Business

Mehli Mistry files caveat on removal from Tata Trusts; cites past resolution to contest ouster – The Times of India

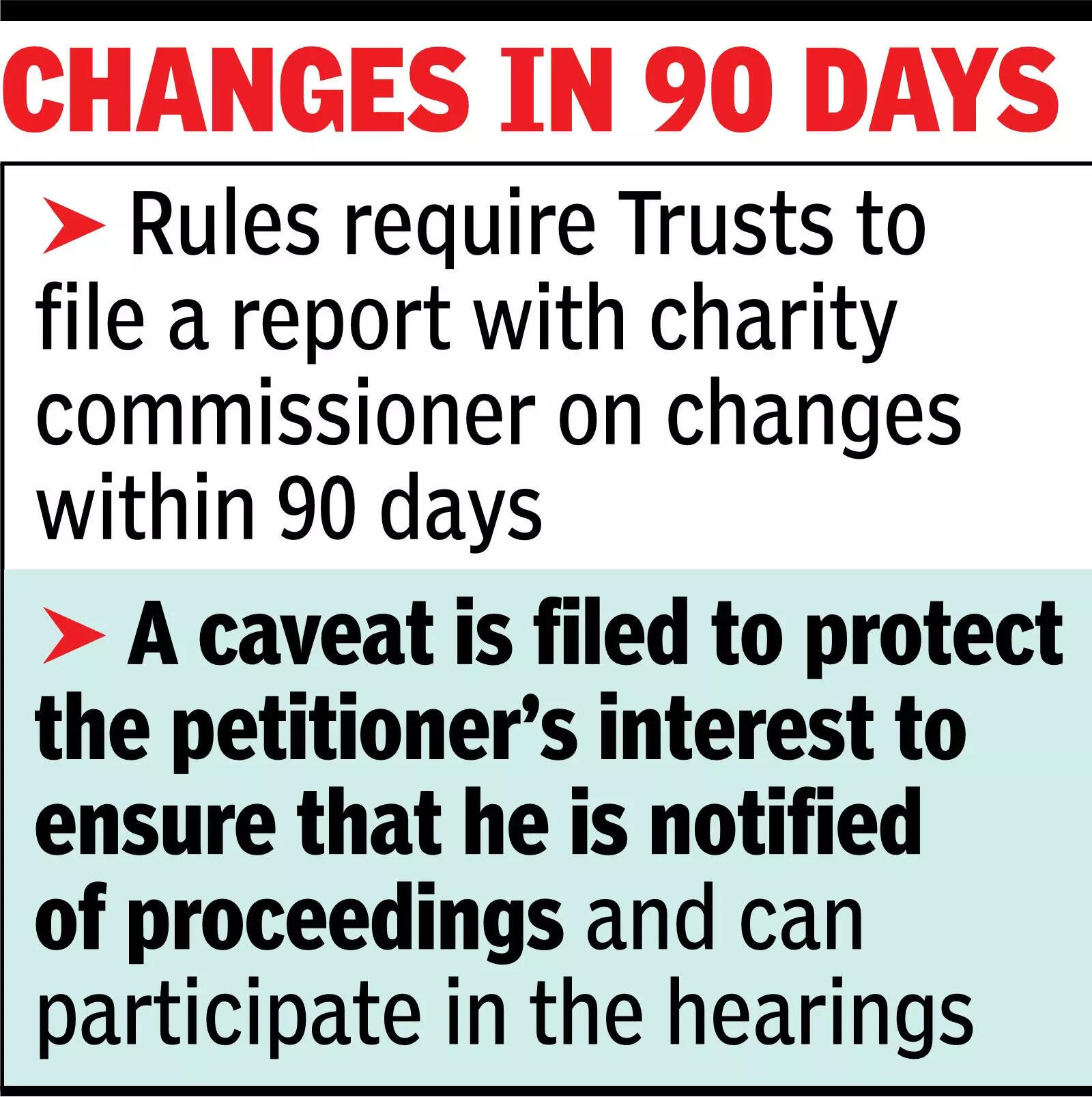

MUMBAI: Mehli Mistry, whose reappointment on Tata Trusts boards was denied by a majority decision last week, filed a caveat before the charity commissioner in Mumbai Saturday requesting an opportunity to be heard before any decision on a change is sanctioned.Mistry, executor of Ratan Tata‘s will, has also sent the caveat notice to all trustees of Sir Dorabji Tata Trust, Sir Ratan Tata Trust, and Bai Hirabai Jamsetji Navsari Charitable Institution, including chairman Noel Tata, whose wife Aloo is his first cousin.Rules require the Trusts to file a report with the charity commissioner on the changes within 90 days. Once the charity commissioner accepts the new board composition, only then can the Trusts make changes in the signatories of their bank accounts, official correspondence, etc. Charity commissioner is the first judicial forum where grievances related to public charities are taken up.A caveat is filed to protect the petitioner’s interest to ensure that he is notified of the proceedings and has an opportunity to participate in the hearings before any order by the charity commissioner is passed in the particular matter, said senior Supreme Court advocate HP Ranina. In other words, a caveat is a notice not to sanction a change in the board of trustees without Mistry’s submissions. Tata Trusts will also present their arguments before the charity commissioner.

At Tata Trusts, reappointment of a trustee requires unanimous consent of all trustees. Mistry, who was inducted into the boards of Tata Trusts by Ratan Tata in Oct 2022 for three years, had a tenure which expired on October 28, 2025. On October 23, the Trusts circulated a circular seeking trustees’ consent on his reappointment as a permanent trustee. Noel and Trusts’ vice chairmen Venu Srinivasan and Vijay Singh denied Mistry’s continuation, while three other trustees, Pramit Jhaveri, Darius Khambata and Jehangir Jehangir, favoured his reappointment. Ratan Tata’s brother Jimmy Tata abstained from participation. Since there was no unanimity, Mistry’s trusteeship was not renewed.Ranina told TOI that Mistry’s defence before the charity commissioner will be the unanimous October 17, 2024 resolution passed by the trustees that they all will be reappointed as permanent trustees as and when their existing tenures expire. Ranina said any resolution passed by the Trusts is binding on the public charities according to the Maharashtra Public Trusts Act and the Trusts’ deeds. If Trusts want to revoke the October 17 resolution, then they will have to call a meeting and all the trustees will have to unanimously rescind it, Ranina added.However, a trustee who didn’t support Mistry’s reappointment, had said that the October 17 resolution cannot be interpreted as a procedural formality, which undermines the trustees’ fiduciary duties and runs contrary to the law. Senior advocate Devdatt Kamat said Mistry would need to show how due process in conducting the vote rejecting his reappointment was impaired or if there was a mala fide action or if the trust deed was breached since much would also depend on the deed.Senior counsel Shekhar Naphade said the “jurisdiction of the charity commissioner is very limited and confined only to the genuineness and it is not for the charity commissioner to decide the wisdom or its propriety, but if it leads to a deadlock or issues of any alleged mal-administration, the charity commissioner can step in. Otherwise the Trust is entitled to manage its own affairs in terms of its trust deed.If a trusteeship is not renewed, it constitutes a change in composition of the board of trustees which requires under Sec 22 to be formally and mandatorily reported to the charity commissioner via a change report within 90 days of the change that occurred.”The law also provides for provisional acceptance by the deputy or assistant charity commissioner of the change report within 15 working days of it being filed and for a notice to be issued inviting objections to such change within 30 days from the notice date. The Maharashtra Public Trusts Act provides that if no objections are received the change becomes final, but if objections are made, the deputy charity commissioner “may” hold an inquiry and give a finding in three months.Bombay high court in an Oct 2025 judgment held that in a dispute over management of affairs of a trust, an inquiry would determine the lawful appointment or removal of a trustee and a member removed from the trust could legitimately intervene.

Business

VB G RAM G: A Reimagined Rural Employment Guarantee With A Development Thrust

Last Updated:

Modi government’s VB G RAM G Bill replaces MGNREGA, raising job days from 100 to 125, boosting tech-driven transparency, and enhancing state flexibility amid Opposition protests.

Since FY15, the cumulative budgetary allocation to MGNREGA has reached Rs 8.64 lakh crore, about 3.6 times that of the UPA period.

As the Modi government introduced the VB G RAM G Bill — Viksit Bharat – Guarantee for Rozgar and Ajeevika Mission (Gramin) in the Lok Sabha, replacing MGNREGA, the Opposition, including the Congress, vociferously protested and tore copies of the legislation in the well of the House, irked by the absence of Mahatma Gandhi’s name. Realising its bankruptcy of issues, the Congress latched onto this matter hurriedly, without examining the fine print—where none existed. What the Congress fails to acknowledge is that rural employment schemes have existed since the 1960s, and even MGNREGA did not carry Mahatma Gandhi’s name when the Bill was legislated in 2005.

Improvements to MGNREGA since 2014-15

The implementation of MGNREGA during the UPA years was riddled with weak oversight, patchy execution, and relatively shallow budget allocations. Since FY15, the cumulative budgetary allocation to MGNREGA has reached Rs 8.64 lakh crore, about 3.6 times that of the UPA period. This includes stepped-up expenditure of Rs 1.12 lakh crore during crisis periods such as the Covid pandemic.

This exponential increase in allocation translated into visible improvements in women’s participation, person-days generated, and the creation of durable rural assets. Unlike the UPA era, digitisation and geotagging of photographs have aided in improving transparency and facilitating timely payment of wages.

However, despite the ramp-up in implementation, several irregularities and structural issues — such as fake job cards, chronic delays in wage payments, quality and durability deficits in assets, and accountability gaps — have been highlighted in various Departmentally Related Standing Committee reports.

The Bill: Differentiation across multiple dimensions

The new Bill represents a comprehensive revamp of MGNREGA while retaining the core employment guarantee. It raises the guaranteed wage employment from 100 days to 125 days per household per financial year, covering more than a third of the year. While convergence, saturation, and a whole-of-government approach existed operationally under MGNREGA, these principles have now been formally embedded in the legislation, reinforcing the commitment to rural resilience and prosperity.

The Bill also mandates that wage payments be made within seven days of completion of work, compared to the earlier ceiling of 15 days.

The most defining feature of the Bill is its emphasis on technology-enabled planning, transparency, and accountability. All Viksit Gram Panchayat Plans will be aggregated into the Viksit Bharat National Rural Infrastructure Stack and integrated with the PM Gati Shakti National Master Plan to enable spatially optimised infrastructure development. Artificial intelligence will also be leveraged for planning, audits, and fraud-risk mitigation.

Biometric authentication of workers, mobile application-based and dashboard-based monitoring systems providing real-time visibility of demand, works, workforce deployment, payments, and progress, along with weekly public disclosure mechanisms — both digital and physical — covering key metrics, muster rolls, payments, sanctions, inspections, and grievance redressal — form a robust technology-driven transparency and accountability framework.

Enhancing responsibility, predictability, flexibility, and accountability for states

Earlier, states received 32 percent devolution from central taxes. This was increased to 42 percent by the Fourteenth Finance Commission. In alignment with this shift, VB G RAM G will be implemented as a centrally sponsored scheme with a 60:40 Centre-state funding pattern, replacing the earlier central sector structure.

States will also have greater flexibility to allocate funds, based on Viksit Gram Panchayat Plans, to those gram panchayats that need them the most, thereby addressing regional disparities more effectively. The Bill introduces normative allocations, enabling states to better predict finances and plan works in advance.

With technology-driven governance and the liability resting on states to provide unemployment allowance if work is not provided within 15 days, states are firmly brought within the accountability framework. When analysed together, the employment guarantee and panchayat plans clearly reinforce the demand-driven character embedded in the Bill.

Relief for farmers and support to agriculture

Agriculture and allied activities play a critical role in food security and contribute significantly to GDP. As the annadata is a key stakeholder in the vision of Viksit Bharat, farmer welfare remains a core focus of the Modi government. Initiatives such as PM-KISAN, PMFBY, the announcement of 50 percent returns over cost in MSP, and GST 2.0 reforms, including a reduction in GST on key farm inputs to five percent, reflect this commitment.

Yet, persistent challenges remain in agricultural production, with implications for food security. One major issue is the chronic labour shortage during peak sowing and harvesting periods. This concern was also flagged by the Standing Committee on Rural Development in its 2012–13 report on MGNREGA, which noted that MGNREGA works during peak agricultural seasons adversely affect labour availability for farming. While the department acknowledged the issue, it had earlier rejected a blanket ban on works during peak periods.

Recognising this challenge, and considering that over 80 percent of farmers are small and marginal, farm mechanisation levels remain low, and more than 45 percent of the cost of cultivation is labour-related, the Bill empowers states to notify, in advance, a period aggregating up to 60 days in a financial year covering peak sowing and harvesting seasons during which works under the scheme will not be undertaken. This ensures adequate availability of farm labour during critical agricultural operations.

Another major concern is that over 50 percent of India’s net sown area remains monsoon-dependent, exposing food production to high rainfall variability. With water security identified as one of the four thematic focus areas, water-related works such as irrigation support and groundwater recharge will strengthen agricultural resilience. The other thematic focus areas—connectivity, storage, and protection from extreme weather—also provide direct and indirect support to farmers.

Conclusion

The transformative VB G RAM G Bill represents continuity rather than rupture, carrying forward the spirit embedded in MGNREGA while addressing its structural shortcomings. By raising the employment guarantee from 100 to 125 days, strengthening execution through technology-enabled planning, payments, and oversight, and enhancing state participation and accountability, the Bill seeks to elevate rural employment guarantees to the next level.

In doing so, states are also poised to reap positive spillover effects across agriculture and rural infrastructure, making VB G RAM G a more holistic instrument for rural development in a Viksit Bharat.

December 20, 2025, 07:32 IST

Read More

Business

Ministers asked to take G Ram G to rural India – The Times of India

NDA functionaries, including ministers, would soon hit the ground to explain and create more awareness about benefits of the new rural employment guarantee scheme VB G-RAM-G, which has replaced the UPA-era MNREGA, to negate the opposition’s narrative. This was discussed at Friday’s Cabinet meeting, which PM Modi chaired soon after his foreign trip, sources said.TOI has learnt rural development and agriculture minister Shivraj Singh Chouhan briefed the key provisions of the new scheme to all ministers while urging them to take the message to people. Sources said the PM was also of the similar view for creating more awareness about the new law. Opposition parties may soon carry out protests against the new scheme, particularly for dropping the name of Mahatma Gandhi and increasing burden on the state govts.

Business

Mitsubishi announces $4.4bn Shriram deal – The Times of India

New Delhi: Japan’s Mitsubishi UFJ Financial Group (MUFG) will acquire a 20 per cent in non-bank finance company Shriram Finance (SFL) for $4.4 billion (Rs 39,618 crore), in what is the largest foreign direct investment in the country’s financial services space. MUFG will pick up the minority stake through preferential equity shares, Shriram Finance said in a statement.The Indian financial services outfit will issue 47.1 crore shares at Rs 840.9 each to MUFG Bank through a preferential allotment, it said in a stock exchange filing. MUFG will be able to nominate two directors on the board of Shriram Finance (SFL). The investor will also have a pre-emptive right to subscribe to pro rata shareholding. “These rights shall fall away if the shareholding of the investor in the company falls below 10 per cent on a fully diluted basis,” a press release said. In its edition on Wednesday, TOI had reported about the proposed transaction. “This collaboration combines SFL’s established domestic franchise and extensive distribution network with MUFG Banks’ global expertise and financial strength. The fund infusion will significantly enhance SFL’s capital adequacy, strengthen its balance sheet, and provide long-term growth capital. It will improve access to low-cost liabilities and potentially strengthen SFL’s credit ratings while aligning governance and operational practices with global best standards,” the NBFC said in a statement.

-

Business6 days ago

Business6 days agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Sports5 days ago

Sports5 days agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Tech6 days ago

Tech6 days agoFor the First Time, AI Analyzes Language as Well as a Human Expert

-

Business5 days ago

Business5 days agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Business1 week ago

Business1 week agoIPO Explained: Meaning, Process, Benefits, Risks

-

Business5 days ago

Business5 days agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Entertainment4 days ago

Entertainment4 days agoPrince Harry, Meghan Markle’s 2025 Christmas card: A shift in strategy

-

Tech1 week ago

Tech1 week agoThe Disney-OpenAI Deal Redefines the AI Copyright War