Business

Trade deal talks with Qatar from next week – The Times of India

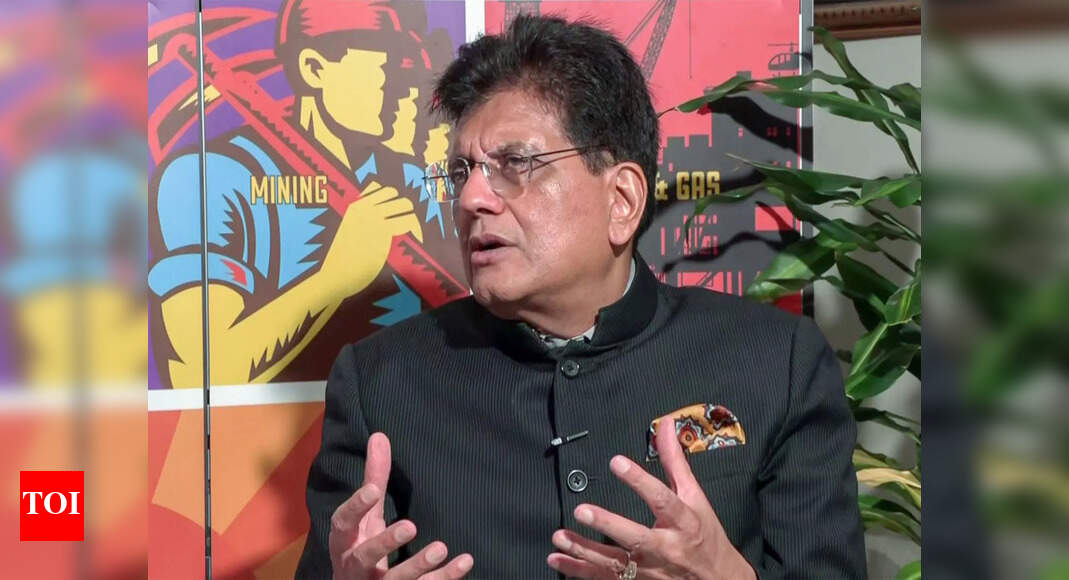

NEW DELHI: Commerce and industry minister Piyush Goyal will visit Doha next week to kick off talks for a bilateral trade agreement, adding another Gulf nation to the bouquet of countries negotiating trade treaties with India. UAE already has a pact with India.Sources said the minister will travel to Singapore as well, an ASEAN member with which India has a Comprehensive Economic Cooperation Agreement (CECA) but is not satisfied with the outcomes. He will also meet European trade commissioner Maros Sefcovic on the sidelines of the G20 meet in South Africa in Nov. India and EU are trying to conclude an FTA by the year-end. The talks come amid turbulence in the US-India trade relations with 50% tariff on Indian goods entering American markets from Aug 27.At a CII event, Goyal described India as the fastest-growing large economy in a world “full of uncertainty, turbulence and volatility.” He said that India is focusing on self-reliance by strengthening capabilities and making supply chains more resilient to counter the “weaponisation of trade.”

Business

LSEG boosts returns for shareholders amid activist investor pressure

The London Stock Exchange Group has unveiled plans for a £3 billion share buyback amid pressure from an activist investor and as artificial intelligence fears have hammered the stock.

LSEG said it would follow £2.1 billion in buybacks made last year with another £3 billion by February next year, on top of a hike in dividend payouts.

Details of the pledge to step up returns for investors came as it reported underlying operating profits of £3.51 billion for 2025, up 10.8% or 14.7% higher on a constant currency basis.

On a bottom line basis, pre-tax profits jumped 56.5% to £1.97 billion for 2025.

Shares in the group rose as much as 5% in Thursday morning trading, in a welcome increase after the stock has been battered in recent weeks by global investor concerns over the impact of AI on its firm and data companies more widely.

Shares in the firm, which makes a significant chunk of its earnings from selling access to markets data, have slumped by nearly a third in the past year.

Activist investor Elliott Management has also built up a stake in the firm earlier this month and has reportedly been pushing for more share buybacks as it has held talks with LSEG bosses.

In the face of the recent shares slump, chief executive David Schwimmer said recent results showed “another year of very strong financial performance”.

He said: “In the fourth quarter alone, major financial institutions signed long-term contracts worth £1.9 billion to access our leading data and workflow.”

“With our LSEG Everywhere data strategy, we are positioning ourselves as the partner of choice for licensed, trusted data as the use of AI in decision-making scales – and we are seeing very positive signs of adoption,” he added.

It outlined new performance guidance for 2027 to 2029, with aims to deliver “mid to high single digit” growth in total income and further increase profitability.

Despite taking a significant stake in LSEG, the Financial Times newspaper reported earlier this week that Elliott has made assurances to the UK government over its intentions for LSEG as speculation mounted it would look to push for a break-up of the firm or for it to switch its listing to New York.

Business

Rolls-Royce makes £1 billion more profit after major defence orders

Rolls-Royce has revealed its annual profit surged by £1 billion and upgraded its outlook for the years ahead, following major military aircraft orders and soaring demand for powering data centres.

The engineering giant said its business divisions were in a good place to benefit from “key global trends” over the coming years.

It reported an underlying operating profit of £3.5 billion for 2025, a jump of 40% from the £2.5 billion made the prior year.

Underlying revenues surpassed £20 billion over the year, up about a 10th on 2024.

This was driven by profit and sales growth across its civil aerospace, defence, and power businesses.

Rolls-Royce said demand for its defence products was strong and it secured major orders during 2025.

This included contracts worth more than £1.5 billion with the UK’s Ministry of Defence and the US’s Department of War for EJ200 and AE 2100 engines to power military aircraft.

New orders for the Eurofighter aircraft engines from Italy, Germany and Spain, as well as export agreements from Turkey, will drive production into the 2030s, it said.

Furthermore, Rolls-Royce said it was benefiting from growing demand for power generation, driven by data centres with revenues up by more than a third.

Rolls-Royce said it was now expecting underlying operating profits to increase to between £4.9 billion and £5.2 billion by 2028 following the strengthened financial performance in 2025.

This is significantly higher than the £3.6 billion to £3.9 billion range that it had previously been targeting.

Chief executive Tufan Erginbilgic said growth would not have been possible “before our transformation”, with the business making £600 million worth of cost savings since 2022.

“With our new capabilities and mindset, we have navigated challenges from supply chain to tariffs, and delivered a strong performance in 2025, all while we built the foundations for significant growth for years to come,” he said.

“Based on our 2026 guidance, we expect to deliver underlying operating profit within the prior mid-term guidance range two years earlier than planned.

“Beyond the mid-term we continue to see significant growth from existing businesses as well as from new business opportunities.”

Business

RBI’s Rs 25,000-Crore Switch Auction On March 2nd And Its Impact On Bond Markets, Government Debt Strategy | Explained

Last Updated:

RBI Switch Auction On March 2: The Reserve Bank of India will conduct a government securities switch auction worth Rs 25,000 crore on March 2 between 10:30 AM and 11:30 AM

In the latest exercise, all securities, having maturities in FY27, are being replaced with bonds maturing after FY32.

RBI Switch Auction On March 2: The Reserve Bank of India (RBI) will conduct a government securities switch auction worth Rs 25,000 crore on March 2 between 10:30 AM and 11:30 AM, with results to be declared the same day and settlement scheduled for March 4. The move marks the third such operation this month and is aimed at smoothing India’s future debt repayment profile.

What is a switch auction?

A switch auction is a debt management tool through which the government exchanges bonds that mature soon with bonds that mature later. Instead of repaying investors in cash when near-term securities mature, the government offers them longer-dated securities. This effectively postpones repayment obligations without increasing total debt.

In the latest exercise, all securities, having maturities in FY27, are being replaced with bonds maturing after FY32, according to RBI data.

Why is RBI conducting it now?

The key trigger is the heavy redemption pressure expected in FY27, when government securities worth about Rs 5.47 lakh crore are scheduled to mature. By replacing these with bonds maturing after FY32, the authorities are spreading repayment obligations across future years. This reduces refinancing risk and prevents sudden spikes in borrowing needs.

How does it help the government?

India has already budgeted gross market borrowing of Rs 17.2 lakh crore. Large redemptions in a single year would force the government either to borrow more or use fiscal resources for repayment. Switch auctions smooth this maturity profile, making debt servicing more predictable and fiscally manageable.

What has happened so far this month?

Before this latest announcement, the RBI conducted two switch auctions in which securities worth Rs 84,804 crore were bought back and replaced. The repeated use of this tool signals a proactive debt-management strategy rather than a reactive measure.

Why markets watch switch auctions closely

Bond investors track such operations because they affect liquidity, yield curves and supply of long-term securities. Extending maturities can reduce pressure on near-term yields while increasing supply at the long end, influencing pricing across the sovereign curve.

The broader takeaway

The latest switch auction is part of a deliberate strategy to manage India’s rising debt stock more efficiently. By pushing repayments further into the future and avoiding bunching of maturities, policymakers aim to maintain stability in government borrowing costs and ensure smoother fiscal operations in coming years.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 11:11 IST

Read More

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Fashion1 week ago

Fashion1 week agoPhilippines expands logistics network to address supply chain issues

-

Fashion1 week ago

Fashion1 week agoFrance’s Kering’s FY25 sales fall; eyes growth & margin recovery

-

Business1 week ago

Business1 week agoAir India and Lufthansa Group sign MoU to expand India-Europe flight network

-

Politics1 week ago

Politics1 week agoRamadan Moon Sighted in Saudi Arabia, First Fast to Be Observed on February 18

-

Entertainment1 week ago

Entertainment1 week agoIran foreign minister says progress made in nuclear talks with US