Business

Trump sees a ‘dead economy’ – but US-based S&P Global upgrades India’s credit rating – here’s why – Times of India

S&P Global, the US-based credit ratings agency, has upgraded India’s rating to ‘BBB’ from ‘BBB-) citing several positive factors in favour of the world’s fifth largest economy. S&P’s confidence in India’s growth story comes at a time when US President Donald Trump has imposed a 50% tariff on Indian exports to America, and has even called India a ‘dead economy’. This is reportedly the first rating upgrade for India in almost 19 years.The credit rating of an economy reflects the country’s ability and willingness to repay debt. It is a crucial indicator of economic health, indicating the risk level for investors and lenders.

“The upgrade of India reflects its buoyant economic growth, against the backdrop of an enhanced monetary policy environment that anchors inflationary expectations. Together with the government’s commitment to fiscal consolidation and efforts to improve spending quality, we believe these factors have coalesced to benefit credit metrics,” S&P said.

Little impact of Trump’s tariffs on India

Not only has S&P upgraded India’s sovereign rating, it has also said that the impact of US tariffs is not likely to be extensive on India’s economy.“We believe the effect of US tariffs on the Indian economy will be manageable. India is relatively less reliant on trade and about 60% of its economic growth stems from domestic consumption,” S&P Global said.“We expect that in the event India has to switch from importing Russian crude oil, the fiscal cost, if fully borne by the government, will be modest given the narrow price differential between Russian crude and current international benchmarks,” it said.While the United States is India’s biggest trading ally, the potential imposition of 50% tariffs is not anticipated to significantly hinder economic growth. Exports from India to the US account for roughly 2% of the country’s GDP, S&P notes.Taking into account specific exemptions for sectors like pharmaceuticals and consumer electronics, the portion of Indian exports that would be affected by these tariffs decreases to 1.2% of GDP. Although this could lead to a temporary setback in growth, we predict that the overall effect will be minimal and will not disrupt India’s long-term economic trajectory, it added.Also Read | ’Secondary tariffs could go up…’: US official warns of higher sanctions on India if Trump’s talks with Putin fail; asks Europe to ‘put up or shut up’After Trump’s move to impose high tariffs on India, several global institutions and experts have predicted that India’s GDP growth may take an up to 0.3% hit due to US trade moves.

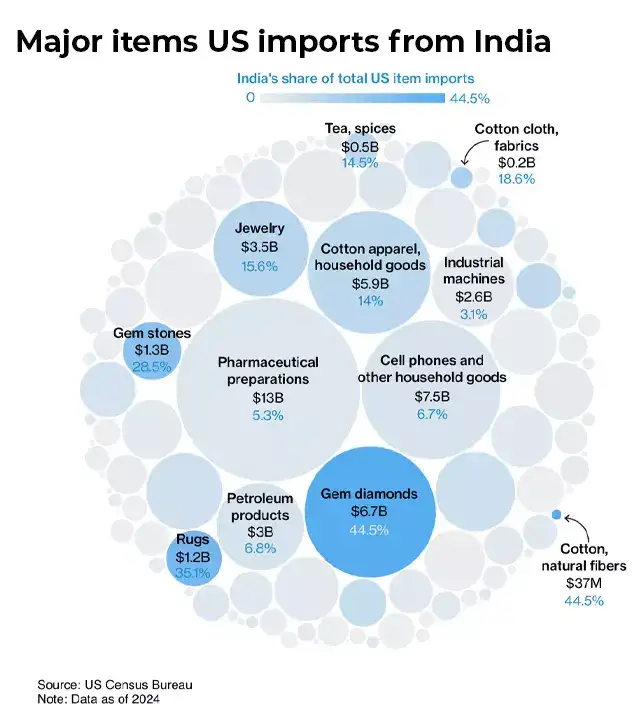

Major items US imports from India

Why did S&P upgrade India’s credit rating?

- India continues to be one of the top-performing economies globally. It has made a significant recovery from the pandemic, with real GDP growth from fiscal year 2022 (ending March 31) to fiscal year 2024 averaging 8.8%, the highest in the Asia-Pacific region.

- The Indian economy’s overall size is now believed to be approximately 80% bigger in rupee terms compared to its pre-COVID state, and nearly 50% larger when measured in dollars. However, the pace of economic growth is stabilizing towards a more sustainable rate, maintaining strong momentum.

- S&P anticipates that this growth trend will persist in the medium term, with GDP projected to rise by 6.8% annually over the next three years. This growth helps to moderate the government debt-to-GDP ratio, despite the presence of substantial fiscal deficits.

- The recent performance of India’s economy underscores its enduring strength. S&P’s forecasts for robust growth, despite external challenges, are based on the country’s positive structural developments. These include favorable demographics and competitive labor costs.

- India’s corporate and financial sectors have improved their balance sheets compared to the pre-pandemic period. Nonetheless, S&P acknowledges that maintaining high growth rates over an extended period is essential for the economy to generate enough jobs, lessen inequality, and fully capitalize on its demographic advantages.

- India’s fiscal weaknesses have historically been the most fragile aspect of its sovereign credit ratings. However, with the economy now on a solid recovery path, the government is able to outline a clearer, though gradual, strategy for fiscal consolidation. S&P forecasts suggest that the general government deficit, which is 7.3% of GDP in fiscal year 2026, will decrease to 6.6% by fiscal year 2029.

- Over the past five to six years, the quality of government expenditure has seen improvement, says S&P. The current government has increasingly prioritized infrastructure in its budget allocations. The union government’s capital expenditure is projected to rise to 11.2 trillion Indian rupees, or approximately 3.1% of GDP, by fiscal year 2026, up from 2% of GDP a decade ago.

- When including capital spending by state governments, total public investment in infrastructure is expected to be around 5.5% of GDP, which is comparable to or exceeds that of similar sovereign entities. S&P anticipate that enhancements in infrastructure and connectivity in India will eliminate bottlenecks that currently impede long-term economic growth.

- The shift in monetary policy towards inflation targeting has proven beneficial. Inflation expectations are now more stable compared to ten years ago. From 2008 to 2014, India frequently experienced inflation rates in the double digits. However, over the last three years, despite fluctuations in global energy prices and supply disruptions, the Consumer Price Index (CPI) has grown at an average rate of 5.5%. Recently, it has remained at the lower end of the Reserve Bank of India’s (RBI) target range of 2%-6%. These changes, along with a robust domestic capital market, indicate a more stable and conducive environment for monetary policy, says S&P.

- India’s sovereign ratings are supported by a vibrant and rapidly expanding economy, a strong external balance sheet, and democratic institutions that ensure policy consistency. These positive aspects are offset by the government’s poor fiscal performance, high debt levels, and low GDP per capita.

Indian Economy: The road ahead

“The Indian general elections resulted in a third consecutive term for Prime Minister Narendra Modi after his Bhartiya Janata Party (BJP) won the largest number of seats but fell short of an absolute majority. The subsequent formation of a coalition government is a first for the BJP, which has ruled independently in its previous two terms,”S&P said.“But the BJP retains a healthy majority in the Lok Sabha, India’s lower house of parliament. This supports the government’s efforts to implement economic reforms. Since the beginning of economic liberalization in 1991, India has had consistently high GDP growth while governed by different political parties and coalitions–reflecting a consensus on key economic policies,” it adds.Also Read | ‘Can’t cross some red lines’: Government officials tell Parliamentary Panel on India-US trade talks; focus on export diversification amidst Trump tariffs“In our view, the success of the government in funding large infrastructure investment without substantially widening the country’s current account deficit will be important. If India can shrink the fiscal deficit significantly while achieving these objectives, rating support will strengthen over time,” it says.According to S&P Global, its stable outlook indicates the belief that India’s long-term growth prospects will be bolstered by consistent policy stability and significant infrastructure investments. This, coupled with prudent fiscal and monetary policies that help manage the government’s high debt and interest obligations, will support the rating over the next two years.S&P said that it may upgrade the ratings if fiscal deficits significantly decrease, leading to a structural reduction in the net change of general government debt to below 6% of GDP. Sustained increases in public infrastructure investment would enhance economic growth, and when combined with fiscal reforms, could strengthen India’s weak public finances.However, S&P said it might consider lowering the ratings if it sees a decline in political commitment to improving public finances. Additionally, if India’s economic growth significantly slows down in a way that threatens fiscal sustainability, it could also exert downward pressure.

Business

South Korea: Online retail giant Coupang hit by massive data leak

Osmond ChiaBusiness reporter

Getty Images

Getty ImagesSouth Korea’s largest online retailer, Coupang, has apologised for a massive data breach potentially involving nearly 34 million local customer accounts.

The country’s internet authority said that it is investigating the breach and that details from the millions of accounts have likely been exposed.

Coupang is often described as South Korea’s equivalent of Amazon.com. The breach marks the latest in a series of data leaks at major firms in the country, including its telecommunications giant, SK Telecom.

Coupang told the BBC it became aware of the unauthorised access of personal data of about 4,500 customer accounts on 18 November and immediately reported it to the authorities.

But later checks found that some 33.7 million customer accounts – all in South Korea – were likely exposed, said Coupang, adding that the breach is believed to have begun as early as June through a server based overseas.

The exposed data is limited to name, email address, phone number, shipping address and some order histories, Coupang said.

No credit card information or login credentials were leaked. Those details remain securely protected and no action is required from Coupang users at this point, the firm added.

The number of accounts affected by the incident represents more than half of South Korea’s roughly-52 million population.

Coupang, which is founded in South Korea and headquartered in the US, said recently that it had nearly 25 million active users.

Coupang apologised to its customers and warned them to stay alert to scams impersonating the company.

The firm did not give details on who is behind the breach.

South Korean media outlets reported on Sunday that a former Coupang employee from China was suspected of being behind the breach.

The authorities are assessing the scale of the breach as well as whether Coupang had broken any data protection safety rules, South Korea’s Ministry of Science and ICT said in a statement.

“As the breach involves the contact details and addresses of a large number of citizens, the Commission plans to conduct a swift investigation and impose strict sanctions if it finds a violation of the duty to implement safety measures under the Protection Act.”

The incident marks the latest in a series of breaches affecting major South Korean companies this year, despite the country’s reputation for stringent data privacy rules.

SK Telecom, South Korea’s largest mobile operator, was fined nearly $100m (£76m) over a data breach involving more than 20 million subscribers.

In September, Lotte Cards also said the data of nearly three million customers was leaked after a cyber-attack on the credit card firm.

Business

Pakistan’s crisis differs from world | The Express Tribune

1729471601-0/image-(8)1729471601-0-640x480.webp)

Multiple elite clusters capture system as each extracts benefits in different ways

Pakistan’s ruling elite reinforces a blind nationalism, promoting the belief that the country does not need to learn from developed or emerging economies, as this serves their interests. PHOTO: FILE

KARACHI:

Elite capture is hardly a unique Pakistani phenomenon. Across developing economies – from Latin America to Sub-Saharan Africa and parts of South Asia – political and economic systems are often influenced, shaped, or quietly commandeered by narrow interest groups.

However, the latest IMF analysis of Pakistan’s political economy highlights a deeper, more entrenched strain of elite capture; one that is broader in composition, more durable in structure, and more corrosive in its fiscal consequences than what is commonly observed elsewhere. This difference matters because it shapes why repeated reform cycles have failed, why tax bases remain narrow, and why the state repeatedly slips back into crisis despite bailouts, stabilisation efforts, and policy resets.

Globally, elite capture typically operates through predictable channels: regulatory manipulation, favourable credit allocation, public-sector appointments, or preferential access to state contracts. In most emerging economies, these practices tend to be dominated by one or two elite blocs; often oligarchic business families or entrenched political networks.

In contrast, Pakistan’s system is not captured by a single group but by multiple competing elite clusters – military, political dynasties, large landholders, protected industrial lobbies, and urban commercial networks; each extracting benefits in different forms. Instead of acting as a unified oligarchic class, these groups engage in a form of competitive extraction, amplifying inefficiencies and leaving the state structurally weak.

The IMF’s identification of this fragmentation is crucial. Unlike countries where the dominant elite at least maintains a degree of policy coherence, such as Vietnam’s party-led model or Turkiye’s centralised political-business nexus, Pakistan’s fragmentation results in incoherent, stop-start economic governance, with every reform initiative caught in the crossfire of competing privileges.

For example, tax exemptions continue to favour both agricultural landholders and protected sectors despite broad consensus on the inefficiencies they generate. Meanwhile, state-owned enterprises continue to drain the budget due to overlapping political and bureaucratic interests that resist restructuring. These dynamics create a fiscal environment where adjustment becomes politically costly and therefore systematically delayed.

Another distinguishing characteristic is the fiscal footprint of elite capture in Pakistan. While elite influence is global, its measurable impact on Pakistan’s budget is unusually pronounced. Regressive tax structures, preferential energy tariffs, subsidised credit lines for favoured industries, and the persistent shielding of large informal commercial segments combine to erode the state’s revenue base.

The result is dependency on external financing and an inability to build buffers. Where other developing economies have expanded domestic taxation after crises, like Indonesia after the Asian financial crisis, Pakistan’s tax-to-GDP ratio has stagnated or deteriorated, repeatedly offset by politically negotiated exemptions.

Moreover, unlike countries where elite capture operates primarily through economic levers, Pakistan’s structure is intensely politico-establishment in design. This tri-layer configuration creates an institutional rigidity that is difficult to unwind. The civil-military imbalance limits parliamentary oversight of fiscal decisions, political fragmentation obstructs legislative reform, and bureaucratic inertia prevents implementation, even when policies are designed effectively.

In many ways, Pakistan’s challenge is not just elite capture; it is elite entanglement, where power is diffused, yet collectively resistant to change. Given these distinctions, the solutions cannot simply mimic generic reform templates applied in other developing economies. Pakistan requires a sequenced, politically aware reform agenda that aligns incentives rather than assuming an unrealistic national consensus.

First, broadening the tax base must be anchored in institutional credibility rather than coercion. The state has historically attempted forced compliance but has not invested in digitalisation, transparent tax administration, and trusted grievance mechanisms. Countries like Rwanda and Georgia demonstrate that tax reforms succeed only when the system is depersonalised and automated. Pakistan’s current reforms must similarly prioritise structural modernisation over episodic revenue drives.

Second, rationalising subsidies and preferential tariffs requires a political bargain that recognises the diversity of elite interests. Phasing out energy subsidies for specific sectors should be accompanied by productivity-linked support, time-bound transition windows, and export-competitiveness incentives. This shifts the debate from entitlement to performance, making reform politically feasible.

Third, Pakistan must reduce its SOE burden through a dual-track programme: commercial restructuring where feasible and privatisation or liquidation where not. Many countries, including Brazil and Malaysia, have stabilised finances by ring-fencing SOE losses. Pakistan needs a professional, autonomous holding company structure like Singapore’s Temasek to depoliticise SOE governance.

Fourth, politico-establishment reform is essential but must be approached through institutional incentives rather than confrontation. The creation of unified economic decision-making forums with transparent minutes, parliamentary reporting, and performance audits can gradually rebalance power. The goal is not confrontation, but alignment of national economic priorities with institutional roles.

Finally, political stability is the foundational prerequisite. Long-term reform cannot coexist with cyclical political resets. Countries that broke elite capture, such as South Korea in the 1960s or Indonesia in the 2000s, did so through sustained, multi-year policy continuity.

What differentiates Pakistan is not the existence of elite capture but its multi-polar, deeply institutionalised, fiscally destructive form. Yet this does not make reform impossible. It simply means the solutions must reflect the structural specificity of Pakistan’s governance. Undoing entrenched capture requires neither revolutionary rhetoric nor unrealistic expectations but a deliberate recalibration of incentives, institutions, and political alignments. Only through such a pragmatic approach can Pakistan shift from chronic crisis management to genuine economic renewal.

The writer is a financial market enthusiast and is associated with Pakistan’s stocks, commodities and emerging technology

Business

India’s $5 Trillion Economy Push Explained: Why Modi Govt Wants To Merge 12 Banks Into 4 Mega ‘World-Class’ Lending Giants

India’s Public Sector Banks Merger: The Centre is mulling over consolidating public-sector banks, and officials involved in the process say the long-term plan could eventually bring down the number of state-owned lenders from 12 to possibly just 4. The goal is to build a banking system that is large enough in scale, has deeper capital strength and is prepared to meet the credit needs of a fast-growing economy.

The minister explained that bigger banks are better equipped to support large-scale lending and long-term projects. “The country’s economy is moving rapidly toward the $5 trillion mark. The government is active in building bigger banks that can meet rising requirements,” she said.

Why India Wants Larger Banks

Sitharaman recently confirmed that the government and the Reserve Bank of India have already begun detailed conversations on another round of mergers. She said the focus is on creating “world-class” banks that can support India’s expanding industries, rising infrastructure investments and overall credit demand.

She clarified that this is not only about merging institutions. The government and RBI are working on strengthening the entire banking ecosystem so that banks grow naturally and operate in a stable environment.

According to her, the core aim is to build stronger, more efficient and globally competitive banks that can help sustain India’s growth momentum.

At present, the country has a total of 12 public sector banks: the State Bank of India (SBI), the Punjab National Bank (PNB), the Bank of Baroda, the Canara Bank, the Union Bank of India, the Bank of India, the Indian Bank, the Central Bank of India, the Indian Overseas Bank (IOB) and the UCO Bank.

What Happens To Employees After Merger?

Whenever bank mergers are discussed, employees become anxious. A merger does not only combine balance sheets; it also brings together different work cultures, internal systems and employee expectations.

In the 1990s and early 2000s, several mergers caused discomfort among staff, including dissatisfaction over new roles, delayed promotions and uncertainty about reporting structures. Some officers who were promoted before mergers found their seniority diluted afterward, which created further frustration.

The finance minister addressed the concerns, saying that the government and the RBI are working together on the merger plan. She stressed that earlier rounds of consolidation had been successful. She added that the country now needs large, global-quality banks “where every customer issue can be resolved”. The focus, she said, is firmly on building world-class institutions.

‘No Layoffs, No Branch Closures’

She made one point unambiguous: no employee will lose their job due to the upcoming merger phase. She said that mergers are part of a natural process of strengthening banks, and this will not affect job security.

She also assured that no branches will be closed and no bank will be shut down as part of the consolidation exercise.

India last carried out a major consolidation drive in 2019-20, reducing the number of public-sector banks from 21 to 12. That round improved the financial health of many lenders.

With the government preparing for the next phase, the goal is clear. India wants large and reliable banks that can support a rapidly growing economy and meet the needs of a country expanding faster than ever.

-

Sports7 days ago

Sports7 days agoWATCH: Ronaldo scores spectacular bicycle kick

-

Entertainment7 days ago

Entertainment7 days agoWelcome to Derry’ episode 5 delivers shocking twist

-

Politics7 days ago

Politics7 days agoWashington and Kyiv Stress Any Peace Deal Must Fully Respect Ukraine’s Sovereignty

-

Business1 week ago

Business1 week agoKey economic data and trends that will shape Rachel Reeves’ Budget

-

Tech5 days ago

Tech5 days agoWake Up—the Best Black Friday Mattress Sales Are Here

-

Fashion7 days ago

Fashion7 days agoCanada’s Lululemon unveils team Canada kit for Milano Cortina 2026

-

Politics1 week ago

Politics1 week ago53,000 Sikhs vote in Ottawa Khalistan Referendum amid Carney-Modi trade talks scrutiny

-

Tech5 days ago

Tech5 days agoThe Alienware Aurora Gaming Desktop Punches Above Its Weight