Business

Trump sees a ‘dead economy’ – but US-based S&P Global upgrades India’s credit rating – here’s why – Times of India

S&P Global, the US-based credit ratings agency, has upgraded India’s rating to ‘BBB’ from ‘BBB-) citing several positive factors in favour of the world’s fifth largest economy. S&P’s confidence in India’s growth story comes at a time when US President Donald Trump has imposed a 50% tariff on Indian exports to America, and has even called India a ‘dead economy’. This is reportedly the first rating upgrade for India in almost 19 years.The credit rating of an economy reflects the country’s ability and willingness to repay debt. It is a crucial indicator of economic health, indicating the risk level for investors and lenders.

“The upgrade of India reflects its buoyant economic growth, against the backdrop of an enhanced monetary policy environment that anchors inflationary expectations. Together with the government’s commitment to fiscal consolidation and efforts to improve spending quality, we believe these factors have coalesced to benefit credit metrics,” S&P said.

Little impact of Trump’s tariffs on India

Not only has S&P upgraded India’s sovereign rating, it has also said that the impact of US tariffs is not likely to be extensive on India’s economy.“We believe the effect of US tariffs on the Indian economy will be manageable. India is relatively less reliant on trade and about 60% of its economic growth stems from domestic consumption,” S&P Global said.“We expect that in the event India has to switch from importing Russian crude oil, the fiscal cost, if fully borne by the government, will be modest given the narrow price differential between Russian crude and current international benchmarks,” it said.While the United States is India’s biggest trading ally, the potential imposition of 50% tariffs is not anticipated to significantly hinder economic growth. Exports from India to the US account for roughly 2% of the country’s GDP, S&P notes.Taking into account specific exemptions for sectors like pharmaceuticals and consumer electronics, the portion of Indian exports that would be affected by these tariffs decreases to 1.2% of GDP. Although this could lead to a temporary setback in growth, we predict that the overall effect will be minimal and will not disrupt India’s long-term economic trajectory, it added.Also Read | ’Secondary tariffs could go up…’: US official warns of higher sanctions on India if Trump’s talks with Putin fail; asks Europe to ‘put up or shut up’After Trump’s move to impose high tariffs on India, several global institutions and experts have predicted that India’s GDP growth may take an up to 0.3% hit due to US trade moves.

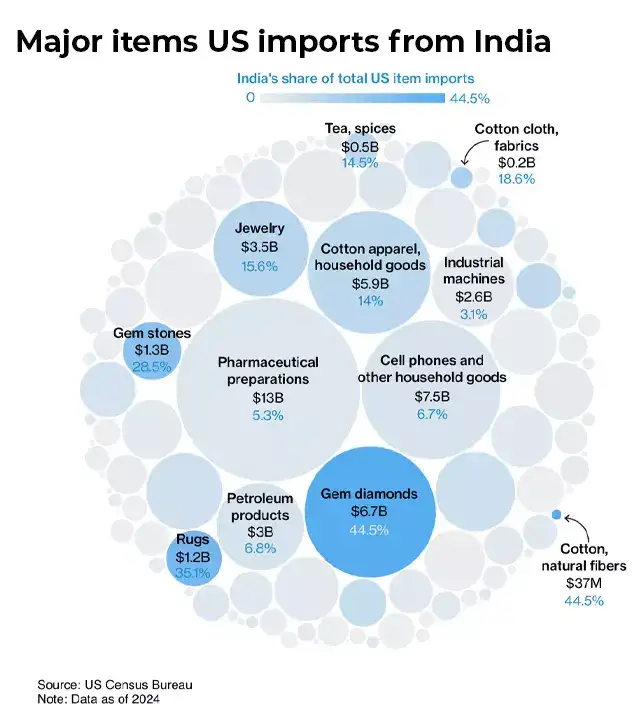

Major items US imports from India

Why did S&P upgrade India’s credit rating?

- India continues to be one of the top-performing economies globally. It has made a significant recovery from the pandemic, with real GDP growth from fiscal year 2022 (ending March 31) to fiscal year 2024 averaging 8.8%, the highest in the Asia-Pacific region.

- The Indian economy’s overall size is now believed to be approximately 80% bigger in rupee terms compared to its pre-COVID state, and nearly 50% larger when measured in dollars. However, the pace of economic growth is stabilizing towards a more sustainable rate, maintaining strong momentum.

- S&P anticipates that this growth trend will persist in the medium term, with GDP projected to rise by 6.8% annually over the next three years. This growth helps to moderate the government debt-to-GDP ratio, despite the presence of substantial fiscal deficits.

- The recent performance of India’s economy underscores its enduring strength. S&P’s forecasts for robust growth, despite external challenges, are based on the country’s positive structural developments. These include favorable demographics and competitive labor costs.

- India’s corporate and financial sectors have improved their balance sheets compared to the pre-pandemic period. Nonetheless, S&P acknowledges that maintaining high growth rates over an extended period is essential for the economy to generate enough jobs, lessen inequality, and fully capitalize on its demographic advantages.

- India’s fiscal weaknesses have historically been the most fragile aspect of its sovereign credit ratings. However, with the economy now on a solid recovery path, the government is able to outline a clearer, though gradual, strategy for fiscal consolidation. S&P forecasts suggest that the general government deficit, which is 7.3% of GDP in fiscal year 2026, will decrease to 6.6% by fiscal year 2029.

- Over the past five to six years, the quality of government expenditure has seen improvement, says S&P. The current government has increasingly prioritized infrastructure in its budget allocations. The union government’s capital expenditure is projected to rise to 11.2 trillion Indian rupees, or approximately 3.1% of GDP, by fiscal year 2026, up from 2% of GDP a decade ago.

- When including capital spending by state governments, total public investment in infrastructure is expected to be around 5.5% of GDP, which is comparable to or exceeds that of similar sovereign entities. S&P anticipate that enhancements in infrastructure and connectivity in India will eliminate bottlenecks that currently impede long-term economic growth.

- The shift in monetary policy towards inflation targeting has proven beneficial. Inflation expectations are now more stable compared to ten years ago. From 2008 to 2014, India frequently experienced inflation rates in the double digits. However, over the last three years, despite fluctuations in global energy prices and supply disruptions, the Consumer Price Index (CPI) has grown at an average rate of 5.5%. Recently, it has remained at the lower end of the Reserve Bank of India’s (RBI) target range of 2%-6%. These changes, along with a robust domestic capital market, indicate a more stable and conducive environment for monetary policy, says S&P.

- India’s sovereign ratings are supported by a vibrant and rapidly expanding economy, a strong external balance sheet, and democratic institutions that ensure policy consistency. These positive aspects are offset by the government’s poor fiscal performance, high debt levels, and low GDP per capita.

Indian Economy: The road ahead

“The Indian general elections resulted in a third consecutive term for Prime Minister Narendra Modi after his Bhartiya Janata Party (BJP) won the largest number of seats but fell short of an absolute majority. The subsequent formation of a coalition government is a first for the BJP, which has ruled independently in its previous two terms,”S&P said.“But the BJP retains a healthy majority in the Lok Sabha, India’s lower house of parliament. This supports the government’s efforts to implement economic reforms. Since the beginning of economic liberalization in 1991, India has had consistently high GDP growth while governed by different political parties and coalitions–reflecting a consensus on key economic policies,” it adds.Also Read | ‘Can’t cross some red lines’: Government officials tell Parliamentary Panel on India-US trade talks; focus on export diversification amidst Trump tariffs“In our view, the success of the government in funding large infrastructure investment without substantially widening the country’s current account deficit will be important. If India can shrink the fiscal deficit significantly while achieving these objectives, rating support will strengthen over time,” it says.According to S&P Global, its stable outlook indicates the belief that India’s long-term growth prospects will be bolstered by consistent policy stability and significant infrastructure investments. This, coupled with prudent fiscal and monetary policies that help manage the government’s high debt and interest obligations, will support the rating over the next two years.S&P said that it may upgrade the ratings if fiscal deficits significantly decrease, leading to a structural reduction in the net change of general government debt to below 6% of GDP. Sustained increases in public infrastructure investment would enhance economic growth, and when combined with fiscal reforms, could strengthen India’s weak public finances.However, S&P said it might consider lowering the ratings if it sees a decline in political commitment to improving public finances. Additionally, if India’s economic growth significantly slows down in a way that threatens fiscal sustainability, it could also exert downward pressure.

Business

Key Financial Deadlines That Have Been Extended For December 2025; Know The Last Date

New Delhi: Several crucial deadlines have been extended in December 2025, including ITR for tax audit cases, ITR filing and PAN and Aadhaar linking. These deadlines will be crucial in ensuring that your financial affairs operate smoothly in the months ahead.

Here is a quick rundown of the important deadlines for December to help you stay compliant and avoid last-minute hassles.

ITR deadline for tax audit cases

The Central Board of Direct Taxes has extended the due date of furnishing of return of income under sub-Section (1) of Section 139 of the Act for the Assessment Year 2025-26 which is October 31, 2025 in the case of assessees referred in clause (a) of Explanation 2 to sub-Section (1) of Section 139 of the Act, to December 10, 2025.

Belated ITR filing deadline

A belated ITR filing happens when an ITR is submitted after the original due date which is permitted by Section 139(4) of the Income Tax Act. Filing a belated return helps you meet your tax obligations, but it involves penalties. You can only file a belated return for FY 2024–25 until December 31, 2025. However, there will be a late fee and interest charged.

PAN and Aadhaar linking deadline

The Income Tax Department has extended the deadline to link their PAN with Aadhaar card to December 31, 2025 for anyone who acquired their PAN using an Aadhaar enrolment ID before October 1, 2024. If you miss this deadline your PAN will become inoperative which will have an impact on your banking transactions, income tax return filing and other financial investments.

Business

Stock Market Live Updates: Sensex, Nifty Hit Record Highs; Bank Nifty Climbs 60,000 For The First Time

Stock Market News Live Updates: Indian equity benchmarks opened with a strong gap-up on Monday, December 1, touching fresh record highs, buoyed by a sharp acceleration in Q2FY26 GDP growth to a six-quarter peak of 8.2%. Positive cues from Asian markets further lifted investor sentiment.

The BSE Sensex was trading at 85,994, up 288 points or 0.34%, after touching an all-time high of 86,159 in early deals. The Nifty 50 stood at 26,290, higher by 87 points or 0.33%, after scaling a record intraday high of 26,325.8.

Broader markets also saw gains, with the Midcap index rising 0.27% and the Smallcap index advancing 0.52%.

On the sectoral front, the Nifty Bank hit a historic milestone by crossing the 60,000 mark for the first time, gaining 0.4% to touch a fresh peak of 60,114.05.

Meanwhile, the Metal and PSU Bank indices climbed 0.8% each in early trade.

Global cues

Asia-Pacific markets were mostly lower on Monday as traders assessed fresh Chinese manufacturing data and increasingly priced in the likelihood of a US Federal Reserve rate cut later this month.

According to the CME FedWatch Tool, markets are now assigning an 87.4 per cent probability to a rate cut at the Fed’s December 10 meeting.

China’s factory activity unexpectedly slipped back into contraction in November, with the RatingDog China General Manufacturing PMI by S&P Global easing to 49.9, below expectations of 50.5, as weak domestic demand persisted.

Japan’s Nikkei 225 slipped 1.6 per cent, while the broader Topix declined 0.86 per cent. In South Korea, the Kospi dropped 0.30 per cent and Australia’s S&P/ASX 200 was down 0.31 per cent.

US stock futures were steady in early Asian trade after a positive week on Wall Street. On Friday, in a shortened post-Thanksgiving session, the Nasdaq Composite climbed 0.65 per cent to 23,365.69, its fifth consecutive day of gains.

The S&P 500 rose 0.54 per cent to 6,849.09, while the Dow Jones Industrial Average added 289.30 points, or 0.61 per cent, to close at 47,716.42.

Business

South Korea: Online retail giant Coupang hit by massive data leak

Osmond ChiaBusiness reporter

Getty Images

Getty ImagesSouth Korea’s largest online retailer, Coupang, has apologised for a massive data breach potentially involving nearly 34 million local customer accounts.

The country’s internet authority said that it is investigating the breach and that details from the millions of accounts have likely been exposed.

Coupang is often described as South Korea’s equivalent of Amazon.com. The breach marks the latest in a series of data leaks at major firms in the country, including its telecommunications giant, SK Telecom.

Coupang told the BBC it became aware of the unauthorised access of personal data of about 4,500 customer accounts on 18 November and immediately reported it to the authorities.

But later checks found that some 33.7 million customer accounts – all in South Korea – were likely exposed, said Coupang, adding that the breach is believed to have begun as early as June through a server based overseas.

The exposed data is limited to name, email address, phone number, shipping address and some order histories, Coupang said.

No credit card information or login credentials were leaked. Those details remain securely protected and no action is required from Coupang users at this point, the firm added.

The number of accounts affected by the incident represents more than half of South Korea’s roughly-52 million population.

Coupang, which is founded in South Korea and headquartered in the US, said recently that it had nearly 25 million active users.

Coupang apologised to its customers and warned them to stay alert to scams impersonating the company.

The firm did not give details on who is behind the breach.

South Korean media outlets reported on Sunday that a former Coupang employee from China was suspected of being behind the breach.

The authorities are assessing the scale of the breach as well as whether Coupang had broken any data protection safety rules, South Korea’s Ministry of Science and ICT said in a statement.

“As the breach involves the contact details and addresses of a large number of citizens, the Commission plans to conduct a swift investigation and impose strict sanctions if it finds a violation of the duty to implement safety measures under the Protection Act.”

The incident marks the latest in a series of breaches affecting major South Korean companies this year, despite the country’s reputation for stringent data privacy rules.

SK Telecom, South Korea’s largest mobile operator, was fined nearly $100m (£76m) over a data breach involving more than 20 million subscribers.

In September, Lotte Cards also said the data of nearly three million customers was leaked after a cyber-attack on the credit card firm.

-

Sports1 week ago

Sports1 week agoWATCH: Ronaldo scores spectacular bicycle kick

-

Entertainment1 week ago

Entertainment1 week agoWelcome to Derry’ episode 5 delivers shocking twist

-

Politics1 week ago

Politics1 week agoWashington and Kyiv Stress Any Peace Deal Must Fully Respect Ukraine’s Sovereignty

-

Business1 week ago

Business1 week agoKey economic data and trends that will shape Rachel Reeves’ Budget

-

Tech6 days ago

Tech6 days agoWake Up—the Best Black Friday Mattress Sales Are Here

-

Fashion7 days ago

Fashion7 days agoCanada’s Lululemon unveils team Canada kit for Milano Cortina 2026

-

Tech6 days ago

Tech6 days agoThe Alienware Aurora Gaming Desktop Punches Above Its Weight

-

Politics1 week ago

Politics1 week ago53,000 Sikhs vote in Ottawa Khalistan Referendum amid Carney-Modi trade talks scrutiny