Business

Drug pricing, patent losses and deals: Here’s what pharma execs see ahead in the industry

President Donald Trump arrives for an announcement in the Roosevelt Room of the White House in Washington, Dec. 19, 2025.

Will Oliver | Bloomberg | Getty Images

Drug pricing. Looming patent cliffs. Dealmaking. The first year of Trump 2.0.

Those are among the themes that dominated conversations last week as drugmakers of all sizes met with investors to map out their plans for 2026 and beyond at the annual JPMorgan Healthcare Conference in San Francisco.

After geopolitical uncertainty weighed on dealmaking during the first half of 2025, investors and drugmakers sounded optimistic that 2026 may mark a turning point for the sector. Investors are beginning to see signs of recovery in U.S. biotech so far this year after years of volatility, betting that lower interest rates and a renewed appetite for deals will reopen the IPO window.

The conference lacked the splashy, high-dollar acquisitions that typically take center stage there. But big pharma made it clear it is on the hunt for potential buyouts and collaborations as it looks to make up for roughly $300 billion in possible lost revenue as patents for blockbuster drugs expire toward the end of the decade.

Some concerns around President Donald Trump‘s health-care policy agenda have eased after more than a dozen major drugmakers ended 2025 with landmark drug pricing deals and three-year reprieves from tariffs.

When asked about whether he still held to his prediction last year that Trump will be a positive for the sector, Pfizer CEO Albert Bourla told reporters last week, “Yes,” even though “I got scared big time” along the way.

Still, investors are trying to understand how the drug pricing agreements will impact businesses, and parse out the implications of policy changes like softer U.S. vaccine recommendations.

Here’s what we heard from pharma executives about the year ahead.

Drug pricing

Some executives said the recent drug pricing deals — part of Trump’s “most-favored-nation” policy — reduce uncertainty and will likely have a modest impact on their businesses.

The agreements involve lowering prices of certain products for Medicaid patients by tying them to the lowest ones abroad, and agreeing to sell some medicines at a discount on direct-to-consumer platforms, including the administration’s upcoming TrumpRx site.

“I don’t want to give the impression that there’s no impact from [the most-favored-nation deal], because there is,” Sanofi CEO Paul Hudson told reporters at a media event Wednesday morning. “The question for us is, can we manage that and deliver an attractive long-range plan? We feel, so far, we can.”

Sanofi and several other companies with pricing deals could outline how they expect the agreements to affect their businesses when they release their 2026 outlooks in the coming weeks.

Sanofi CEO Paul Hudson speaks during an event held by President Donald Trump to make an announcement about lowering drug prices, at the Roosevelt Room of the White House in Washington, Dec. 19, 2025.

Evelyn Hockstein | Reuters

AstraZeneca expects the initial effects of its drug pricing deal to be limited and manageable, as it so far applies to a specific Medicaid population and represents “a low single-digit percentage” of the company’s global sales, said CFO Aradhana Sarin during a presentation on Jan. 13.

Meanwhile, Bourla told reporters on Jan. 12 that the deals will help companies pressure European countries to increase what they will pay for drugs, similar to how the U.K. agreed in December to raise prices for medicines as part of a trade deal with the U.S.

He said companies could stop supplying medicines to some countries that refuse to pay more.

“Do you reduce [U.S.] prices to France’s level or stop supplying France? You stop supplying France,” Bourla said. “So they will stay without new medicines … because the system will force us not to be able to accept the lower prices.”

Patent losses, dealmaking

Pharmaceutical companies were confident they will be able to offset losses from upcoming patent expirations of popular drugs and zeroed in on dealmaking as a critical tool to add new revenue. Cheaper generic versions of brand-name drugs typically enter the market after their patents expire, leading to significant price drops and a loss of market share over time due to increased competition.

During a presentation on Jan. 12, Merck CEO Rob Davis said his company hopes “to grow through” the upcoming loss of exclusivity for its top-selling cancer immunotherapy Keytruda.

Merck raised its outlook for new products, saying those items will contribute a projected $70 billion in sales by the mid-2030s. That is almost double what Wall Street expects Keytruda to record in 2028 before its patent expires. Keytruda generated $29.48 billion in sales in 2024, which was nearly half of Merck’s total revenue for that year.

Davis indicated that Merck may not be done with dealmaking, especially for later-stage or already-approved products.

“If you look from a dollar perspective, we’ve been looking in that up to $15 billion dollar range,” he said. “We’ve been very clear that we’re willing to go larger than that, but we only will do so following the exact same logic and discipline.”

Bristol Myers Squibb has the highest exposure to the upcoming loss of exclusivity cycle, with blockbuster drugs such as the blood thinner Eliquis set to face generic competition, according to a note from JPMorgan analysts in late December. Eliquis raked in $13.3 billion in sales in 2024, making up more than a quarter of the company’s revenue for the year.

But in an interview on Jan. 13, Bristol Myers Squibb CEO Chris Boerner said the company has the potential to deliver up to 10 new products by the end of the decade.

“We feel really good about the substrate we have in late-stage development, and the mid-stage pipeline is also progressing nicely,” he told CNBC.

Boerner highlighted 11 late-stage data readouts in 2026 across six potential new products. Boerner said the company is “casting a wide net” for its business development.

He added that Bristol Myers Squibb is hoping to build on the core therapeutic areas it knows well, look across different phases of development and focus on “the best, most innovative science that we can find” to tackle difficult-to-treat diseases.

This year, Novo Nordisk is also facing patent expirations for semaglutide — the active ingredient in its blockbuster diabetes drug Ozempic and obesity counterpart Wegovy — in certain countries, including Canada and China.

Novo Nordisk CEO Mike Doustdar said 2026 “will be the year of price pressure” due to generic competition in some international markets and its U.S. drug pricing deal. He added that Novo Nordisk aims to offset price cuts with volume growth and will be active in business development to see what “can complement our own pipeline.”

Those comments come after Novo Nordisk lost a heated bidding war with Pfizer last year over the obesity biotech Metsera.

Vaccine rhetoric

Health and Human Services Secretary Robert F. Kennedy Jr. announces new nutrition policies during a press conference at the Department of Health and Human Services in Washington, Jan. 8, 2026.

Jonathan Ernst | Reuters

Some executives reiterated concerns about the administration’s changes to U.S. immunization policy under Health and Human Services Secretary Robert F. Kennedy Jr. — a prominent vaccine skeptic — and his appointees. That includes the Centers for Disease Control and Prevention’s recent move to roll back the number of immunizations routinely recommended for children.

“I’m very annoyed. I’m very disappointed,” Pfizer’s Bourla said, adding that “what is happening has zero scientific merit and is just serving an agenda, which is political.”

He added, “I think we do see that there are reductions in vaccination rates of kids and that will raise diseases, and I’m certain about that.” But Bourla said he doesn’t believe the recent changes to the childhood vaccine schedule will impact Pfizer’s bottom line.

He said the pressure the administration is putting on immunizations “is an anomaly that will correct itself.”

Meanwhile, Sanofi’s Hudson said the scrutiny of vaccines by the Trump administration is aligned with what the company expected ahead of the 2024 election.

“I’ve had conversations with Kennedy, we just try to stick to the facts of the evidence,” Hudson said. “There’s not much we can do.

“I just hope that the evidence is enough in the end with all these things,” he added.

Business

Next buys shoe brand Russell & Bromley but 400 jobs still at risk

High street fashion giant Next has bought shoe retailer Russell & Bromley which had collapsed in to administration.

Next paid £2.5m in a rescue deal for the upmarket British footwear and accessories seller — but the future for most of the chain’s current staff and shops remains uncertain

Next will own the brand and three of Russell & Bromley’s 36 stores, as well as some existing stock for which it is paying an additional £1.3m.

Administrators Interpath said it was considering the future of the remaining stores, which for the moment remain open, as well as nine concession stores which all employ around 400 people.

Russell & Bromley’s chief executive Andrew Bromley said it was a “difficult decision” but the sale of the brand was the best way to secure its future.

The company is around 150 years old but has become the latest to struggle in a tough retail environment.

It joins other brands in a familiar path to largely disappearing off the high street via a process of administration, which means companies are often broken up and the highest value assets sold off to the highest bidder.

The Original Factory Shop and accessories retailer Claire’s are both currently going through a process of administration, with site closures and jobs at risk. Around 1,000 people lost their jobs after Bodycare collapsed in September, while River Island will close some stores to avoid a total collapse. The woes all come after a tranche of high profile closures such as Debenhams and Wilko.

In a statement, Next said it secured “the future of a much loved British footwear brand.”

“Next intends to build on this legacy and provide the operational stability and expertise to support Russell & Bromley’s next chapter, allowing it to return to its core mission: the design and curation of world-class, premium footwear and accessories for many years to come.”

The three stores Next will acquire are in high-end shopping destinations in or around London: Chelsea, Mayfair and Kent.

Next has seen relatively solid performance in the current turbulent retail landscape – unlike Russell & Bromley which has been loss-making in recent years.

Its saviour has experience in failing circumstances: last year, Next bought out of administration fashion maternity label Seraphine, and began rolling out its FatFace concessions a few years after snapping it up.

Business

Over 80% of below 40 entrepreneurs self-made – The Times of India

MUMBAI: Nearly four out of five of India’s leading young entrepreneurs are self-made, underscoring a shift in the country’s business landscape from inheritance to merit, according to the Avendus Wealth – Hurun India Uth Series 2025. The report shows that about 80% of business leaders under 40 featured in the ranking are first-generation founders.The study tracks entrepreneurs aged up to 40 whose companies meet minimum valuation thresholds ranging from $25 million to $200 million, based on age cohort and whether the founder is first- or next-generation. Of the 436 entrepreneurs shortlisted, 349 are self-made, pointing to a growing ecosystem driven by new ideas and technology rather than legacy ownership.Among first-generation founders, Ritesh Agarwal, founder of OYO, leads the list. At 31, Agarwal has built one of the most capitalised startups in the country, raising $3.7 billion. He is followed by Aadit Palicha and Kaivalya Vohra, both 22, whose quick-commerce firm Zepto has raised $1.95 billion.Other prominent first-generation entrepreneurs include Nikhil Kamath of Zerodha, now among India’s most-followed entrepreneurs on LinkedIn; Alakh Pandey of Physics Wallah, who disrupted the ed-tech space; and Ghazal Alagh, the most-followed woman entrepreneur on the list.Next-generation leaders account for about 20% of the ranking and continue to shape large family-run businesses. Key names include Isha Ambani of Reliance Retail, which employs more than 2.47 lakh people; Abhyuday Jindal, who is driving sustainability initiatives at Jindal Stainless; and Vidhi Shanghvi, who recently led Sun Pharmaceutical’s $355 million acquisition of US-based Checkpoint Therapeutics.The report categorises entrepreneurs across three age groups—under 30, under 35 and under 40. Together, the companies led by these 436 entrepreneurs are valued at more than $950 billion, higher than Switzerland’s GDP. Bengaluru tops the list with 109 entrants, followed by Mumbai with 87 and New Delhi with 45. Software products and services dominate with 77 entrepreneurs, ahead of financial services and healthcare, highlighting the tilt toward digital and technology-led businesses.

Business

Are UK interest rates expected to fall again?

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesThe Bank of England has cut interest rates from 4% to 3.75%, the lowest level since February 2023.

Analysts are divided about whether the Bank will cut again when it next meets in February.

Interest rates affect mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England’s base rate is what it charges other banks and building societies to borrow money, which influences what they charge their own customers for mortgages as well as the interest rate they pay on savings.

The Bank moves interest rates up and down in order to keep UK inflation – the rate at which prices are increasing – at or near 2%.

When inflation is above that target, the Bank typically puts rates up. The idea is that this encourages people to spend less, reducing demand for goods and services and limiting price rises.

What has been happening to UK interest rates and inflation?

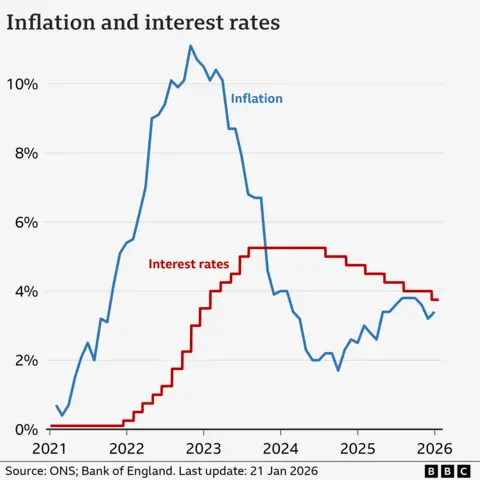

The main inflation measure, CPI, has dropped significantly since the high of 11.1% recorded in October 2022.

However, it was 3.4% in the year to December 2025 – up from 3.2% in November, and slightly higher than analysts had expected.

The Office for National Statistics (ONS) – which measures inflation – said the increase was driven by higher tobacco prices and the cost of airfares over the Christmas and New Year period.

The Bank of England’s base rate reached a recent high of 5.25% in 2023. It remained at that level until August 2024, when the Bank started cutting.

Five cuts brought rates down to 4%, before the Bank held rates at its meetings in September and November 2025 before the December cut.

Are interest rates expected to fall again?

Most analysts had expected the December cut, but the vote among members of the nine-member monetary policy committee (MPC) was divided, with only five in favour.

The Bank said rates were likely to continue dropping in the future, but warned decisions on further cuts in 2026 would be contested.

“We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call,” said the Bank’s governor Andrew Bailey.

If inflation continues to rise – or just fails to fall – further rate cuts are less likely.

Mr Bailey has also repeatedly warned about the continuing impact of US tariffs, and political uncertainty around the world.

The next interest rate decision is on Thursday 5 February.

How do interest rate cuts affect mortgages, loans and savings rates?

Getty Images

Getty ImagesMortgages

Just under a third of households have a mortgage, according to the government’s English Housing Survey.

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate. A 0.25 percentage point cut is likely to mean a reduction of £29 in the monthly repayments for the average outstanding loan.

For the additional 500,000 homeowners on standard variable (SVR) rates – assuming their lender passed on the benchmark rate cut – there would typically be a £14 a month fall in monthly payments for the average outstanding loan.

But the vast majority of mortgage customers have fixed-rate deals. While their monthly payments aren’t immediately affected by a rate change, future deals are.

Mortgage rates have been falling recently, partly owing to the expectation the Bank would cut rates in December.

As of 21 January, the average two-year fixed residential mortgage rate was 4.77%, according to financial information company Moneyfacts. A five-year rate was 4.87%.

The average two-year tracker rate was 4.41%.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027. Borrowing costs for customers coming off those deals are expected to rise sharply.

Mortgage calculator

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if Bank cuts make borrowing costs cheaper.

However, this tends to happen very slowly.

Getty Images

Getty ImagesSavings

The Bank base rate also affects how much savers earn on their money.

A falling base rate is likely to mean a reduction in the returns offered to savers by banks and building societies.

The current average rate for an easy access savings account is 2.45%, according to Moneyfacts.

Any further cut in rates could particularly affect those who rely on the interest from their savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%.

At its meeting in June 2025 the ECB cut rates by 0.25 percentage points to 2% where they have remained.

The US central bank – the Federal Reserve – has cut interest rates three times since September 2025, taking them to the current range of 3.5% to 3.75%, the lowest since 2022.

President Trump had repeatedly attacked the Fed for not cutting earlier.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment1 week ago

Entertainment1 week agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports6 days ago

Sports6 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Politics4 days ago

Politics4 days agoSaudi King Salman leaves hospital after medical tests

-

Business5 days ago

Business5 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Tech6 days ago

Tech6 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech7 days ago

Tech7 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Fashion4 days ago

Fashion4 days agoBangladesh, Nepal agree to fast-track proposed PTA