Business

Why Warner Bros. Discovery shareholders might opt for Paramount’s offer — and why they might not

Ted Sarandos, CEO of Netflix and David Zaslav, CEO of Warner Bros. Discovery.

Mario Anzuoni | Mike Blake | Reuters

Hours before Warner Bros. Discovery agreed to sell its studio and streaming assets to Netflix, Ted Sarandos, the co-CEO of Netflix, called WBD CEO David Zaslav to inform him Netflix wouldn’t be bidding any higher.

WBD shareholders now have a chance to call Sarandos’ bluff.

WBD shareholders have until Jan. 8 to tender their shares to Paramount for $30 in cash, though that deadline may be artificial. Paramount can extend it all the way to WBD’s annual meeting, which hasn’t been set yet but this year took place June 2.

If Paramount acquires 51% of outstanding WBD shares, it would control the company, even though the WBD board already agreed to sell the company’s studio and streaming assets to Netflix. Both Netflix and Paramount can use the coming days and weeks to speak with WBD shareholders to gauge whether they’d like to take Paramount’s offer or stick with the board’s recommendation to sell to Netflix.

To tender or not to tender, that is the question. There are sound arguments for both sides. The decision also presents a game theory element for shareholders who may simply want a bidding war rather than caring about the right buyer.

To tender

There are two overarching reasons why a shareholder might tender their holdings to Paramount.

The first is if the investor believes Paramount’s $30-per-share, all-cash offer for the entirety of WBD is more valuable than Netflix’s $27.75-per-share bid for just the Warner Bros. film studio and HBO Max streaming business. The second is a belief that tendering shares is the best way to force a bidding war between Netflix and Paramount.

A shareholder could decide Paramount’s current offer is better than Netflix’s if they think it has a higher likelihood of regulatory approval or if they believe Discovery Global — the portfolio of linear cable networks including CNN, TNT, Discovery, HGTV and TBS that’s set to be spun out — will have minimal value as a publicly traded company.

Paramount Skydance CEO David Ellison told CNBC earlier this month he values Discovery Global at $1 per share, given his prediction on the likely multiple (2 times earnings before interest, taxes, depreciation and amortization) at which it will trade based on current valuations for similar linear cable networks. If WBD doesn’t agree to sell the entire company to Paramount, it plans to split Discovery Global out as its own publicly traded entity in mid-2026.

Paramount’s argument is that $30 per share is already greater than Netflix’s $27.75-per-share offer plus $1 for Discovery Global.

David Ellison, CEO of Paramount Skydance, exits following an interview at the New York Stock Exchange (NYSE) in New York City, U.S., December 8, 2025.

Brendan Mcdermid | Reuters

Paramount’s bid is also all cash, while Netflix’s bid includes 16% equity with a so-called “collar,” which means shareholders won’t know exactly how much Netflix stock they’ll actually receive until the deal closes.

As for regulatory approval, Paramount has played up arguments that a combined Netflix and HBO Max streaming business would be anticompetitive. Netflix has more than 300 million global paying customers. The idea of the largest streamer buying HBO Max has already raised concerns with politicians, including President Donald Trump, who said there may be a “market share” issue with a Netflix deal.

While Paramount would combine Paramount+ with HBO Max, Paramount+ has about 80 million subscribers, presenting less of a risk to competition.

The second, more nuanced argument to tender is to maximize upside even if the assets ultimately go to Netflix.

Ellison has already made it known Paramount’s $30-per-share offer isn’t best and final. Tendering could cause Netflix to come back with a higher offer, which may then prompt Paramount to raise its bid as well.

GAMCO Investors chairman and CEO Mario Gabelli told CNBC earlier this month “the notion of Company A and Company B having a bidding war — that’s what we like as part of the free market system.”

He added last week that while he was previously leaning toward tendering his shares to Paramount, “the most important part is to keep it in play.”

Not to tender

Other shareholders may believe, in contrast, that not tendering is the best way of jumpstarting a bidding war. If Paramount sees that it’s not getting traction with shareholders as the annual meeting gets closer, it may raise its bid to get more shareholders on board.

There are additional reasons not to tender. Shareholders may want the Netflix and Discovery Global equity portion of the Netflix proposal.

In a WBD filing last week, the company said a mystery “Company C” proposed to acquire Discovery Global and its 20% stake in WBD’s streaming and studios business for $25 billion in cash. That bid was rejected by the WBD board as “not actionable.”

Still, the mystery bid suggests there may be an interested buyer in all of Discovery Global if it gets spun out, which could result in far more than $1 per share, according to Rich Greenfield, an analyst at LightShed Partners. That’s a good reason not to tender, he said, because it makes the Netflix offer much more valuable than Paramount’s bid.

Ensuring WBD splits Discovery Global is also the safe play for shareholders in case regulators block a Paramount-WBD merger, Greenfield said. Since the Paramount deal is for all of WBD, including CNN, Ellison’s bid — which includes roughly $24 billion from Middle Eastern sovereign funds — may run into regulatory and political hurdles, Greenfield noted.

“You want the split to happen,” Greenfield said in an interview. “If the Paramount deal doesn’t get regulatory approval, now you’ve prevented the split from happening. You’re stuck in 2027 with declining cable networks, and you haven’t spun them off. Does the U.S. really want a company funded by more Middle Eastern money than money from the Ellisons owning CNN?”

‘Where’s Poppa?’

WBD’s board has argued part its reasoning for rejecting Paramount’s $30-per-share bid was its concern with financing, noting more funding comes from Middle Eastern sovereign wealth funds than the Ellison family, which has committed about $12 billion.

Paramount altered the terms of its deal Monday to help address funding concerns. Oracle founder Larry Ellison, the father of David and one of the world’s five wealthiest people, agreed to provide “an irrevocable personal guarantee of $40.4 billion of the equity financing for the offer and any damages claims against Paramount,” should the existing financing fall through, Paramount said in a statement.

Paramount also said Monday it will publish records confirming the Ellison family trust “owns approximately 1.16 billion shares of Oracle common stock and that all material liabilities of the Ellison family trust are publicly disclosed.” Paramount has said the family trust will backstop the financing. WBD’s board had previously argued the trust is an “opaque entity,” preferring a direct commitment from the Ellisons.

Notably, even with the Monday announcement, the Ellisons haven’t increased their personal equity investment, which still stands at $12 billion. Internally, some WBD executives have cited the 1970 Carl Reiner movie “Where’s Poppa?” when speaking about the bid, according to a person familiar with the matter. WBD has pushed for the Ellisons to commit more personal money to the deal.

Still, a WBD shareholder may not care where the funding is coming from as long as it’s there. The three SWFs involved in the deal are the Saudi Arabian Public Investment Fund (PIF), Abu Dhabi’s L’imad Holding Company and the Qatar Investment Authority (QIA). The PIF and QIA, in particular, are known institutions that have contributed billions of dollars to other U.S.-based deals.

Business

Major supermarket hikes pay for the seventh time since 2023

Discount chain Lidl has announced its seventh pay rise since 2023.

The German-owned group’s £29 million investment in pay rises will see entry-level pay rise to £13.45 an hour nationwide, increasing to £14.45 with length of service, from March 1. New starter pay in London will also increase from £14.35 to £14.80, rising to £15.30 with length of service.

The group, which employs more than 35,000 workers, claimed it was once again the “highest paying UK supermarket” following the moves.

It comes ahead of the national minimum wage rising by 50p from £12.21 to £12.71 per hour for eligible workers aged 21 and over from April 1.

Lidl said it was also doubling paternity leave from two to four weeks’ full pay, which will rise to eight weeks’ full paid leave after five years of service.

Stephanie Rogers, chief people officer at Lidl, said: “Our colleagues are the backbone of our business, and their success is our success.”

“We are continuing to mark unprecedented growth across Great Britain, creating thousands more jobs along the way, while continuing to invest in our people,” she added.

On the paternity leave changes, she said: “We believe that a longer period of paid paternity leave is a vital step on our journey towards gender equality in the workplace.”

Lidl revealed plans earlier this year to open 19 stores over the next eight weeks, which will create up to 640 jobs.

The group last year hit the milestone of opening its 1,000th store as it looks to add around another 40 sites in the year to February 28.

Lidl is currently Britain’s sixth-largest grocery chain, according to experts at Worldpanel, after making the biggest market share gains in the sector in recent months.

Recent figures from the group showed it enjoyed a strong Christmas, with a 10 per cent surge in sales seeing it notch up more than £1.1 billion in turnover in the four weeks leading up to Christmas Eve.

Business

Bitcoin dips below $70,000 amid gold demand and economic worries – SUCH TV

The price of Bitcoin fell below $70,000 on February 5, down 44% from its October 2025 high of $126,210, as investors shift interest to gold and global economic concerns rise.

Earlier in the day, Bitcoin briefly touched $63,000 before closing at $70,000.

Last week alone, its value dropped more than $20,000, reducing it by almost a quarter.

Compared to four months ago, Bitcoin has now lost about half its peak value.

Analysts say investor interest in Bitcoin is waning, with growing pessimism surrounding the broader cryptocurrency market.

Business

Gold, Silver ETFs Sink Up To 10% As Precious Metals Rout Deepens; What Should Investors Do Now?

Last Updated:

Silver and gold-linked commodity ETFs extended their slide, falling as much as 10%, tracking sharp drop in precious metal futures on the MCX

Silver ETFs

Silver and gold-linked commodity ETFs extended their slide on Friday, falling as much as 10%, tracking a sharp drop in precious metal futures on the MCX for the second straight session.

The decline came amid a global sell-off in technology stocks and a strengthening US dollar, which wiped out most of the gains from a brief rebound earlier in the week.

Silver ETFs lead losses

Kotak Silver ETF was the worst hit, tumbling 10%, while HDFC Silver ETF, SBI Silver ETF and Edelweiss Silver ETF declined about 9% each. Bandhan Silver ETF limited losses to around 6%.

Among gold-linked funds, Angel One Gold ETF slipped 8%, while Zerodha Gold ETF fell about 5%.

Volatility persists after steep correction

Hareesh V, Head of Commodity Research at Geojit Investments, said gold and silver continue to witness heightened volatility after last week’s sharp selloff. The correction was driven by hawkish US Federal Reserve expectations following Kevin Warsh’s nomination, a stronger dollar, and steep margin hikes by the CME that forced leveraged positions to unwind. Profit-taking after record highs further amplified price swings, keeping sentiment fragile.

He advised bullion investors to remain patient and avoid reacting to short-term volatility driven by margin hikes, profit booking and policy uncertainty.

“Gradual, staggered accumulation can help manage timing risks, as long-term fundamentals such as geopolitical tensions, central bank demand and currency pressures remain supportive. Closely tracking the US dollar and upcoming Federal Reserve signals is crucial in this phase of elevated volatility,” he said.

MCX futures slide sharply

In Friday’s session, MCX silver futures for March 5 delivery plunged 6%, or ₹14,628, to ₹2,29,187 per kg. Gold futures for April 2 delivery also weakened, slipping ₹2,675, or 2%, to ₹1,49,396 per 10 grams.

Globally, silver remained extremely volatile. Prices rebounded as much as 3% after plunging 10% to below the $65 level, a more than six-week low. Despite the bounce, silver was still down nearly 16% for the week. In the previous week, it had fallen 18%, marking its steepest weekly decline since 2011.

Margin hikes add pressure

The selloff spilled into domestic ETFs after sharp margin hikes in precious metal futures. On Thursday, commodity-based ETFs dropped as much as 21%, led by silver ETFs, while gold ETFs declined up to 7%.

Margins on silver futures were raised by 4.5% and on gold futures by 1% effective February 5, followed by an additional hike of 2.5% on silver and 2% on gold on Friday. As a result, total additional margins now stand at 7% for silver futures and 3% for gold futures from February 6.

“Markets often see sharp corrections after extended rallies. Broader risk sentiment and geopolitical cues can trigger profit booking in commodities, especially where positioning has been crowded,” said Nirpendra Yadav, Senior Commodity Research Analyst at Bonanza.

However, he added that industrial demand for silver remains strong, with a tight global supply environment and persistent deficits supporting prices over the medium to long term. Short-term intraday swings, he said, do not alter the long-term outlook.

Trade deal, macro cues in focus

Ross Maxwell, Global Strategy Operations Lead at VT Markets, said the India–US trade deal could improve risk appetite by easing supply-chain frictions and reducing tariff-linked inflation pressures.

“In this context, gold and silver will balance lower trade tensions against ongoing macro uncertainty. A clearer trade outlook can reduce risk aversion, limiting upside in precious metals,” he said.

Maxwell added that gold remains supported by concerns around inflation, currency stability and geopolitical risks, making it attractive as a strategic hedge rather than a short-term trade. Silver, he noted, also benefits from industrial demand, meaning improved global trade expectations could lend support through stronger manufacturing activity.

“While reduced tariffs may dampen fear-driven buying, both gold and silver are likely to remain structurally firm as long as economic and policy uncertainty persists,” he said.

February 06, 2026, 12:08 IST

Read More

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

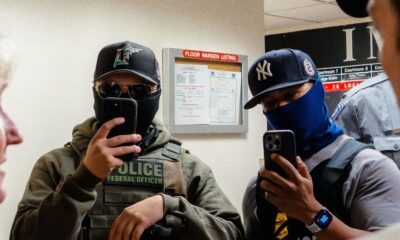

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Entertainment1 week ago

Entertainment1 week agoPeyton List talks new season of "School Spirits" and performing in off-Broadway hit musical

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami