Business

Zydus Lifesciences Taps 3 Bankers For Rs 5,000-Crore QIP; Issue Likely In Early 2026

Last Updated:

Zydus Lifesciences has appointed three investment banks as advisers as it prepares to raise up to Rs 5,000 crore through QIP

Zydus QIP

Zydus Lifesciences (formerly Cadila Lifesciences) has appointed three investment banks as advisers as it prepares to raise up to Rs 5,000 crore through a qualified institutional placement (QIP), Moneycontrol reported, quoting industry sources.

According to the sources, the company aims to pare debt and pursue mergers and acquisitions (M&A) opportunities, particularly in its US specialty business.

“Jefferies, JP Morgan and IIFL Capital have been picked for the proposed capital raise,” one of the persons told Moneycontrol.

A second source confirmed the advisory syndicate and added that the QIP could be launched by the end of December or in early 2026, depending on market conditions.

During the Q25Y26 post-results earnings call, Zydus Lifesciences Managing Director Dr Sharvil Patel elaborated on the rationale behind the capital raise.

“So, the key objective is to deleverage our balance sheet by reducing our existing debt. Also, there are strategic moves which will enhance our financial ability and agility to strengthen our capital structure, positioning us better for future growth. The board has approved the enabling QIP resolution to allow us the flexibility to tap capital markets when required. More importantly, we have opportunities to look at the US specialty business and scale it up beyond Saroglitazar,” Patel said.

Saroglitazar is a liver disease drug for which Zydus plans to submit a US regulatory application in the first quarter of 2026, as per reports.

Patel further added, “There are opportunities in the international market, specifically Europe, and we are also evaluating innovative assets. The capital raise will give us the capability to execute on some of these.”

Zydus Lifesciences: Focus on reducing debt

On its net debt-to-EBITDA ratio, Patel noted: “Without any acquisition, we don’t want to cross one time, and for a short period we can go up to two times and then reduce net debt back to one time. That’s the range of spend we will look at.”

For FY25–26, the company reported revenues of Rs 15,116 crore and a net profit of Rs 5,774 crore, according to exchange filings.

A September 9 report by Crisil stated: “Gross debt stood at Rs 3,213 crore as of March 31, 2025 (Rs 804 crore as of March 31, 2024), on account of higher working capital requirements. Liquidity was superior at Rs 5,681 crore as of March 31, 2025.”

Crisil also noted: “Crisil Ratings expects the business risk profile of Zydus Life to continue improving, supported by double-digit revenue growth this fiscal and the next, led by continued traction in domestic and international markets, ramp-up in sales of new chemical entities and biosimilars, and benefits from recent acquisitions. The company is expected to sustain healthy operating margins of 25–26%, leading to higher cash accrual.”

Zydus Lifesciences: M&A strategy

Earlier this year, the company strengthened its medical technology portfolio by acquiring a majority stake in a French asset for around Rs 2,450 crore.

On March 11, Zydus Lifesciences said it had entered exclusive negotiations to acquire an 85.6 percent controlling stake in France-based Amplitude Surgical SA, a leading medical technology player specialising in lower-limb orthopaedic solutions.

In the consumer wellness segment, Zydus Wellness, a subsidiary of Zydus Lifesciences, acquired the UK-based Comfort Click Limited (CCL), one of the fastest-growing digital consumer healthcare platforms in the vitamins, minerals and supplements (VMS) space, which derives most of its revenue from e-commerce and D2C channels.

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a…Read More

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a… Read More

November 20, 2025, 12:44 IST

Read More

Business

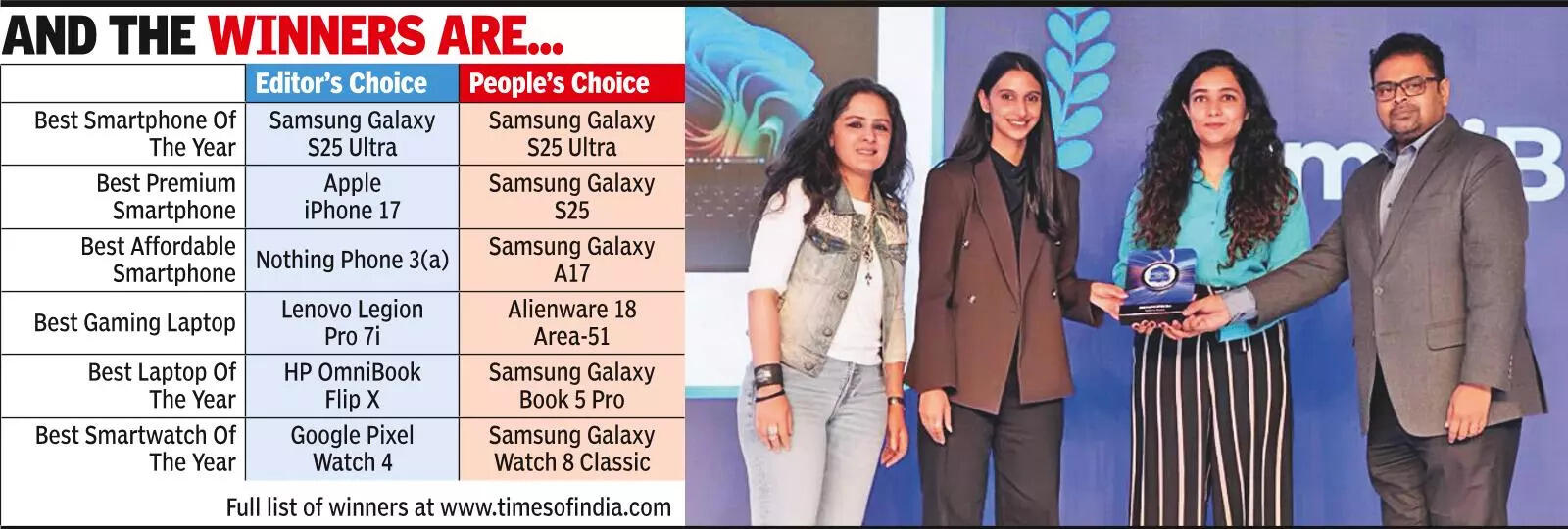

Gadgets Now Awards 2025 recognise tech excellence – The Times of India

NEW DELHI: The Times of India Gadgets Now Awards 2025 celebrated last year’s standout gadgets at an event on Monday where technology met glamour. The event drew an eclectic gathering of distinguished guests who came together to recognise technological excellence across key categories, including smartphones, smartwatches, audio products, televisions and more.This year, the Awards that are in its 6th edition went a step further and also recognised India’s leading influencers and creators who are redefining the tech content landscape.

The winners included Samsung Galaxy S25 Ultra, which scored a double win as the Best Smartphone Editor’s Choice and Popular Choice.Apple iPhone 17 was adjudged the Best Premium Smartphone Editor’s Choice, while Samsung Galaxy S 25 won the Popular Choice in the same category.Samsung once again picked up 2 awards as Galaxy Z Fold 7 was crowned the Editor’s Choice and Popular Choice winner in the Best Foldable Smartphone category.Samsung Galaxy Book 5 Pro won the Editor’s Choice Best AI-powered gadget, while Neosapien Neo 1 was the Popular Choice winner.

Business

Google apologises for Baftas alert to ‘see more’ on racial slur

Google said the news alert was an error that should not have happened.

Source link

Business

Trump’s new global tariff comes into effect at 10%

The global levy comes in at 10%, lower than the rate the president had threatened at the weekend.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash