Business

Vodafone down: Thousands of UK customers report broadband issues

Liv McMahonTechnology reporter

Getty Images

Getty ImagesThousands of Vodafone customers across the UK have reported its services are down.

Downdetector, which monitors web outages, showed more than 130,000 people had flagged problems affecting their Vodafone broadband or mobile network on Monday afternoon.

According to its website, the firm has more than 18 million customers in the UK, including nearly 700,000 home broadband customers.

In an updated statement on Monday evening, Vodafone apologised to customers and said its network was “recovering”.

“This afternoon the Vodafone network had an issue affecting broadband, 4G and 5G services,” a company spokesperson said.

“2G voice calls and SMS messaging were unaffected and the network is now recovering.

“We apologise for any inconvenience this caused our customers.”

It comes after people on social media said they were struggling to access Vodafone customer service operators, amid ongoing issues affecting mobile data and broadband.

Many also said they have had difficulty accessing the company’s website and app, which typically allow people to view the status of its network services.

Customers have also taken to social media to complain of “complete outages” in their area.

The issues appear to have begun for customers shortly after 15:00 BST.

Internet monitor Netblocks said in a post on X that live network data showed Vodafone was experiencing “a national outage” impacting both broadband and mobile data.

Some customers expressed being doubly frustrated by not being able to access their Wi-Fi or mobile data.

“Sort it out soon please,” wrote one frustrated X user – who said they were having to use a coffee shop’s Wi-Fi to access online services, without the means to do so using their mobile data or broadband.

Another said they were self-employed and could not work because of the outage, adding: “Never regretted more having my mobile and broadband on the same network.”

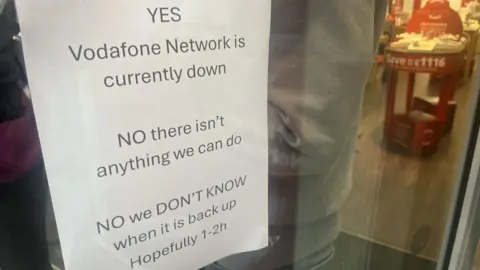

The issues are also understood to have impacted some Vodafone shops.

BBC News

BBC News‘Dropped off the internet’

The issues affecting Vodafone services have also impacted customers of other telecoms firms that use its network.

Downdetector saw a similar spike in reports on Monday afternoon from users of the mobile network Voxi, which is owned by Vodafone.

Lebara, which piggy-backs off Vodafone’s network, has also been affected by the company’s outage.

“Outages have been reported across multiple networks across broadband and mobile services,” said Sabrina Hoque, telecoms expert at Uswitch.

These, she added, can be “a really frustrating experience for customers, especially when it’s not clear how long it could last”.

Vodafone has not yet said how long it expects its outage to last – though its website since appears to have come back online.

Cloudflare Radar, which tracks and displays patterns in global internet traffic, said in a post on Bluesky earlier it had “effectively dropped off the internet, with traffic dropping to zero”.

The company has also not said what caused the issue affecting its networks.

“Incidents like this are often caused by a technical fault or configuration error rather than a major cyber-attack, so until more details are confirmed it’s best not to speculate,” said Daniel Card, a cyber expert with BCS, The Chartered Institute for IT.

“Having teams capable of diagnosing and responding rapidly to network failures is key to maintaining public trust and keeping the UK’s digital infrastructure running smoothly.”

Additional reporting by Ewan Somerville.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

Business

Asian stocks today: Markets inch higher mirroring Wall Street gains; Kospi jumps 10%, Nikkei up 1,400 points – The Times of India

Asian stocks inched higher on Thursday, after days of trading in red amid ongoing Middle East tensions. This comes as equities were lifted by a rebound on Wall Street as oil prices paused their recent spike and economic updates painted a more positive picture of the American economy. In South Korea, Kospi hit a pause on its downward rally to add a whopping 10% or 513 points, to reach 5,606. Japan’s Nikkei 225 also climbed 2.7% to 55,713. Hong Kong’s HSI also traded in green, rising 353 points to 25,603 as of 9:10 am. Shanghai and Shenzhen added 0.9% and 1.7% respectively. Gains elsewhere in the region were more modest. Australia’s S&P/ASX 200 added 0.3% to 8,927.20, while New Zealand’s benchmark index moved 0.9% higher. In contrast, US futures indicated a subdued start ahead. Futures linked to the Dow Jones Industrial Average were almost unchanged, while S&P 500 futures ticked up 0.2%. The S&P 500 advanced 0.8% on Wednesday, clawing back much of the decline seen since the onset of the Iran conflict. The Dow Jones Industrial Average rose 0.5%, and the Nasdaq Composite outperformed with a 1.3% gain. Globally, market sentiment has remained sensitive to developments in the Middle East, with oil price swings continuing to steer trading direction. Crude prices eased during Wednesday’s session. Brent crude briefly moved above $84 a barrel before settling at $81.40, roughly matching the previous day’s level. US benchmark crude edged up 0.1% to finish at $74.66 per barrel. By early Thursday, however, oil was on the rise again. Brent crude climbed 2.4% to $83.32 per barrel, while U.S. benchmark crude jumped 2.5% to $76.53 per barrel.

Business

China sets lowest economic growth target since 1991

It is also the first time the target has been lowered since it was cut to “around 5%” in 2023.

Source link

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics7 days ago

Politics7 days agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoOECD GDP growth slows to 0.3% in Q4 amid mixed trends

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’