Business

‘Every day feels like firefighting’: Hit by EU sanctions over Russian oil – Indian refinery Nayara Energy struggles to sustain operations – The Times of India

Nayara Energy, the Indian refinery with major Russian ownership, is scrambling to sustain operations after being hit by European Union sanctions. The Russian-owned refinery, facing exclusion from many international markets due to severe EU sanctions implemented on July 18, has been compelled to redirect additional fuel towards domestic consumption whilst seeking alternative export destinations, amongst various necessary adaptations required by the EU restrictions.According to a Reuters report, from late August onwards, Nayara Energy’s refinery has intensified its railway usage, dispatching two to three trains daily, each comprising 50 tanker cars to transport fuel to inland storage facilities. This is more than twice its previous railway utilisation for diesel and petrol transportation.Nayara’s Russian ownership exemplifies the enduring close relationship between New Delhi and Moscow, a connection that positions India differently from Western allies.The government has found itself managing a delicate situation with Nayara’s ongoing difficulties, providing essential operational support whilst being cautious not to trigger Western opposition, according to government and company officials quoted in the report. The administration’s assistance includes allocation of tank wagons and authorisation for coastal vessels to transport the refinery’s products.The refinery, with Russian state oil corporation Rosneft as its primary stakeholder, now sources its crude oil requirements exclusively from Russia, following the cessation of Iraqi and Saudi Arabian supplies post-EU sanctions. This dependency creates potential vulnerabilities should supply chains face disruption from enhanced sanctions or increased pressure from the Donald Trump administration.The UK government is evaluating dual strategies: supporting Nayara whilst being cognisant of mounting international pressure for stricter sanctions, according to Amitendu Palit, senior research fellow at the National University of Singapore’s Institute of South Asian Studies quoted in the report.“Long-term support might not be sustainable unless the whole global dynamics change – like a resolution between Russia and the U.S.A. or progress in Russia-Ukraine conflict,” he said.The Mumbai-based Nayata holds significant influence in India’s expanding fuel industry, contributing 8% of refined products output and managing over 6,500 petrol stations.The company has been compelled to decrease crude processing at its 400,000-barrel-per-day Vadinar refinery to 70-80% capacity – down from its previous 104% – as it encounters difficulties securing export customers for its fuel and banking institutions to process payments, according to sources familiar with refinery operations.

What Nayara is doing to sustain operations?

Nayara adapted its operations by increasing railway transportation after sanctions impeded its coastal shipping and export capabilities, necessitating domestic distribution of its products, the Reuters report said. The refinery, lacking pipeline connectivity, received assistance from the government to access additional railcars and temporary permission to operate four coastal vessels, including the sanctioned Leruo and two vessels from the shadow fleet: the Garuda (Guinea-Bissau flag) and Chongchon (Djibouti flag), the report said.The company has requested governmental authorisation for two additional coastal vessels. Additionally, Nayara seeks official support to acquire equipment and materials, currently restricted by sanctions, for its maintenance closure initially planned for February. Sources indicate the company might postpone the shutdown until April whilst searching for alternative materials.“We are under constant threat,” a senior company official said on condition of anonymity, citing the worry that vessels the company is now using could come under future Western sanctions.“We never anticipated that we would be hit so directly. Now, every day feels like firefighting.”Nayara – the name is a mix of Hindi and English for “New Era” – previously operated as Essar Oil before its 2017 acquisition by Rosneft alongside a consortium including Russian fund UCP and Trafigura, with the latter later divesting its stake. The company sourced oil from diverse nations until 2022. Subsequently, India increased its Russian oil imports at discounted rates following Western sanctions on Moscow post the Ukraine invasion, becoming the primary buyer of Russian seaborne crude.The refiner’s primary concerns centre on maintenance issues and international payment capabilities, according to internal sources at Nayara quoted in the Reuters report.Since August, the state-owned SBI has halted processing of trade and forex transactions for Nayara, citing concerns about EU sanctions.Despite meetings between Nayara officials, finance ministry representatives and banks to address these banking complications, a resolution remains pending. This situation hampers the company’s ability to conduct international crude imports and fuel exports, as per government sources.Recent shipments have been directed to the Middle East, Turkey, Taiwan and Brazil, with 16 cargo loads of diesel, gasoline and jet fuel transported via EU-sanctioned vessels, according to available data.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

Chancellor Rachel Reeves urged to scrap fuel duty hike amid oil price fears

The Chancellor has been urged to scrap the proposed hike in fuel duty as concerns have been raised about the conflict in the Middle East.

Rachel Reeves announced last year that the long-held discount in fuel duty would be scrapped from September, with a 1p hike followed by two increases of 2p each in subsequent years.

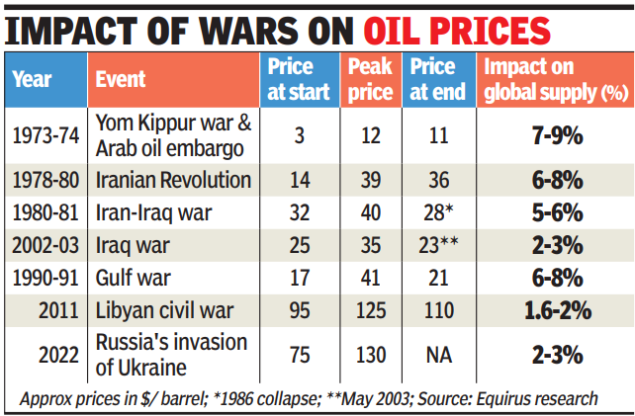

But following the US and Israeli attacks on Iran at the weekend – which killed the country’s Supreme Leader Ayatollah Ali Khamenei – concerns have been raised about the impact of oil price hikes which could hit consumers at the pumps.

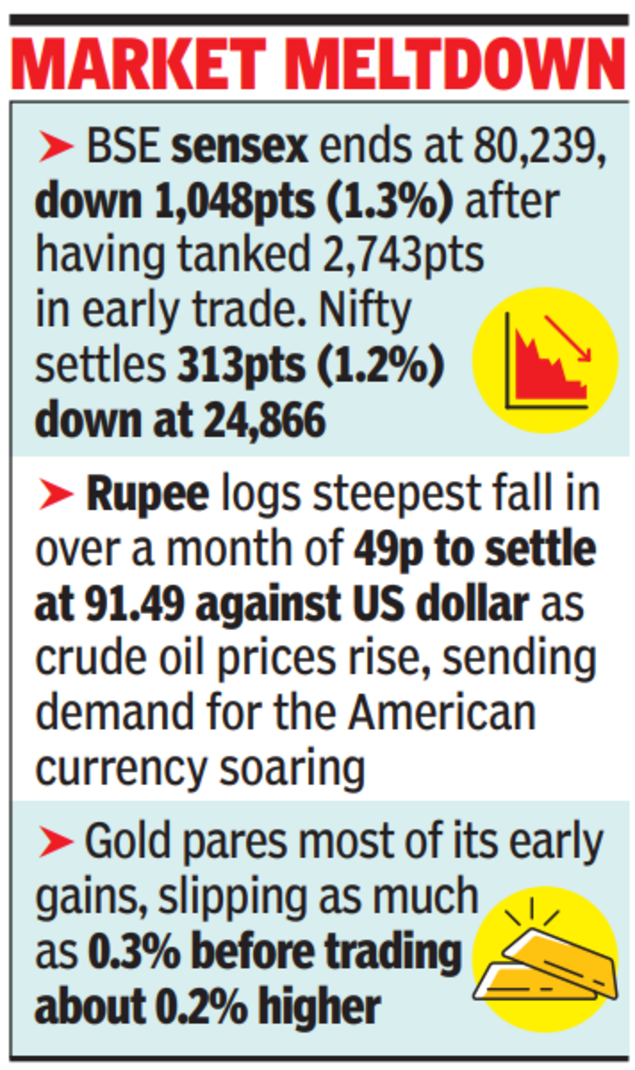

Following the attack, the price of oil jumped to 80 US dollars a barrel, with some analysts suggesting it could rise above 100 dollars.

Speaking ahead of the spring statement, SNP economy spokesman Dave Doogan said: ““With real fears that prices at the pump are now set to soar because of the situation in the Middle East – instead of stubbornly doubling down, the Chancellor needs to scrap her price hike plans before motorists face a devastating double hit.

“Oil prices are already spiking – the last thing motorists and businesses now need is another damaging tax hike from the Labour Party.

“The Chancellor needs to see sense, recognise what is unfolding globally, and immediately scrap her plans to hike prices at pumps.

“Everyone knows that Keir Starmer’s Labour Party has broken their promise to cut energy bills by £300 – it would be another slap in the face for families if Labour made the cost-of-living crisis even worse with a plan that will inevitably increase prices.

“After 14 U-turns from this chaotic Labour Government – scrapping their plans to hike fuel duty is one U-turn motorists, businesses and families right across Scotland would actually welcome.”

A spokeswoman for the Treasury said: “We have extended the 5p fuel duty cut from this month to the end of August to support drivers across the country.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%