight delays, you have a responsibility to let your employer know, legal experts say.

You should agree with your employer how to deal with the absence – for example, by using annual leave or taking unpaid leave.

Employers have no legal obligation to pay employees who are absent in this situation, experts say, unless it is stated in their contract.

Business

US deal to play pivotal role in India achieving USD 100 billion textiles exports in 2030

New Delhi: The India-US trade agreement is expected to play a pivotal role in India achieving its intended target of $100 billion textiles exports in 2030, the government said on Saturday.

The deal is expected to provide the requisite momentum, with the US to contribute to more than one-fifth of this target, according to Ministry of Textiles.

The ministry welcomed the landmark agreement between India and the US as a major catalyst enhancing the textile trade relations between the nations.

The textile industry expressed the hope that this is a major economic game changer for the sector.

For textiles exports, the deal opens up a USD 118 billion US global imports market of textiles, apparels and made ups. With the US being India’s largest export destination of around USD 10.5 billion exports, comprising around 70 per cent apparel and 15 per cent made ups, this is a major opportunity.

The 18 per cent reciprocal tariffs on all the textiles products including apparel and made-ups will not only remove the disadvantage that Indian exporters had, but would place them in a better position than most competitors like Bangladesh (20 per cent), China (30 per cent), Pakistan (19 per cent) and Vietnam (20 per cent) who have higher reciprocal tariffs.

“This would alter the market dynamics as large buyers would surely relook at their sourcing in the light of this agreement,” said the ministry.

The agreement would also enable the industry to be cost competitive and diversify their risks by sourcing intermediates for the textiles sector from the US.

This would facilitate manufacturing of value-added textiles in the country and diversify our production and exports. The deal would generate additional employment and encourage investments by US entities, said the ministry.

The US trade agreement framework represents a historic milestone for India’s textiles and apparel sector.

Business

‘Child’s future can’t be monthly burden’: Noida doctor flags impact of soaring school fees on families

New Delhi: For many urban families in India, a child’s education has always been seen as the key to a brighter future. But today, that dream is coming with a growing price tag. The steady and often steep rise in school fees is no longer just a budgeting issue but it’s also becoming a major source of anxiety for parents. From cutting back on expenses to postponing savings goals, households are increasingly adjusting their lifestyles and financial plans just to keep up with the cost of schooling.

School fees don’t just test a parent’s income.

They test their silence.Every year, the number rises.

And parents quietly adjust life around it.

Fewer vacations. Delayed dreams. Extra shifts.

No complaints. Just quiet sacrifice.We are told it’s for “quality education.”

But…

— Dr SHRADDHEY KATIYAR (@Wegiveyouhealt1) February 3, 2026

When School Fees Begin to Weigh on Families

For many parents, rising school fees are not just figures on a receipt but they carry an emotional cost too. Dr Shraddhey Katiyar, a Noida-based doctor, recently shared a heartfelt post on X, drawing attention to the silent stress families experience as education expenses continue to climb. His words struck a chord with many parents who see their own struggles reflected in the issue.

“School fees don’t just test a parent’s income. They test their patience, their silence, and their endurance,” Katiyar wrote. He noted that many families adjust their lives silently by skipping holidays, postponing personal goals, or taking on extra work, simply to ensure their children’s education continues smoothly.

According to him, most parents do not openly complain about rising school fees. Instead, they quietly make adjustments in their daily lives. Family holidays are put on hold, personal ambitions take a back seat, and longer working hours become the norm, all to manage the growing expenses.

“Every year, the number rises. And parents quietly adjust life around it. Fewer vacations. Delayed dreams. Extra shifts. No complaints. Just quiet sacrifice,” he added.

Katiyar also questioned the reasons often given by schools for repeated fee hikes. He pointed out that even though parents are told the higher fees will improve the quality of education, classrooms continue to remain crowded and teachers’ salaries do not always reflect those increases. “Education should not feel like a monthly threat,” he wrote, stressing that learning must remain a basic right and not turn into a financial strain.

He further warned that when education starts feeling like a luxury instead of a necessity, many deserving children risk being left behind, and families are left emotionally drained. “Education should lift families up, not leave them exhausted. Children often realise later that their parents bore the cost quietly,” Katiyar noted.

Parents Share Their Concerns

Many parents say the financial pressure begins much earlier than expected, sometimes as early as playschool. Ishani Bhatt, a mother of a 2.5 year old living in Greater Noida West, says education costs start piling up right from toddlerhood.

“My child goes to a reputed playschool, but the expenses are steep. For 3-4 hours, you will shell out Rs 6-7k per month, not to take into account the one-time admission fee, which was nearly Rs40,000. Initially, we were told that this would cover all extra curriculum activity expenses, but every other day, there’s some expense or the other, albeit small ones,” she says.

Bhatt explains that apart from direct fees, there are several indirect expenses too. “Even if they are not direct expenses, there are several indirect expenses. For instance, schools will have different ‘days’ – say tomorrow is ‘purple colour day’. Schools ask parents to send wards in clothes of that shade. Now if they don’t have that colour, parents often end up buying new clothes. While our school doesn’t make it mandatory, yet as a parent, you might feel your child should not be the one feeling left out. These create indirect pressure. Then again recently, school charged around Rs 500 for a photobook of class picture. There are several such instances. So we are left wondering what were the extracurricular fees that we paid at the beginning of the season for?”

She adds that education should remain a right and not feel like a privilege that only some families can afford, and that this principle should apply right from playgroup and nursery.

Business

Ola, Uber, Rapido Strike Today: Will You Get A Cab Or Auto On February 7? What Commuters Should Know

Last Updated:

Drivers gather at Jantar Mantar where multiple unions flagged concerns over fare policies, alleged regulatory gaps and the use of private vehicles for commercial taxi services.

Ola, Uber, Rapido Strike Today.

Ola, Uber, Rapido Strike Today: Passengers booking taxis or autorickshaws through app-based platforms may have noticed disruptions and uncertainty on Saturday as drivers across several states held protests and strikes, demanding tighter regulation of the sector and a crackdown on bike taxi services.

Drivers gathered at Jantar Mantar, New Delhi, where multiple unions flagged concerns over fare policies, alleged regulatory gaps and the use of private vehicles for commercial taxi services. The protests brought together both app-based and conventional cab drivers, highlighting growing discontent over pricing policies, the use of private vehicles for commercial transport, and what unions describe as uneven enforcement of rules.

What Are Drivers Demanding?

Driver unions are seeking structural changes rather than temporary relief. Their key demands include the creation of a Rashtriya Chalak Ayog, a national drivers’ welfare body, an all-India ban on private bike taxis, and stricter action against the use of unlicensed private vehicles as taxis.

A major concern is surge pricing on ride-hailing platforms. Drivers allege that while fares rise sharply during peak hours, the additional amount largely goes to aggregators, leaving drivers with little benefit even as commuters assume they are earning more.

Why Bike Taxis Are At The Centre Of The Dispute

Licensed taxi and autorickshaw drivers say bike taxis, often operated using private two-wheelers, are cutting into their earnings while operating in a regulatory grey zone. According to unions, enforcement against such services varies widely across states, creating uneven competition.

Drivers have also raised safety and insurance concerns, alleging that accident victims involving illegal bike taxis often struggle to get insurance compensation due to unclear liability and lack of permits.

Panic Buttons

One of the lesser-known issues affecting drivers is the mandatory installation of panic buttons in commercial vehicles. While the Centre has approved around 140 device providers, unions claim state governments have declared a large number of these companies unauthorised.

As a result, drivers say they are being forced to remove existing devices and spend up to Rs 12,000 again on new installations, turning a safety requirement into a repeated financial burden.

Will Cabs And Autos Be Available?

Despite union claims that vehicles were kept off the roads, cabs and autorickshaws continued to be available on platforms such as Uber, Ola and Rapido in many cities, though availability and waiting times varied by location.

For commuters, this means service disruptions are likely to be uneven rather than total, depending on city-wise participation and enforcement.

Why This Issue Keeps Returning

Drivers say that without a uniform national framework covering fares, commissions, licensing and welfare, disputes will continue to surface.

Unions also point to the rapid increase in autorickshaw permits under open permit policies, saying the growing supply of vehicles has reduced per-driver income without a corresponding rise in demand.

February 07, 2026, 14:23 IST

Read More

-

Tech5 days ago

Tech5 days agoHow to Watch the 2026 Winter Olympics

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Business5 days ago

Business5 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion5 days ago

Fashion5 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech6 days ago

Tech6 days agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Business1 week ago

Business1 week agoVideo: Who Is Trump’s New Fed Chair Pick?

-

Business5 days ago

Business5 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV