Fashion

Emtec to showcase TSA Tactile Sensation Analyzer at ITMA ASIA + CITME

emtec Electronic GmbH introduces a new era in textile feel simulation at China’s most important textile event. The key benefit: TSA and Virtual Haptic Library improve the communication along the supply chain by providing a clear terminology and objective targets for the different haptic quality parameters. This helps companies to reduce costs, accelerate decision-making, and minimize their environmental footprint by decreasing the number of physical samples needed.

At ITMA ASIA + CITME 2025 in Singapore, Emtec Electronic GmbH will showcase its TSA and cloud-based Virtual Haptic Library, enabling digital fabric feel simulation to cut costs, speed decisions, and reduce samples.

Marking its 30th anniversary, emtec highlights its shift into textiles and invites visitors to booth H3-B303 for live testing and demonstrations.

In the cloud-based Virtual Haptic Library the test results can be digitized for further processing. This digital platform links TSA data to realistic, virtual haptic profiles, allowing users the impression of how fabrics feel – without physical samples. This digital platform links TSA data to realistic, virtual haptic profiles, allowing users to feel fabrics digitally – without physical samples. This helps companies to reduce costs, accelerate decision-making, and minimize their environmental footprint by decreasing the number of physical samples needed.

2025 marks a special milestone for emtec Electronic: the company celebrates its 30th anniversary. Since 1995, emtec has been dedicated to developing innovative testing solutions that combine precision, efficiency, and ease of use – a commitment that continues to drive its success and partnerships worldwide. “The ITMA is the perfect stage to demonstrate how far our solutions have come – and to show our partners and customers what the future of objective hand-feel analysis will look like.” says Giselher Gruener, Managing Director of emtec Electronic. “With our long-standing expertise in the paper industry, we are now setting a clear focus on establishing ourselves in the textile sector.”

From 28 – 31 October 2025 Markus Amthor from emtec’s Global Business Development will be available on-site, supported by the company’s regional sales partner in China, James Xiang from RoacheLab (Asia) Co., Ltd. Visitors of the ITMA ASIA + CITME are warmly invited to bring their own textile samples to the booth H3-B303 for live testing and direct discussion of results.

Visit the emtec team in Singapore to discover how their tactile analysis solutions can optimize the product development and streamline communication with customers and partners across the globe.

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (HU)

Fashion

Swarovski brings its ‘Masters of Light’ exhibition to Los Angeles

Published

October 29, 2025

Swarovski’s traveling exhibition “Masters of Light” made its U.S. debut on Wednesday, at the Amoeba Music venue in Los Angeles.

Running until November 3, the exhibition celebrates the Austrian luxury house’s 130th anniversary and its heritage of creativity, craftsmanship, and cultural influence.

Curated by British fashion journalist and critic Alexander Fury, and presented under the creative direction of Swarovski global creative director Giovanna Engelbert, the latest chapter, Masters of Light — Hollywood, explores Swarovski’s deep ties to the entertainment industry and its role in shaping some of the most memorable moments in cinema and fashion history.

“We are delighted to bring the Masters of Light exhibition to Los Angeles as part of our 130 Years of Joy anniversary celebration,” said Alexis Nasard, Swarovski CEO.

“As the global epicenter of the music and film industry, this is the ideal setting to honor our intimate connection to Hollywood and our role in its most iconic moments. Swarovski continues to be a key protagonist in pop culture through the sparkle of our various activities and are proud to celebrate our legacy through this.”

Among the standout displays is the original gown worn by Marilyn Monroe when she famously sang “Happy Birthday” to U.S. President John F. Kennedy.

The exhibition also features the Pop Icons chamber, showcasing crystal-embellished outfits worn by performers including Beyoncé, Madonna, Tina Turner, and Lady Gaga.

Another section, Silver Screen Style, highlights Swarovski’s longstanding collaborations with Hollywood costume designers and filmmakers, while Mathemagical delves into the brand’s savoir-faire in crystal making and jewelry design, spotlighting couture pieces created by Engelbert for the Met Gala.

Adding a contemporary twist, Engelbert expands Swarovski’s narrative to include modern pop culture through displays of its iconic crystal figurines from Disney princesses to Marvel superheroes, and introduces a limited-edition collaboration with Erewhon, featuring exclusive products available during the exhibition.

“Since I joined as global creative director in 2020, my goal has been to spotlight this link between Swarovski and pop culture, fashion, stage, and screen,” explained Engelbert.

“It has been a dream working on this US premiere in the heart of Hollywood. There is no better location to showcase the stories and iconic pieces that have made us a staple of pop culture for 130 years and counting.”

Copyright © 2025 FashionNetwork.com All rights reserved.

Fashion

Italy’s Artknit Studios opens first London pop-up

Published

October 29, 2025

It’s time to “invite a new audience to experience [our] signature approach to refined, sustainable luxury”. So says premium Italian knitwear label Artknit Studios, which has chosen upscale Draycott Avenue in London’s Chelsea for its first physical pop-up store “that’s an important milestone in the brand’s European expansion”.

Known for its “commitment to Italian craftsmanship and 100% natural materials”, the brand said the new store is “a cosy enclave of Italian elegance where heritage craftsmanship meets timeless style”.

The interior “blends an understated storefront with warm, artisanal touches”. This means handcrafted furniture and tiles from Biella (the brand’s Italian home) sit alongside restored vintage pieces. Meanwhile, dark wood, metal accents, soft textiles, and a muted palette “create an immersive, welcoming environment”.

Its autumn seasonal offer is “centred on the versatility of wool”, with the collection moving from “lightweight city essentials to structured winter tailoring”.

Highlights include fine-gauge sweaters, combed-wool polos, and overshirts, alongside twill jackets and cardigans.

Alessandro Lovisetto, founder and CEO, said: “Following the success of [our] flagship stores in Milan, Rome, and Paris, [we’re] excited to bring our philosophy of ‘less, but better’ to the British capital.

“London feels like [our] natural home… a city that values the same things we do: quality, craftsmanship, and timeless design.”

Copyright © 2025 FashionNetwork.com All rights reserved.

Fashion

Max&Co to launch in India with Reliance Brands Limited

Published

October 29, 2025

Reliance Brands Limited has signed a long-term master franchise agreement to bring the Max&Co fashion brand to India. As part of the partnership, the first Max&Co store in India is set to open in Mumbai in early 2026.

“Max&Co embodies a bold, modern expression of femininity– dynamic, joyful, and unapologetically individual– a spirit that deeply resonates with the evolving style and confidence of Indian women,” said Reliance Retail Ventures Limited’s executive director Isha Ambani in a press release. “It’s distinctive fusion of Italian design heritage and youthful energy will have significant appeal for the Indian woman. Through our partnership with Max Mara Fashion Group, we are proud to bring this iconic global brand to India and shape a new chapter in contemporary women’s fashion.”

Following the mono-brand store opening in Mumbai, Reliance Brands Limited will undertake a national roll-out for the brand in key metropolitan cities. Max&Co is part of the Max Mara Fashion Group and specialises in contemporary Italian ready-to-wear and accessories, the full offering of which will be available in the upcoming India stores along with seasonal ‘&Co.llaboration’ capsule lines.

“We are pleased to join forces with Reliance Brands, whose strong experience in building and nurturing global premium brands makes them an ideal match for Max&Co in the region,” said Maria Giulia Prezioso Maramotti, Max&Co’s brand divisional director and Max Mara Fashion group board member. “India represents a vibrant and forward-thinking market, one that shares our passion for creativity, style, and self-expression. Our future mission is to inspire a new community of women who live with confidence, curiosity, and a cool, modern attitude.”

This partnership taps into the increasing demand for modern luxury and global fashion amongst Indian consumers. Founded in 1986, Max&Co is distributed in more than 400 stores across the globe and online.

Copyright © 2025 FashionNetwork.com All rights reserved.

-

Fashion1 week ago

Fashion1 week agoChinese woman charged over gold theft at Paris Natural History Museum

-

Entertainment1 week ago

Entertainment1 week agoJohn Grisham unveils his first-ever mystery, “The Widow”

-

Tech1 week ago

Tech1 week agoThis Smart Warming Mug Is Marked Down by $60

-

Tech1 week ago

Tech1 week agoEaster Island’s Moai Statues May Have Walked to Where They Now Stand

-

Fashion1 week ago

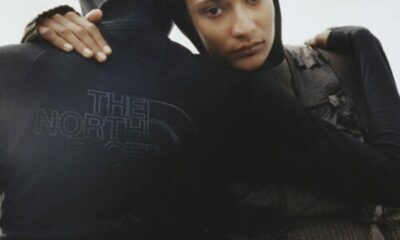

Fashion1 week agoThe North Face and Cecilie Bahnsen launch second collaboration

-

Politics5 days ago

Politics5 days agoTrump slams ‘dirty’ Canada despite withdrawal of Reagan ad

-

Entertainment1 week ago

Entertainment1 week agoPrince Harry hit with an accusation: ‘Don’t blame us!’

-

Sports1 week ago

These five NBA players could be ready for an all-star breakthrough