Business

ITR Filing Deadline: Who Needs To File ITR By September 15? A Quick Guide For Non-Audit Taxpayers

Last Updated:

Income tax practitioners advise taxpayers to file now without any delay, and warns against last-minute ITR filings as portal slowdowns are common in the final hours of filing.

ITR Deadline 2025.

The clock is ticking for lakhs of taxpayers who are yet to file their income tax returns for Assessment Year 2025-26. The government had extended the original July 31 deadline for non-audit cases to September 15, 2025, but with just days left and no word on another extension, individuals should not bank on last-minute relief.

So, who exactly has to meet this September 15 deadline?

Salaried and Non-Audit Category Taxpayers

The extended deadline is meant for taxpayers who do not require a tax audit. This includes:

- Salaried individuals whose annual income exceeds the basic exemption limit — Rs 2.5 lakh for those below 60, Rs 3 lakh for senior citizens, and Rs 5 lakh for those above 80 under the old tax regime. However, in the new tax regime, the limit is Rs 3 lakh for all categories for FY 2024-25 (AY 2025-26).

- Freelancers and professionals with income below the audit threshold.

- Small traders and businesses that are not covered under Section 44AB of the Income Tax Act.

- Investors who earned capital gains from equities, mutual funds, property, or gold, but are not subject to audit.

- Resident taxpayers with foreign income or assets, who are required to file returns irrespective of income level.

ITR Filing 2025: Who Gets More Time?

Taxpayers whose books need to be audited — businesses with turnover above specified limits or professionals above the prescribed receipts — have until October 31, 2025.

ITR Filing 2025: What If You Miss The September 15 Deadline?

As the last date to file non-audit ITRs is September 15, a late fee will be charged after this deadline. A late filing fee of Rs 1,000 (on income up to Rs 5 lakh) or Rs 5,000 (income above Rs 5 lakh) applies under Section 234F. Delayed filing also attracts interest on tax due and denies taxpayers the option to carry forward certain losses, such as from capital markets or business.

ITR Filing 2025: Key Checks Before You Hit Submit Filing

Tax experts advise taxpayers to run through a quick checklist before hitting submit:

- Reconcile salary, interest and other income with the Annual Information Statement (AIS) and Form 26AS.

- Ensure capital gains are correctly reported.

- Disclose foreign assets and bank accounts, if any.

- Verify bank account details for refunds.

- Double-check deductions claimed under various sections.

Don’t Wait for the Last Day

Income tax practitioners also said that with portal slowdowns common in the final hours of filing, taxpayers should avoid last-minute filings and do it now. Early filing not only avoids late fees but also ensures faster processing of refunds, crucial for salaried individuals and small taxpayers relying on the money.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

September 05, 2025, 10:42 IST

Read More

Business

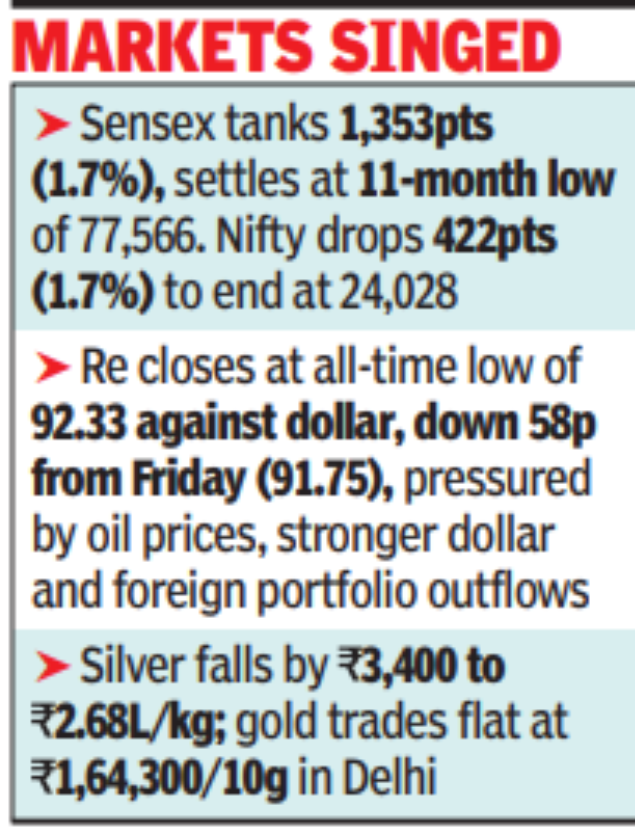

Middle East crisis: Oil tops $100, nears 4-year high as Saudis cut production – The Times of India

Oil prices surged to $120 a barrel before retreating to $102 Monday as Saudi Arabia was reported to be cutting output, adding to the supply squeeze due to disruption in the Strait of Hormuz.Finance ministers of developed G7 nations, who met Monday evening, deferred plans to tap their strategic reserves to cool down the global flare-up in prices, while vowing to keep close tabs on the evolving supply situation.Although Brent prices touched the highest level seen since mid-2022, govt officials said there was no immediate plan to increase pump prices of fuel in India. “We are nicely placed vis-a-vis crude. There is unlikely to be a rise in petrol and diesel prices in the foreseeable future, even if prices remain at $110-120 a barrel,” said a senior govt official.

Iran conflict sends Brent soaring 65% since Feb 28

The Indian basket was on the verge of hitting $100 a barrel after having reached $99.12 on Friday, almost 40% higher than the Feb 27 level of $71.19. Since Feb 28, when the US and Israel bombed Iran, global benchmark Brent has surged as much as 65%.The statement came amid reports that Saudi Aramco had begun reducing production from two of its fields, joining Iraq, Kuwait, Qatar and the UAE, as they ran out of storage due to blocked shipments.Govt officials, however, reiterated that India has sufficient stock of oil and gas to meet domestic requirements. They also sought to dispel rumours of a scarcity of fuel and dismissed reports of shortages anywhere in the country. Officials also maintained there are adequate stocks of aviation turbine fuel. “India is also a producer and exporter of ATF; there is no need to worry,” said one of them.The disruptions have prompted govts to initiate emergency action. For instance, Japan, which imports around 95% of its oil from West Asia, has instructed a national oil reserve storage site to prepare for a possible crude release, while China has asked refiners to halt fuel exports. South Korea has capped prices for the first time in 30 years, while Vietnam removed import tariffs on fuels. Bangladesh has shut universities to conserve electricity and fuel.Panic across markets prompted G7 finance ministers to consider releasing crude from strategic reserves, a step officials said was not being considered by India as it sought to secure its supply lines.India, world’s third-largest oil-importing and consuming nation, has 5.3 million tonnes of underground strategic reserves, which are at 80% of their capacity. “The crisis (that led to a rise in prices) is not our creation. Those responsible have to deal with it and create situations to ease (prices). Ours is an India first policy,” said a govt functionary.India is not a full member of IEA and does not have an obligation to follow the diktat of the international body, officials added.

Business

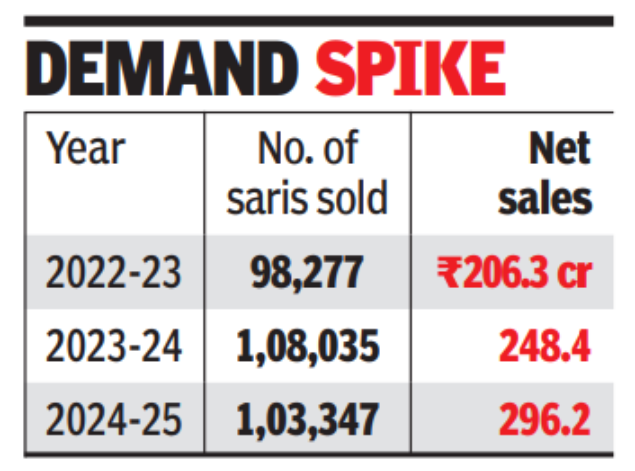

Karnataka suspends online sale of Mysore silk saris as orders surge – The Times of India

BENGALURU: Karnataka govt has suspended online sales of Mysore silk saris after surging orders outstripped supply of the GI-tagged weave made with pure mulberry silk, gold zari and silver threads. State-owned Karnataka Silk Industries Corporation will prioritise limited stocks for buyers visiting its exclusive outlets.Sericulture minister K Venkatesh made the announcement in the assembly on Monday, attributing the spike in demand to the high quality of the saris. He said online sales would resume once production stabilises.KSIC launched online sales to make the saris accessible to customers outside the state. It been producing the famed weave since 1912 and currently turns out 300–400 saris a day. Its collective output over the past three years stood at 3.1 lakh saris.

Venkatesh said the popularity of the saris was evident during special discount sales. “Since saris with defects remain unsold, we offer 25% to 50% discounts. During these special sales, people queue up from 3am,” he said.KSIC sources premium cocoons mostly from govt markets in Sidlaghatta, Ramanagara and Kollegal in the state. “There is huge competition in procuring high-quality cocoons from Maharashtra, Tamil Nadu and other states,” Venkatesh said, adding efforts were being made to secure quality supply.To meet growing demand, the govt has installed 30 e-jacquard looms, increasing production by about 7,500 metres a month. KSIC’s finances have also improved, with profit rising to Rs 101 crore in 2024-25 from Rs 73 crore in 2023-24 and Rs 46 crore in 2022-23.

Business

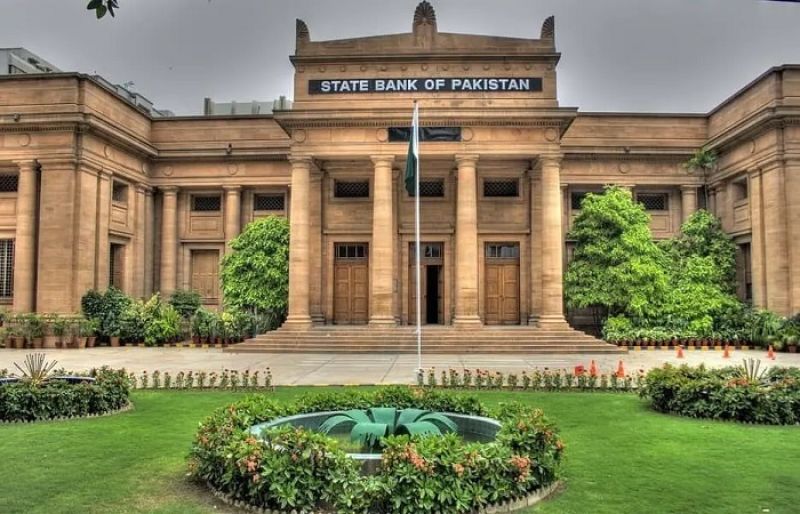

SBP maintains interest rate at 10.5% on inflation fears amid surging oil prices – SUCH TV

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) on Monday maintained its key interest rate at 10.5%, pausing its easing cycle as rising global energy prices and regional tensions pose new inflation risks for the import-dependent economy.

“The Monetary Policy Committee has decided to keep the policy rate unchanged at 10.5%,” the State Bank of Pakistan (SBP) said on its website, adding that a detailed statement would be released soon.

The SBP has cut the key rate by a cumulative 1,150 basis points since mid-2024, from a record 22% in 2023, as inflation cooled sharply from multi-decade highs.

In its policy statement, the SBP said that the MPC decided to keep the policy rate unchanged as it observed that the macroeconomic outlook has “become quite uncertain following [the] outbreak of the war in the Middle East”.

During the meeting, the MPC noted that “the conflict in the Middle East has led to a sharp increase in global fuel prices as well as freight and insurance costs, while also affecting cross-border trade and travel.”

“The MPC observed that the intensity and duration of the conflict will both be important determinants of the impact on the domestic economy.”

However, the committee noted that macroeconomic fundamentals, especially in terms of inflation, foreign exchange reserves, and fiscal buffers, were better compared to the time of the start of the Russia-Ukraine war in early 2022.

The MPC’s initial assessment of the evolving geopolitical situation indicated that the outlook for key macroeconomic variables for fiscal year 2026 was within the earlier projected ranges. However, risks for the macroeconomic outlook have increased significantly.

Meanwhile, on the domestic front, inflation rose to 5.8% in January and further to 7% in February 2026.

The current account recorded a surplus in January, which, amidst weak official inflows, led to continued interbank FX purchases by the SBP and the buildup in FX reserves to $16.3 billion as of February 27.

Large-scale manufacturing (LSM) grew by 0.4% year-on-year in December 2025, with cumulative growth reaching 4.8% in July-December FY26.

Additionally, consumers’ inflation expectations and confidence improved, while those of businesses remained broadly stable in February.

The Federal Board of Revenue (FBR) tax collection remained below target in both January and February, further widening the cumulative shortfall during July-February FY26.

“The Committee noted the high degree of uncertainty in the outlook for international commodity prices and supply-chain disruptions in the backdrop of the war in the Middle East. In this context, the MPC deemed today’s decision as appropriate, and reaffirmed its commitment to ensure the hard-earned price stability,” read the statement.

However, the MPC stressed the need for expediting structural reforms to ensure sustainable economic growth.

The committee noted that the headline inflation rose to 7% year-on-year in February, attributed to the phasing out of the low base effect from food and energy prices, along with the rationalisation of fixed charges on households’ electricity bills.

The MPC assessed that the impact of higher expected domestic energy prices is likely to be partially offset by recent favourable movement in food prices amidst improved supply of key items and better prospects of agriculture produce.

It is expected that inflation may remain above 7% in the remaining months of FY26 and into FY27.

-

Politics3 days ago

Politics3 days agoIndia let Iran warship dock the day US sank another off Sri Lanka, say officials

-

Sports3 days ago

Sports3 days agoPakistan set for FIH Pro League debut | The Express Tribune

-

Entertainment3 days ago

Entertainment3 days agoHarry Styles kicks off new era with ‘One Night Only’ comeback show

-

Business1 week ago

Business1 week agoLabour parliamentarians urge UK Government to oppose Rosebank oil field

-

Sports1 week ago

Sports1 week agoMichigan loses L.J. Cason for rest of season with torn ACL

-

Business3 days ago

Business3 days agoHome heating oil: ‘Most of my pension has gone on home heating oil’

-

Business3 days ago

Business3 days agoRestaurant group changes name after bid to buys pubs across the UK

-

Tech1 week ago

Tech1 week agoThe 5 Big ‘Known Unknowns’ of Donald Trump’s New War With Iran