Business

The around-the-world cruise that is yet to set sail

Suranjana TewariAsia Business Correspondent

BBC

BBC“Throw your current lifestyle overboard!” boasts the advert for Victoria Cruises Line (VCL), which bills itself as the world’s first affordable residential cruise.

Cabins typically go for US$3,840 (£2,858) a month for a three-year voyage to 115 countries, and travellers from all over the world have the option of doing the route for as long as they like.

For Australians Dennis and Taryna Wawn from Perth, excited by the prospect of a home at sea, the advert on Facebook couldn’t have come at a better time as they planned their retirement.

Three years later, the ship has yet to sail. In fact, they and other would-be cruise residents have found that VCL does not even own or have a lease on the ship that is being advertised.

The Wawns are just two of dozens of people who have been waiting for VCL to refund their deposits, the BBC has learned.

Other would-be residents told the BBC they sold their homes, rehomed cats and put their belongings into storage. One woman said she had put down her sick dog, believing she would be gone for years.

Another couple have now had to move into a retirement community because of their advanced ages and failing health. They could no longer commit to a residential cruise that might or might not ever sail.

“The people that put down a deposit for this cruise were sold a dream… and it has turned into nothing short of a nightmare,” said Adam Glezer, who runs a consumer advocacy company. “What VCL has done is disgusting.”

Those affected have contacted the company, some have launched legal cases and others have filed consumer complaints to government agencies. One even wrote to the FBI.

VCL told the BBC that it still needs more customers before a vessel can be chartered and so is continuing to advertise the cruise.

The company said customers knew about the occupancy condition when booking, and the company denies targeting or harming anyone, adding that it advised some clients not to sell homes to pay deposits.

Many of those who signed up have given up hope of the ship ever sailing, or of getting their money back.

‘All above board’

Taryna, 64, said that in May 2022, she and Dennis were starting to think about their future and what it could look like when they came across the residential cruise. The couple feel they did their due diligence.

Taryna said the company had a well-built and detailed website, they also spoke to a man from the company “who answered all the questions”, and they joined a Facebook group made up of other cruise “residents”.

“We did some checking, thought it was all above board,” she said.

Within a month, they took the step of paying a deposit of US$10,000 (£7,450). Their bank transfer has been viewed by the BBC.

But weeks before they were due to set sail in May 2023, VCL postponed the scheduled departure date.

In an email viewed by the BBC, VCL said the cruise hadn’t reached a roughly 80% occupancy – something the company said it needed in order to charter a vessel.

When VCL postponed twice more, the couple started to think something was up.

Then a fellow would-be resident got in touch, saying: “I’ve dug a little bit further. Get out.”

‘Our shared dream is very much alive’

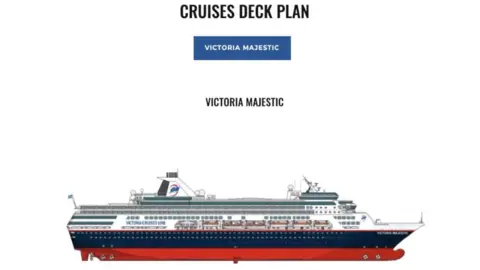

VCL’s marketing promised a fully-fledged cruise liner that could house 1,350 guests, with pools, tennis courts and an Italian restaurant.

“We do have a beautiful, seaworthy ship, the former Holland American Veendam, now the Majestic,” VCL’s US representative wrote on the company’s Facebook page.

But the BBC has learned that on being contacted by some would-be residents, the firm that owns the ship denied any association with VCL.

Although it has not yet leased a ship, the company said it has continued to advertise the cruise and collect deposits in order to reach the necessary occupancy rate.

“If we had signed the lease agreement at the beginning of 2024, we would have had to pay approximately USD 18 million for nothing,” VCL said in an email to the BBC.

It also acknowledged that there had been 132 cancellations, and said it investigated 38 complaints, but found none justified a refund.

VCL also denied there were any “victims”, and said that 38 customers who asked for refunds cannot accept they were not entitled to one.

The company added that the refunds were withheld for administrative reasons, missing or incorrect bank details, failure to return termination administration agreements within deadlines, and anti-money laundering checks.

VCL’s cruise was last scheduled to depart on 26 July 2025, according to its website. But once again it failed to set sail.

“Despite the delay, we’ve been encouraged by a surprising influx of new interest in recent weeks – a strong signal that our shared dream is very much alive,” VCL’s website reads.

‘It got dirty’

Graham Whittaker, a former journalist based in Australia, estimates that VCL has taken money that goes into the millions.

“It got dirty because we started to find scores and scores more people who had never been refunded, who had asked for their money back, who had been lied to,” Whittaker said.

When passengers pushed harder – asking about refunds, and talking to the media about the case – they were threatened with legal action. The BBC has seen dozens of such emails.

“The threats and the harassments are getting serious for some,” Whittaker said.

VCL justified the threat of legal action in its email to the BBC.

“Yes, we will take legal action against anyone who tries to settle their complaint on social media,” it said.

The paper trail

Company records reviewed by the BBC show a web of shell businesses registered to the same address in Budapest, some now no longer trading.

The company is also registered in Florence, Italy, but as a specialised wholesaler of food, beverages and tobacco.

In Hungary, Viktória Takács-Ollram is listed as the founder, while her 79-year-old mother is registered as the chief executive.

Another company is registered under the same address to Viktória’s son, Marcell Herold, who is named as the vice president of VCL on its website.

In Hungary, VCL was registered in 2017 under a different name as an accounting and tax advising firm.

That changed to VCL in 2022, with “services auxiliary to waterborne transport” and “rental of water transport equipment” added.

In 2023 new activities were added: “car rental”, “lending of other machinery and equipment”.

As of 1 January 2025, its main activity is listed as “passenger transport by sea”.

Tax filings indicate more than $253,000 in unpaid taxes.

Taking matters into their own hands

A couple won a case in Hungary, overturning VCL’s contract changes, but enforcement stalled when VCL shifted its base to Italy.

VCL admitted to the BBC that it changed contracts after customers signed, and that new terms would apply retroactively.

“When drafting a contract, lawyers try to include everything. But sometimes life happens and the contract needs to be amended. That is what happened in this case,” VCL said.

“These contracts work this way for all shipping companies.”

Another couple filed a complaint in the US state of Utah, with the investigation finding that a berth was not booked on a stated departure date.

It also found that people purporting to be hired staff on the website did not plan to be on the cruise, nor had they received offers of employment.

The investigation ruling said that VCL’s US representative encouraged people to sign up for the cruise.

The investigation found that she truthfully believed the residential cruise was going to sail, but she agreed to sign a compliance order barring her from promoting such travel services in the future.

‘Not a phantom company’

Despite all of this, VCL continues to advertise its cruise on Facebook and Instagram.

Accounts on the platforms show glossy brochures of the ship’s decks, menus and cabins.

New “residents” are shown posing on board – many of them are actually stock images widely available on the internet.

To encourage lengthy stays, the cruise company has been offering hefty discounts, flash sales and cashback schemes.

Alleged victims say they have reported the ads repeatedly, but Meta – which owns Facebook and Instagram – has declined to take them down.

“It is reprehensible that these platforms are allowing advertising for VCL despite the significant amount of evidence. They should be held accountable for this,” said consumer champion Adam Glezer.

In a statement, Meta told the BBC that its advertising standards strictly prohibit deceptive or misleading ads, including scams, but it found no evidence that the page violates its policies.

VCL denied that it was running a scam, saying those affected were unable to accept that they were not entitled to a refund.

“Our company has never disappeared, we have responded to every email, so we are not a phantom company.”

Taryna said the idea of the cruise isn’t too good to be true – some people who signed up for the VCL cruise were currently travelling the world with other cruise liners.

However, for her and Dennis, going on another such cruise is no longer something they can afford.

“It was a dream for us and we were really focusing on it as a lovely adventure. It’s been traumatising.”

Additional reporting by Orsolya Polyacsko

Business

How Costly Is A $10 Oil Spike For India’s Economy?

Last Updated:

Every $10 rise in global crude oil prices could shave around 0.5 percentage points off India’s GDP growth, say experts

India imports nearly 50 percent of crude oil from the Middle East

Every $10 rise in global crude oil prices could shave around 0.5 percentage points off India’s GDP growth, underscoring the country’s heavy reliance on imported oil and vulnerability to global energy volatility, Vandana Bharti, Research Head–Commodity at SMC Global Securities, told ANI.

In an interview with ANI, Bharti said escalating geopolitical tensions in West Asia pose a significant economic risk for India as crude prices climb and supply chains face potential disruptions.

“Every $10 increase in crude oil prices impacts India’s GDP by roughly 0.5%. We have already seen prices rise by about $10–$15 recently, and the economic impact will eventually reflect in growth numbers,” she said.

West Asia tensions driving oil prices higher

The surge in oil prices follows intensifying tensions involving the United States, Israel and Iran, particularly around the Strait of Hormuz — a critical maritime corridor through which roughly 20–25% of global oil shipments pass.

Bharti said the conflict has injected additional uncertainty into global energy markets and added what she described as a “war premium” to crude prices.

“It’s not just about the possibility of the Strait of Hormuz closing. Insurance costs and freight charges are rising, and shipments are being rerouted. All these factors add a war premium to crude oil prices and increase market uncertainty,” she said.

Risks extend beyond shipping

According to Bharti, the risks go beyond maritime routes and extend to energy infrastructure itself.

“Energy sites such as crude oil facilities and LNG plants are potential targets. There are also concerns about seabed cables and other critical infrastructure. So the threat is not only to energy supply but also to broader global trade and connectivity,” she noted.

Crude prices rise sharply

Oil prices have already surged as tensions intensified in the region.

Bharti said crude climbed from around $69 per barrel to nearly $78 per barrel within a week.

“In just one week we have seen prices move from about $69 to $78 per barrel. If tensions persist, crude could rise further to around $85–$87 per barrel in the coming days,” she said.

India’s reliance on Middle Eastern crude

India remains particularly vulnerable to such price shocks due to its heavy dependence on imported oil.

Bharti noted that roughly half of India’s crude imports come from the Middle East, and many domestic refineries are specifically configured to process Middle Eastern crude grades.

“India imports nearly 50% of its crude from the Middle East, so any disruption in the region directly impacts supply availability and pricing,” she said.

India maintains strategic petroleum reserves that can help cushion short-term disruptions, but Bharti emphasised that these are primarily meant for emergencies.

“We have reserves that can last about 25–30 days in emergency situations, but the structural dependence on Middle Eastern supply remains,” she said.

She added that even brief supply disruptions could trigger volatility across Asian financial markets.

“Even a two-week disruption could create significant volatility in Asia. We are already seeing pressure on currencies, equity outflows and rising economic uncertainty,” Bharti said.

Diversification may cushion the impact

Bharti said India could mitigate some risks by diversifying crude supply sources.

“Russia has been offering crude at discounted prices, so India may increase purchases from Russia or other suppliers if required. Adjusting supply chains and renegotiating trade arrangements can provide some relief,” she said.

She also pointed out that members of the Organization of the Petroleum Exporting Countries (OPEC) may attempt to stabilise prices, although security concerns could limit immediate production increases.

Impact on fertilisers and agriculture

Higher crude prices could also ripple into other sectors of the economy.

Bharti warned that rising energy costs may push up fertiliser prices and agricultural input costs, potentially affecting the upcoming kharif crop season.

“Higher energy costs could make fertilisers and farm inputs more expensive, which may increase the cost of cultivation for farmers,” she said.

Renewables gain strategic importance

Bharti added that the ongoing geopolitical tensions highlight the need for countries to accelerate the transition to renewable energy.

“Events like this are a wake-up call. Governments may increasingly prioritise renewable energy such as solar to reduce dependence on volatile fossil-fuel supply routes,” she said.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

March 06, 2026, 08:16 IST

Read More

Business

Anthropic officially designated a supply chain risk by Pentagon

The supply chain risk designation of the artificial intelligence firm is a first for a US company.

Source link

Business

FDA official calls UniQure’s gene therapy a ‘failed’ treatment for Huntington’s disease

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

UniQure needs to run another study to prove that its gene therapy “actually helps people with Huntington’s disease,” a senior U.S. Food and Drug Administration official said on a call with reporters Thursday.

The official, who requested anonymity before discussing sensitive information, confirmed the agency has asked the company to run a placebo controlled trial of its treatment, which is administered directly into the brain. UniQure has said that type of study isn’t ethical because it would require putting people under general anesthesia for hours, a characterization the official disputed.

“So what is really going on? UniQure is the latest company to make a failed therapy for Huntington’s patients,” the official said. “They likely acknowledge or understand at some deep level that their trial failed years ago, and instead of doing the right thing and running the correct clinical study, UniQure is performing a distorted or manipulated comparison in the mind of FDA.”

The comments mark the latest development in a messy public spat between UniQure and the FDA, and as the agency comes under fire for a number of recent drug approval application rejections, including some where companies have accused it of going back on previous guidance. FDA Commissioner Marty Makary in an interview with CNBC’s Becky Quick last week seemingly criticized UniQure’s gene therapy for Huntington’s disease. Makary didn’t name UniQure but described its treatment.

UniQure then accused the FDA of reversing its stance that the company’s clinical trial data would be sufficient to seek approval. UniQure’s study used an outside database to measure how patients with Huntington’s disease might decline without treatment, known as an external control. UniQure has said it wouldn’t be feasible to run a true randomized, double-blind placebo-controlled study, considered the gold standard, because it wouldn’t be ethical to make people undergo a sham hours-long brain surgery.

The FDA official said the agency “never agreed to accept this distorted comparison” and the FDA “never makes such assurances.” Instead, the “FDA will always say, ‘Well, we have to see the data when we get it.'”

UniQure didn’t immediately comment.

The company’s stock rose more than 10% on Thursday and has fallen 58% this year as of Thursday afternoon.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business6 days ago

Business6 days agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’