Business

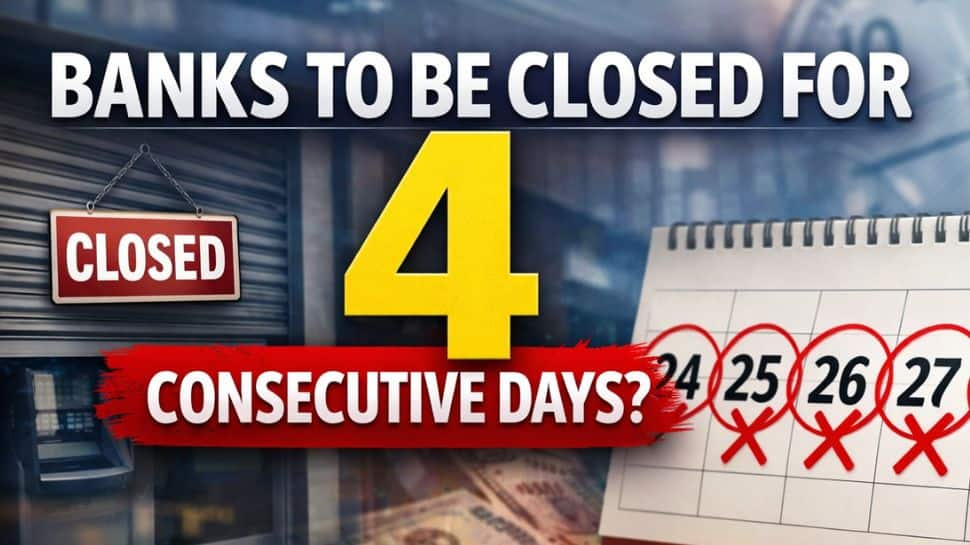

Bank Holiday Today Guru Nanak Jayanti: Are Branches Closed Or Open In Your City? Check State-Wise List

New Delhi: As per RBI holiday list, bank branches will be closed in several cities today 5 November 2025 on account of several regional festivities as well as Guru Nanak Jayanti. Branches in several states will be closed on account of Kartika Purnima/Rahas Purnima today.

List of cities where bank branches will remain closed on 5 November 2025

Bank branches will be closed for Guru Nanak Jayanti/Kartika Purnima/Rahas Purnima in different Mizoram, Maharashtra, Madhya Pradesh, Odisha, Chandigarh, Uttarakhand, Telangana, Arunachal Pradesh, Rajasthan, Jammu & Srinagar, Uttar Pradesh, Nagaland, West Bengal, New Delhi, Chhattisgarh, Jharkhand, and Himachal Pradesh.

Holidays of the mentioned days will be observed in various regions according to the state declared holidays, however for the gazetted holidays, banks will be closed all over the country.

If you keep a track of these holidays, you would be able to plan bank transaction activities in a better way. For long weekends, you can even plan your holidays well.

Business

Car finance: What happened and how much compensation will be paid?

Millions could be entitled to compensation as a result of commission arrangements between lenders and dealers.

Source link

Business

Over 2.5 crore Aadhaar Numbers deactivated by govt due to…

New Delhi: The Unique Identification Authority of India (UIDAI) has deactivated more than 2.5 crore Aadhaar numbers of deceased persons till date. This is as part of a nationwide clean-up effort to maintain the continued accuracy and integrity of the Aadhaar database, Union Minister of State for Electronics and Information Technology Shri Jitin Prasada in Lok Sabha on Wednesday.

Aadhaar is the world’s largest biometric identity system with approximately 134 crores live Aadhaar holders.

In case of the death of a person, it is essential that his/her Aadhaar number is deactivated to prevent potential identity fraud, or unauthorized usage of such Aadhaar number for availing welfare benefits.

The State / UT mentioned in the address of an Aadhaar number holder in the Aadhaar database may vary from the State / UT where death was registered.

Measures to prevent potential identity fraud

Government has said that several measures have been taken to reduce the risk of identity fraud and ensure leak-proof delivery of benefits in the country.

The key measures include:

Biometric Lock/Unlock feature enables an Aadhaar number holder to “Lock” his biometrics, preventing any unauthorized authentication attempts.

Aadhaar Lock/Unlock feature for an Aadhaar number holder.

Deployment of Face Authentication having ‘Liveness Detection feature’ to prevent spoofing and ensure the physical presence of the beneficiary during transactions.

Offline Verification: Promotion of Aadhaar Secure QR Code, Aadhaar paperless offline e-KYC, e-Aadhaar and Aadhaar verifiable credentials for offline identity verification.

No sharing of Core Biometric information of Aadhaar number holders in any manner by UIDAI.

Secure Data Storage: Mandatory use of Aadhaar Data Vaults by all requesting entities to store Aadhaar numbers in an encrypted format.

Database Sanitization: Regular de-duplication and deactivation of Aadhaar numbers belonging to deceased persons.

Updation of demographic details of an Aadhaar number holder is allowed only as per documents listed by UIDAI.

UIDAI has launched a new Aadhaar app which facilitates sharing of verified credentials by Aadhaar number holder with the Offline Verification Seeking Entities (OVSE) in a secure and seamless manner.

Business

TDS alert! Important February compliance dates you must track– Check Full list

New Delhi: February 2026 brings a series of important deadlines related to Tax Deducted at Source (TDS) that taxpayers and deductors should not overlook. From issuing TDS certificates to submitting mandatory statutory forms, these compliance dates play a key role in ensuring smooth and accurate tax reporting. Businesses, employers, and government offices must stay alert and complete the required filings on time to avoid penalties or complications under the Income-tax Act. Keeping track of these dates can help ensure hassle-free compliance and prevent last-minute stress.

February 14:

– Deadline for issuing TDS certificate under Section 194-IA for tax deducted on transfer of immovable property in December 2025.

– Deadline for issuing TDS certificate under Section 194-IB for tax deducted on rent paid by individuals or HUFs in December 2025.

– Deadline for issuing TDS certificate under Section 194M for tax deducted on contractual or professional payments made in December 2025.

– Deadline for issuing TDS certificate under Section 194S for tax deducted on transfer of virtual digital assets by specified persons in December 2025.

February 15:

– Deadline for government offices to furnish Form 24G where TDS/TCS for January 2026 was deposited without generating a challan.

– Deadline for issuing the quarterly TDS certificate for non-salary payments for the quarter ended December 31, 2025.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade