Business

Court documents shed new light on UK-Apple row over user data

Graham FraserTechnology Reporter

Getty Images

Getty ImagesThe UK government may have wanted to force Apple to provide it with access to more customer data than previously thought, a court document has indicated.

A row erupted between the two after it emerged the Home Office asked the tech giant for the right access to highly encrypted user data stored via a service called Advanced Data Protection (ADP).

Now a court document suggests the request – made under legislation called the Investigatory Powers Act – could have also enabled the government to seek access to a wider range of Apple customer data.

It also suggests the government may still be seeking to access data of non-UK users, despite US officials saying last week it had dropped the demand.

The UK government and Apple have been approached for comment.

It is believed the UK government would only want to access this data if there was a risk to national security.

In February, it emerged the government had demanded to be able to access encrypted data stored by Apple users worldwide in its cloud service. It applied to all content stored using ADP service.

The tech uses end-to-end encryption, where only the account holder can access the data stored – even Apple itself cannot see it.

It was an opt-in service, and not all users choose to activate it.

While it makes your data more secure, it comes with a downside – it encrypts your data so heavily that it cannot be recovered if you lose access to your account.

It is unknown how many people choose to use ADP.

‘Back door’

After US politicians and privacy campaigners outlined their anger at the move, Apple decided to pull ADP from customers in the UK.

Now, a new court document has emerged from the Investigatory Powers Tribunal (IPT), an independent judicial body.

The IPT hears complaints from anyone who feels they have been the victim of unlawful action by a public body using covert investigative techniques.

It could also relate to the conduct of UK intelligence services including MI5 and MI6.

In this latest court filing, first reported by the Financial Times, it states Apple was given a technical capability notice (TCN) by the UK government at some point between late 2024 and early 2025.

It states the notice “applies to (although is not limited to) data covered by” ADP – it was previously understood the government’s demand was exclusively focused on data stored using the encryption technology.

The TCN to Apple also included “obligations to provide and maintain a capability to disclose categories of data stored within a cloud based backup service and to remove electronic protection which is applied to the data where that is reasonably practicable”.

The filing adds: “The obligations included in the TCN are not limited to the UK or users of the service in the UK; they apply globally in respect of the relevant data categories of all iCloud users.”

The new court document from the IPT is dated Wednesday, 27 August – eight days after Tulsi Gabbard, the US director of national intelligence, said the UK had withdrawn its controversial demand to access global Apple users’ data if required.

Gabbard said at the time in a post on X the UK had agreed to drop its instruction for the tech giant to provide a “back door” which would have “enabled access to the protected encrypted data of American citizens and encroached on our civil liberties”.

The BBC understood at the time Apple had not yet received any formal communication from either the US or UK governments.

It is not clear if this new court document simply refers to the UK government’s initial intention, or if indicates that the UK government has not yet dropped its wish to be able to access the data of Apple users from around the world, including those from the US.

Apple declined to comment, but says on its website that it views privacy as a “fundamental human right”.

Apple has previously said it would “never build a back door” in its products.

Cyber security experts agree that once such an entry point is in place, it is only a matter of time before bad actors also discover it.

No Western government has yet been successful in attempts to force big tech firms like Apple to break their encryption.

The US government has previously asked for this, but Apple has refused.

In 2016, Apple resisted a court order to write software which would allow US officials to access the iPhone of a gunman – though this was resolved after the FBI was able to successfully access the device.

Similar cases have followed, including in 2020, when Apple refused to unlock iPhones of a man who carried out a mass shooting at a US air base.

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

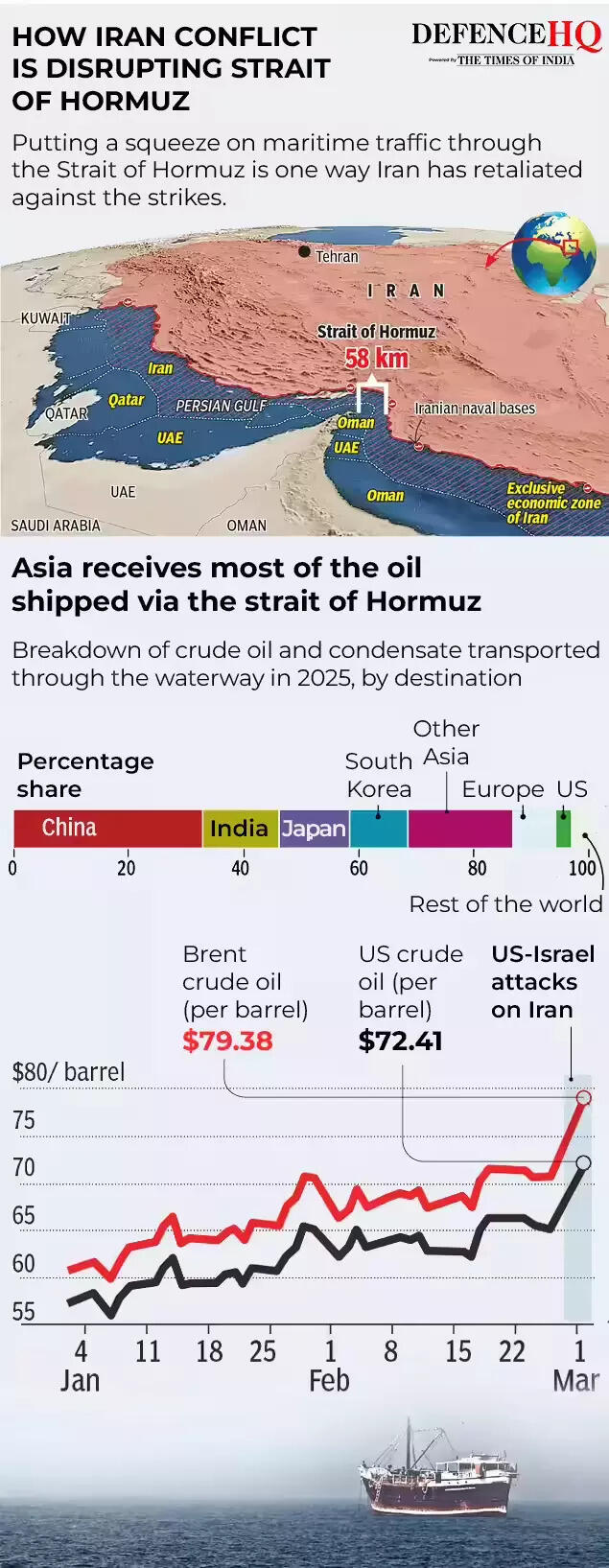

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire