Business

Why your chocolate is getting smaller, more expensive and less chocolatey

Archie MitchellBusiness reporter

Getty Images

Getty ImagesCrack open a tub of Celebrations or pull a Terry’s Chocolate Orange from a stocking these days, and have you noticed, there seems to be a little less to go around?

Not only that, you might find – no, it is not your imagination – that some popular treats taste a little different, a little less “chocolatey”.

To top it all the prices have risen too.

So will your festive favourites still hit the sweet spot this Christmas?

Chocs away

Many of the companies making popular bars and chocolates admit they have been looking for ways to save money. A tried-and-tested one is to replace some of the more expensive ingredients, like cocoa, with cheaper ones, a strategy that’s been dubbed “skimpflation”.

Some recipes have changed so much that bars like Toffee Crisp, Penguin and others can no longer be called chocolate.

There is even a debate among some chocolate fans over whether the year-round classic Cadbury’s Dairy Milk has changed its recipe.

Becca Amy Stock, a TikTok influencer who goes by the name Becca Eats Everything, set herself the task of reviewing every milk chocolate bar at Britain’s major supermarkets. The 29-year-old spent six hours and £100 on her rigorous research.

She concluded Dairy Milk was “more oily” since Cadbury’s takeover by the American company Mondelez in 2010. And the brand, famous for its “glass and a half” of milk, was less milky, she said.

“You do notice the difference,” Becca says, “Cadbury’s does not taste how it used to taste.”

Becca Amy Stock

Becca Amy StockMilk chocolate in the UK must have at least 20% cocoa solids and 20% milk solids to earn the name chocolate. Without that it has to be labelled “chocolate flavour” not chocolate. Cadbury’s Dairy Milk still meets that standard.

Mondelez says it has not been fiddling with the recipe, at least not recently.

“Our Cadbury Dairy Milk products continue to be made with the same delicious recipes that consumers know and love,” its spokesperson said. “The cocoa content has not changed for many years.”

Crunching the numbers

But it is still one which you’ll be paying more for.

Plenty of food manufacturers have been reducing the size of their products, without dropping prices, known as shrinkflation.

And some are also putting prices up, too.

Chocolate prices in supermarkets have risen by more than 18% on average from this time last year, according to market researchers Kantar.

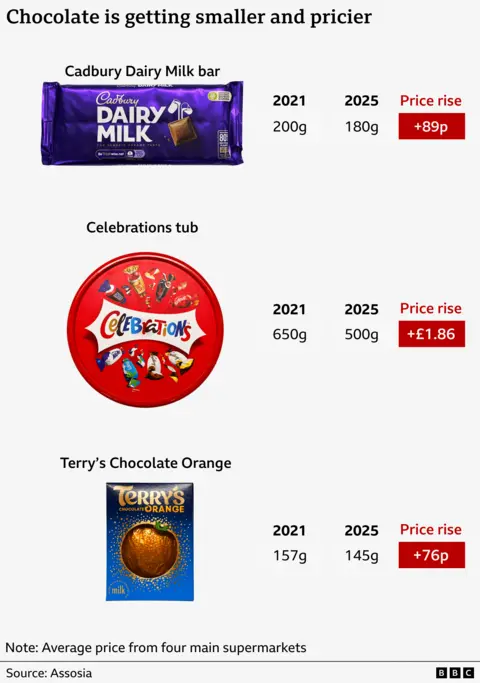

We got these figures by analysing price data collected by market researchers Assosia across four of the UK’s biggest grocers, Tesco, Sainsbury’s, Asda and Morrisons, between December 2021 and December 2025.

They show:

- Cadbury’s Dairy Milk weighs 10% less, while the cost jumped from £1.86 to £2.75 – a 48% price increase

- Mars Celebrations has shrunk by 23%. The price has risen from £4.25 to £6.11 – a 44% jump

- Terry’s Chocolate Orange is 8% smaller, while the cost has risen from £1.49 to £2.25 – a 51% price rise

Getty Images

Getty ImagesMondelez’s spokesperson said putting up prices was a “last resort” but ingredients are costing more – in particular cocoa and dairy.

“This means our products continue to be much more expensive to make.

“As a result of this difficult environment, we have had to make the decision to slightly reduce the weight and increase the list price of some of our Cadbury products,” they said.

Mars Wrigley told the BBC higher cocoa prices and manufacturing costs meant they had to “adjust some… product sizes… without compromising on quality or taste.”

Sticky costs

So what has caused the price of cocoa and milk to shoot up?

Extreme weather caused by climate change has hit cocoa farmers’ crop yields in Africa, says Ghadafi Razak, an academic at Warwick Business School.

Extreme rainfall in India, Brazil and Thailand in 2023, followed by droughts the following year have meant poor harvests in those countries too, pushing up prices.

The extra costs take time to feed through to customers, says Christian Jaccarini, a senior food analyst at the Energy & Climate Intelligence Unit think tank, which means those extra costs are hitting shop shelves now.

“It takes about 18 months for the impact of a shock to be felt by consumers, so we still have quite a long time with higher prices for chocolate,” he said.

Milk prices have shot up too. Diarmaid Mac Colgáin, founder of the Concept Dairy consultancy blames the rising cost of feed, fuel and fertilisers as well as farmers facing higher wage bills and production costs.

He says some brands have substituted palm oil and shea oil for some of the milk to make up the fat content of their chocolate.

Bad taste

Shoppers are becoming increasingly aware of these cost-saving tactics, but that does not mean they are happy about it.

It is the element of unwanted surprise that can leave a bad taste, according to Reena Sewraz, retail editor at consumer champion, Which?

It can feel “especially sneaky” when companies shrink products or downgrade their ingredients she said.

“With Christmas not far away, shoppers will be looking to get the best value from what they buy,” she said. “Supermarkets and manufacturers should be more upfront about making these changes. Customers may not love the news – but [then] at least they don’t feel misled.”

Alamy

AlamyBut there is not much you can do about it. For Becca, who insists she’s not “chocolated out” despite her chocolate-tasting marathon, quality not quantity is the way to go.

She suggests fellow chocoholics treat themselves to smaller premium bars such as Tony’s Chocolonely. They’ll cost more but she finds them more satisfying.

She also plans to treat herself to a selection-box on Christmas day.

Otherwise she generally advises against “food snobbery”.

“I think supermarket own-brands are actually a much better way to get better quality chocolate.”

Business

Gold and silver sell-off gathers steam in correction after record highs

Gold and silver prices have continued to drop sharply in a “brutal” sell-off after hitting record highs in recent weeks.

The precious metals began falling on Friday in response to US President Donald Trump’s nomination for the incoming chairman of the Federal Reserve.

His choice for former Fed governor Kevin Warsh to replace current chairman Jerome Powell when his term ends in May soothed some investor nerves, which boosted the US dollar but saw appetite for safe-haven investments gold and silver slump in response.

Gold and silver suffered their worst trading days for decades on Friday and were down heavily again on Monday, with spot prices off by another 7% and 11% respectively at one stage.

Silver had plunged by nearly 30% on Friday and gold dropped over 9% in its worst one-day drop since 1983.

Gold and silver had been enjoying a record breaking rally as investors sought refuge amid global geopolitical uncertainty, conflict and tariff woes.

Ipek Ozkardeskaya, senior analyst at Swissquote, said: “The sell-off has been far more brutal than I, and many, expected.”

He added: “For silver, the rally on the way up was faster than gold’s, so the correction on the way down is faster too.”

Kathleen Brooks, research director at XTB, added: “If the sell off continues, then gold and silver are at risk of eroding their losses for the year so far.

“The historic move lower in silver prices has not stemmed a fall at the start of this week.

“Traders have not yet found a level that they are happy to buy the dips, and the timing of Chinese Lunar New Year in mid-February could accelerate the sell off, as Chinese traders reduce risk ahead of the holiday.”

UK and US stock markets are expected to open in the red on Monday, as the gold and silver rout has a knock on effect on mining giants, while Brent oil was also 5% lower.

Derren Nathan, head of equity research at Hargreaves Lansdown, said: “Mining stocks are likely to feel the heat as metal prices scramble to find a floor.

“Oil prices are also trending the wrong way for investors in commodity-focused companies.”

Business

Budget’s mild fiscal consolidation to be positive for GDP growth: Report

Mumbai: Lower revenue as a share of GDP has been more than offset by cuts to subsidies and spending on current schemes, leading to the smallest fiscal consolidation in six years, likely positive for growth, a new report has said.

The fiscal consolidation for FY27 is the slowest in six years. And the budgeted disinvestment, which is a below-the-line funding item, is likely to see the highest rise in six years, the report from HSBC Global Investment Research said.

“The central government continues with fiscal consolidation, though signing up for a gentler path for FY27; the fiscal impulse will likely turn neutral after several years in the negative, and this should be good news for GDP growth,” the research firm added.

The report said that the services sector was the focus of the Budget, “with ambitious plans and increased outlays for medical institutions, universities, tourism, sports facilities, and the creative economy.”

Urban infrastructure saw a renewed push with each City Economic Region (CER) set to receive get Rs 50 billion over 5 years.

Seven new high-speed rail corridors will connect major cities, the report noted, adding large cities will also get an incentive of Rs 1 billion if they issue municipal bonds worth more than Rs 10 billion.

The report highlighted policy priorities, saying, “new manufacturing sectors were given incentives, namely biopharma, semiconductors, electronic components, rare earth corridors, chemical parks, container manufacturing, and high-tech tool rooms.”

Direct taxes are expected to grow faster than nominal GDP while indirect taxes will expand more slowly, with gross tax revenues budgeted to rise about 8 per cent year‑on‑year, the report said.

Central government set a fiscal deficit target of 4.3 per cent of GDP for FY27 after a 4.4 per cent estimate for FY26, and nominal GDP growth was pegged at 10 per cent.

Business

India’s $5 trillion economy push: How ‘C+1’ strategy could turn country into world’s factory

New Delhi: India is preparing for a major economic transformation. The Union Budget 2026-27 lays out measures that could make the country the top choice for global manufacturing using the popular ‘China +1’ (C+1) strategy. This comes as international companies rethink supply chains after COVID-19 disruptions, rising trade tariffs and geopolitical tensions.

India has positioned itself as the backup factory for the world that is ready to absorb international demand in case of any crisis in China or Taiwan.

The government has offered tax breaks for cell phone, laptop, and semiconductor makers, making India more attractive to foreign investors. Reducing bureaucratic hurdles for global firms, the budget also strengthens the National Single Window System to simplify business procedures. The message is clear: India is ready to step in as a global manufacturing hub, ensuring supply continuity for the world.

The expressway to a $5 trillion economy

China presently dominates about 40% of global manufacturing. Its factories supply critical products worldwide, but 2026 is expected to be a turning point. Expanding influence and economic opacity have made global companies seek alternatives.

India has leveraged this moment, offering a comprehensive incentive package for foreign manufacturers. Analysts call it more than policy; it is a blueprint to become a $5 trillion economy and reclaim India’s historic position as a global industrial leader.

Why the world needs India now

The COVID-19 pandemic exposed the dangers of over-reliance on a single supplier. When China halted medical exports, nations realised the need for diversified supply chains. Major companies such as Apple and Samsung now see India as a dependable alternative.

China’s aging workforce and rising labour costs further enhance India’s appeal. With 65% of its population under 35, India offers a vast, skilled and affordable workforce for decades. The geopolitical uncertainty surrounding Taiwan, which produces 90% of advanced chips, has also created demand for a secure manufacturing backup. India is stepping in to fill that gap.

How India stands to gain from China’s challenges

India’s budget, 2026-27, slashes import duties on cell phone and laptop components, turning the country into a hub for component manufacturing, not just assembly. Electronics exports are projected to cross $120 billion by 2025.

The government has also launched a Rs 1.5 lakh crore semiconductor mission, attracting companies like Tata and Micron to establish advanced chip plants in India. In the chemical sector, stricter environmental regulations in China have shut down several plants, benefiting Indian companies such as Privi Specialty and Aarti Industries, which are now filling gaps in global supply chains.

Incentives for companies

The Production Linked Incentive (PLI) scheme promises cash rewards for output, covering over 14 sectors. This is India’s answer to Chinese subsidies. From land acquisition to electricity connections, the National Single Window System now enables businesses to clear all approvals through a single portal.

Infrastructure investment has also received a massive boost, with Rs 11.11 lakh crore allocated under PM GatiShakti. New ports and dedicated freight corridors are being built to ensure that exports from India reach the world faster and cheaper than ever before.

India’s moves points to a strategic shift in global manufacturing. By rolling out the red carpet for foreign companies and investing heavily in infrastructure, technology and policy reforms, the country is poised to become the go-to destination for global supply chains. The C+1 formula is not only a concept; it is a roadmap to turn India into the next industrial superpower and a $5 trillion economy.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Business1 week ago

Business1 week agoShould smartphones be locked away at gigs and in schools?