Business

Vande Bharat sleeper: What issues have been flagged by Railway Ministry in the first train? Top things to know – The Times of India

Vande Bharat sleeper train: Indian Railways is aiming to launch the first Vande Bharat sleeper train in the coming months, but ahead of its launch the Ministry of Railways has highlighted concerns regarding the quality of furnishings and craftsmanship.Vande Bharat sleeper train will be a variant of the chair car air-conditioned service, aimed at long-distance travel on the Indian Railways network. The Vande Bharat sleeper trains are expected to offer a premium passenger experience, better than Rajdhani Express trains. The first ten trainsets are being manufactured by BEML, in collaboration with ICF Chennai.Railway minister Ashwini Vaishnaw recently said that two rakes of Vande Bharat sleeper trains will be launched together.

Vande Bharat sleeper train: What are the issues?

According to a PTI report, in a recent written correspondence to the Director General, Research Designs and Standards Organisation (RDSO) and General Managers across railway zones, the Railway Board identified several deficiencies.“There are issues related to furnishing and workmanship at many places in respect of sharp edges and comers at berthing area, window curtain handles, pigeon pockets between berth connectors inviting cleaning issues etc,” the Board said.The Board emphasised that remedial actions are essential for the present rake, whilst also stating that design enhancements would be required for subsequent rakes.The Railway Ministry has instructed zones to comply with all RDSO-specified conditions for operations reaching speeds of 160 kmph.Officials explained the authorisation procedure, stating that after RDSO obtains final CCRS approval for new train designs, CCRS forwards the matter to the Railway Ministry for operational clearance.“The CCRS during trial conveys its observations to the RDSO for compliance. In the case of the Vande Bharat Sleeper Train, the RDSO sent its updated compliance on September 1, 2025,” officials said.Officials noted that since the Vande Bharat Sleeper Train’s route remains undecided, the Ministry distributed its letter dated October 28 across all zones.The Ministry has emphasised adherence to several requirements, including fire safety protocols, installation of Kavach 4.0, establishment of reliable communication between loco pilots, train managers and station masters, and proper brake system maintenance.The railway authorities instructed regional divisions to train engine drivers for emergency uncoupling of semi-permanent couplers within 15 minutes, ensuring essential tools are included in the driver and guard equipment sets.“Suitable setting of temperature inside coaches shall be maintained to ensure comfortable conditions to passengers, considering ambient conditions and frequent opening & closing of doors,” they specified.The Ministry emphasised the importance of having trained technical personnel available to address any operational difficulties and emergencies during the journey.“Regular announcements shall be made through the PA system informing all persons other than passengers to disembark from the train before its departure. Also, pre-recorded Passenger safety announcements in three languages (Regional, Hindi & English) should be made during the run to sensitize passengers about personal safety norms to be observed during travel,” according to the directive.Additionally, the Ministry instructed regional divisions to assign skilled and dedicated personnel for Vande Bharat Sleeper Trainset maintenance, whilst ensuring sufficient spare parts and consumables are readily available.

Business

Chipotle stock sinks as restaurant chain reports falling traffic, weak guidance

A Chipotle store stands in the Bronx in New York City on April 23, 2025.

Spencer Platt | Getty Images

Chipotle Mexican Grill on Tuesday reported quarterly earnings and revenue that topped analysts’ expectations, although traffic to its restaurants fell for the fourth straight quarter.

For 2026, the company is projecting flat same-store sales growth, signaling that the burrito chain’s woes are not expected to disappear quickly. Chipotle ended a bumpy 2025 with a full-year same-store sales decline of 1.7%.

Shares of the company fell as much as 11% in extended trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: 25 cents adjusted vs. 24 cents expected

- Revenue: $2.98 billion vs. $2.96 billion expected

The fast-casual chain reported fourth-quarter net income of $330.9 million, or 25 cents per share, down from $331.8 million, or 24 cents per share, a year earlier.

Excluding impairment costs, gains from terminating restaurant leases and other items, Chipotle earned 25 cents per share.

Net sales rose 4.9% to $2.98 billion.

The company’s same-store sales fell 2.5% for the quarter, making this reporting period the third quarter of the year with same-store sales declines. However, Wall Street was anticipating a steeper same-store sales decrease of 3%, according to StreetAccount estimates.

Traffic to Chipotle restaurants fell by 3.2%. Executives have previously said they have seen a pullback in spending from consumers of all income cohorts, although low-income diners have made the most significant shift to their behavior.

Over the past year, shares of Chipotle have lost roughly a third of their value, dragging the company’s market value down to about $51 billion. Investor enthusiasm for the stock waned after the fast-casual chain began reporting shrinking traffic to its restaurants.

To bring back customers, Chipotle is focusing on improving the chain’s operations and adding new menu items, rather than leaning into discounts. In December, at the tail end of the quarter, the company unveiled “protein cups,” with the goal of convincing protein-obsessed customers to stop by for a snack, not just lunch or dinner.

Chipotle opened 132 company-owned locations and seven restaurants run by international licensees during the quarter. That brought its total to 334 company-owned locations and 11 international partner restaurants opened for the year.

In 2026, the company is projecting that it will open 350 to 370 new restaurants, including 10 to 15 international locations that will be run by licensees.

Business

India–US trade deal: Textile, leather players see revival in volumes – The Times of India

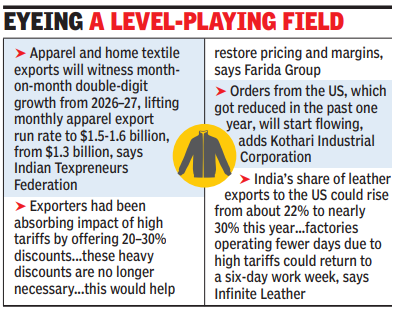

CHENNAI: India’s textile, apparel and leather exporters are expecting a sustained recovery in orders from the US, following tariff reductions under the proposed India–US trade deal. Industry representatives said the move will restore competitiveness, improve margins and revive volumes that were under pressure over the past year.Textile and apparel exporters are now expecting an increased sourcing by global brands as India will now enjoy one of the lowest tariff regimes among major Asian manufacturing hubs, with a marginal advantage over competitors, such as Bangladesh, Sri Lanka, Vietnam and China. The tariff relief is expected to create a level-playing field, particularly for small and medium exporters in clusters such as Surat, Gurugram and Tirupur.Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation, said sourcing interest of US from India is rising and exports are likely to improve steadily. “The apparel and home textile exports will witness month-on-month double-digit growth from the 2026–27 fiscal, lifting the monthly apparel export run rate to $1.5 to $1.6 billion, from the current $1.3 billion.”

Eyeing a level-playing field

A Sakthivel, chairman of the Apparel Export Promotion Council, said improved trade terms would significantly enhance the competitiveness of Indian apparel products in the US market.The leather sector has termed the US decision to reduce tariffs to 18% a “double dhamaka”, coming soon after India’s strategic trade deal with the European Union. Israr Ahmed, former vice-president of the Federation of Indian Export Organisations (Fieo) and managing director of the Farida Group, said exporters had been absorbing the impact of high tariffs by offering discounts of 20–30%. “With the US now reducing tariffs on Indian goods to 18%— a rate lower than those faced by key South Asian competitors, such as Bangladesh and Vietnam — these heavy discounts are no longer necessary,” he said, adding that this would help restore pricing and margins.Rafiq Ahmed, chairman of Kothari Industrial Corporation, noted that competition in the US market has intensified over the past year but said long-standing relationships would help Indian exporters regain lost ground. “The orders from the US, which got reduced in the past one year, will start flowing,” he said.Yavar Dhala, vice-president of the Indian Shoe Federation and CEO of Infinite Leather, said India’s share of leather exports to the US could rise from about 22% to nearly 30% this year, adding that factories operating fewer days due to high tariffs could return to a six-day work week.

Business

Disney names Josh D’Amaro as new chief executive

The media giant chooses the head of its amusement park business to replace longtime boss Bob Iger.

Source link

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports7 days ago

Sports7 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment7 days ago

Entertainment7 days agoK-Pop star Rosé to appear in special podcast before Grammy’s