Business

Energy standing charge plans could backfire, MPs told

Kevin PeacheyCost of living correspondent and

Joshua NevettPolitical reporter

Getty Images

Getty ImagesEnergy bosses have given a cool reception to regulator Ofgem’s plan to overhaul standing charges.

Under Ofgem’s plans announced in September, all suppliers in England, Scotland and Wales will offer at least one tariff in which standing charges are lower but customers then pay more for each unit of energy used.

But appearing before a committee of MPs, the chief executives and senior management of the UK’s biggest suppliers questioned the outcome of such a move.

Some called for the abolition of standing charges, while others say the proposals would make the issue worse for customers.

Rachel Fletcher, director of regulation and economics at the UK’s largest supplier Octopus Energy, said: “I think a lot of the concern about standing charges is just that people can’t afford to pay their bill.

“Where Ofgem is going is not going to solve any problems, it could make things worse.”

The bosses, giving evidence to the Energy Security and Net Zero Committee, pointed out that the major problem for some customers is that the cost of energy was unaffordable, and some could make the wrong choice when choosing tariffs with low standing charges.

Many called for a social tariff, in which those who are on low incomes receive a discount which is likely to be paid for by other billpayers.

Energy UK, which represents suppliers, recently called for “enduring” government support for those struggling to pay their bills.

Ministers have pointed to the extension of the Warm Home Discount to those on benefits, which knocks £150 off winter bills for one in five households. It is funded by a rise for all billpayers.

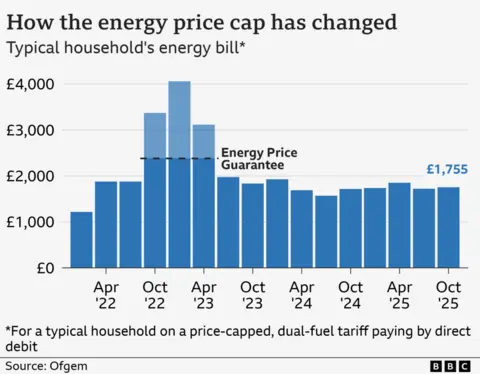

Ofgem’s price cap, which sets a maximum price per unit of energy for millions of people in England, Scotland and Wales who are on variable tariffs, rose by 2% in October.

The amount owed to energy suppliers by customers has already increased to a new record high of £4.4bn.

The data, which covers the period from April to June, shows that more than one million households have no arrangement to repay their debt, also a record high.

At the hearing, Simone Rossi, chief executive of EDF UK, was among the bosses who told MPs asking about the climate challenge that the price of electricity compared with a gas was a disincentive to customers wanting to go electric. It was also expensive in the UK compared with other countries.

On Tuesday, Energy Secretary Ed Miliband told the BBC shifting green levies from electricity bills to gas was one option being considered to lower energy costs for households.

But Miliband said no decisions had been made and insisted he would not change energy policy costs “in a way that damages the finances of ordinary people”.

While rebalancing energy policy costs could lower electricity bills, it could increase them for householders using gas boilers.

When asked if the rebalancing of energy bills was being reviewed by the UK government, Miliband said: “We’ve always said we will look at ways of lowering bills for people and that’s obviously one of the options.

“I just want to say on that, we will only ever do that in a way that’s fair and genuinely reduces bills for people.”

‘Fair’ bills

Policy costs are effectively government taxes used to fund environmental and social schemes, such as subsidies for renewables.

These costs made up about 16% of an electricity bill and 6% of a gas bill last year, according to research by the charity Nesta.

The Climate Change Committee has long recommended removing policy costs from electricity bills to help people feel the benefits of net-zero transition.

The government’s climate adviser said the move would make switching to electric technologies, such as heat pumps, cheaper and encourage take-up.

One option – backed by Energy UK – is shifting policy costs from electricity bills to gas.

Energy UK analysis shows that over 15 years, households using an air source heat pump, which is an electrically powered system, could save up to £7,000, compared to those with gas boilers, if energy bills were fully rebalanced.

But such a move would result in an increase in bills for households that use gas for heating.

When asked if that was one option the government was considering, Miliband said: “I’m not going to get into any of the detail of this.

“All I am saying is I’ve always said I’m cautious about this issue because fairness is my watchword.

“So if we can do it in a way that’s fair, that’s obviously something we’re seriously looking at.

“But no decisions have been made on that. I’m not going to do it in a way that damages the finances of ordinary people.”

At the committee, Chris O’Shea, chief executive of Centrica, said this would be a subsidy from the poor to the rich.

Business

Budget 2026 Should Support MSMEs, Critical Minerals For Boosting Trade Resilience: Deloitte

Last Updated:

Deloitte India urges FY27 Budget to boost MSME support and critical mineral security, job protection and advancing India’s global manufacturing and clean energy goals.

Budget 2026 Expectations.

Budget 2026: Deloitte India has pitched a sharper focus on MSME support and critical mineral security in the FY27 Union Budget, arguing that these measures are essential to strengthen India’s trade resilience and reduce external vulnerabilities amid rising global uncertainty.

In its Budget expectations note, Deloitte India said micro, small and medium enterprises play a pivotal role in the economy, accounting for nearly 46% of India’s exports and emerging as the second-largest employer after agriculture. According to the firm, easing financial and compliance-related pressures on MSMEs would help them cope with global volatility, sustain production and remain competitive in overseas markets.

The Union Budget 2026-27 will be tabled on Sunday, February 1.

“Strengthening MSMEs will safeguard jobs and drive inclusive economic growth, boost rural incomes and support India’s ambition to become a global manufacturing hub,” Deloitte said.

The firm recommended measures such as enhanced export credit availability, concessional financing and simplified digital compliance systems to reduce the regulatory burden on small businesses. It also called for comprehensive training programmes to improve last-mile competitiveness of MSMEs, particularly those linked to global value chains.

Deloitte further suggested targeted export incentives or enhanced duty drawback support for tariff-sensitive sectors such as ready-made garments, gems and jewellery, and leather, which are more vulnerable to global trade disruptions.

Highlighting the risks from an increasingly protectionist global environment, Deloitte Economist Rumki Majumdar said rising uncertainty from tariff hikes, changes in rules of origin and non-tariff barriers could disproportionately affect Indian exporters. While the direct impact of global trade frictions on GDP growth may be limited to 40-80 basis points, the spillover effects on MSMEs and employment could be far more severe.

“MSMEs contribute 30.1 per cent to GDP, account for 45.79 per cent of India’s exports and employ nearly 290 million people; disruptions in export markets or tightening trade rules pose serious risks to jobs and income stability,” Majumdar said.

Beyond MSMEs, Deloitte emphasised the need for a strategic push on critical minerals to secure supply chains and support India’s clean energy transition. It proposed setting up a dedicated critical minerals fund to finance overseas acquisitions and technology partnerships, ensuring long-term access to essential resources.

The firm also recommended deeper global collaboration with regions such as Africa, Australia and Latin America to secure upstream access to minerals, alongside joint research and development in mineral processing and recycling. In addition, it called for incentives to promote investments in renewable energy, green hydrogen and grid-scale energy storage.

Deloitte said expanded funding for exploration, extraction and processing of key critical minerals, including lithium, cobalt and rare earth magnets, would be crucial to reduce import dependence and strengthen India’s strategic and economic security in the years ahead.

January 16, 2026, 15:02 IST

Read More

Business

Pakistan Stock Exchange staged a strong comeback – SUCH TV

Pakistan Stock Exchange (PSX) on Friday staged a strong comeback, breaking the long bearish momentum as snowballing forex reserves have lifted investor sentiment.

During intraday trading, the PSX’s benchmark KSE-100 index gained a whopping 3,146.23 points to climb to 184,602.56 points, marking a positive change of 1.70%.

Out of 562 active companies, share prices of 375 advanced and of 67 declined while rates of 120 companies remained unchanged.

Economic analysts said the uptick offered some breathing space for the economy, even as the country continued to keep a close watch on external inflows and outflows.

Pakistan’s foreign exchange reserves inched up by $16 million over the past week, according to figures released by the State Bank of Pakistan.

The central bank said its official reserves rose from $16.0557 billion to $16.0718 billion, showing a modest gain during the week.

Overall, the country’s total reserves climbed to $21.2484 billion.

The State Bank also noted that commercial banks’ holdings went up by $5.6 million, reaching $5.1927 billion.

The central bank projects the FY26 current account deficit at 0–1% of GDP and sees reserves at $17.8 billion by June 2026 with planned official inflows.

A day earlier, the stock exchange dropped by over 1,100 points due to massive selling pressure.

The PSX had extended losses after recording an increase for a brief period as investors seemed cautious amid rising geopolitical tensions involving Iran.

During intraday trading, the KSE-100 index touched 183,717.53 due to strong buying in the early sessions before it turned bearish by losing 69.29 points to close at 182,500.52 points.

International officials have warned that US military intervention in Iran now appears likely and could take place within the next 24 hours amid sharply escalating tensions in the Middle East.

American, European and Israeli sources said preparations for possible action were under way as Washington began evacuating personnel from its major air base in Qatar.

Business

Those with MGNREGA cards to get work during transition to G RAM G Act – The Times of India

NEW DELHI: People with job cards assigned under Mahatma Gandhi National Rural Guarantee Scheme will be able to get work without disruption when transition takes place to new rural employment framework under Viksit Bharat-Guarantee for Rozgar and Aajeevika Mission (Gramin) Act.Even though exact timeframe is not known yet, rural development ministry officials said the VB-G RAM G scheme will come into force in the coming financial year after the Centre frames and notifies the rules. After govt notifies the Act’s commencement date, states will get six months to make their schemes to enable implementation of the law.To ensure there is no disruption and job guarantee is upheld during transition from MGNREGA, it has been proposed to enable workers to use the same job cards issued under MGNREGA with Aadhaar-based eKYC.The officials said that as of now, around 75% of job cards have been verified with eKYC under the ongoing scheme. Moreover, ongoing projects under MGNREGA, if incomplete when the transition happens to the new scheme, would stay on course.Meanwhile, work is on to frame rules, lay out regulations on normative allocations, fund flow plan, IT framework, a national-level steering panel and social audits.Under the new law, focus will be on transparency to weed out leakages and duplicacy of work,the social audit system will be strengthened, and technology leveraged to create systems to establish work progress, timely wage payment and accountability through ‘e-measurement’ books, sources said. Demand for work will have to be entered on a digital platform. Officials made it clear the new law in no way interferes with demand-driven character of the scheme.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Tech3 days ago

Tech3 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV