Business

Ed Miliband hints at cut to VAT on energy bills

Becky MortonPolitical reporter

BBC

BBCThe government is looking at the possibility of cutting the rate of VAT on energy bills, Ed Miliband has suggested.

The energy secretary said he would not speculate ahead of the chancellor’s Budget in November.

But asked if the government would consider scrapping the 5% rate, he told the BBC the country was facing a “cost-of-living crisis that we need to address as a government” and “we’re looking at all of these issues”.

The government is under pressure to reduce household energy costs and before the election Labour pledged to lower average bills by £300 a year by 2030.

Miliband told the BBC’s Sunday with Laura Kuenssberg programme he stood by that promise but the reason bills were so high was “because of our dependence on fossil fuels”.

He added: “There is only one route to get bills down, which is to go for clean power, home-grown, clean energy, that we control, so we’re not at the behest of the petrol states and the dictators.”

Pressed over whether the government was considering scrapping the 5% VAT rate on energy bills in November’s Budget, Miliband said: “The whole of the government, including the chancellor, understand that we face an affordability crisis in this country.

“We face a cost-of-living crisis, a longstanding cost-of-living crisis, that we need to address as a government. We also face difficult fiscal circumstances… so obviously we’re looking at all of these issues.”

A Treasury spokesperson said: “We do not comment on speculation.”

Scrapping VAT on domestic energy bills would save the average household £86 per year and cost an estimated £2.5bn per year to implement, according to the charity Nesta.

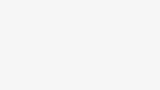

There was a rapid spike in energy prices in 2021, following Russia’s invasion of Ukraine, and although costs have gone down, they have remained high by historical standards.

This month bills went up by 2% for millions of households, under the energy regulator Ofgem’s price cap.

It means a household using a typical amount of energy will pay £1,755 a year, up £35 a year on the previous cap.

Earlier this week Chancellor Rachel Reeves told the BBC she was planning “targeted action to deal with cost-of-living challenges” in her Budget next month.

The BBC understands this could also include reducing some of the regulatory levies currently added to energy bills.

Levies known as “policy costs” – which are used to fund environmental and social schemes such as subsidies for renewables – made up around 16% of the average electricity bill and 6% of the average gas bill last year.

Some energy bosses have argued green levies are partly to blame for rising bills and the government’s independent adviser, the Climate Change Committee, has long recommended removing policy costs from electricity bills to help people feel the benefits of net-zero transition.

Asked whether these could be funded through taxes rather than coming off energy bills, Miliband said: “That’s always a judgement for the chancellor, but let’s be honest we know we’ve got really difficult fiscal circumstances that we inherited… but absolutely we look at those things.”

He argued the government had to invest in “aging electricity infrastructure” but there needed to be a “balance between public expenditure and levies”.

The cost of household energy bills has become a major political battleground, with the Conservatives and Reform UK blaming net-zero policies for higher prices.

The Conservatives have said they would scrap the Climate Change Act, which legally requires the UK government to reduce emissions to net zero by 2050, as well as ditch carbon taxes on electricity generation and cut a funding scheme for renewables.

Shadow energy secretary Claire Coutinho said her party’s plans would cut electricity bills for everyone by 20%.

“[The public] care about climate change but what I don’t think they are signing up for is much higher bills and jobs being lost to countries abroad,” she told the BBC.

In an interview with the same programme, Green Party leader Zack Polanski argued nationalising energy companies would help cut costs for customers.

His party has also proposed a new tax on carbon emissions to drive fossil fuels out of the economy and raise money to invest in the green transition.

Challenged over whether businesses would simply pass on these costs to customers, Polanski rejected this and said the tax would be “vital for tackling the climate crisis”.

“What we need to be doing is finding other ways to support particularly small and local businesses… We know the big corporations are destroying our environment, our democracy and our communities,” he said.

“They can make a profit, sure, but this isn’t about squeezing out every single profit they can make.”

Business

Chipotle stock sinks as restaurant chain reports falling traffic, weak guidance

A Chipotle store stands in the Bronx in New York City on April 23, 2025.

Spencer Platt | Getty Images

Chipotle Mexican Grill on Tuesday reported quarterly earnings and revenue that topped analysts’ expectations, although traffic to its restaurants fell for the fourth straight quarter.

For 2026, the company is projecting flat same-store sales growth, signaling that the burrito chain’s woes are not expected to disappear quickly. Chipotle ended a bumpy 2025 with a full-year same-store sales decline of 1.7%.

Shares of the company fell as much as 11% in extended trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: 25 cents adjusted vs. 24 cents expected

- Revenue: $2.98 billion vs. $2.96 billion expected

The fast-casual chain reported fourth-quarter net income of $330.9 million, or 25 cents per share, down from $331.8 million, or 24 cents per share, a year earlier.

Excluding impairment costs, gains from terminating restaurant leases and other items, Chipotle earned 25 cents per share.

Net sales rose 4.9% to $2.98 billion.

The company’s same-store sales fell 2.5% for the quarter, making this reporting period the third quarter of the year with same-store sales declines. However, Wall Street was anticipating a steeper same-store sales decrease of 3%, according to StreetAccount estimates.

Traffic to Chipotle restaurants fell by 3.2%. Executives have previously said they have seen a pullback in spending from consumers of all income cohorts, although low-income diners have made the most significant shift to their behavior.

Over the past year, shares of Chipotle have lost roughly a third of their value, dragging the company’s market value down to about $51 billion. Investor enthusiasm for the stock waned after the fast-casual chain began reporting shrinking traffic to its restaurants.

To bring back customers, Chipotle is focusing on improving the chain’s operations and adding new menu items, rather than leaning into discounts. In December, at the tail end of the quarter, the company unveiled “protein cups,” with the goal of convincing protein-obsessed customers to stop by for a snack, not just lunch or dinner.

Chipotle opened 132 company-owned locations and seven restaurants run by international licensees during the quarter. That brought its total to 334 company-owned locations and 11 international partner restaurants opened for the year.

In 2026, the company is projecting that it will open 350 to 370 new restaurants, including 10 to 15 international locations that will be run by licensees.

Business

India–US trade deal: Textile, leather players see revival in volumes – The Times of India

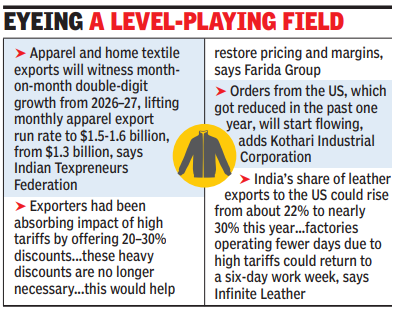

CHENNAI: India’s textile, apparel and leather exporters are expecting a sustained recovery in orders from the US, following tariff reductions under the proposed India–US trade deal. Industry representatives said the move will restore competitiveness, improve margins and revive volumes that were under pressure over the past year.Textile and apparel exporters are now expecting an increased sourcing by global brands as India will now enjoy one of the lowest tariff regimes among major Asian manufacturing hubs, with a marginal advantage over competitors, such as Bangladesh, Sri Lanka, Vietnam and China. The tariff relief is expected to create a level-playing field, particularly for small and medium exporters in clusters such as Surat, Gurugram and Tirupur.Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation, said sourcing interest of US from India is rising and exports are likely to improve steadily. “The apparel and home textile exports will witness month-on-month double-digit growth from the 2026–27 fiscal, lifting the monthly apparel export run rate to $1.5 to $1.6 billion, from the current $1.3 billion.”

Eyeing a level-playing field

A Sakthivel, chairman of the Apparel Export Promotion Council, said improved trade terms would significantly enhance the competitiveness of Indian apparel products in the US market.The leather sector has termed the US decision to reduce tariffs to 18% a “double dhamaka”, coming soon after India’s strategic trade deal with the European Union. Israr Ahmed, former vice-president of the Federation of Indian Export Organisations (Fieo) and managing director of the Farida Group, said exporters had been absorbing the impact of high tariffs by offering discounts of 20–30%. “With the US now reducing tariffs on Indian goods to 18%— a rate lower than those faced by key South Asian competitors, such as Bangladesh and Vietnam — these heavy discounts are no longer necessary,” he said, adding that this would help restore pricing and margins.Rafiq Ahmed, chairman of Kothari Industrial Corporation, noted that competition in the US market has intensified over the past year but said long-standing relationships would help Indian exporters regain lost ground. “The orders from the US, which got reduced in the past one year, will start flowing,” he said.Yavar Dhala, vice-president of the Indian Shoe Federation and CEO of Infinite Leather, said India’s share of leather exports to the US could rise from about 22% to nearly 30% this year, adding that factories operating fewer days due to high tariffs could return to a six-day work week.

Business

Disney names Josh D’Amaro as new chief executive

The media giant chooses the head of its amusement park business to replace longtime boss Bob Iger.

Source link

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports7 days ago

Sports7 days agoCollege football’s top 100 games of the 2025 season

-

Entertainment7 days ago

Entertainment7 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics7 days ago

Politics7 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports7 days ago

Sports7 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment7 days ago

Entertainment7 days agoK-Pop star Rosé to appear in special podcast before Grammy’s