Business

The around-the-world cruise that is yet to set sail

Suranjana TewariAsia Business Correspondent

BBC

BBC“Throw your current lifestyle overboard!” boasts the advert for Victoria Cruises Line (VCL), which bills itself as the world’s first affordable residential cruise.

Cabins typically go for US$3,840 (£2,858) a month for a three-year voyage to 115 countries, and travellers from all over the world have the option of doing the route for as long as they like.

For Australians Dennis and Taryna Wawn from Perth, excited by the prospect of a home at sea, the advert on Facebook couldn’t have come at a better time as they planned their retirement.

Three years later, the ship has yet to sail. In fact, they and other would-be cruise residents have found that VCL does not even own or have a lease on the ship that is being advertised.

The Wawns are just two of dozens of people who have been waiting for VCL to refund their deposits, the BBC has learned.

Other would-be residents told the BBC they sold their homes, rehomed cats and put their belongings into storage. One woman said she had put down her sick dog, believing she would be gone for years.

Another couple have now had to move into a retirement community because of their advanced ages and failing health. They could no longer commit to a residential cruise that might or might not ever sail.

“The people that put down a deposit for this cruise were sold a dream… and it has turned into nothing short of a nightmare,” said Adam Glezer, who runs a consumer advocacy company. “What VCL has done is disgusting.”

Those affected have contacted the company, some have launched legal cases and others have filed consumer complaints to government agencies. One even wrote to the FBI.

VCL told the BBC that it still needs more customers before a vessel can be chartered and so is continuing to advertise the cruise.

The company said customers knew about the occupancy condition when booking, and the company denies targeting or harming anyone, adding that it advised some clients not to sell homes to pay deposits.

Many of those who signed up have given up hope of the ship ever sailing, or of getting their money back.

‘All above board’

Taryna, 64, said that in May 2022, she and Dennis were starting to think about their future and what it could look like when they came across the residential cruise. The couple feel they did their due diligence.

Taryna said the company had a well-built and detailed website, they also spoke to a man from the company “who answered all the questions”, and they joined a Facebook group made up of other cruise “residents”.

“We did some checking, thought it was all above board,” she said.

Within a month, they took the step of paying a deposit of US$10,000 (£7,450). Their bank transfer has been viewed by the BBC.

But weeks before they were due to set sail in May 2023, VCL postponed the scheduled departure date.

In an email viewed by the BBC, VCL said the cruise hadn’t reached a roughly 80% occupancy – something the company said it needed in order to charter a vessel.

When VCL postponed twice more, the couple started to think something was up.

Then a fellow would-be resident got in touch, saying: “I’ve dug a little bit further. Get out.”

‘Our shared dream is very much alive’

VCL’s marketing promised a fully-fledged cruise liner that could house 1,350 guests, with pools, tennis courts and an Italian restaurant.

“We do have a beautiful, seaworthy ship, the former Holland American Veendam, now the Majestic,” VCL’s US representative wrote on the company’s Facebook page.

But the BBC has learned that on being contacted by some would-be residents, the firm that owns the ship denied any association with VCL.

Although it has not yet leased a ship, the company said it has continued to advertise the cruise and collect deposits in order to reach the necessary occupancy rate.

“If we had signed the lease agreement at the beginning of 2024, we would have had to pay approximately USD 18 million for nothing,” VCL said in an email to the BBC.

It also acknowledged that there had been 132 cancellations, and said it investigated 38 complaints, but found none justified a refund.

VCL also denied there were any “victims”, and said that 38 customers who asked for refunds cannot accept they were not entitled to one.

The company added that the refunds were withheld for administrative reasons, missing or incorrect bank details, failure to return termination administration agreements within deadlines, and anti-money laundering checks.

VCL’s cruise was last scheduled to depart on 26 July 2025, according to its website. But once again it failed to set sail.

“Despite the delay, we’ve been encouraged by a surprising influx of new interest in recent weeks – a strong signal that our shared dream is very much alive,” VCL’s website reads.

‘It got dirty’

Graham Whittaker, a former journalist based in Australia, estimates that VCL has taken money that goes into the millions.

“It got dirty because we started to find scores and scores more people who had never been refunded, who had asked for their money back, who had been lied to,” Whittaker said.

When passengers pushed harder – asking about refunds, and talking to the media about the case – they were threatened with legal action. The BBC has seen dozens of such emails.

“The threats and the harassments are getting serious for some,” Whittaker said.

VCL justified the threat of legal action in its email to the BBC.

“Yes, we will take legal action against anyone who tries to settle their complaint on social media,” it said.

The paper trail

Company records reviewed by the BBC show a web of shell businesses registered to the same address in Budapest, some now no longer trading.

The company is also registered in Florence, Italy, but as a specialised wholesaler of food, beverages and tobacco.

In Hungary, Viktória Takács-Ollram is listed as the founder, while her 79-year-old mother is registered as the chief executive.

Another company is registered under the same address to Viktória’s son, Marcell Herold, who is named as the vice president of VCL on its website.

In Hungary, VCL was registered in 2017 under a different name as an accounting and tax advising firm.

That changed to VCL in 2022, with “services auxiliary to waterborne transport” and “rental of water transport equipment” added.

In 2023 new activities were added: “car rental”, “lending of other machinery and equipment”.

As of 1 January 2025, its main activity is listed as “passenger transport by sea”.

Tax filings indicate more than $253,000 in unpaid taxes.

Taking matters into their own hands

A couple won a case in Hungary, overturning VCL’s contract changes, but enforcement stalled when VCL shifted its base to Italy.

VCL admitted to the BBC that it changed contracts after customers signed, and that new terms would apply retroactively.

“When drafting a contract, lawyers try to include everything. But sometimes life happens and the contract needs to be amended. That is what happened in this case,” VCL said.

“These contracts work this way for all shipping companies.”

Another couple filed a complaint in the US state of Utah, with the investigation finding that a berth was not booked on a stated departure date.

It also found that people purporting to be hired staff on the website did not plan to be on the cruise, nor had they received offers of employment.

The investigation ruling said that VCL’s US representative encouraged people to sign up for the cruise.

The investigation found that she truthfully believed the residential cruise was going to sail, but she agreed to sign a compliance order barring her from promoting such travel services in the future.

‘Not a phantom company’

Despite all of this, VCL continues to advertise its cruise on Facebook and Instagram.

Accounts on the platforms show glossy brochures of the ship’s decks, menus and cabins.

New “residents” are shown posing on board – many of them are actually stock images widely available on the internet.

To encourage lengthy stays, the cruise company has been offering hefty discounts, flash sales and cashback schemes.

Alleged victims say they have reported the ads repeatedly, but Meta – which owns Facebook and Instagram – has declined to take them down.

“It is reprehensible that these platforms are allowing advertising for VCL despite the significant amount of evidence. They should be held accountable for this,” said consumer champion Adam Glezer.

In a statement, Meta told the BBC that its advertising standards strictly prohibit deceptive or misleading ads, including scams, but it found no evidence that the page violates its policies.

VCL denied that it was running a scam, saying those affected were unable to accept that they were not entitled to a refund.

“Our company has never disappeared, we have responded to every email, so we are not a phantom company.”

Taryna said the idea of the cruise isn’t too good to be true – some people who signed up for the VCL cruise were currently travelling the world with other cruise liners.

However, for her and Dennis, going on another such cruise is no longer something they can afford.

“It was a dream for us and we were really focusing on it as a lovely adventure. It’s been traumatising.”

Additional reporting by Orsolya Polyacsko

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

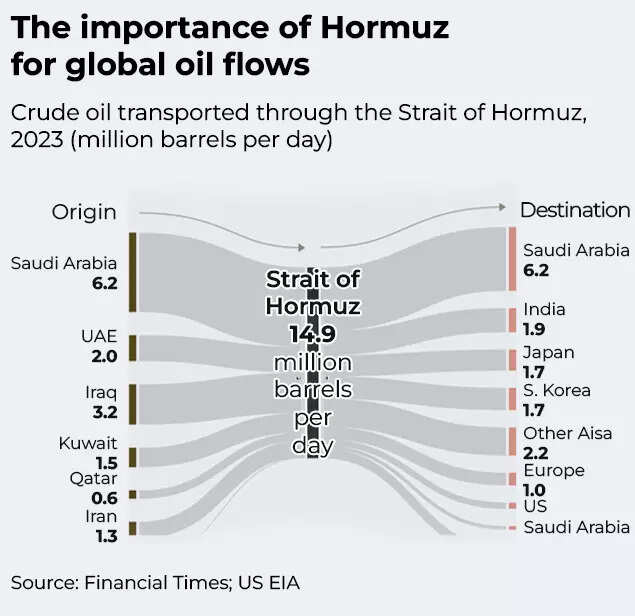

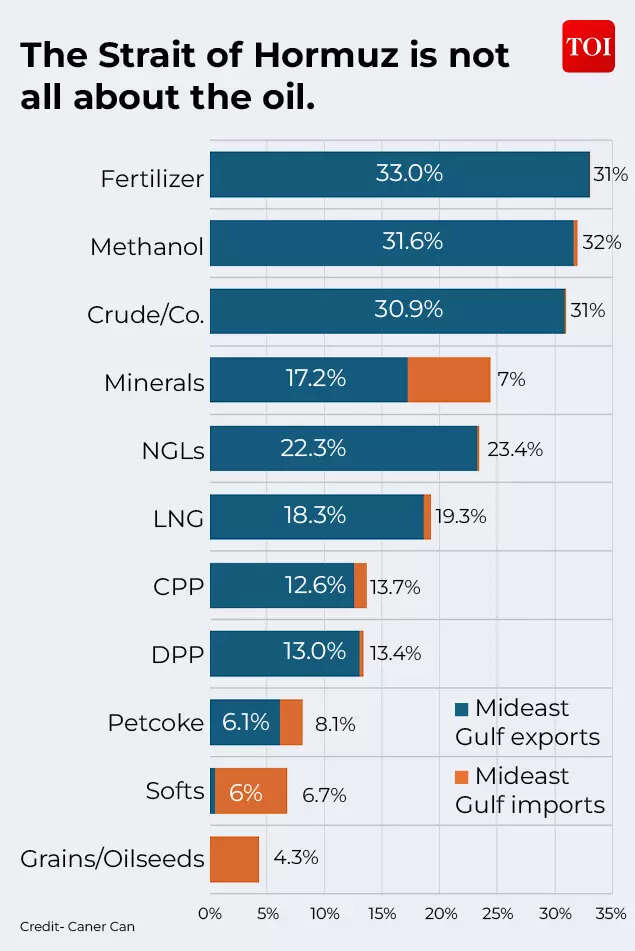

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

Business

Asian stocks today: Markets inch higher mirroring Wall Street gains; Kospi jumps 10%, Nikkei up 1,400 points – The Times of India

Asian stocks inched higher on Thursday, after days of trading in red amid ongoing Middle East tensions. This comes as equities were lifted by a rebound on Wall Street as oil prices paused their recent spike and economic updates painted a more positive picture of the American economy. In South Korea, Kospi hit a pause on its downward rally to add a whopping 10% or 513 points, to reach 5,606. Japan’s Nikkei 225 also climbed 2.7% to 55,713. Hong Kong’s HSI also traded in green, rising 353 points to 25,603 as of 9:10 am. Shanghai and Shenzhen added 0.9% and 1.7% respectively. Gains elsewhere in the region were more modest. Australia’s S&P/ASX 200 added 0.3% to 8,927.20, while New Zealand’s benchmark index moved 0.9% higher. In contrast, US futures indicated a subdued start ahead. Futures linked to the Dow Jones Industrial Average were almost unchanged, while S&P 500 futures ticked up 0.2%. The S&P 500 advanced 0.8% on Wednesday, clawing back much of the decline seen since the onset of the Iran conflict. The Dow Jones Industrial Average rose 0.5%, and the Nasdaq Composite outperformed with a 1.3% gain. Globally, market sentiment has remained sensitive to developments in the Middle East, with oil price swings continuing to steer trading direction. Crude prices eased during Wednesday’s session. Brent crude briefly moved above $84 a barrel before settling at $81.40, roughly matching the previous day’s level. US benchmark crude edged up 0.1% to finish at $74.66 per barrel. By early Thursday, however, oil was on the rise again. Brent crude climbed 2.4% to $83.32 per barrel, while U.S. benchmark crude jumped 2.5% to $76.53 per barrel.

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026