Business

BYD: Chinese EV giant sees UK sales soar by 880%

Chinese car making giant BYD says the UK has become its biggest market outside China, after its sales there surged by 880% in September compared to a year earlier.

The company says it sold 11,271 cars in the UK last month, with the plug-in hybrid version of its Seal U sports utility vehicle (SUV) accounting for the majority of those sales.

It comes after figures from the car industry body the Society of Motor Manufacturers and Traders (SMMT) showed that sales of electric vehicles (EVs) jumped to a record high in September.

The UK is particularly attractive to firms like BYD as the country has not imposed tariffs on Chinese EVs, unlike other major markets such as the European Union and the US.

BYD, which offers cheaper models than many of its Western rivals, said its share of the UK market jumped to 3.6% in September.

The company will launch more new hybrid and electric cars in the months ahead, said the BYD’s UK manager Bono Ge. He added that the brand’s future in Britain looks “hugely exciting”, having just opened its 100th retail outlet.

UK EV sales hit a record high last month, with sales of pure battery electric vehicles rising to almost 73,000, according to the SMMT.

Sales of plug-in hybrid cars grew even faster, it said.

The Kia Sportage, Ford Puma and Nissan Qashqai were the best-selling cars in September. Chinese models – the Jaecoo 7 and BYD Seal U – were also in the top 10.

But despite the surge in overall EV sales in the UK, petrol and diesel vehicles still made up more than half of new car sales last month, according to the SMMT.

In October last year, the EU announced it would hit imports of Chinese EVs with levies of up to 45%.

The measure is aimed to protect European car makers from being undermined by what the EU believes are unfair Chinese-state subsidies.

Chinese car makers like BYD have been effectively shut out of the US by high tariffs, which were backed by both President Donald Trump and his predecessor Joe Biden.

Business

Gadgets Now Awards 2025 recognise tech excellence – The Times of India

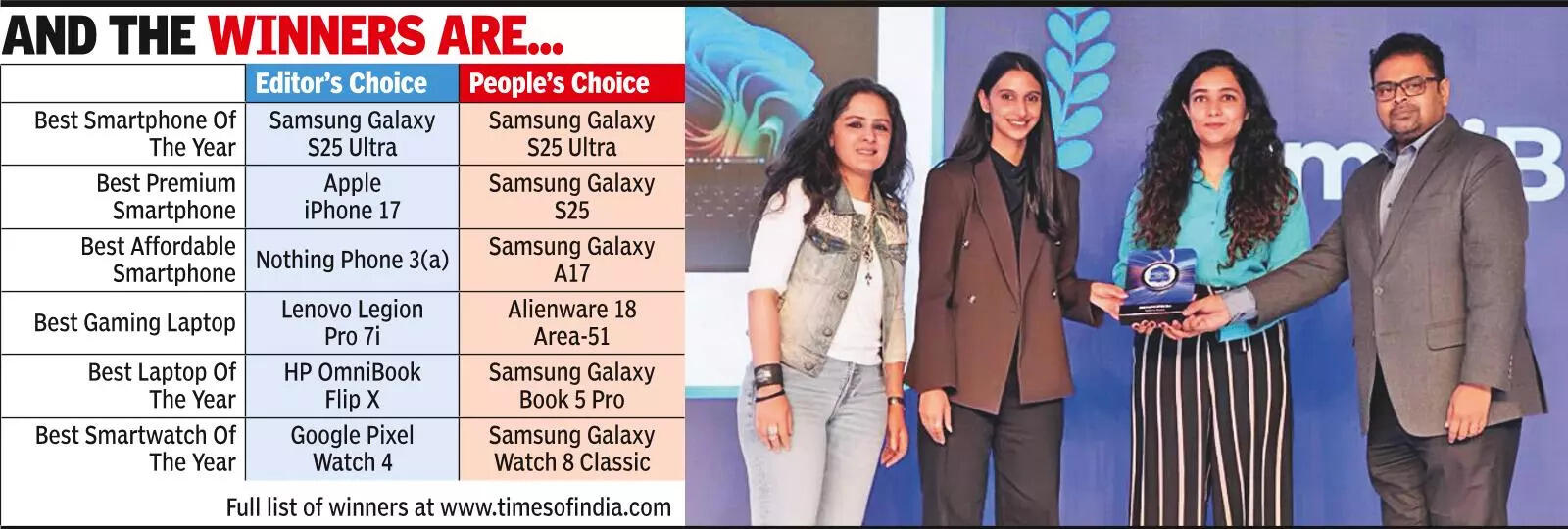

NEW DELHI: The Times of India Gadgets Now Awards 2025 celebrated last year’s standout gadgets at an event on Monday where technology met glamour. The event drew an eclectic gathering of distinguished guests who came together to recognise technological excellence across key categories, including smartphones, smartwatches, audio products, televisions and more.This year, the Awards that are in its 6th edition went a step further and also recognised India’s leading influencers and creators who are redefining the tech content landscape.

The winners included Samsung Galaxy S25 Ultra, which scored a double win as the Best Smartphone Editor’s Choice and Popular Choice.Apple iPhone 17 was adjudged the Best Premium Smartphone Editor’s Choice, while Samsung Galaxy S 25 won the Popular Choice in the same category.Samsung once again picked up 2 awards as Galaxy Z Fold 7 was crowned the Editor’s Choice and Popular Choice winner in the Best Foldable Smartphone category.Samsung Galaxy Book 5 Pro won the Editor’s Choice Best AI-powered gadget, while Neosapien Neo 1 was the Popular Choice winner.

Business

Google apologises for Baftas alert to ‘see more’ on racial slur

Google said the news alert was an error that should not have happened.

Source link

Business

Trump’s new global tariff comes into effect at 10%

The global levy comes in at 10%, lower than the rate the president had threatened at the weekend.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash