Business

CEOs of Wells Fargo and Pfizer caution the U.S. could lose its edge to China without innovation

Albert Bourla, CEO of Pfizer, Charlie Scharf, Wells Fargo & Company CEO and Kathy Warden, Northrop Grumman Chair & CEO speak during the Invest in America Forum on Oct. 15, 2025.

Aaron Clamage | CNBC

Wells Fargo CEO Charlie Scharf and Pfizer CEO Albert Bourla sounded the alarm Wednesday over the potential for the the U.S. to lose its competitive edge to China, but said artificial intelligence could help America maintain its lead.

Speaking at CNBC’s inaugural Invest in America Forum in Washington, D.C., the two executives said that while the U.S. still leads in many sectors, inconsistent policy and underinvestment is ceding ground to China. AI, they said, poses both risks and benefits for the U.S. economy.

Scharf said AI will likely reduce the size of workforces — but will boost productivity.

“We will likely have less people, absolutely,” Scharf said. “When we look at the tools that we’ve implemented just for people that are coding, you see 20%, 30%, 40% improvement in coders. We haven’t reduced our head count by 20%, 30% or 40%. We’re actually doing more than we otherwise would have been able to do.”

Wells Fargo big bank peers like JPMorgan and Goldman Sachs are already hiring fewer people because of AI advancements.

Scharf also said the financial sector is poised for major regulatory changes despite an ongoing political stalemate in Washington.

“We ultimately do expect significant changes in capital requirements, liquidity requirements,” he said. “We do expect to see changes which will allow people in the industry, not just big banks and medium-sized banks, but smaller banks as well, to do more in these [local] communities.”

Bourla, meanwhile, expressed concern about China’s growing strength in biotechnology and pharmaceuticals, pointing to a surge in research and development spending, regulatory reforms and a national strategy focused on life sciences.

“They [China] filed more patents this year than the U.S.,” Bourla said. “That’s never happened in history. Five years ago, the split was 90%-10%. … The gap is closing, but they probably will become [better than us] unless we get our act together.”

Bourla urged the U.S. to shift focus from trying to slow China’s progress toward improving its own productivity and innovation.

“We spend more time trying to think about how to slow down China rather than think how we can become better than them,” Bourla said. “We need to have regulatory changes here. We need to have stability. Tariffs and pricing was not helping.”

Pfizer recently agreed to a drug pricing deal with the Trump administration as part of a broader effort to remove long-standing uncertainties around pricing, Medicaid reimbursements and distribution. As part of the agreement, Pfizer secured a three-year exemption from pharmaceutical-specific tariffs, contingent on additional investments in U.S. manufacturing.

“Tariffs and the uncertainty of drastic correction of U.S. pricing — with this deal, we are removing both uncertainties,” Bourla said Wednesday.

He also called artificial intelligence the next frontier for medicine, predicting that AI will revolutionize drug discovery by dramatically accelerating timelines for finding treatments for diseases like Alzheimer’s and cancer.

“We tried for years to find cures … AI will make it happen,” Bourla said.

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

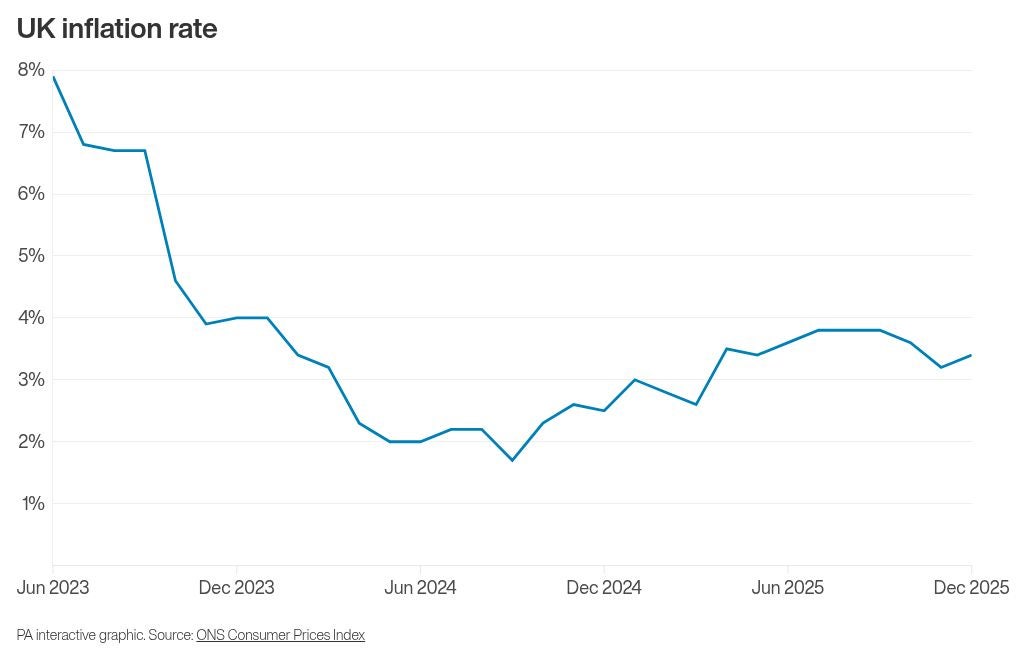

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44