Business

Wisdom beyond markets: What is Warren Buffett’s success mantra & how to recreate it? – The Times of India

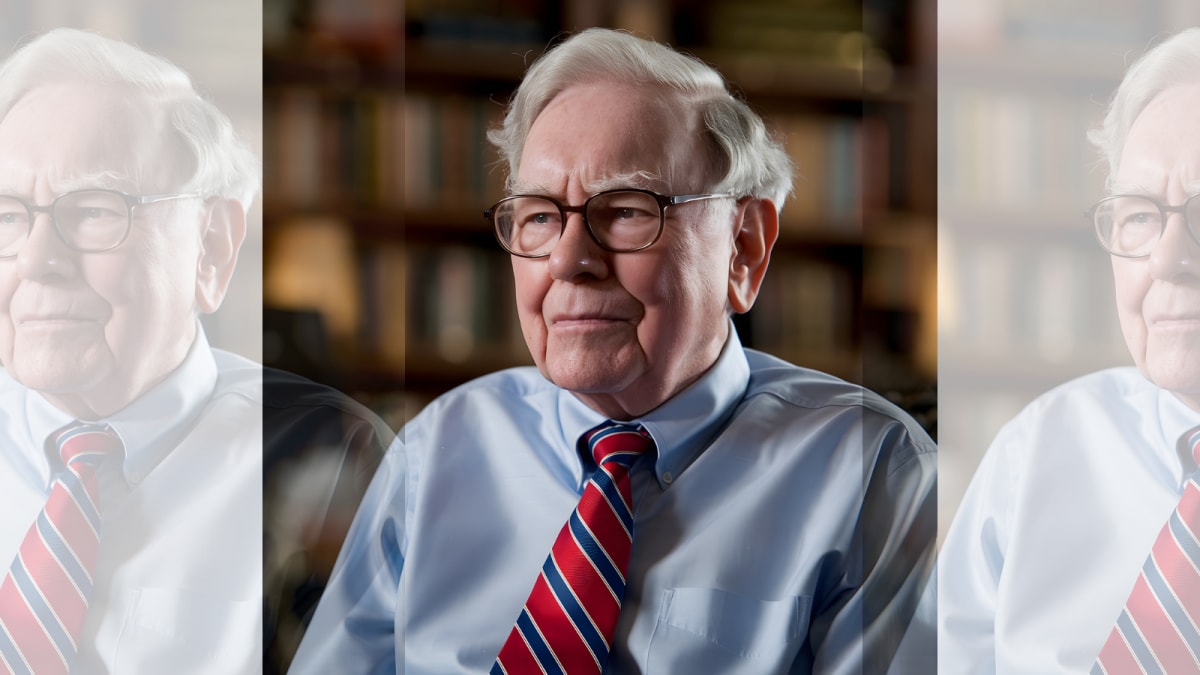

Warren Buffett is known for many things – he is one of the richest persons in the world, a master of investment, the ‘Oracle of Omaha’, Zen master and more. When it comes to business acumen and mastering the stock markets, Buffett’s mantras are cited as near-gospel by investors.As the 95-year-old approaches his retirement as Berkshire Hathaway’s CEO later this year, his remarkable investment acumen has garnered widespread recognition. His achievements have established him amongst history’s most accomplished investors, accumulating wealth estimated at $150 billion.But Buffett’s lessons don’t just extend to markets and investment – they are often regarded as pearls of wisdom for dealing with life’s ups and downs.According to a CNN report, Buffett’s teachings incorporate diverse philosophical traditions, drawing from Zen Buddhism, Confucian thought, Stoic philosophy and New Testament teachings. These principles provide guidance for navigating both financial markets and personal difficulties.

Warren Buffett’s Zen-like principles

Although not religious himself, Buffett’s career reflects substantial engagement with spiritual principles. Religious scholars and practitioners studying Buffett’s approach recognise him not only as a business leader but also as someone who embodies Zen-like wisdom in his methods and teachings, says CNN.Warren Buffett’s spiritual influence has extended globally over the years. His followers attend Berkshire Hathaway shareholder meetings to see the individual whom a financial expert described as “the God of investing.”Buffett himself serves as the primary source of his spiritual wisdom, having developed his own philosophical perspective. Both investors and non-investors study his sayings and teachings, including statements like “Someone is sitting in the shade today because someone planted a tree a long time ago.” He also notes that wealth “lets you be in more interesting environments, but it can’t change how many people love you or how healthy you are.“Such philosophical observations from Buffett have led Leo Babauta, who practises Zen Buddhism, to recognise Buffett’s alignment with Zen principles.“He’s one of the richest men in the world, and yet I really don’t feel like he has made that a central part of who he is,” Babauta, author of “The Power of Less: The Fine Art of Limiting Yourself to the Essential…in Business and in Life,” tells CNN.“He’s surrounded by people who are focused on making money, and he sees how people are deluded (by that). That’s one of the central ideas of Zen: We’re all living these illusions of what’s going to make us happy.”In Buffett’s perspective, excellence in investing and personal integrity are inseparable. He suggests that one can always be in a bull market by adhering to three spiritual guidelines, which he articulates in his own words: ‘Envy and greed go hand in hand’The Ten Commandments include the directive against coveting, whilst envy features amongst the seven deadly sins. According to Buffett, amongst the seven deadly sins, envy stands alone as the only one devoid of pleasure. He has said, “Being envious of someone else is pretty stupid. Wishing them badly, or wishing you did as well as they did — all it does is ruin your day. Doesn’t hurt them at all, and there’s zero upside to it. If you’re going to pick a sin, go with something like lust or gluttony. That way at least you’ll have something to remember the weekend for.”This mindset has implications for investment strategies. Babauta’s analysis of Buffett’s investment approach reveals a conservative methodology rooted in Zen principles. Buffett acknowledges his own boundaries, particularly regarding technology investments, due to his limited understanding of the sector.“You would never find him chasing after cryptocurrency or the latest AI thing,” Babauta says according to CNN. “He looks for things that are fundamentally sound and that kind of discipline can only happen if he didn’t need to chase after things because of his contentment. That contentment, in his case, led to a lot of discipline.”‘More blessed to give than to receive’In June 2006, Buffett announced a big philanthropic commitment through a series of letters, pledging most of his wealth to foundations and charitable organisations. This philanthropic spirit continued in his recent shareholder letter, where he discussed plans to accelerate his charitable giving, allocating approximately a billion dollars to four family foundations.According to the CNN report, Buffett exemplifies the New Testament principle of giving over receiving, setting him apart amongst America’s wealthy. This characteristic inspired Robert L. Bloch, whose father established H&R Block, to compile “The Warren Buffett Book of Investing Wisdom: 350 Quotes from the World’s Most Successful Investor”. Speaking to CNN, Bloch identifies Buffett’s gratitude and generosity as essential spiritual values.Buffett demonstrates genuine concern for underprivileged and ordinary citizens, expressing a desire to contribute to society’s welfare, as Bloch notes. “That’s very spiritual. Not many billionaires are like that.”His charitable nature aligns with ancient Greco-Roman Stoic principles. Philosophers like Epictetus and Marcus Aurelius advocated that virtuous living was essential for happiness, whilst viewing material attachments as obstacles to self-control. As documented by Ryan Holiday, author of popular books on Stoicism, Aurelius, whilst serving as Roman emperor, liquidated palace possessions to reduce empire debt and support Roman citizens.According to Bloomberg Opinion columnist Beth Kowitt, Buffett credits his success to luck. “He is very clear that a lot of his success comes from being born a white male American in the year 1930. I think he believes that his wealth is a product of the system. It’s not all. He doesn’t buy into his own hype. And I think that is really different from what we see from a new cohort of Silicon Valley CEOs who seem to feel that they’ve contributed so much more to society than they’ll get back,” she tells Bloomberg. “This is a little bit of the secret of his success. It’s kind of helped him avoid hubris and the mistakes that come with it. And I think, you cannot recreate Warren Buffett’s luck, but you can certainly try to recreate this mentality,” she says.

Keeping the faith

People in the US have faced significant challenges recently. A Politico survey reveals nearly 50% of citizens struggle with essential expenses like food and healthcare. Various polls indicate that over half of Americans believe the country’s peak has passed.Nevertheless, Buffett maintains optimism in America. This optimistic outlook mirrors the Christian virtue of faith, despite his non-religious stance. According to Christianity’s central figure, faith possesses transformative power. Another New Testament author defines it as “confidence in what we hope for and assurance of what we do not see.”Warren Buffett stands as America’s foremost optimist. During challenging economic periods and political turmoil, he has maintained his positive outlook with statements like, “For 240 years, it’s been a terrible mistake to bet against America, and now is no time to start.” And: “We always live in an uncertain world. What is certain is that the United States will go forward over time.”This unwavering confidence motivated Bloch to explore Buffett’s statements in detail.“You got to have faith that it’s going to get better and we will come out of this,” Bloch explains to CNN, referring to the current political and economic climate in the US. “Look at 1776, 1820, and the Great Depression. America just got bigger and better throughout history.”This steadfast belief appears to be the source of Buffett’s consistent positive attitude. His wholesome Midwestern outlook is captured in his retirement letter: “Kindness is costless, but also priceless.”Unlike many billionaires who display domineering attitudes, Buffett maintains courtesy even towards critical voices at shareholder meetings and avoids associations with questionable individuals. As he stated, “You can’t make a good deal with a bad person.”He frequently discusses an unexpected topic in the competitive investment world: love.His perspective on love is clear: “The only way to get love is to be lovable” as money cannot purchase genuine affection. He believes in the reciprocal nature of love, stating, “The more you give love away, the more you get.”This approach, rather than his successful investments in Coca-Cola, Wells Fargo and Kraft Heinz, might be considered his most significant contribution. He has earned widespread respect in America not solely for his financial success but for his consistent consideration of others.His investment in human relationships may prove to be his most valuable achievement.

Business

Investors suffer a big blow, Bitcoin price suddenly drops – SUCH TV

After the drop in gold price, Bitcoin price also fell.

Bitcoin fell below $77,000 in the global market, Bitcoin price fell by more than 13% in a week.

Bitcoin’s highest price in 6 months fell below $126,000, Bitcoin price has dropped by more than $49,000.

Business

Post-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

Last Updated:

The BSE Sensex is trading higher by 371 points, or 0.47%, at 81,090.24, while the NSE Nifty rises by 70 points to trade above 24,850 at 24,889.25.

Stock Market Today.

Market Updates Today: A day after the market crash following the Budget’s provision to hike Securities Transaction Tax (STT), the domestic equity market on Monday saw heightened volatility. After opening nearly flat, the NSE Nifty rose to the day’s high, then touched the day’s low before sharply recovering to trade at the day’s high of 25,093.

As of 3:16 pm, the BSE Sensex surged by 932 points, or up 1.13%, to 81,641.87 in the afternoon trade and the NSE Nifty rose by 267 points, or up 1.07%, to trade above 25,000 at 25,093.27. After opening nearly flat, the NSE Nifty rose to the day’s high, then touched the day’s low before sharply recovering to trade at the day’s high of 25,093.27.

Among the 30 Sensex shares, 25 stocks were trading in the green. Among the top gainers were PowerGrid, Adani Ports, BEL, Reliance, Mahindra & Mahindra, Larsen & Toubro, and IndiGo, rising by up to 7.91%. The laggards were Axis Bank, Infosys, Titan, TCS, and Trent, falling by up to 1.97%.

After opening nearly flat, at around 9:30 am, the BSE Sensex jumped by 350 points to 81,112.03 in the opening trade, while the NSE Nifty rose 91 points to trade above the 24,900 level at 24,910.85. However, the benchmarks gave up all gains and declined to day’s low amid heavy volatility.

Aakash Shah, technical research analyst at Choice Equity Broking Private Ltd, said, “Near-term sentiment remains cautious despite some support from domestic technical indicators. The broader market direction will largely be influenced by global equity cues, crude oil price movements, and institutional fund flows.”

On Sunday, the Nifty saw an aggressive sell-off after the Budget 2026 announcement to hike STT, plunging nearly 870 points from 25,440 to an intraday low of 24,571, before staging a partial recovery to close at 24,825.

“A strong bearish candle was formed, with the index closing decisively below the 200-day EMA, indicating a deterioration in trend strength. Immediate resistance is placed at 24,950–25,000, while key support lies in the 24,650-24,700 zone. The RSI slipped to 31, reflecting oversold conditions, while India VIX surged 10.73% to 15.09, highlighting elevated market volatility,” Shah said.

On Sunday, February 1, foreign institutional investors (FIIs) sold equities worth Rs 588 crore, while domestic institutional investors (DIIs) also remained net sellers, offloading shares worth Rs 682 crore, adding to the pressure on the market.

V K Vijayakumar, chief investment strategist at Geojit Investments Ltd, said, “Yesterday’s market selloff resulting in 495 point crash in Nifty was a knee-jerk reaction to the sharp increase in STT on F&O trades. This was not a revenue-raising measure, but a decision to discourage retail traders from complex F&O trading, in which 92% of them were losing money. This decision is in the interest of retail investors. But this decision impacted the market sentiments, which were already impacted by the decision to make no changes in the LTCGs tax, which a section of the market was expecting rather unrealistically.”

It is important to understand that the Budget is a growth-oriented Budget with fiscal prudence. The 10% nominal GDP growth projected in the Budget is achievable and has the potential to deliver around 15% earnings growth in FY27. The market will soon start discounting this positive. But it is possible that FIIs may continue to sell impacting the market. Retail investors should keep their cool and remain invested and continue to invest systematically. A significant upturn in the market may take time; perhaps a retreat from AI trade globally. We don’t know when this will happen. But we know that an earnings rebound is imminent in response to this growth oriented Budget. That is a clear positive, he added.

February 02, 2026, 09:34 IST

Read More

Business

Gold prices fall sharply locally and internationally – SUCH TV

Gold prices have fallen significantly in both local and international markets, with 10 grams now priced at Rs18,433 and a tola at Rs21,500.

The price per tola fell below Rs22,000, reaching Rs21,500, while 10 grams dropped to Rs18,433.

Internationally, gold also saw a decline, with prices falling by 215 dollars to 4,676 dollars per ounce.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings