Business

‘Every day feels like firefighting’: Hit by EU sanctions over Russian oil – Indian refinery Nayara Energy struggles to sustain operations – The Times of India

Nayara Energy, the Indian refinery with major Russian ownership, is scrambling to sustain operations after being hit by European Union sanctions. The Russian-owned refinery, facing exclusion from many international markets due to severe EU sanctions implemented on July 18, has been compelled to redirect additional fuel towards domestic consumption whilst seeking alternative export destinations, amongst various necessary adaptations required by the EU restrictions.According to a Reuters report, from late August onwards, Nayara Energy’s refinery has intensified its railway usage, dispatching two to three trains daily, each comprising 50 tanker cars to transport fuel to inland storage facilities. This is more than twice its previous railway utilisation for diesel and petrol transportation.Nayara’s Russian ownership exemplifies the enduring close relationship between New Delhi and Moscow, a connection that positions India differently from Western allies.The government has found itself managing a delicate situation with Nayara’s ongoing difficulties, providing essential operational support whilst being cautious not to trigger Western opposition, according to government and company officials quoted in the report. The administration’s assistance includes allocation of tank wagons and authorisation for coastal vessels to transport the refinery’s products.The refinery, with Russian state oil corporation Rosneft as its primary stakeholder, now sources its crude oil requirements exclusively from Russia, following the cessation of Iraqi and Saudi Arabian supplies post-EU sanctions. This dependency creates potential vulnerabilities should supply chains face disruption from enhanced sanctions or increased pressure from the Donald Trump administration.The UK government is evaluating dual strategies: supporting Nayara whilst being cognisant of mounting international pressure for stricter sanctions, according to Amitendu Palit, senior research fellow at the National University of Singapore’s Institute of South Asian Studies quoted in the report.“Long-term support might not be sustainable unless the whole global dynamics change – like a resolution between Russia and the U.S.A. or progress in Russia-Ukraine conflict,” he said.The Mumbai-based Nayata holds significant influence in India’s expanding fuel industry, contributing 8% of refined products output and managing over 6,500 petrol stations.The company has been compelled to decrease crude processing at its 400,000-barrel-per-day Vadinar refinery to 70-80% capacity – down from its previous 104% – as it encounters difficulties securing export customers for its fuel and banking institutions to process payments, according to sources familiar with refinery operations.

What Nayara is doing to sustain operations?

Nayara adapted its operations by increasing railway transportation after sanctions impeded its coastal shipping and export capabilities, necessitating domestic distribution of its products, the Reuters report said. The refinery, lacking pipeline connectivity, received assistance from the government to access additional railcars and temporary permission to operate four coastal vessels, including the sanctioned Leruo and two vessels from the shadow fleet: the Garuda (Guinea-Bissau flag) and Chongchon (Djibouti flag), the report said.The company has requested governmental authorisation for two additional coastal vessels. Additionally, Nayara seeks official support to acquire equipment and materials, currently restricted by sanctions, for its maintenance closure initially planned for February. Sources indicate the company might postpone the shutdown until April whilst searching for alternative materials.“We are under constant threat,” a senior company official said on condition of anonymity, citing the worry that vessels the company is now using could come under future Western sanctions.“We never anticipated that we would be hit so directly. Now, every day feels like firefighting.”Nayara – the name is a mix of Hindi and English for “New Era” – previously operated as Essar Oil before its 2017 acquisition by Rosneft alongside a consortium including Russian fund UCP and Trafigura, with the latter later divesting its stake. The company sourced oil from diverse nations until 2022. Subsequently, India increased its Russian oil imports at discounted rates following Western sanctions on Moscow post the Ukraine invasion, becoming the primary buyer of Russian seaborne crude.The refiner’s primary concerns centre on maintenance issues and international payment capabilities, according to internal sources at Nayara quoted in the Reuters report.Since August, the state-owned SBI has halted processing of trade and forex transactions for Nayara, citing concerns about EU sanctions.Despite meetings between Nayara officials, finance ministry representatives and banks to address these banking complications, a resolution remains pending. This situation hampers the company’s ability to conduct international crude imports and fuel exports, as per government sources.Recent shipments have been directed to the Middle East, Turkey, Taiwan and Brazil, with 16 cargo loads of diesel, gasoline and jet fuel transported via EU-sanctioned vessels, according to available data.

Business

Prices for home heating oil in NI rise as Middle East conflict escalates

Global oil prices spike after Iran launched strikes across the Middle East in response to attacks by the US and Israel.

Source link

Business

PSX Rebounds, Gains Over 4,000 Points After Historic Crash – SUCH TV

The Pakistan Stock Exchange (PSX) staged a strong comeback on Tuesday, recovering more than 2,000 points after suffering its steepest one-day decline in history.

The benchmark KSE-100 Index climbed to an intraday high of 156,106.01, gaining 4,133.02 points (2.72%) from the previous close of 151,972.99.

However, volatility persisted, with the index also dipping to an intraday low of 151,258.85, reflecting continued investor caution.

After Monday’s Historic Slump

The rebound follows Monday’s massive crash, when the KSE-100 plunged 16,089.17 points (-9.57%), marking its largest single-day fall ever.

The sell-off was triggered by escalating Middle East tensions and panic-driven mutual fund selling.

Analysts described Tuesday’s rise as a technical rebound, with value investors stepping in after excessive pressure eased.

Global Markets Under Pressure

While PSX showed recovery, global markets remained under strain:

MSCI Asia-Pacific index (ex-Japan) fell 1.5%

Japan’s Nikkei dropped 2.3%

US futures slipped 0.6%

Rising geopolitical tensions have intensified concerns about energy prices and global economic stability.

Oil Prices Surge

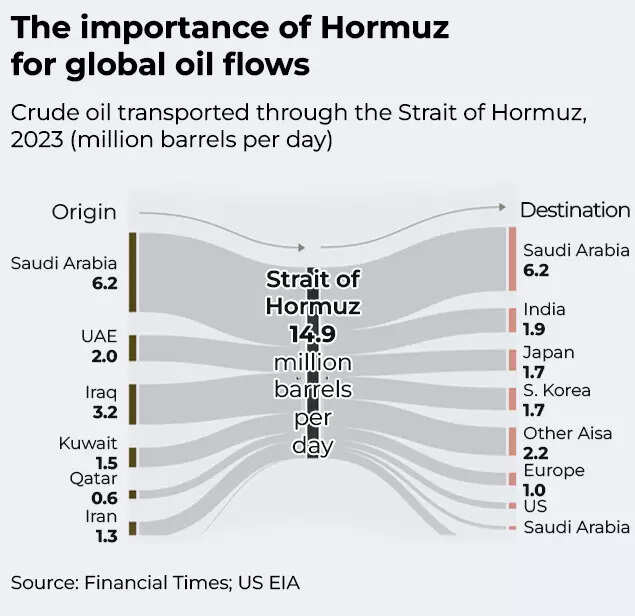

Fears of disruption in the Strait of Hormuz pushed energy markets higher:

Brent crude rose 2% to $79.22 per barrel

Shipping costs for oil tankers surged sharply

European and Asian natural gas prices jumped nearly 40% earlier

Higher oil prices pose inflationary risks for import-dependent economies like Pakistan.

What’s Next?

Market experts say the key question is whether the recovery gains momentum or remains a short-term bounce.

Investor sentiment remains fragile amid geopolitical uncertainty and volatile global energy markets.

Business

US-Israel-Iran war hits oil supplies: How India is preparing for the economic fallout – The Times of India

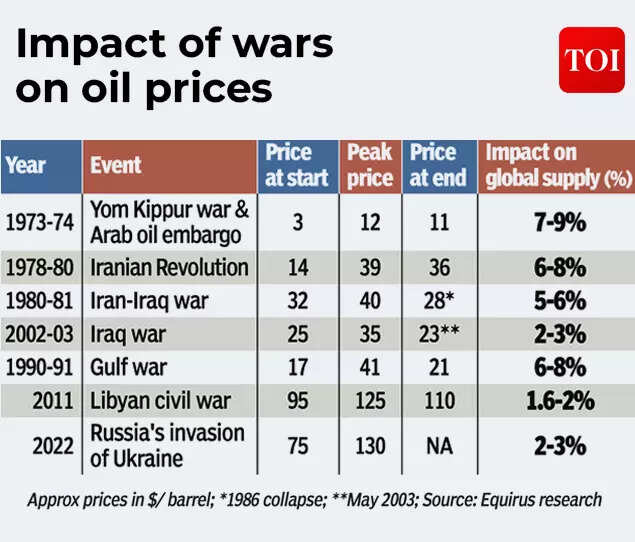

India is looking at several emergency measures to tackle the risk of fuel shortages if shipping through the Strait of Hormuz remains affected for an extended period. Strait of Hormuz in the Persian Gulf is a prominent and vital maritime route for transmit of oil and goods. According to people aware of discussions between the government and industry stakeholders, the options under consideration include curbing exports of petrol and diesel, stepping up crude purchases from Russia, and implementing demand-side steps such as rationing LPG supplies.Even as the Centre and oil firms maintained that there is no immediate scarcity, refiners have begun scouting for alternative crude sources to offset supplies affected by the conflict in West Asia.

The geopolitical strain has pushed up global oil and gas prices. For India, which relies heavily on imports, this surge translates into a higher import bill and adds to inflationary pressures.

India depends on overseas purchases for almost 90 per cent of its crude oil needs. It also relies on imports to meet around 60–65 per cent of its LPG consumption and roughly 60 per cent of its LNG requirement. A significant portion of these supplies originates in West Asia and moves through the Strait of Hormuz, a vital corridor that faces the risk of disruption amid the ongoing conflict.

India to curb oil exports?

With concerns mounting over potential disruptions in crude oil availability, the government is considering measures to encourage refiners to channel a larger share of automobile fuels and LPG toward the domestic market by trimming exports, according to a TOI report. It is also exploring ways to step up cooking gas output to ensure uninterrupted supplies for local consumers.Currently, India sends abroad roughly one-third of its petrol production, about a quarter of its diesel output, and nearly half of the aviation turbine fuel it produces. If necessary, refiners can also channel excess ATF into alternative product streams, they said.

Data from the International Energy Agency shows that 5.9 per cent of India’s petroleum output was exported in 2023. During the period from April to December 2025, the country shipped petroleum products worth nearly $330 billion, with key markets including the Netherlands, the UAE, the US, Singapore, Australia and China. In 2024, petroleum gas exports totalled $454 million, largely destined for Nepal, China and Myanmar. The Reliance Industries Limited refinery at Jamnagar remains the country’s biggest exporter.An executive at an oil company said refiners have already initiated discussions with traders to secure capacity amid concerns over a potential blockade of the Strait of Hormuz. By Monday, global markets were unsettled following QatarEnergy’s decision to halt gas shipments.

LNG and LPG disruptions

The most pressing area of concern is LPG, as the country relies on imports to meet close to two-thirds of its consumption and keeps relatively limited stockpiles. Around 85–90 per cent of LPG imports originate from Gulf nations.Industry assessments indicate that existing inventories, including domestic storage and cargoes that have already passed through the Strait of Hormuz, would be sufficient for less than a fortnight if fresh supplies are halted. To prepare for such a scenario, Indian Oil Corporation, Hindustan Petroleum Corporation Limited, and Bharat Petroleum Corporation Limited have started raising LPG production at select refineries integrated with petrochemical units.Officials are also examining focused demand-management strategies, including the possibility of rationing LPG for consumers who have access to alternate cooking fuels, particularly in rural regions, the people said. India’s crude oil stockpiles are estimated to cover around 17–18 days of consumption, while reserves of refined products such as petrol and diesel could last approximately 20–21 days.LNG inventories are sufficient for about 10–12 days. Without additional shipments through the Strait of Hormuz, these reserves would gradually diminish. Increasing purchases of Russian crude is another option being evaluated, sources told ET.Another industry executive noted that while any disruption could pose short-term challenges, Indian companies maintain a diversified LNG sourcing portfolio, including supplies from the US, with vessels routed via the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. Although oil and gas prices climbed on Monday, efforts remain focused on keeping supply chains operational.

No rise in petrol, diesel prices expected

Officials indicated that pump prices of petrol and diesel are unlikely to be revised upward in the near term. Oil marketing companies continue to adhere to a calibrated pricing strategy, absorbing losses when international rates climb and recovering margins when they ease. Retail fuel prices have effectively remained frozen since April 2022.On a day when Iranian drone strikes damaged sections of a Saudi Aramco refinery and QatarEnergy, the world’s largest LNG producer, announced a temporary halt to exports, Petroleum Minister Hardeep Singh Puri convened a meeting with senior officials and oil company representatives to review the status of crude and gas supplies.“We are closely tracking the fast-changing developments and will take every necessary measure to maintain both the supply and affordability of key petroleum products across the country,” the oil ministry said in a message posted on X.

Measures for Exporters

The government has sought to reassure exporters, saying that it stands prepared to extend necessary support and introduce flexible measures to ease trade operations in view of the uncertainty stemming from tensions in West Asia.At a meeting held in the commerce department and chaired by special secretary Suchindra Misra and DGFT Lav Agarwal, exporters highlighted several areas of concern.

These included risks to perishable consignments already in transit, escalating freight costs, demurrage charges, rerouting of shipments leading to longer transit times, dependence on imported inputs for exports, and potential strain on loan repayments to banks.According to an official statement, authorities are considering setting up a monitoring mechanism or round-the-clock control room to improve inter-agency coordination and swiftly address emerging challenges. The government reiterated its commitment to facilitating trade and signalled openness to granting procedural relaxations in instances of genuine disruption. It also indicated that it would work closely with customs officials to ensure timely clearances and coordinate with banks and insurance companies to ease operational bottlenecks.

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Business5 days ago

Business5 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?