Business

Trophy-property ranches hit the market as more heirs chose to sell

Owned by the same family for more than 116 years, Reynolds Ranch is now on the market for $30.7 million.

Courtesy of California Outdoor Properties

For more than 116 years, Deanna Davis’ family has owned Reynolds Ranch, spanning 7,600 acres in California’s Central Coast region. With the heirs in disagreement over the homestead’s future, Reynolds Ranch is now on the market for $30.7 million.

“It’s so hard to make decisions together as a family about the ranch,” she told CNBC. “If I had the cash, I would buy the whole thing right now and cash everybody out and start over and take the title in a LLC.”

It’s a common predicament for family trees that have too many branches, said Davis, who runs the ranch. Her mother, who died last December, was the last family member who grew up on Reynolds Ranch. Now the family is scattered across the country and some of her relatives live overseas. Some family members who can only visit once or twice a year would rather cash out.

Families like Davis’ are increasingly choosing to sell these long-held properties, high-end ranch brokers told CNBC.

The legacy properties are in big demand — even if not at pandemic highs — as deep-pocketed buyers crave wide open skies and a slower pace of life. The so-called “Yellowstone” effect remains in full force, with fans of the Paramount show seeking sprawling properties in Montana, Wyoming, Colorado and other Western states.

“All I know is whoever buys this property, when they sit on the porch in the afternoon, sipping their margarita or iced tea, they will think they landed in paradise,” Davis said.

‘Nothing quite like it’

Ranch brokerage Live Water Properties currently has $700 million in listing inventory, up from under $200 million in May 2024, according to Jackson Hole, Wyoming, broker Latham Jenkins. Many of these properties are legacy ranches that are on the market for the first time in generations, he said.

One such listing is Antlers Ranch in Meeteetse, Wyoming, which spans 40,000 acres — nearly three times the size of Manhattan — and is priced at $85 million. Antlers Ranch is on the market for the first time in five generations.

“Large historic properties are less common as many have been broken up and sold off,” Jenkins said. “Those that remain are highly desirable.”

These legacy ranches can demand a premium for reasons other than acreage, he said. Many historic ranches, like another one of his listings, Red Hills Ranch, a 190-acre property asking for $65 million, are surrounded by public lands that cannot be developed. Buyers are drawn to that privacy, as well as the ability to hike and fish nearby and see wildlife up close.

Red Hills Ranch, 25 miles outside Jackson WY, spans 190 acres and is listed for $65 million. Nestled in the Bridger-Teton National Forest, Red Hills Ranch was formerly the private guest ranch of late senator Herb Kohl.

Courtesy of Live Water Properties

“When you sit next to a running river, watching sunrises and sunsets, seeing an elk calf be born, there’s nothing quite like it,” Jenkins said.

Families usually come to him when the next generation has little interest in taking over the ranch or the heirs can’t come to an agreement. He described it as “bittersweet” when these one-of-a-kind properties become available for the first time in generations.

“That’s the thing with real estate. The land is perpetual, but the ownership is not,” he said.

Bill McDavid, a broker at Hall and Hall, represents Rocking Chair Ranch, a 7,200-acre Montana ranch that has been in the same family for more than seven decades.

“The adult children just got to the point where they realized, ‘No, it’s time for this family to move on and do something else,” he said of the sellers behind the property, which is listed at $21.7 million.

Generational transfer of wealth

As ranching has been on the decline for decades, many multigenerational ranches have already changed hands, according to McDavid, who is based in Missoula, Montana. However, he is also seeing a rise in families looking to sell ranches they bought 20 to 30 years ago. The owners typically don’t have family ties to ranching and decided to buy trophy properties after making their fortune in tech or finance.

“For the buyer who made their money in the dot-com era, they had a grand idea about a family legacy, or whatever,” he said. “And then their kids got older, and they didn’t move to the ranch because nobody ever moved to the ranch. I mean, the dot-com guy, he came out and visited for at most the summer.”

He added of the heirs, “it was never in the cards for them to take over the ranch.”

Davis said she hopes a local ranching family will buy her California property, which has abundant grazing pastures and water sources. However, she said its likely a buyer from Silicon Valley will snap up Reynolds Ranch, which is only an hour and a half drive from San Jose and can accommodate a landing strip for a private plane.

John Onderdonk, who advises on agricultural properties for wealth manager Northern Trust, said the generational transfer of wealth is shaping the market. He is also a fourth-generation cattle rancher and said he is fortunate that his brothers agree on keeping their central California ranch in the family. However, he said many of the families he works with that choose to sell do so because of finances rather than disinterest.

“Real estate is a capital-intensive asset class, and if there isn’t liquidity in the portfolio, and the rest of the family isn’t able to support that, tough decisions come into play,” he said.

Listed at $21.7 million, Rocking Chair Ranch is on the market for the first time in over seven decades. The Philipsburg, MT, ranch spans 7,200 acres.

Courtesy of Hall and Hall

Legacy ranches, which may come with livestock and cropland, are attractive but require much due diligence, according to Ken Mirr of Mirr Ranch Group. For instance, these ranches are usually run by long-tenured managers who might leave when the property is sold and are hard to replace, said the Denver, Colorado-based broker. Or, they stay and have a rough time adjusting to new ownership, Mirr added.

“Those managers who have been here a long time start thinking that they own the place, right?” he said. “Sometimes that’s not the best person to be managing the ranch.”

Buyers expecting complete privacy can get a rude awakening. For instance, Mirr said, the previous family could have a longstanding verbal agreement with a neighbor allowing them to cross through their property. Depending on the state, members of the public may also be fish or wade in rivers located on private property, he said.

McDavid said buyers with deep pockets can have unrealistic expectations, wanting a rural property without sacrificing convenience. For instance, many want to live within 30 minutes’ driving distance of a major airport. Buyers also prefer move-in-ready properties, and multigenerational ranches may lack modern amenities.

As for the sellers, they get a windfall but aren’t able to replicate the lifestyle that comes with a legacy ranch.

“It’s just kind of a unique thing when you’re sitting on your porch and you look around and you own everything as far as your eyes can see,” Davis said. “It’s extremely difficult, the concept of losing the place, but on the other hand it’s going to make the next family very happy.”

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

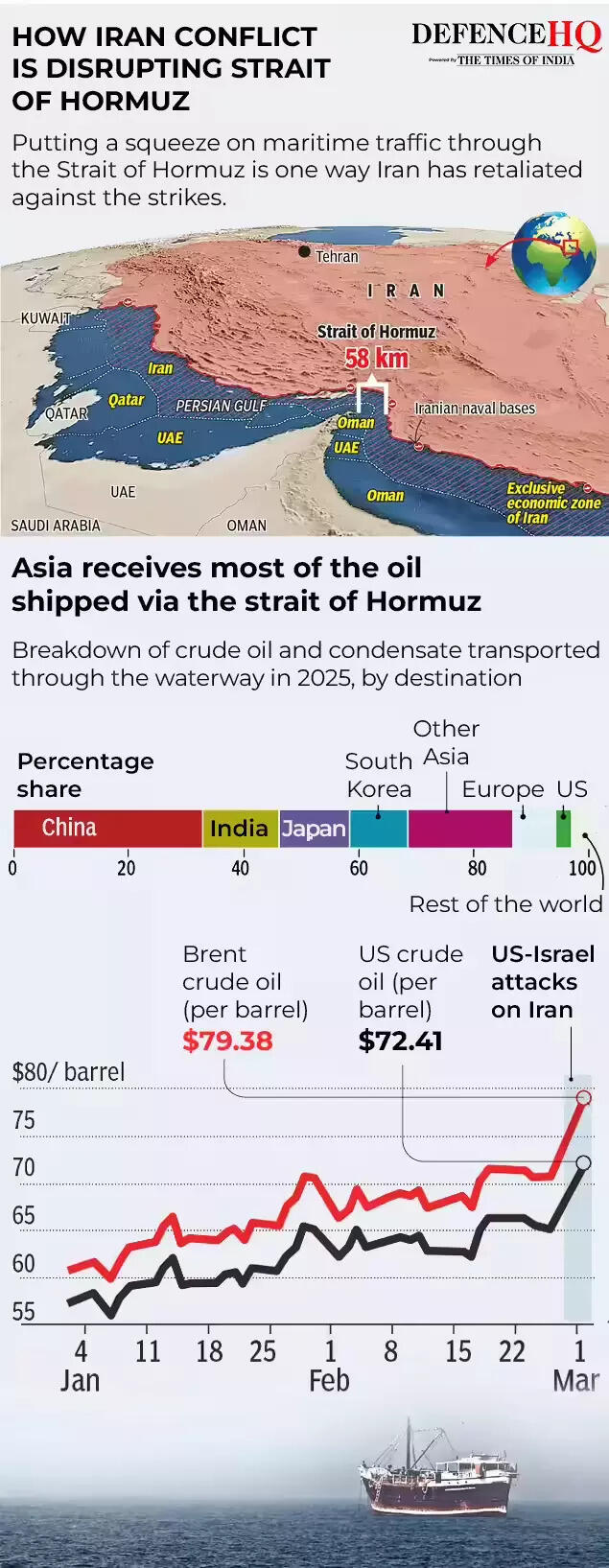

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition