Business

Blue badge holders should not pay airport drop-off fees, charity says

Business reporter, BBC News

Getty Images

Getty ImagesAll UK airports should stop charging blue badge holders for being dropped off close to terminals, a disability charity has said.

Several people with blue badges got in touch with the BBC following news that more than half of the busiest airports had raised the so-called “kiss-and-fly” fees to as high as £7 in some cases.

Many airports already offer discounts or waive the fee for disabled drivers, but blue badge holders say the system is complex and inconsistent.

Graham Footer, chief executive of Disabled Motoring UK, said some airports have “allowed greed to cloud their judgement”, and argues people with disabilities should not have to pay the charge at all.

“Disabled customers deserve to be treated with respect and dignity and not fleeced as soon as they arrive,” he said.

Free drop offs

The BBC contacted the 20 busiest airports in the UK to confirm their policy on drop-off charges for blue badge holders.

London City does not charge drop-off fees for any kind of passenger.

Gatwick, Birmingham, Edinburgh, Heathrow, Liverpool John Lennon and Manchester all charge a drop-off fee, but blue badge holders do not have to pay it.

Luton, Glasgow, Belfast International, Belfast City, East Midlands, Aberdeen, and Southampton all charge blue badge holders the same as other passengers for using the drop-off spaces closest to the airport. But they also all offer separate free drop-off parking specifically for blue badge holders elsewhere.

For Glasgow and Aberdeen, this parking is only free if blue badge holders are being dropped off by family or friends – not if they are dropped off by taxi.

All airports offer free drop-off options further from the terminals for all passengers – not just blue badge holders – such as “park and ride” facilities where people can leave their car and take a bus to the airport.

Bristol, Leeds Bradford, and Bournemouth all charge blue badge holders for drop off but allow them to stay for longer than other passengers at a lower fee.

Bristol charges £7 for 40 minutes, Leeds Bradford charges £7 for 60 minutes, and Bournemouth charges £5 for four hours because it said disabled passengers “may require more time”.

Only Cardiff, Newcastle, and Stansted charge the same fee with no discount at all.

Cardiff charges £3 for 10 minutes, Newcastle charges £5 for 10 minutes, and Stansted charges £7 for 15 minutes.

Airports UK, which represents the industry, said that the best accessible drop-off for blue badge holders depends on the layout of the airport.

“No one option is ideal at all airports, so to optimise access at each airport the offer will necessarily be different,” it said.

It advised passengers to check the airport’s website before travelling to identify the best drop-off location.

‘You have to jump through hoops’

Most of the airports that waive drop-off fees do so if a disabled driver shows their blue badge at the airport on the day.

However, for Heathrow and Liverpool, the exemption needs to be claimed online or on the phone either before or after travelling. Heathrow says its online process for confirming blue badges can take five days to complete, though it told the BBC it usually takes 48 hours.

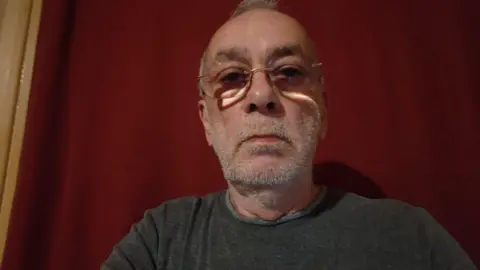

James Williams, 67, from London finds these services difficult to use.

“I am a blue badge holder and I have to pay because I am not computer literate,” he says, arguing that “you have to jump through hoops to get this discount”.

James Williams

James WilliamsJonathan Cassar, 51, from London says the complex nature of online registration means that “disabled people who need to be dropped at terminal cannot be spontaneous as others can”.

Heathrow said it had tried to make the blue badge registration process “as simple as possible” and advised anyone who needs registration urgently to get it approved over the phone.

Liverpool said it had introduced online confirmation “to minimise abuse of the blue badge system”.

‘Not against principle’

Not all blue badge holders feel being charged for airport drop off is unfair.

Gordon Richardson, chair of the British Polio Fellowship Board, is a blue badge holder but says he is “not against the principle” of disabled people paying the same as non-disabled people.

He says what is most important is that the space is accessible and easy to use.

He urges blue badge holders to contact airports before travelling so that the airports can have the staff ready to help them and ensure they get their discount or free parking.

Many of the airports the BBC contacted said their blue badge policies had been drafted in consultation with disability groups and with special consideration for their needs.

Business

Two ships hit near Strait of Hormuz as fears grow of oil price rises

International shipping is said to have come to a standstill at the strait’s entrance, with fears of disruption already pushing up global oil prices.

Source link

Business

Khamenei dead, Middle East on edge: What will be the implications of Trump’s ‘Epic fury’ on stock markets, gold & oil? – The Times of India

The global markets are in for a phase of enhanced turmoil and uncertainty! The ongoing tensions in the Middle East after US and Israel’s strikes on Iran and Ali Khamenei’s death may have investors running for cover – looking for an asset class that is safer.During the night of February 27–28, the United States and Israel carried out joint aerial strikes on Iran as part of “Operation Epic Fury.” Statements by President Trump openly referring to regime change suggest that the confrontation could evolve into a prolonged campaign rather than remain a limited exchange, say market analysts at Franklin Templeton Institute.What does the situation mean for stock markets, energy markets (oil), gold and other asset classes? Here’s what Franklin Templeton Institute analysts have to say:From a market perspective, the key uncertainty is whether the conflict remains confined to direct military engagement or expands into disruptions affecting energy supplies and logistics networks, which would sustain a higher and more persistent risk premium.At the centre of the ongoing uncertainty from a global market and trade perspective is the Strait of Hormuz. While a complete blockade would carry severe consequences for Iran itself, the country has the capability to disrupt maritime traffic through tactics such as vessel harassment, seizures, drone activity, cyber operations, or the use of proxy forces.

Strait of Hormuz

The most immediate economic impact is expected in energy markets, where crude oil and natural gas prices are likely to move higher, they say. Such actions, feel analysts, will keep geopolitical risk premiums at high levels. In 2024, approximately 20 million barrels per day moved through the Strait of Hormuz, which is around one-fifth of global petroleum liquids consumption. Even a limited interference – which can be caused by delays, rerouting, or isolated seizure – can push prices higher through increased risk perception well before any actual shortages emerge.Liquefied natural gas should not be overlooked in this context. Qatar has the world’s third-largest LNG export capacity, and roughly one-fifth of global LNG shipments pass through the Strait of Hormuz, largely consisting of Qatari exports. As a result, shipping risks in the region affect gas markets as significantly as oil markets.Also Read | US-Israel strikes on Iran: How will India be hit by Strait of Hormuz closure? ExplainedShipping expenses have already begun to rise, with insurance costs acting as a major driver. Insurers have started issuing cancellation notices and revising war-risk premiums for voyages in the Gulf region. Some routes have reportedly seen premium increases of up to about 50%, while earlier periods of tension recorded rises exceeding 60% on important trade corridors. These developments effectively tighten supply conditions even when production levels remain unchanged.The possibility of the conflict spreading across the region is increasing. Franklin Templeton Institute analysts are of the view that across global financial markets, the immediate response to such shocks is usually driven by adjustments in risk perception rather than by underlying economic changes. “The initial market reaction for this type of event would typically see Treasury yields move lower and equities lower—mostly a risk-premium repricing. Impacts on activity/earnings may be delayed and uneven. The US dollar reaction is not guaranteed; gold tends to benefit while bitcoin has been trading like a risk asset (i.e., down with equities), reinforcing that it’s not typically a reliable hedge/diversifier in geopolitical drawdowns,” say Franklin Templeton Institute analysts.However, they note that experience shows markets often come to view geopolitical disruptions as temporary. Initial spikes in risk premiums are frequently followed by the realization that the overall effect on corporate profitability is limited. The duration of the conflict, developments in shipping and insurance costs, and the eventual resolution will be more important than the initial headlines.“We would not yet label this a clean buy-the-dip setup—duration, shipping/insurance mechanics, and the endgame matter more than the first headline,” they say.From an investment perspective, the near-term outlook favours sectors linked to energy markets, as well as companies benefiting from higher shipping and insurance costs, along with defence-related industries, the analysts say. At the same time, caution is warranted toward emerging markets that depend heavily on energy imports and toward cyclical sectors sensitive to fuel and logistics costs, including airlines and certain industrial segments.“For protection, we prefer oil upside/volatility structures and selective gold exposure over broad equity shorts—the path will be driven more by shipping/insurance reality than by the new cycle,” they conclude.

Business

Oil jumps 10% and could spike to $100 a barrel, analysts warn

Brent crude jumped 10% to about $80 a barrel over the counter on Sunday, oil traders said, while analysts predicted that prices could climb as high as $100 after U.S. and Israeli strikes on Iran plunged the Middle East into a new war.

The primary driver of this market volatility is the critical Strait of Hormuz. Ajay Parmar, director of energy and refining at ICIS, stated: “While the military attacks are themselves supportive for oil prices, the key factor here is the closing of the Strait of Hormuz.”

Most tanker owners, oil majors and trading houses have suspended crude oil, fuel and liquefied natural gas shipments via the Strait of Hormuz, trade sources said, after Tehran warned ships against moving through the waterway. More than 20% of global oil is moved through the Strait of Hormuz.

“We expect prices to open (after the weekend) much closer to $100 a barrel and perhaps exceed that level if we see a prolonged outage of the Strait,” Parmar said.

Middle East leaders have warned Washington that a war on Iran could lead to oil prices jumping to more than $100 a barrel, said RBC analyst Helima Croft. Barclays analysts also said prices could hit $100.

The OPEC+ group of oil producers agreed on Sunday to raise output by 206,000 barrels per day (bpd) from April, a modest increase representing less than 0.2% of global demand.

While some alternate infrastructure could be used to bypass the Strait of Hormuz, the net impact from its closure would be a loss of 8 million to 10 million bpd of crude oil supply even after diverting some flows through Saudi Arabia’s East-West pipeline and Abu Dhabi pipeline, said Rystad energy economist Jorge Leon.

Rystad expects prices to rise by $20 to about $92 a barrel when trade opens.

The Iran crisis also prompted Asian governments and refiners to assess oil stockpiles and alternative shipping routes and supplies.

-

Business1 week ago

Business1 week agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Sports1 week ago

Sports1 week agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoSaturday Sessions: Say She She performs "Under the Sun"

-

Business1 week ago

Business1 week agoEquinox chairman says ‘health is the new luxury’ as wellness spending soars

-

Sports1 week ago

Sports1 week agoHow James Milner broke Premier League’s appearances record

-

Tech1 week ago

Tech1 week agoThe Supreme Court’s Tariff Ruling Won’t Bring Car Prices Back to Earth