Business

World awaits landmark US Supreme Court decision on Trump’s tariffs

Natalie ShermanBusiness reporter

Reuters

ReutersWhat may be the biggest battle yet in Donald Trump’s trade war is about to begin.

The Trump administration heads to the US Supreme Court on Wednesday, facing off against small businesses and a group of states who contend most of the tariffs it has put in place are illegal and should be struck down.

If the court agrees with them, Trump’s trade strategy would be upended, including the sweeping global tariffs he first announced in April. The government would also likely have to refund some of the billions of dollars it has collected through the tariffs, which are taxes on imports.

The final decision from the justices will come after what could be months of poring over the arguments and discussing the merits of the case. Eventually they will hold a vote.

Trump has described the fight in epic terms, warning a loss would tie his hands in trade negotiations and imperil national security.

On Sunday, the president said he will not attend the hearing in person as he did not want to cause a distraction.

“I wanted to go so badly… I just don’t want to do anything to deflect the importance of that decision,” he said. “It’s not about me, it’s about our country.”

Trump previously said that if he does not win the case the US will be “weakened” and in a “financial mess” for many years to come.

The stakes feel just as high for many businesses in the US and abroad, which have been paying the price while getting whipped about by fast-changing policies.

Trump’s tariffs will cost Learning Resources, a US seller of toys made mostly overseas and one of the businesses suing the government, $14m (£10.66m) this year. That is seven times what it spent on tariffs in 2024, according to CEO Rick Woldenberg.

“They’ve thrown our business into unbelievable disruption,” he said, noting the company has had to shift the manufacturing of hundreds of items since January.

Few businesses, though, are banking on a win at the court.

“We are hopeful that this is going to be ruled illegal but we’re all also trying to prepare that it’s setting in,” said Bill Harris, co-founder of Georgia-based Cooperative Coffees.

His co-op, which imports coffee from more than a dozen countries, has already paid roughly $1.3m in tariffs since April.

A test to Trump’s presidential power

In deciding this case, the Supreme Court will have to take on a broader question: How far does presidential power go?

Legal analysts say it is hard to predict the justices’ answer, but a ruling siding with Trump will give him and future White House occupants greater reach.

Specifically, the case concerns tariffs that the Trump administration imposed using the 1977 International Emergency Economic Powers Act (IEEPA), which the White House has embraced for its speed and flexibility. By declaring an emergency under the law, Trump can issue immediate orders and bypass longer, established processes.

Trump first invoked the law in February to tax goods from China, Mexico and Canada, saying drug trafficking from those countries constituted an emergency.

He deployed it again in April, ordering levies ranging from 10% to 50% on goods from almost every country in the world. This time, he said the US trade deficit – where the US imports more than it exports – posed an “extraordinary and unusual threat”.

Those tariffs took hold in fits and starts this summer while the US pushed countries to strike “deals”.

Opponents say the law authorises the president to regulate trade but never mentions the word “tariffs”, and they contend that only Congress can establish taxes under the US Constitution.

They have also challenged whether the issues cited by the White House, especially the trade deficit, represent emergencies.

Members of Congress from both parties have asserted the Constitution gives them responsibility for creating tariffs, duties and taxes, as well.

More than 200 Democrats in both chambers and one Republican, Senator Lisa Murkowski, filed a brief to the Supreme Court, where they also argued the emergency law did not grant the president power to use tariffs as a tool for gaining leverage in trade talks.

Meanwhile, last week the Senate made a symbolic and bipartisan move to pass three resolutions rejecting Trump’s tariffs, including one to end the national emergency he declared. They are not expected to be approved in the House.

Still, business groups said they hoped the rebuke would send a message to the justices.

‘An energy drain like I’ve never seen’

Three lower courts have ruled against the administration. After the Supreme Court hears arguments on Wednesday it will have until June to issue its decision, although most expect a ruling to come by January.

Whatever it decides has implications for an estimated $90bn worth of import taxes already paid – roughly half the tariff revenue the US collected this year through September, according to Wells Fargo analysts.

Trump officials have warned that sum could swell to $1tn if the court takes until June.

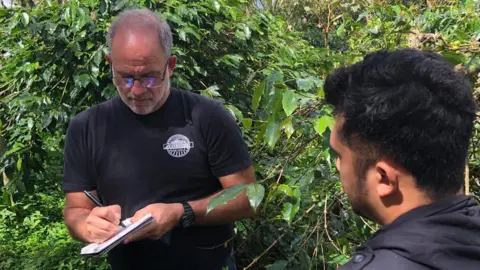

Cafe Campesino

Cafe CampesinoIf the government is forced to issue refunds, Cooperative Coffees will “absolutely” try to recoup its money, said Mr Harris, but that would not make up for all the disruption.

His business has had to take out an extra line of credit, raise prices and find ways to survive with lower profits.

“This is an energy drain like I’ve never seen,” said Mr Harris, who is also chief financial officer of Cafe Campesino, one of the 23 roasteries that own Cooperative Coffees. “It dominates all the conversations and it just kind of sucks the life out of you.”

What could happen next?

The White House says that if it loses, it will impose levies via other means, such as a law allowing the president to put tariffs of up to 15% in place for 150 days.

Even then, businesses would have some relief, since those other means require steps like issuing formal notices, which take time and deliberation, said trade lawyer Ted Murphy of Sidley Austin.

“This is not just about the money,” he said. “The president has announced tariffs on Sunday that go into effect on Wednesday, without advance notice, without any real process.”

“I think that’s the bigger thing for this case for businesses – whether or not that is going to be in our future,” he added.

There is no clear sign of how the court will rule.

In recent years it has struck down major policies, such as Biden-era student loan forgiveness, as White House overreach.

But the nine justices, six of whom were appointed by Republicans, including three by Trump, have shown deference to this president in other recent disputes and historically have given leeway to the White House on questions of national security.

“I really do think arguments are available for the Supreme Court to go in all different directions,” said Greta Peisch, partner at Wiley and former trade lawyer in the Biden administration.

Adam White, senior fellow at the American Enterprise Institute, said he expected the court to strike down the tariffs, but avoid questions like what constitutes a national emergency.

Reuters

ReutersThe case has already complicated the White House’s trade deals, such as one struck in July with the European Union.

The European Parliament is currently considering ratifying the agreement, which sets US tariffs on European goods at 15% in exchange for promises including allowing in more US agricultural products.

“They’re not going to act on this until they see the outcome of the Supreme Court decision,” said John Clarke, former director for international trade at the European Commission.

Chocolats Camille Bloch

Chocolats Camille BlochIn Switzerland, which recently downgraded its outlook for economic growth citing America’s 39% tariff on its goods, chocolatier Daniel Bloch said he’d welcome a ruling against the Trump administration.

His business Chocolats Camille Bloch is absorbing about a third of the cost of new tariffs on kosher chocolate that his firm has exported to the US for decades, aiming to blunt price increases and maintain sales. That decision has wiped out profits for the unit and is not sustainable, he said.

He hopes Trump will reconsider his tariffs altogether, because “that would be easiest”.

“If the court were to make the tariffs go away of course we would see that as a positive sign,” he said. “But we don’t trust that that will bring the solution.”

Business

India-US trade deal: 25% penal tariffs linked to Russian oil gone? Here’s what we know – The Times of India

US President Donald Trump has reportedly agreed to remove the 25% tariff America imposed on India for its crude oil imports from Russia. A New Delhi–based source quoted in a Bloomberg report said that the US has agreed to withdraw the 25% penal tariff for India’s Russian oil procurement. In the meantime, India and the US have announced a trade deal, with the Trump administration lowering the tariffs on Indian exports to 18%. Trump took to social media platform Truth Social to announce the trade deal, which was later confirmed by PM Narendra Modi confirming it via X (Twitter). However, India is yet to confirm the details of the trade deal shared by Trump in his post.

Also Read | India-US trade deal announced by US President Donald Trump; check detailsUS Ambassador to India Sergio Gor also told a TV channel that the final figure of tariff on India will be 18%, indicating that the 25% penal tariff linked to Russian crude has also been removed.He also said that the 18% tariff rate is effective immediately, and that India would buy $500 billion worth of US energy, coal, technology and agricultural products.Russia has been the largest supplier of crude for India since the start of the former’s war with Ukraine. The share in India’s oil import basket has gone up to almost 40%. But recently, after US sanctions on Russian oil firms, Indian refiners had been forced to reduce Russian crude oil purchases.

India-US Trade Deal: What PM Modi, Trump said

PM Modi posted on X, “Wonderful to speak with my dear friend President Trump today. Delighted that Made in India products will now have a reduced tariff of 18%. Big thanks to President Trump on behalf of the 1.4 billion people of India for this wonderful announcement. When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation. President Trump’s leadership is vital for global peace, stability, and prosperity. India fully supports his efforts for peace. I look forward to working closely with him to take our partnership to unprecedented heights.”Before Trump had posted on social media, “It was an Honor to speak with Prime Minister Modi, of India, this morning. He is one of my greatest friends and, a Powerful and Respected Leader of his Country. We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the United States and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week! Out of friendship and respect for Prime Minister Modi and, as per his request, effective immediately, we agreed to a Trade Deal between the United States and India, whereby the United States will charge a reduced Reciprocal Tariff, lowering it from 25% to 18%. They will likewise move forward to reduce their Tariffs and Non Tariff Barriers against the United States, to ZERO. The Prime Minister also committed to “BUY AMERICAN,” at a much higher level, in addition to over $500 BILLION DOLLARS of U.S. Energy, Technology, Agricultural, Coal, and many other products. Our amazing relationship with India will be even stronger going forward. Prime Minister Modi and I are two people that GET THINGS DONE, something that cannot be said for most. Thank you for your attention to this matter!”

Business

Disney supercharged its parks. The booming division still has room to run

People walk in front of Cinderella’s Castle at the Magic Kingdom Park at Walt Disney World on May 31, 2024, in Orlando, Florida.

Gary Hershorn | Corbis News | Getty Images

All is well in the Magic Kingdom — and all of Disney’s other theme parks, too.

The company’s experiences division, which includes its parks, cruise ships, hotels and consumer products, posted record revenue for the fiscal first quarter, topping $10 billion for the first time in Disney’s more than 100-year history. It also reported operating income of $3.3 billion, a 6% bump from the same period a year ago.

Growth in this segment has supercharged in the wake of the Covid pandemic. It often accounts for the lion’s share of the company’s profits. For the period ended Dec. 27, experiences represented 38% of Disney’s total revenue, yet generated a whopping 71% of its operating income.

Company executives expect those good times to continue, forecasting high-single-digit growth in operating income for the segment for fiscal 2026.

“When you look at the footprint of the business today, it’s never been more broad or more diverse,” Bob Iger, CEO of Disney, said during Monday’s earnings call. “And the projects that we have underway are going to make it even more so.”

The strong parks performance comes against the backdrop of a CEO succession competition that could see Chairman of Disney Experiences Josh D’Amaro step in for Iger. The Disney board is meeting this week and is expected to vote on its next CEO, according to people familiar with the matter who spoke on the condition of anonymity about internal matters.

Industry insiders and Disney sources expect D’Amaro to be appointed Iger’s successor, though the decision ultimately lies with the Disney board and won’t be final until directors vote.

“The board has not yet selected the next CEO of The Walt Disney Company and once that decision is made, we will announce it,” a Disney spokesperson said in a statement, declining to comment on the timing of the next board meeting.

Parks expansion

Much of the experiences division’s success comes from major investments to expand the footprint of Disney theme parks, refurbish existing rides and themed areas of its parks, add cruise ships to its fleet and grow its digital gaming presence. This new evolution of the segment is being fueled by Disney’s library of franchises and iconic intellectual property.

Disney has long pulled from its portfolio of content. Disneyland opened its doors more than 70 years ago with rides based on “Alice in Wonderland,” “The Adventures of Ichabod and Mr. Toad,” “Peter Pan” and “Snow White.”

While those classic attractions remain, the company’s more recent developments have been fueled by Iger’s strategic acquisitions of four major film studios — Pixar in 2006, Marvel in 2009, Lucasfilm in 2012 and 20th Century Fox in 2019. This brought coveted franchises under the House of Mouse roof, including Star Wars, Toy Story, the Avengers and Avatar.

“As we added IP to our stable … we gained access to intellectual property that had real value in terms of parks and resorts, and enabled us to lean into more capital spending because of the confidence level we had in improving returns,” Iger said.

Having the film and television rights to these properties allows the company more control over production and how that translates into rides, experiences and merchandise.

And that work continues as part of a 10-year, $60 billion investment effort that launched in 2023.

“We have expansion projects underway at every one of our theme parks,” Iger said.

He touted the upcoming opening of the World of Frozen in Disneyland Paris and the launch of a new cruise ship, the Disney Adventure, which will make berth in Asia.

On the horizon is also a new villains land coming to Magic Kingdom as well of the reshaping of “Rivers of America,” “Tom Sawyer Island” and the “Liberty Square Riverboat” into an area called “Piston Peak” — a second Cars-themed land modeled after America’s natural parks. At Hollywood Studios there will be a new “Monsters Inc.” land while the Muppets will take over the Rock ‘n’ Roller Coaster attraction. Animal Kingdom will host an “Encanto” ride and a new Indiana Jones ride.

At Disneyland, Avengers Campus, the Marvel-themed area, will get two new attractions, guests will get a glimpse at the Land of the Dead from “Coco” and Disney will build a new Avatar area inspired by the scenery in “Avatar: Fire and Ash.”

Internationally, Disney has struck a deal to bring a new park and resort to Yas Island in the United Arab Emirates.

International headwinds

The company’s commitment to bringing beloved IP into its parks is paying off, according to Iger, particularly outside the U.S.

“The percentage of people that go to Shanghai Disneyland just to go to Zootopia Land is very, very high,” he said Monday.

Revenue from international theme parks and experiences grew 7% during the fiscal first quarter, to $1.75 billion.

Of course, the company is still facing headwinds from the decline of international visitors to its domestic parks.

It’s a trend that many theme park destinations in America are contending with, as overall tourism to the United States fell 6% in 2025. Industry analysts point to higher travel costs and fees, ongoing trade frictions and geopolitical unease for the drop in demand for travel stateside.

Despite this, domestic theme park and experiences revenue grew 7% during the quarter, to $6.91 billion.

New offerings at Disney’s international parks, the launch of a cruise ship that services Asia and the new Abu Dhabi park are all ways that Disney can tap into that foreign market and engage with consumers that are not making the trek to the company’s domestic destinations.

— CNBC’s Julia Boorstin and Alex Sherman contributed to this report.

Business

Disney signals its next CEO will take over a company with strong momentum

Walt Disney Company CEO Bob Iger looks on prior to the game between the Philadelphia Eagles and the Green Bay Packers at Lambeau Field on November 10, 2025 in Green Bay, Wisconsin.

Michael Reaves | Getty Images Sport | Getty Images

Disney is ready for its next CEO.

On Monday, the company’s leadership outlined its recent successes during its quarterly earnings report. CEO Bob Iger made the case that when his soon-to-be-named successor picks up the baton, Disney will be primed to seize the momentum.

“I’m incredibly proud of all that we’ve accomplished over the past three years to set Disney on the path to continued growth. I’m inspired and energized by the opportunities ahead for this wonderful company,” Iger told investors on Monday.

Iger reclaimed the CEO role in late 2022 after a failed succession plan involving former parks boss Bob Chapek. Disney picked Chapek to succeed Iger in 2020 only to fire him 2½ years later and undo many of the changes he’d implemented.

Now, Disney is counting on a smoother handover the second time around, cushioned by a path to growth.

The Disney board is meeting this week and is expected to vote on its next CEO, according to people familiar with the matter who spoke on the condition of anonymity about internal matters. The company previously said it would announce a replacement for Iger in the first quarter of this year.

“I think what is noteworthy is that when I came back three years ago, I had a tremendous amount that needed fixing,” Iger said on Monday’s call. “But anyone who runs a company also knows that it can’t just be about fixing. It has to be preparing a company for its future … but taking steps to create opportunities for growth.”

On Monday, Disney topped Wall Street expectations for both revenue and earnings for its fiscal first quarter.

The company’s experiences division, which includes theme parks, resorts and cruises, notched more than $10 billion in quarterly revenue for the first time. Chairman of Disney Experiences Josh D’Amaro is among the front-runners to be named as the next CEO.

Industry insiders and Disney sources expect D’Amaro to be appointed Iger’s successor, though the decision ultimately lies with the Disney board and won’t be final until directors vote.

“The board has not yet selected the next CEO of The Walt Disney Company and once that decision is made, we will announce it,” a Disney spokesperson said in a statement, declining to comment on the timing of the next board meeting.

Iger said Monday he was “very, very bullish” on the parks business and its ability to grow. Disney is now planning to develop a theme park and resort in Abu Dhabi, United Arab Emirates, has been launching more cruise ships, and is in the midst of a previously announced investment of $60 billion into its theme parks over the next decade.

Meanwhile, Disney’s entertainment segment — the unit that houses its TV networks, streaming and theatrical releases, and arguably needed the biggest turnaround in recent years — saw revenue rise 7% in the period. Disney stopped breaking out streaming subscriber growth this quarter, but offered guidance that showed Disney is confident it will continue to grow and offset traditional TV declines.

While theme parks, resorts and cruises have been the profit driver for Disney, its TV, streaming and film business is often in focus. Following underwhelming years at the box office, Disney dominated in 2025, and on Monday its leadership touted its slate ahead.

“Looking back just a few years when our movie business was suffering from Covid and the streaming business was obviously not in an acceptable place, it’s clear that the future of both of those businesses, or let’s call it our entertainment business, is also bright and it’s going to grow,” Iger said on the company’s earnings call.

Disney’s co-chairman of Entertainment, Dana Walden, is also among the Iger lieutenants vying for the CEO seat, CNBC previously reported.

Former Morgan Stanley CEO James Gorman has been running the process to select a successor. Given the focus on theme parks in recent years, speculation has recently swung in D’Amaro’s favor.

“In a world that changes as much as it does … trying to preserve the status quo was a mistake,” Iger said Monday addressing Disney’s last leadership transition.

“And I’m certain that my successor will not do that,” he said. “They’ll be handed, I think, a good hand in terms of the strength of the company, a number of opportunities to grow and also the expectation that in a world that changes, you also have to continue to change and evolve as well.”

— CNBC’s Julia Boorstin contributed to this report.

Correction: This story has been updated to correct the spelling of Morgan Stanley.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings