Business

Vodafone down: Thousands of UK customers report broadband issues

Liv McMahonTechnology reporter

Getty Images

Getty ImagesThousands of Vodafone customers across the UK have reported its services are down.

Downdetector, which monitors web outages, showed more than 130,000 people had flagged problems affecting their Vodafone broadband or mobile network on Monday afternoon.

According to its website, the firm has more than 18 million customers in the UK, including nearly 700,000 home broadband customers.

In an updated statement on Monday evening, Vodafone apologised to customers and said its network was “recovering”.

“This afternoon the Vodafone network had an issue affecting broadband, 4G and 5G services,” a company spokesperson said.

“2G voice calls and SMS messaging were unaffected and the network is now recovering.

“We apologise for any inconvenience this caused our customers.”

It comes after people on social media said they were struggling to access Vodafone customer service operators, amid ongoing issues affecting mobile data and broadband.

Many also said they have had difficulty accessing the company’s website and app, which typically allow people to view the status of its network services.

Customers have also taken to social media to complain of “complete outages” in their area.

The issues appear to have begun for customers shortly after 15:00 BST.

Internet monitor Netblocks said in a post on X that live network data showed Vodafone was experiencing “a national outage” impacting both broadband and mobile data.

Some customers expressed being doubly frustrated by not being able to access their Wi-Fi or mobile data.

“Sort it out soon please,” wrote one frustrated X user – who said they were having to use a coffee shop’s Wi-Fi to access online services, without the means to do so using their mobile data or broadband.

Another said they were self-employed and could not work because of the outage, adding: “Never regretted more having my mobile and broadband on the same network.”

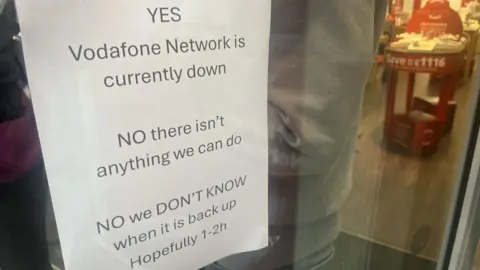

The issues are also understood to have impacted some Vodafone shops.

BBC News

BBC News‘Dropped off the internet’

The issues affecting Vodafone services have also impacted customers of other telecoms firms that use its network.

Downdetector saw a similar spike in reports on Monday afternoon from users of the mobile network Voxi, which is owned by Vodafone.

Lebara, which piggy-backs off Vodafone’s network, has also been affected by the company’s outage.

“Outages have been reported across multiple networks across broadband and mobile services,” said Sabrina Hoque, telecoms expert at Uswitch.

These, she added, can be “a really frustrating experience for customers, especially when it’s not clear how long it could last”.

Vodafone has not yet said how long it expects its outage to last – though its website since appears to have come back online.

Cloudflare Radar, which tracks and displays patterns in global internet traffic, said in a post on Bluesky earlier it had “effectively dropped off the internet, with traffic dropping to zero”.

The company has also not said what caused the issue affecting its networks.

“Incidents like this are often caused by a technical fault or configuration error rather than a major cyber-attack, so until more details are confirmed it’s best not to speculate,” said Daniel Card, a cyber expert with BCS, The Chartered Institute for IT.

“Having teams capable of diagnosing and responding rapidly to network failures is key to maintaining public trust and keeping the UK’s digital infrastructure running smoothly.”

Additional reporting by Ewan Somerville.

Business

Target is making big changes to win back customers. Here’s what shoppers can expect to see

A Target store in Chicago, Feb. 10, 2026.

Scott Olson | Getty Images

MINNEAPOLIS — Target customers will soon see changes on the retailer’s shelves, as the company tries to woo back shoppers during a turnaround effort that has started to catch Wall Street’s eye.

Among those shifts, Target will add more fresh and trendy groceries, a dedicated display for higher-end makeup and a larger array of merchandise for sports fans.

At the big-box retailer’s Minneapolis headquarters on Tuesday, Target’s merchandising leaders previewed the company’s ambitious plans to overhaul key categories, including home and apparel, which have posted year-over-year sales declines. The company held an investor meeting to share its holiday-quarter results and its turnaround strategy for this year, which hinges in part on regaining its reputation for stylish and unique items.

CEO Michael Fiddelke, a Target veteran who stepped into the top role on Feb. 1, told investors on Tuesday that the company is making changes that “don’t happen overnight.” But, he added, they include many tweaks that customers “will see and feel right away.”

“If I were to step back and draw a heat map of the entire store highlighting where we’re making changes this year, you’d see more change to what we sell and how we sell it than you’ve seen in a decade,” he said.

The success of Target’s merchandise makeover will help determine whether the company meets its sales and earnings outlook for the current year and whether it can reverse four consecutive quarters of declining customer traffic. The company’s revenue fell slightly in fiscal 2025 and has been stagnant for four years.

Target said Tuesday that it expects net sales for the current fiscal year to rise about 2% compared with the previous year and anticipates that sales will grow in every quarter of the year.

Wall Street had a positive early read on Target’s turnaround progress: The company’s stock climbed more than 6% on Tuesday, and was trading higher on Wednesday.

Here’s a closer look at Target’s merchandising changes:

Putting a fresher spin on grocery

Target is expanding the fresh department and adding more prominent signage for its Good & Gather private brand as it tries to draw more customers to stores for grocery shopping. This rendering shows what the expanded fruit, vegetable and meat displays will look like.

Courtesy of Target

One of the top reasons for customers’ Target trips is a simple one — running in for a quick grocery item like a gallon of milk or box of pasta. The challenge is getting shoppers to buy more of their food there.

Food is the No. 1 traffic driver for Target, and over half of customers have food in their shopping basket, said John Conlin, senior vice president of merchandising, food and beverage. Target’s grocery category, which it labels food and beverage, drew higher sales than any of Target’s merchandising segments in the past fiscal year. It grew by about 1% year over year and totaled $24.14 billion — or roughly 23% of Target’s net sales for the fiscal year.

Yet for many customers, Target is a destination for buying just a few grocery items rather than a fuller basket of food for the week. Plus, competition has grown fiercer — not only from the nation’s largest grocer by revenue, Walmart, but also from Amazon and fast-expanding discounter Aldi.

“We don’t want food to just be a business that guests are shopping while they’re at Target,” he said. “But increasingly, we want to be a business that is why guests are at Target.”

He said Target is “trying to carve our own lane with our assortment strategy” rather than copy the grocers down the street.

Going forward, Target will expand the square footage it devotes to grocery as it remodels stores and builds new ones, Conlin said. In over half of the stores that the company remodels, Target will double the square footage for fresh foods like fruits, vegetables and meats, he added.

The company also plans to add more brands that shoppers haven’t yet discovered and lean on seasonal items and private brands. To stand out from competitors, Target is going to ramp up the amount of new items by up to 50% in key categories like snacks and dry groceries, Conlin said.

But he acknowledged a challenge that has tripped up Target in recent years, which it’s tried to fix by owning its supply chain and opening a new facility in Colorado in the next year.

“None of this comes to light if we’re not in stock for our guests,” he said.

He declined to share a key detail about some items and brands that Target is adding: price points.

Giving beauty a glow up

In many of Target’s stores, customers buy lip gloss and other items from Ulta Beauty. That will change in August, after the two brands announced the end of a deal that brought the mini beauty shops to nearly a third of Target’s big-box stores.

On Tuesday, Target said it plans to give its own beauty assortment a glow up. This fall, it will open what it is dubbing its Beauty Studio in more than 600 stores and online, said Amanda Nusz, senior vice president of merchandising for essentials and beauty at Target.

Beauty Studio will replace Ulta Beauty at Target. It will be a dedicated shop within the store with prestige beauty brands, elevated lighting, enhanced service and a loyalty program tied to beauty, Nusz said. In renderings, the beauty shop looks similar to Ulta Beauty at Target, but without the beauty retailer’s branding.

Starting this fall, Target will open Beauty Studio dedicated shops in more than 600 stores and online. The prestige beauty shop will replace Ulta Beauty at Target.

Courtesy of Target

Nusz declined to share the national brands that the Beauty Studio will carry and whether it will offer some of the same brands sold by Ulta Beauty and other competitors like Sephora.

Beauty “has been one of the strongest growth engines for Target,” Nusz said. She said it was also the top growth category for Target’s curbside pickup service, Drive Up, and in-store pickup of online orders in the fourth quarter. A bonus for Target: Beauty tends to draw in younger shoppers.

The segment’s sales were roughly flat year over year in the most recent fiscal year, but accounted for about 13% of Target’s overall net sales for the period.

Along with rolling out Beauty Studio, Nusz said, Target will add more well-recognized national brands like sunscreen brand Supergoop, lean into trends like Korean beauty and invest more in men’s beauty, such as grooming and fragrance items.

Adding fun and pop culture relevance

Target has overhauled its hardlines category, which includes items like consumer electronics, books and toys. The category, which it now calls Fun101, now carries more items related to sports and pop culture. For example, it has a line of merchandise for the 30th anniversary of the movie “Space Jam.”

Melissa Repko | CNBC

In the back of Target’s stores, the retailer is giving an overhaul to a department that’s typically known for selling consumer electronics, toys and books.

Instead of calling it the traditional name, hardlines, Target coined the category Fun101.

Cassandra Jones, senior vice president of merchandising for Fun101, said the goal went beyond the new name, however. Target wanted to turn around a category that was falling flat.

Starting in late 2024, Target has had a tighter focus on four key areas: play, which includes toys like plush stuffed animals and popular brands like Lego; pop, which includes culturally inspired items like a limited-edition collection tied to Netflix’s “Stranger Things” and another linked to the 30th anniversary of the movie “Space Jam”; sport, which includes items like water bottles and licensed sports apparel for professional teams; and gadget, which includes trendy takes on products like phone cases and headphones.

On the other hand, Jones said Target has cut back on items like TVs and laptops, where it’s harder to stand out from retail competitors or inject a sense of style.

Sales of Fun101 merchandise were roughly flat year over year in the most recent fiscal year, but drove $15.8 billion, or 15%, of Target’s net sales for the period.

Jones said shoppers will see the category go bigger in the second half of the year. Target plans to open a fan shop in stores and online with licensed sports gear, expand its position as a “trading card destination” and open a “collectibles zone” for other types of merchandise.

Target’s home category has been one of its weakest performers. The retailer is overhauling the category and redoing the display area in stores, too. It showed off some of its newer items at an investor event in Minneapolis.

Melissa Repko | CNBC

Rebuilding home goods

Target used to be known for its fashion-forward yet affordable throw pillows, lamps, bedding and other home decor. The category, however, is now one of the retailer’s weaknesses — particularly as it competes with digital players like Wayfair, big-box competitors like Walmart and Costco, off-price chains like TJX‘s HomeGoods and specialty players like Crate & Barrel or Pottery Barn.

Sales in the home furnishings and decor category totaled $15.61 billion in the most recent fiscal year, sinking by nearly 7% year over year. That’s a deeper sales drop than in any of Target’s other key merchandise categories.

The big-box retailer is working to become a destination for the category again, said Mara Sirhal, senior vice president of merchandising for home, who stepped into the role about three months ago.

“Our home business has not delivered to its potential, point-blank,” she said. “The industry grew. Target home underperformed. We lost meaningful share over the last two years, and our authority and style inspiration has weakened. That is on us.”

Among the problems, she said, Target “lost clarity in our point of view,” with a blander assortment rather than a stylish, eye-catching one.

Sales of home goods at Target have also been hurt by economic factors, including higher interest rates and pricier homes in the U.S., which have led to a much older first-time homebuyer, she said.

Starting in June, Target will rebuild the category as part of a multiyear turnaround effort, she said. One of its first moves this summer will be redoing about 75% of its assortment in decorative home, which includes items like candlesticks, throw pillows and greenery. By the fall, she said, three-quarters of its bedding assortment will be reinvented. And next year, she said, Target will overhaul its kitchen and dining merchandise.

It won’t just be the products changing, she said. Shoppers should expect to see new fixtures in stores, too, such as elevated wood displays. It will also use its third-party marketplace, Target Plus, to sell large items that are easier to carry online, such as rugs, mattresses and furniture, she said.

To try to turn around its apparel sales, Target is using an artificial intelligence tool, Trend Brain, to help the company spot the styles that customers want earlier and speed those looks to shelves. The tool helped the company develop a collection of Western-inspired clothing and accessories.

Melissa Repko | CNBC

Speeding up fashion and raising the bar on basics

Another well-known category in Target stores has become a weaker link, too. Apparel and accessories sales at the company fell to $15.74 billion in the most recent fiscal year, down about 5% from the prior year.

To drive sales growth again, the big-box retailer aims to spot trends earlier, speed up the time it takes for new looks to hit shelves and sharpen the selection of clothing that it carries — even for basics like tank tops, said Gena Fox, senior vice president of apparel and accessories at Target.

She said the company’s performance “has not been where we want it to be over the past year.”

Denim, T-shirts and tanks make up about 25% of Target’s total assortment, Fox said. Last year, it overhauled its denim to raise the quality and style, which led to a 10% year-over-year lift in sales for that category.

This year, she said, Target plans to take that same approach to fix T-shirts and tanks, which have had weaker sales. Some of those refreshed closet staples are starting to hit store shelves and Target’s website.

Target is also working to get ahead of trends, which it features in collections in stores and online, she said. To spot trends, it’s using a new artificial intelligence-powered tool called Target Trend Brain, which helps the company’s designers and merchants identify the styles, colors and materials that customers may want.

For example, insights from Trend Brain helped inspire a Western edit of clothing and accessories like purses with fringe and belts with embroidery, with all items under $40. That area will soon rotate to a collaboration with Roller Rabbit, a colorful and brightly patterned pajama brand, that will include swimwear, sundresses and pool accessories.

Target is known for its limited-time brand collaborations. For the spring, it has a new line of swimsuits, pool accessories and more developed with pajama brand Roller Rabbit.

Melissa Repko | CNBC

Fox said the apparel and accessories timeline is now about 40% faster as the company reacts more in the moment rather than planning six to 12 months in advance.

Along with those trend-driven items, Target will expand national brands and add new partnerships. Last week, the company announced it would bring Levi’s to more stores, which will mean the denim brand is in more than 1,000 — or roughly half — of its stores, Fox said. It also developed an exclusive clothing line with country music singer Megan Moroney, which will coincide with her upcoming tour.

Business

Disney launches its Adventure cruise ship — a new foothold in Southeast Asia

Disney’s cruise line is going big in Asia.

This month, the company’s eighth and largest ship, the Disney Adventure, will embark on its maiden voyage, carrying passengers on three- and four-night journeys at sea from its berth in Singapore.

The vessel accommodates a whopping 6,700 passengers, around two-thirds more capacity than Disney’s Wish class ships, which are the Disney Wish, the Disney Treasure and the Disney Destiny. The Adventure can also carry around 2,500 crew members, about 1,000 more than on the Wish class ships.

“It takes a village to be able to support the type of service that we’re known for,” Joe Schott, president of Disney Signature Experiences, told CNBC.

The Disney Adventure sets sail at a time of rapid expansion for Disney’s cruise line. It is one of six vessels set to join the fleet by 2031. It’s also emblematic of the company’s global aspirations, which coincides with a sharp decline in international visitors venturing to the United States.

Mickey and Minnie Mouse pose in front of the Disney Adventure.

Disney

While tourism grew worldwide last year, the United States was the only major destination to see a drop in foreign visitors, according to the World Travel & Tourism Council. Overall, international travel to the U.S. fell 6%, the organization found. That decline continued into 2026, as January’s numbers were down 4.8% compared with the same month a year prior.

Travel bans, visa fees and invasive searches at ports of entry are all contributing to international travelers leaving the United States off their travel itineraries, according to the WTTC. Trade frictions, geopolitical unease and safety concerns have also contributed to the drop in demand for travel stateside, travel experts told CNBC.

Still, Disney’s domestic theme parks drive around two-thirds of revenue in its experiences division, which includes parks, cruises, resorts and consumer products. International destinations account for around one-fifth of revenue.

Expanding its fleet to new ports allows Disney to entice guests that may not have otherwise been able to venture to its theme parks or get on board one of its cruise ships. And Asia is a rapidly growing market.

A whole new market

Disney is no stranger to the Asian market. It already has a strong footprint of theme parks and resorts in Tokyo, Hong Kong and Shanghai.

“We have a really strong presence already up in the the northern part of Asia,” Schott said. “But, I think as you think about the southeast part of Asia, we don’t really have a physical presence. So, this is a great way to really be able to connect a whole lot of people that haven’t had the opportunity to do a physical Disney experience before.”

The cruise industry, in particular, in Asia has been in a state of rapid growth in the wake of the pandemic. In 2024, the region accounted for 2.6 million cruise passengers, a 13% increase from the previous year, according to data from the Cruise Lines International Association.

“Prior to 2024 we were really seeing a rise in the disposable income and the income levels of Southeast Asian travelers,” said Dulani Porter, executive vice president and partner at Spark, a creative agency that works with hospitality and tourism brands. “And so it was a very, very important market for any international tourism organization.”

That’s where the Disney Adventure comes in.

Initially destined to be a floating casino, the ship went up for sale part way through its construction when its parent company, Genting Hong Kong, went bankrupt in 2022. Disney swooped in and bought it.

“I think this was a great opportunity, because if we hadn’t acquired the ship the way we did, we wouldn’t be going into this market as soon as we are,” said Bruce Vaughn, president and chief creative officer of Walt Disney Imagineering. “And that’s a great thing.”

Previously, all of Disney’s cruise ships have left from domestic ports in Florida before traveling to international destinations. In the case of the Adventure, the ship is the destination. Stationed in Singapore, the vessel will voyage entirely at sea, with no port calls.

And Disney says demand is already there. Disney’s cruises are already 80% booked for fiscal 2026, Schott said.

A ‘brand ambassador’

The Disney Adventure’s size isn’t the only thing that sets it apart from the rest of the fleet. The ship has been tailored for consumers in Asia.

“Since the ship is going to be dedicated to Singapore and that market, we also wanted to make sure that we address what we thought would be unique to them,” said Vaughn.

This came in the form of selecting franchises and characters that are popular in the region, designing entertainment and relaxation areas catered to local tastes and providing a diverse selection of menus across its restaurants.

“We’re looking forward to servicing a brand-new audience,” Schott said. “In that respect, the ship is a brand ambassador.”

Guests on board the Adventure will be immersed in Disney’s more than 100 years of storytelling with character meet-and-greets as well as themed shopping and entertainment areas.

Situated in the middle of the ship is a deck designed to look like a street from San Fransokyo, the fictional city in “Big Hero 6.” The area is home to arcade games inspired by the movie, a replica of the Lucky Cat Cafe owned and operated by Aunt Cass as well as four movie theaters and dedicated tween and teen spaces.

A view of San Fransokyo street aboard the Disney Adventure.

Disney

The street also features the first-ever Duffy and Friends store at sea and a National Geographic shop. Disney executives told CNBC that these brands are incredibly popular with consumers in the region.

Duffy the Disney Bear is a character that was developed initially for a merchandise line at Walt Disney World’s Disney Springs, but gained attention when it was brought to Tokyo a few years later. In the last two decades, Duffy has been joined by seven other stuffed animal friends and has become one of the bestselling merchandise lines for the company.

In 2023, Disney reported the character generated $500 million in sales annually.

Disney characters in traditional Han costumes perform on the stage during a special edition of “Enjoying the Moon with Duffy and Friends” event celebrating the Mid-Autumn Festival at the Shanghai Disney Resort on September 17, 2024 in Shanghai, China.

Vcg | Visual China Group | Getty Images

In designing the Disney Adventure, the company was also conscious of local traditions. For many in Asia, vacations aren’t just for a nuclear family, but for extended family and even large groups of friends.

“I think one of the biggest distinctions that I’m seeing with South Asian cultures [is] travel really is about spending more time together,” Porter said. “Not to generalize, but North American cruisers will choose cruising because the kids can go do their thing and the parents can go do their thing, all contained into a ship.

“For Asian travelers, that is a very meaningful time spent together, where the grandparents and the kids and the parents and the grandparents, everybody is really trying to maximize all of that time together,” she said.

Both Vaughn and Schott detailed layers of experiences available to cruise guests that cater to different age ranges, both kids and kids at heart.

There’s Marvel Landing on the upper deck of the ship that features a rollercoaster, a spinning attraction and car-chase ride all inspired by The Avengers. In the same area is a sundeck, infinity pool and a bar.

Wayfinder Bay is an open-air area with amphitheater-like seating that doubles as a performance venue. And there’s D Lounge, which features a number of private karaoke rooms.

“We’ve had to think about that quite extensively in our parks in the region … multigenerational travel is just part of the formula,” said Schott.

Also part of the formula is Disney’s dining experience.

Aboard the Disney Adventure, guests will have an eclectic selection of food and beverages to try, with an emphasis on flavors that are popular in the region.

The Disney Adventure will have burgers and classic American fare at Stitch’s Ohana Grill, bubble teas at the Ursula-inspired Bewitching Boba and Brews, as well as pitas and kebabs at the Ms. Marvel-inspired Cosmic Kebabs.

There will also be Indian cuisine at Mowgli’s Eatery and Polynesian-inspired fare at Gramma Tala’s Kitchen.

Rotational dining is also featured on the cruise ship, a staple of Disney’s service.

While passengers have the option to grab quick-service meals and snacks throughout the ship, several of its restaurants are included in a prescheduled dining plan. Guests have reservations for each of these themed restaurants and rotate through them during their cruise.

Disney rotates the restaurant staff, too, to follow each group of passengers to their scheduled restaurant. As a result, guests have the same servers, busboys and restaurant managers throughout their trip, and the waitstaff gets to know the guests — and their preferences.

“I think at the end of the day, this entry into the market needs to be a really strong one for us,” Schott said. “So we’re looking forward to really being able to deliver the Disney-level of service at an extraordinary level.”

Business

Stock markets rebound and energy prices ease but fears remain over Iran war

European and US stock markets have recovered and oil and gas prices eased, sending some relief to investors after a bruising start to the week despite war in the Middle East stoking fears about the longer-term hit to the economy.

In the UK, the FTSE 100 gained about 80 points to close 0.8% higher at 10,567.65, having slumped nearly 3% on Tuesday amid worries of a prolonged conflict.

Stocks were also rebounding across Europe, with Germany’s Dax up 1.8% at the end of the day, and France’s Cac rising 0.8%.

Over on Wall Street, trading got off to a positive start, with the S&P 500 up 0.85% and Dow Jones 0.65% higher by the time European markets closed.

Global financial markets are largely being led by the movement of wholesale energy prices, which were spiking on Monday and Tuesday as concerns grew about disruption to supply in affected parts of the Middle East.

But there was some steadying to prices on Wednesday, with Brent crude oil down about 0.5% to 80.9 dollars a barrel, and a European benchmark for natural gas slipping by about 9%.

Despite easing back slightly, the prices of both commodities remains substantially higher than last week.

Analysts at Cornwall Insights warned on Wednesday that household energy bills are forecast to rise by 10% from July following the sharp increases in wholesale gas prices.

However, it said the final price cap figure would be based on average wholesale prices over a three-month period, meaning that it would depend on how long gas prices stayed elevated and how long the period of volatility continued.

The share prices of London-listed energy giants BP and Shell were down about 2% on the back of easing prices.

Russ Mould, investment director for AJ Bell, said: “The FTSE 100 and other European markets took their cue from US gains to trade firmly higher, with some of the names caught up in the heavy selling at the start of the week bouncing back from their lows.

“This presents a salutary reminder to investors caught up in the recent volatility that ups and downs are a natural feature of financial markets.

“But the waters remain choppy. Wall Street has been oscillating between healthy gains and more modest moves higher, which hints at continuing nervousness about the outlook amid what remains a fast-moving set of events in the Middle East.”

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics7 days ago

Politics7 days agoWhat are Iran’s ballistic missile capabilities?

-

Politics7 days ago

Politics7 days agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Business6 days ago

Business6 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Fashion6 days ago

Fashion6 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports5 days ago

Sports5 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’