Business

Energy giants told to pass on £150 discount to customers

The Government has instructed energy companies to ensure that customers on fixed tariffs also benefit from the £150 reduction in household bills, a measure announced in the recent Budget.

Chancellor Rachel Reeves confirmed her intention to lower energy costs and alleviate the cost of living, with an average household bill set to decrease by £150 from April.

This saving, Ms Reeves explained, would be achieved by abolishing the Energy Company Obligation (Eco) scheme, which she asserted had burdened households with an additional £1.7 billion annually.

Energy Secretary Ed Miliband formally wrote to energy firms on Wednesday, urging them to extend the benefit of this reduction to consumers currently on fixed energy tariffs.

These tariffs guarantee a consistent unit rate and standing charge for the duration of the agreed contract, typically a year or longer.

In contrast, those on standard variable tariffs experience fluctuating rates, which adjust according to wholesale market costs paid by suppliers, without a set timeframe.

In his letter, Mr Miliband wrote: “This Government has made a clear commitment to cut people’s bills and help ease the financial pressure on millions of families, as we know energy costs cause such anxiety for many people, and that is why we are acting now.

“As we move forward, we want to set out our clear expectation that every single penny of our intervention at this Budget is passed on to consumers, including those on existing fixed term tariffs.

“Around 37% of the market is now on a fixed term tariff and Government is clear that they must benefit from this reduction in bills.

“We urge you to continue to work with our department to ensure that this happens.

“This close, joint working will be both welcomed and reassuring for customers, demonstrating our shared commitment to fairness and consumer protection.

“Thank you once again for your partnership and for your efforts to ensure that these positive changes reach every household.”

According to latest Ofgem figures, around 21 million domestic customers’ energy accounts are on fixed tariffs, while around 34 million remain on standard variable tariffs.

Ned Hammond, deputy director of customer policy at Energy UK, which represents suppliers, said: “The energy industry has long called for Government action to reduce costs, having seen directly how many households are struggling to afford their energy bills and with customer debt at record levels.

“So last week’s Budget announcement was very welcome and suppliers will of course look to pass on the savings. However, it’s also expected that there will be some new costs added to bills over the coming months.

“While most customers remain on the price cap, where the amount they pay for energy is set by Ofgem, suppliers also set their own fixed tariffs to compete on price with each other and so have every reason to pass on any cost savings with these.”

Business

Aviva flags potential for Iran conflict to send claims costs rising

The boss of insurer Aviva has cautioned that a lengthy conflict in the Middle East could send the cost of vehicle parts and repairs surging in an echo of the aftermath seen after Russia’s invasion of Ukraine.

Chief executive Amanda Blanc said the group has seen limited claims so far relating to the US-Israel war with Iran, but flagged the potential for claims costs to jump if supply chains are badly disrupted for a long time.

She said: “We have a good case study on this in terms of the Ukraine situation back in 2022 and the impact on the supply chain, which had an inflationary impact on vehicle parts and replacement vehicles.

“Obviously, if this goes on for a prolonged period of time, we would expect that this could have some impact, but to speak about this from an Aviva perspective, we are very well placed to manage that with our supply chain and our owned garage network.”

Ms Blanc added: “We will take action as necessary to make sure we look after our customers and price accordingly for any new inflationary impact.”

She said there had been “very limited” travel claims so far.

Ms Blanc added: “We have had calls from customers asking about whether they should travel and those sorts of things, and we are pointing them to the Foreign Office guidance on that.”

Full-year results from Aviva on Thursday showed annual earnings leaped 25% higher, while the firm also announced it was resuming share buybacks as it continues to benefit from its £3.7 billion takeover of Direct Line.

The group unveiled an earnings haul of £2.2 billion for 2025, up from £1.8 billion in 2024, including a £174 million contribution from Direct Line, helping the group hit its financial targets a year early.

Aviva unveiled a £350 million share buyback after putting these on hold due to the Direct Line deal, which completed last year.

Ms Blanc cheered an “outstanding performance”.

She said: “We have transformed Aviva over the last five years and whilst we have made significant progress, there is so much more to come.”

Artificial intelligence (AI) is also a big area of focus for the firm, according to Ms Blanc.

“We have clear strengths in artificial intelligence which are creating major opportunities to transform claims, underwriting and customer experience,” she said.

Business

South East Water faces £22m fine for supply failures

The firm was unable to cope during high demand, Ofwat says, leading to “immense stress” for customers.

Source link

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

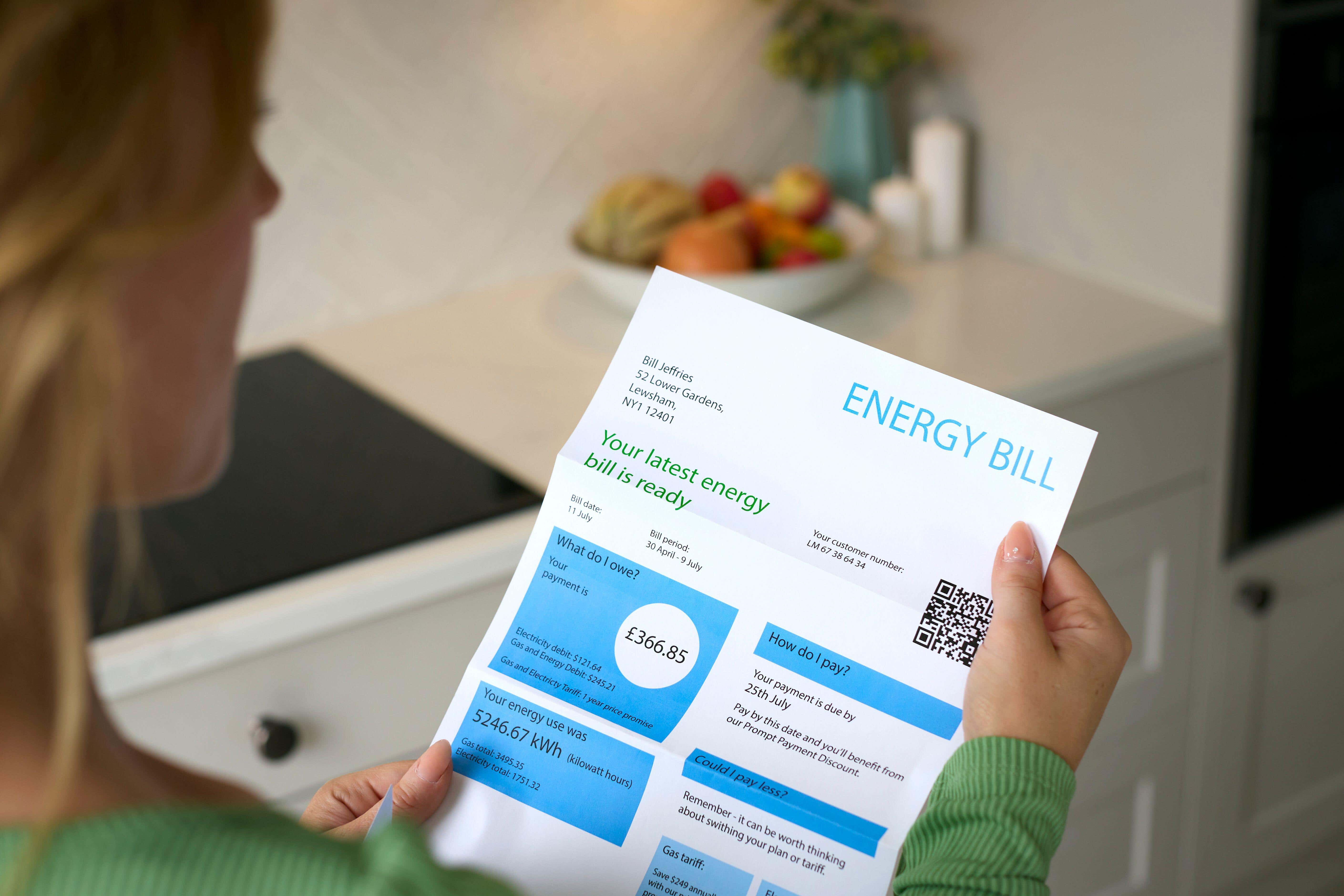

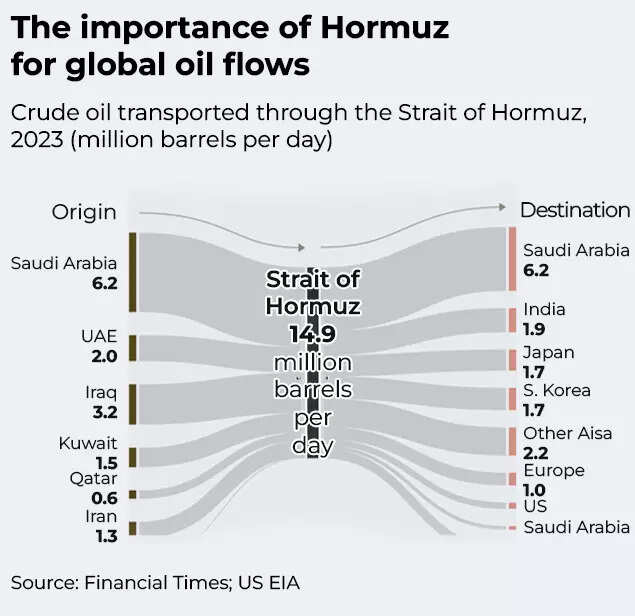

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’