Business

Waterstones would sell books written by AI, says chain’s boss

Felicity Hannah,Big Boss Interviewand

Michael Sheils McNamee,Business reporter

PA

PAWaterstones would stock books created using artificial intelligence, the company’s boss has said, as long as they were clearly labelled, and if customers wanted them.

However, James Daunt, a veteran of the bookselling industry, said he personally did not expect that to happen.

“There’s a huge proliferation of AI generated content and most of it are not books that we should be selling,” he said.

But it would be “up to the reader”.

An explosion in the use of artificial intelligence, or AI, has prompted heated debate in the publishing industry, with writers concerned about the impact on their livelihoods.

In a wide-ranging interview with the BBC’s Big Boss podcast, Daunt said while Waterstones uses AI for logistics they currently try to keep AI generated content out of the shops.

“As a bookseller, we sell what publishers publish, but I can say that instinctively that is something that we would recoil [from],” he said.

Daunt, who is heading into his 36th Christmas season in the book trade, said Waterstones’ success had been built on handing more control to individual store managers to serve their own communities.

“Head office is there to make life easier,” he said.

“Make sure the books that they order turn up on time, but do not tell [managers] where to put them.”

Daunt also said he was a bit of an outlier in welcoming last week’s Budget and he raised the prospect of a stock market flotation of the book chain.

‘Disdain for AI’

A report published last month by the University of Cambridge found that more than half of published authors feared being replaced by artificial intelligence.

Two-thirds also said their work had been used without permission or payment to train the large language models which lie behind generative AI tools.

But some writers use AI themselves, especially for research, and AI tools are being used to edit novels, and even produce full-length works.

“Do I think that our booksellers are likely to put those kind of books front and centre? I would be surprised,” Daunt says.

“Who’s to know? [Technology firms] are spending trillions and trillions on AI and maybe it’s going to produce the next War and Peace.

“And if people want to read that book, AI-generated or not, we will be selling it – as long as it doesn’t pretend to [be] something that it isn’t.

“We as booksellers would certainly naturally and instinctively disdain it,” Daunt said.

Readers value a connection with the author “that does require a real person” he added. Any AI-generated book would always be clearly labelled as such.

The softly spoken former banker has overturned convention before.

When he took over at Waterstones in 2011, he took the bold decision to end the practice of publishers paying to have their books displayed prominently in stores. It cost him £27m in lost revenue and prompted a “nervous breakdown” among publishers, he said, but it paid off and in 2016 the company returned to profit.

Now Waterstones staff write their own book recommendations, choose books of the month, and the manager selects what goes on the display tables.

As well as books, the chain stocks pens, reading lights, games, wrapping paper and other stationery.

The strategy has helped it defy the decline on the High Street, with around ten new stores opening a year, and profits in 2024 of £33m against sales of £528m.

Waterstones is part of a wider stable, including Foyles and Blackwell’s, owned by hedge fund Elliott Advisers.

Daunt has also been appointed chief executive of Barnes and Noble, the large US bookstore chain also owned by Elliot Advisers.

Share sale

Success on both sides of the Atlantic has led to speculation that shares in Waterstones and Barnes and Noble could be jointly floated in either New York or London.

“It feels like an inevitability and probably better than being flipped to the next private equity person,” says Daunt.

Private owners naturally aim to sell businesses on, he points out. “It’s what they do.”

But it is not clear that London, which he says has been “suffering” as a location for initial public offerings lately, would be considered suitable.

“We’re based out of London but we have a huge American business; Barnes and Noble is much larger than Waterstones.”

Helpful rate change

As for last week’s Budget, Daunt says it sometimes feels like he might be “the only person who is sympathetic” to the situation the chancellor is in.

The government has drawn the ire of the business community for raising employer National Insurance and the minimum wage and not coming up with more growth-boosting measures.

But the Budget included changes that were “very helpful” to companies like his, said Daunt.

Getty Images

Getty ImagesBusiness rates will be lower for retailers operating out of small sites, while larger business properties, like warehouses will pay more.

Daunt said that although Waterstones does have larger premises, levelling the playing field between High Street and online retailers was something he has been calling for for a long time.

With the days of advent now ticking past, the company is well into the se portion of the year when Waterstones makes about 70% of its annual profit.

He says the post-pandemic rebound, with people returning to bookshops, does not seem to have gone away.

Personally he has also retained his love of reading, even after 36 years in the industry. But he does have one bad book habit, he said.

“Because I read professionally, I do a rather awful thing which is start a lot of books and then not finish them.

“I love the excitement of opening up a first novel and not knowing what’s going to come of it. But if it isn’t quite that good, I’ll just move on.”

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

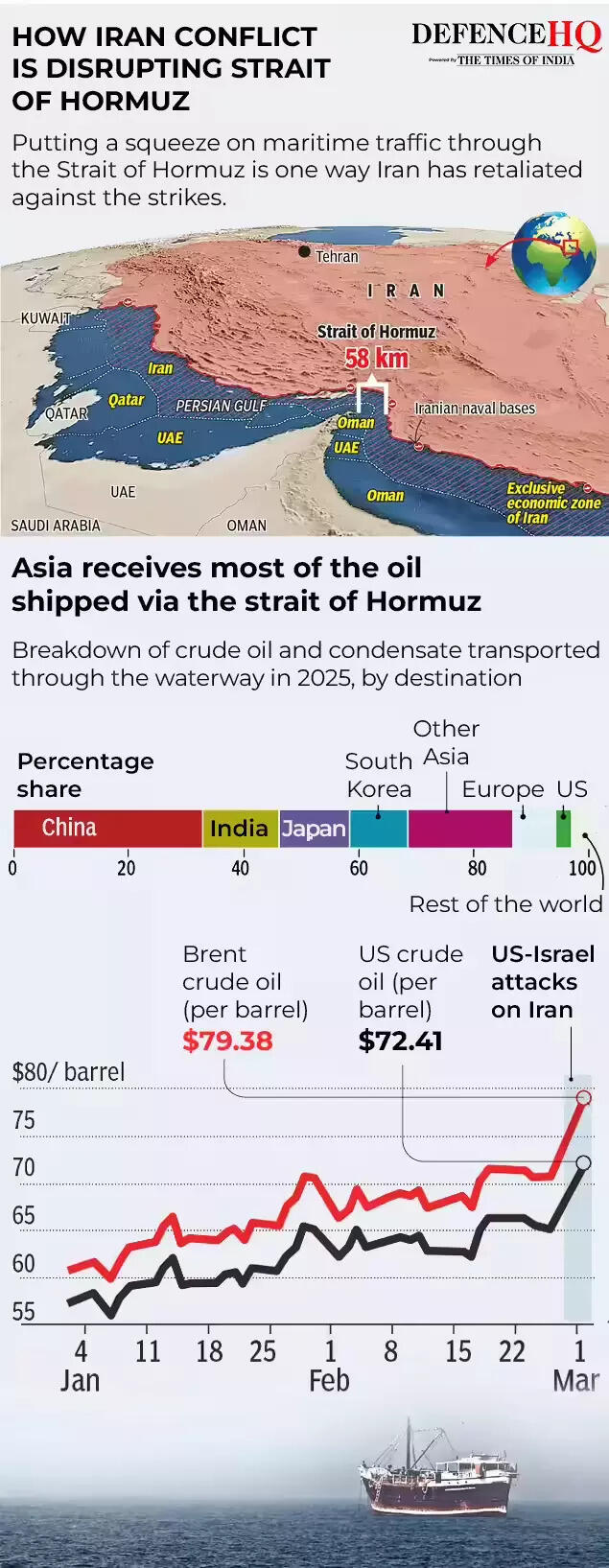

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire