Fashion

China’s personal luxury market down 3–5% in 2025: Bain

The report finds that 2025 marked a year of recalibration for China’s luxury market, as consumers became more selective and prioritised value driven luxury items that balance quality, exclusivity and practicality. Experience-based consumption, including travel and wellness, continued to be favoured, reflecting an ongoing preference for emotional and sensory experiences over material goods.

“After the turbulence of 2024, the market in 2025 began to stabilize, although consumer confidence remained fragile,” said Bruno Lannes, senior partner at Bain & Company. “What we are seeing is not a broad-based rebound, but the start of a recalibration phase, with early signs of recovery emerging in the second half of the year. This recalibration is also segment specific, with the Very Important Clients continuing to represent a large share of the market, while younger aspiring consumers have delayed entry into the luxury category.”

Luxury market performance varied significantly by category. Beauty emerged as the strongest performer, rebounding to 4–7 per cent growth, driven by steady demand for ultra-premium skincare and fragrances as consumers continued to seek emotional and sensory experiences even amid economic uncertainty. Other categories remained under pressure.

Fashion declined by 5–8 per cent, outperforming leather goods which declined 8–11 per cent – reflecting past and ongoing price increases and limited innovation, which made it difficult for consumers to justify purchases.

“In a more selective market, category dynamics and brand fundamentals are becoming increasingly decisive,” said Priscilla Dell’Orto, partner at Bain & Company. “Brands that maintain strong desirability and deliver clear value through innovation and targeted pricing strategies are proving more resilient.”

In contrast to 2023 and 2024, the share of overseas luxury spending declined sharply in 2025. Bain estimates that 65 per cent of Chinese luxury consumption occurred within mainland China, while 35 per cent took place outside, reflecting a renewed degree of consumption repatriation.

This shift was driven in part by low currency and narrowed price gaps between mainland China and key luxury markets, largely resulting from exchange-rate movements, which reduced the incentive for overseas shopping. Domestic tourism growth and ongoing shopping mall promotions further supported mainland consumption, despite the continued recovery of outbound travel.

Daigou activity stayed high in 2025 but showed signs of structural slowdown as brands stepped up efforts to curb gray-market sales and protect pricing in China. Sales among the top 45 brands tracked by Re-Hub grew 3 per cent in 2025, down from 5 per cent in 2024, reflecting tighter control over overseas supply chains and unofficial channels.

At the same time, China’s second-hand luxury market continued to expand, growing by 15–20 per cent in 2025, while remaining underpenetrated at less than 10 per cent of the primary luxury market. Growth was supported by an increased supply of pre-owned goods, rising consumer acceptance – particularly among younger and more price-sensitive buyers – and the widespread adoption of live-streaming as a trusted channel for product verification and engagement.

“The second-hand market is becoming a more established and complementary pillar of China’s luxury ecosystem,” said Elle Yang, partner at Bain & Company. “Its continued growth reflects changing consumer mindsets as well as the increasing maturity of the overall market.”

The report also points to the continued growth of local Chinese luxury brands, especially in beauty and select personal luxury segments. These players are gaining market share through culturally resonant designs, digital-first and engagement-driven consumer strategies, and competitive pricing supported by strong local supply chains.

As competition intensifies in a low-growth environment, the gap between winners and laggards is widening, with consumers consolidating their spending toward a smaller number of preferred brands that deliver perceived ‘true value’.

Looking ahead, Bain expects China’s personal luxury goods market to see modest growth in 2026, albeit with continued volatility and uncertainty. A growing middle class, improving consumer confidence and favourable policies are expected to help direct more luxury consumption back to the mainland, while growth will remain highly category- and brand-dependent.

Fibre2Fashion News Desk (RR)

Fashion

Eurozone private sector expands at slower pace in January

Despite softer current conditions, business sentiment improved. Eurozone firms reported their strongest expectations for activity growth since May 2024, although confidence levels remained below the long-run average, S&P Global said in a press release.

Eurozone private sector growth slowed again in January, with the Composite PMI easing to 51.3, its weakest expansion since September.

Services-led softness offset manufacturing gains, while new orders and employment remained subdued.

Despite fragile demand, business optimism improved to its strongest since May 2024.

Inflation pressures intensified, with input costs and output charges rising sharply.

Input cost inflation rose for a third successive month to an eleven-month high, while output charges increased at their fastest pace in nearly a year. Both indicators remained well above their respective historical averages, pointing to a renewed build-up of inflationary pressures.

Among the major eurozone economies, Spain topped the index rankings with a reading of 52.9, despite marking a seven-month low. Germany followed with an index of 52.1, a two-month high but slightly below its flash estimate of 52.5. Italy posted a Composite PMI of 51.4, also a two-month high, while France slipped into contraction territory at 49.1, its weakest level in three months and below the earlier flash reading of 48.6.

“Service companies in the eurozone have expanded their business activities for the eighth month in a row. The growth trajectory can be described as decent, but the situation is still not comfortable. Companies hardly hired any new staff in January. The fact that new business barely grew also shows that the recovery in this sector is still fragile,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

The survey data were gathered between January 12 and 27, 2025.

Fibre2Fashion News Desk (SG)

Fashion

India–US trade deal set to unlock stalled textile export orders

The Federation of Indian Export Organisations (FIEO) said the sharp tariff reduction is likely to provide an instant boost to sectors such as apparel, textiles, leather and footwear, where global buyers typically finalise summer-season sourcing by December. With improved price parity, greater tariff certainty and renewed buyer confidence, exporters expect a rapid pick-up in orders over the coming months.

India’s exporters have welcomed the India–US trade deal, which cuts US tariffs on Indian goods from around 50 per cent to 18 per cent, saying it will immediately unlock stalled orders.

Industry bodies expect a rapid rebound in textile and apparel exports, improved competitiveness in the US market, renewed buyer confidence, fresh investments, and stronger job creation across labour-intensive sectors.

Hailing the agreement as the ‘Father of All Deals’, S C Ralhan, president, FIEO, said the trade pact marks a major step forward in strengthening bilateral economic ties. “The finalisation of the India–US Trade Deal and the reduction of US tariffs to 18 per cent on Indian-made products is a landmark achievement. It reflects the growing strategic and economic partnership between India and the United States and opens up vast opportunities for Indian exporters, particularly MSMEs,” he said.

Ralhan added that sectors including engineering goods, textiles and apparel, pharmaceuticals, chemicals, leather products, gems and jewellery, and agricultural products are expected to gain significantly. “Lower tariffs will enhance price competitiveness and help Indian exporters integrate more deeply into US supply chains. This will encourage capacity expansion, attract fresh investments and support job creation in export-oriented industries,” he noted.

The Southern India Mills’ Association (SIMA) said the rollback of the punitive US tariff has come as a major relief for India’s textile and clothing industry. SIMA noted that the sudden imposition of a 50 per cent tariff had severely disrupted the manufacturing value chain. SIMA chairman Durai Palanisamy said, “The reduction of the US tariff to 18 per cent, the lowest rate secured by any competing textile and clothing exporting nation, has restored confidence across the industry and is expected to improve India’s global competitiveness.” He added that the move, combined with India’s recent trade agreements with the US, the UK and Europe, is likely to revive export momentum and place the sector back on a sustainable growth path.

He said exporters, particularly in Tamil Nadu, were hit hard, with production levels falling by 30–70 per cent across several units and significant job losses following the tariff hike.

Anant Goenka, president, the Federation of Indian Chambers of Commerce & Industry (FICCI), said the agreement marks a significant reset in bilateral economic ties. “The reduction of reciprocal tariffs on Indian goods to 18 per cent, following months of negotiations, will materially improve the competitiveness of Indian exports in the world’s largest import market,” he said.

Goenka noted that sectors such as apparel, leather, gems and jewellery, and marine products are poised to benefit from the deal, which could strengthen business confidence and deepen economic engagement between the two countries. “If implemented effectively, the agreement can provide a meaningful boost to India’s export growth trajectory, broaden market access, and underscore the strategic importance of sustained cooperation between the world’s largest democracies,” he added.

Fibre2Fashion News Desk (KUL)

Fashion

Australian apparel imports down but textiles up in July-Dec 2025

Australia’s textile‑apparel trade in H1 FY26 looks uneven: apparel imports dipped slightly, while upstream textile imports rose.

Fibre inflows also climbed modestly.

Rising yarn and fabric imports suggest inventory rebuilding and manufacturing needs.

Fibre exports remain resilient short term despite price-led declines last year.

Wool competitiveness stays sensitive to global prices and logistics.

Source link

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

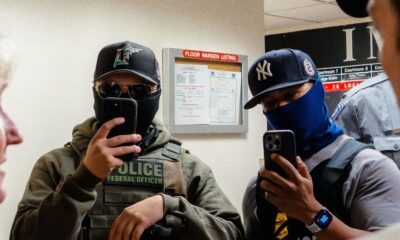

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Entertainment1 week ago

Entertainment1 week agoPeyton List talks new season of "School Spirits" and performing in off-Broadway hit musical

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami