Business

Trump says Venezuela will be ‘turning over’ up to 50m barrels of oil to US

Kayla Epsteinand

Osmond Chia

Getty Images

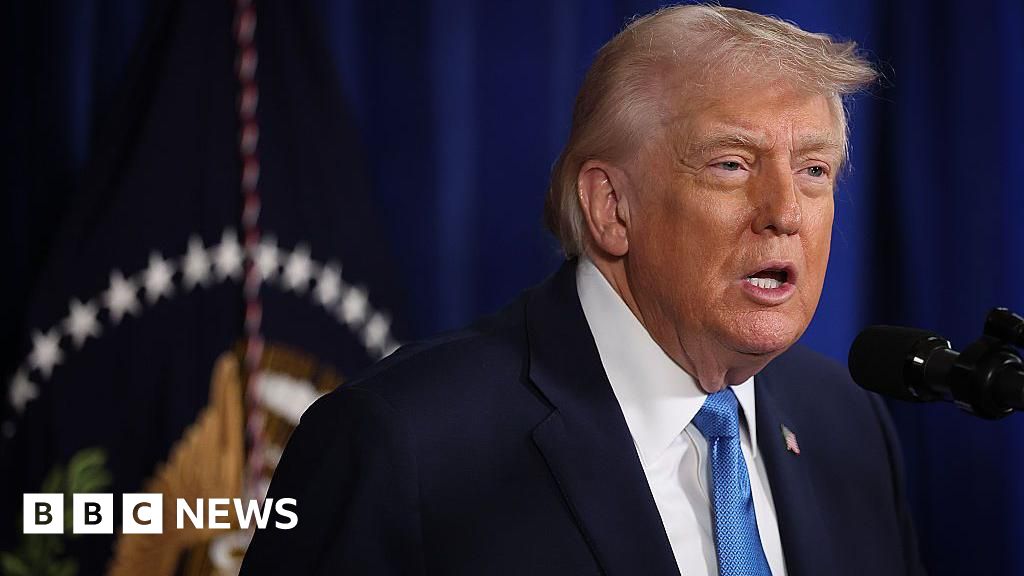

Getty ImagesUS President Donald Trump has said Venezuela “will be turning over” up to 50m barrels of oil to the US, after a surprise military operation that removed President Nicolás Maduro from power.

The oil will be sold at its market price, Trump posted on social media, adding that the money would be controlled by himself and used to benefit the people of Venezuela and the US.

His comments come after he said the US oil industry would be “up and running” in Venezuela within 18 months and that he expected huge investments to pour into the country.

Analysts previously told the BBC it could take tens of billions of dollars, and potentially a decade, to restore Venezuela’s former output.

Trump posted on Truth Social on Tuesday: “I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America.

“This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!”

His comment came a day after Delcy Rodríguez, formerly Venezuela’s vice-president, was sworn in as its interim president. Maduro has been brought to the US to face drug-trafficking and weapons charges.

On Monday the US president told NBC News: “Having a Venezuela that’s an oil producer is good for the United States because it keeps the price of oil down.”

Representatives from major US petroleum companies planned to meet the Trump administration this week, the BBC’s US partner CBS reported.

Analysts who previously spoke to the BBC were sceptical that Trump’s plans would have a major impact on the global supply – and therefore price – of oil.

They suggested that firms would look for reassurance that a stable government was in place, and even when they did invest, their projects would not deliver for years.

Trump has argued in recent days that American oil companies can fix Venezuela’s oil infrastructure.

The country has an estimated 303bn barrels – the world’s largest proven reserve – but its oil production has been in decline since the early 2000s.

The Trump administration sees significant potential for its own energy prospects in Venezuela’s reserves.

Increasing the country’s production of oil would be expensive for US firms.

Venezuelan oil is also heavy and more difficult to refine. There is only one US firm, Chevron, currently operating in the country.

Asked for comment about Trump’s plans for US oil production in Venezuela, Chevron spokesman Bill Turenne said the company “remains focused on the safety and wellbeing of our employees, as well as the integrity of our assets”.

“We continue to operate in full compliance with all relevant laws and regulations,” Turenne added.

ConocoPhillips, a major US oil company that no longer has a presence in Venezuela, “is monitoring developments in Venezuela and their potential implications for global energy supply and stability”, said spokesman Dennis Nuss.

“It would be premature to speculate on any future business activities or investments,” Nuss said.

A third company, Exxon, did not immediately respond to requests for comment.

While justifying the seizure of Maduro from Caracas, Trump also claimed that Venezuela “unilaterally seized and stole American oil”.

Vice-President JD Vance echoed those claims on X after Maduro was taken, writing that “Venezuela expropriated American oil property and until recently used that stolen property to get rich and fund their narcoterrorist activities”.

The reality is more complex.

US oil companies have a long history in Venezuela, extracting oil under licence agreements.

Venezuela nationalised its oil industry in 1976 and in 2007, President Hugo Chavez exerted more state control over the remaining foreign-owned assets of US oil firms operating in the country.

In 2019, a World Bank tribunal ordered Venezuela to pay $8.7 billion to ConocoPhillips in compensation for this 2007 move.

That sum has not been paid by Venezuela, so at least one US oil company has outstanding compensation which is owed to it.

But BBC Verify’s Ben Chu said the claim Venezuela has “stolen” American oil is too simplistic, as experts said the oil itself was never actually owned by anyone except Venezuela.

Business

Eli Lilly launches new form of obesity drug Zepbound with a month’s worth of doses in one pen

An Eli Lilly & Co. Zepbound injection pen arranged in the Brooklyn borough of New York on March 28, 2024.

Shelby Knowles | Bloomberg | Getty Images

Eli Lilly on Monday launched a new form of its blockbuster obesity drug, Zepbound, that offers a month’s worth of doses in a single pen.

Cash-paying patients can get the multi-dose device, called KwikPen, on the company’s direct-to-consumer website, LillyDirect. Prices start at $299 per month for the lowest dose level.

The pen could serve as a more convenient option for some patients, as it reduces the number of devices they have to use in a month to take the drug. Patients can use one pen to take four weekly doses of Zepbound.

Currently, patients on the treatment use a different single-dose autoinjector device each week. Lilly also offers single-dose vials of Zepbound, which requires users to draw the medication into a syringe and inject themselves.

The announcement comes as Lilly works to sustain the early success of Zepbound, which has exploded in demand since it first entered the market in late 2023. LillyDirect has been key to Zepbound’s growth, and rolling out a new form of the drug on the platform could attract even more patients.

The torrid growth of Zepbound has helped Eli Lilly seize a majority share of the weight-loss drug market from rival Novo Nordisk. In the company’s fourth quarter, Zepbound brought in $4.2 billion in U.S. revenue, a 122% spike from the previous year.

In a release, Lilly said the Food and Drug Administration approved a label expansion for Zepbound to include the multi-dose device.

The KwikPen is already used for other drugs, such as Lilly’s popular diabetes medication, Mounjaro.

“As part of our commitment to supporting people living with obesity in their weight management journey, we are introducing a new option with the Zepbound KwikPen, a device trusted by patients globally and in the United States for other Lilly medicines,” said Ilya Yuffa, the president of Lilly USA and Global Customer Capabilities, in the release.

Business

Govt to return unclaimed EPFO deposits, expand scholarships for unorganised workers’ children – The Times of India

The labour ministry has initiated a process to return unclaimed funds lying in inoperative Employees’ Provident Fund Organisation (EPFO) accounts to subscribers, a move expected to benefit over 3.1 million account holders, labour minister Mansukh Mandaviya said.A pilot phase covering about 0.7 million subscribers will be rolled out shortly after the decision was taken during a weekly review meeting chaired by the minister, according to an ET report.EPFO currently has around 31.86 lakh inoperative accounts holding deposits worth Rs 10,903 crore. Nearly 7.11 lakh of these accounts contain unclaimed balances of up to Rs 1,000, totalling Rs 30.52 crore.The ministry said several accounts are as old as 20 years and have recorded no transactions for the past three years, leading to their classification as inoperative.Accounts selected for the pilot phase already have Aadhaar-linked bank details available with EPFO, enabling the retirement fund body to directly credit the pending amounts to subscribers.Under provisions of the EPF & MP Act, beneficiaries must file claims to withdraw their provident fund savings. However, authorities observed that in many cases the balance amount is too small compared with the documentation required, resulting in a buildup of unclaimed deposits over time.

Scholarship scheme to be strengthened

Alongside the payout initiative, the labour ministry said its education assistance programme for children of unorganised workers will now include a merit-based scholarship of up to Rs 25,000 in addition to the existing welfare-based support.“In order to enhance equity, remove unintended exclusions and ensure policy clarity, the ministry is amending the scheme guidelines to allow a student who is availing the ministry’s welfare-based scholarship to also receive a merit-based scholarship from any central or state government agency, wherever eligible,” the labour ministry said in a statement.The ministry said about 0.16 million students have so far received welfare-based financial assistance amounting to Rs 77.9 crore this year, compared with 92,118 beneficiaries who received Rs 31.65 crore in 2024-25.According to the ministry, the initiative aligns with the Code on Social Security, 2020, which seeks to expand social security and welfare measures, including education support, for unorganised workers and their families.

Business

PM Modi to inaugurate Noida’s Jewar airport, says UP CM Yogi – The Times of India

NEW DELHI: Prime Minister Narendra Modi will inaugurate the Noida international airport at Jewar next month, Uttar Pradesh chief minister Yogi Adityanath said during an interaction with the Indian diaspora in Singapore.Highlighting the state’s aviation infrastructure, Yogi said Uttar Pradesh currently has the highest number of airports in the country and that the upcoming airport at Jewar would be the largest in India.“Uttar Pradesh has the highest number of airports in India. PM Modi will inaugurate Noida International Airport, Jewar, next month. This is about to be the biggest airport in India,” he said.He added, “Uttar Pradesh has it and today Uttar Pradesh also has the maximum number of airports in India and next month, Noida International Airport Jewar of Uttar Pradesh, which is going to be the biggest airport of India, is also going to be inaugurated by the hands of Prime Minister Modi. It will emerge as the biggest centre not only for passengers but also for cargo. A very big centre is being built and we are taking it forward.”The Noidai international airport at Jewar is expected to serve as a major passenger and cargo hub for the region once operational.

-

Entertainment6 days ago

Entertainment6 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech6 days ago

Tech6 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics6 days ago

Politics6 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment6 days ago

Entertainment6 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics6 days ago

Politics6 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business6 days ago

Business6 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech6 days ago

Tech6 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports6 days ago

Sports6 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash