Business

Evergrande: Why should I care about the crisis-hit Chinese property giant?

Business reporter, BBC News

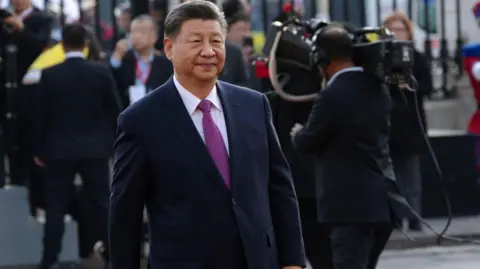

Getty Images

Getty ImagesWhat does Evergrande do?

Evergrande, formerly known as the Hengda Group, was founded by Mr Hui in 1996 in Guangzhou, southern China.

At the time of its collapse, Evergrande had some 1,300 projects under development in 280 cities across China.

The Evergrande Group as a whole encompassed far more than just real estate development.

Its businesses ranged from wealth management to making electric cars. It even owned a controlling stake in the country’s most successful football team, Guangzhou FC.

Mr Hui was once Asia’s richest person with his fortune estimated at $42.5bn (£31.6bn) by Forbes, but his wealth plummeted as Evergrande’s problems deepened.

Why is Evergrande in trouble?

Evergrande expanded aggressively to become one of China’s biggest companies by borrowing more than $300bn.

But in 2020, the Chinese government brought in new rules to control the amount owed by big real estate developers.

The new measures led Evergrande to offer its properties at major discounts to ensure money was coming in to keep the business afloat.

That meant the company struggled to meet the interest payments on its debts.

Since the start of the crisis Evergrande’s shares have lost more than 99% of their value.

In August 2023, the firm filed for bankruptcy in New York, in a bid to protect its US assets as it worked on a multi-billion dollar deal with creditors.

Why do Evergrande’s problems matter?

Evergrande’s problems and the property crisis as a whole have hurt the Chinese economy as the real estate industry accounted for about a third of the country’s gross domestic product (GDP), an annual measure of all economic activity.

It was not only a significant driver of growth but also a major source of revenue for local governments.

Getty Images

Getty ImagesA sharp fall in investment and fund raising activities in real estate have impacted the financial sector, and allied industries like construction, which are a huge source of employment.

At the grassroots level, it has hit ordinary people in China hard as many families put their savings into property.

All of this has helped put pressure on consumer spending, which Beijing sees as crucial to boosting economic growth.

Why didn’t Evergrande get a state bailout?

Through the property crisis the Chinese government has taken a number of measures to help shore up the industry and the economy.

Beijing has poured hundreds of billions of dollars into measures including the country’s central bank providing low-interest loans for state-controlled banks to support struggling real estate projects.

There has also been help for home buyers and incentives to purchase new household appliances.

But it did not roll direct bailouts for the country’s struggling developers, partly to avoid encouraging more risky behaviour.

While the property market was once crucial to China’s economic growth, President Xi Jinping’s focus has changed to competing with US to gain the lead in high-tech manufacturing and AI.

So the ruling Communist Party‘s economic priorities have shifted to areas like renewable energy, electric vehicles, automation and robotics.

Business

Go Digit General Insurance gets GST demand notice of Rs 170 cr – The Times of India

Go Digit General Insurance on Saturday said it has received a demand notice of about Rs 170 crore for short payment of goods and services tax (GST) for nearly five years. The company has received an order copy from the Office of the Commissioner of GST & Central Excise, Chennai South Commissionerate on March 6, confirming GST demand of Rs 154.80 crore levying penalty of Rs 15.48 crore and Interest u/s 50 of CGST Act, 2017 for the period July 2017 to March 2022, the insurer said in a regulatory filing. The company is in the process of evaluating the legal advice on the implications and would file an appeal, it said.

Business

India–US trade ties: Piyush Goyal says India secured best deal among competing nations – The Times of India

Commerce and industry minister Piyush Goyal on Saturday said India has secured the best trade deal with the United States among competing nations, highlighting the strength of the economic and strategic partnership between the two countries, reported PTI.Speaking at the Raisina Dialogue 2026 in New Delhi, Goyal said India and the US share a “very powerful” relationship, adding that the world’s largest economy remains an important partner for New Delhi.

“It has been a fantastic journey. We have the best of relations. You would have observed that through the last year, President Donald Trump has always had the best things to say about India as a country, and about Prime Minister (Narendra) Modi. We have fantastic relations with our counterparts there.“Even within your family, sometimes you can have one or two misunderstandings. It’s a part of the course. I think it’s a very, very powerful relationship that the US and India share. And we got the best deal amongst all the nations with whom we compete,” Goyal said.He added that the two countries are strategic partners and the largest democracies in the world, noting that the US, with a $30 trillion economy, remains central to global trade.“We have a large responsibility cast on both our nations. They are the world’s largest economy, USD 30 trillion economy, nobody can wish them away,” he said.Explaining the significance of trade agreements, Goyal said such deals are meant to secure preferential access for a country’s goods and services compared to competitors.“What’s a trade deal? You are trying to get a preference or a preferential access for yourself, your goods, your services, compared to your competitor. And we got the best deal amongst all the competing nations. I mean whether it’s in our neighbourhood Pakistan or Bangladesh. If we look at the Asian region, we got the best deal amongst all of the competitors…” he said.The minister added that the India-US partnership extends beyond trade, encompassing technology cooperation, critical minerals, defence ties and investments.“There’s a huge technology overlay on it. There’s a huge critical minerals partnership, there’s a defense partnership, there’s a huge amount of investments that flow into India from the US. So it’s a partnership of two countries which is going to define the future,” he said.His remarks come as India and the US have finalised the framework for the first phase of a bilateral trade agreement, under which Washington had announced it would reduce reciprocal tariffs on India to 18 per cent.However, after the US Supreme Court struck down the tariffs, President Donald Trump imposed a 10 per cent tariff on all countries from February 24 for 150 days.A meeting between the chief negotiators of the two countries to finalise the legal text of the agreement has also been postponed.Under the proposed deal, India will eliminate or reduce tariffs on US industrial goods and a range of American agricultural products, including dried distillers’ grains (DDGs), red sorghum for animal feed, tree nuts, fresh and processed fruits, soybean oil, wine and spirits, among others.India has also indicated that it plans to purchase $500 billion worth of US energy products, aircraft and aircraft parts, precious metals, technology products and coking coal over the next five years.Goyal also referred to the nine free trade agreements finalised by the Modi government, saying they were negotiated while safeguarding domestic interests.“These nine free trade agreements, I can say on record with all the courage that I have on my command with all the responsibility that in not a single trade deal, has India compromised on any sensitivity of any of our stakeholders,” he said.Opposition parties, however, have alleged that the government has compromised the interests of farmers in the India-US trade pact.Goyal said opening the auto sector under certain FTAs would expand consumer choice and create employment opportunities.“Demand for this industry is growing at an average of 8 per cent. So you can imagine how much more scope we have to create jobs,” he said.He added that while companies from FTA partner countries may initially export cars to test the Indian market, they would eventually need to manufacture locally once demand is established.“Initially they can sell, say, 5,000 cars or 10,000 cars, to test the market, find the distraction — and then come and manufacture here,” he said.He added that the government’s broader objective is to build a global network of trade partnerships through multiple FTAs.

Business

Inside the booming business of wellness third spaces and membership clubs

A few years ago, Grace Guo began to crave places in New York City where hanging out with friends didn’t have to involve alcohol.

Newly sober and surrounded by friends who also chose not to drink, Guo said she wanted alternatives to the typical social scene. After some research, she landed on Bathhouse and Othership: social wellness clubs designed to create communities around improving health.

“Honestly, it kind of just feels like going to a spa together and spending an afternoon together. I think for me, it just feels much better rather than staying out late at night,” Guo told CNBC.

She’s one of a growing number of people seeking out membership clubs and other places that are structured around maintaining health while also acting as a spot to foster connection.

And those spaces are becoming booming businesses, too. Bathhouse, which opened in 2019 in Brooklyn, New York, told CNBC exclusively that it expects to hit around $120 million in revenue by the end of this year. It declined to disclose any of its other financials, as did Othership.

Many of these types of companies are privately held, but publicly traded gym chain Life Time also began doubling down on premium wellness a few years ago. While investors initially did not like that reallocation of resources, it’s now paying off, with Life Time’s stock more than doubling since October 2023.

Companies old and new are trying to reach consumers like Guo. The 31-year-old said she’s seen an increased focus on health, wellness and peacefulness in her own social life and in those around her, as she searches for so-called third spaces with that focus.

“I’m kind of like, where can I go to try to plug into a community, or where can I go to express a particular interest that I have and find like-minded people?” Guo said. “It’s finding a group of like-minded people, but then also having the space and the novelty to try something or to pursue something.”

At Othership, between spending time in the sauna and the cold plunge and choosing a popular evening time slot, Guo said the environment of health-focused socializing spoke to her.

“Having a space to go to where it kind of shocks us out of our routine and complacency is really important, and I think probably the biggest thing is just the fact that it overcomes a lot of the inertia of doing something,” Guo said.

‘Loneliness is an epidemic’

Bathhouse pools

Source: Bathhouse

The concept of third spaces isn’t new. The term was first coined by sociologist Ray Oldenburg in his 1989 book, “The Great Good Place,” to refer to spaces outside of the home, or the first place, and work, the second place, where people gather and form relationships.

That definition came to encompass places like neighborhood coffee shops, libraries, bars and more, where people from different backgrounds came together in an informal setting with relatively low barriers to access.

But somewhere in the past few years, that definition has evolved, and the importance of third spaces has blossomed.

Richard Kyte, a professor at Viterbo University in Wisconsin and the author of “Finding Your Third Place,” said he’s been teaching courses on third places for nearly two decades, but only noticed the term becoming mainstream in the past few years.

That turning point, Kyte said, also coincided with the pandemic, which sent the world into lockdowns and practically eliminated social gatherings for a period while redefining them for the long term.

“During that time, all of a sudden, we were talking more about the cost of loneliness, the cost of social isolation. It really came home to us during the pandemic that this was not healthy,” Kyte told CNBC. “And at the same time that we were noticing that we need these places more, we were seeing that so many of them were closing. That kind of spurred a renewed interest.”

It’s a trend that’s also been compounded by an increasingly digital-forward society, he added, as younger generations crave more than just social media connections even with the rise of artificial intelligence and chatbots.

“We’ve got all of this huge investment in technology that increases the ease and desirability of being independent,” Kyte said, citing AI companies promoting products that pose as friends. “When we have people turning more to their screens instead of looking to find fulfillment through social interaction, it just takes all these people out of the pool.”

According to Cigna’s 2025 “Loneliness in America” report, 67% of Gen Zers reported feeling lonely, along with 65% of millennials. A 2024 Harvard survey found that 67% of adults feel social and emotional loneliness because they are not part of meaningful groups.

Harry Taylor first founded Othership alongside his wife and friends to create a space that incorporated the wellness trend while combating that isolation.

“We understand that there’s a huge market for people to meet other people. Loneliness is an epidemic right now,” Taylor told CNBC. “We realized, just through doing this, it has the capacity for people to come together and just be themselves, be vulnerable.”

What’s old is new

Third spaces have evolved to encompass specific purposes, justifying the price tag that often comes with them, since some membership clubs can thousands of dollars per month.

Wellness, specifically, has seen a recent boom, becoming one of the top categories for gifting items last holiday season. Equinox chairman Harvey Spevak told CNBC last month that “health is the new luxury,” with the global wellness market expected to reach nearly $10 trillion by 2030, according to estimates from the Global Wellness Institute.

Bathhouse, which operates roughly 90,000 square feet of facilities in New York City, offers a wellness experience based on the bathhouse legacy of Europe. The space has saunas and cold plunges, both guided and unguided, starting at $40 for a drop-in session. The company’s two New York locations see roughly 1,000 customers each day.

“It was really apparent that there was no bathhouse-like concept that was really oriented towards a modern consumer, especially not in America,” co-founder Travis Talmadge told CNBC.

Talmadge said he and his co-founder were focused on creating a human experience, tapping into each person’s body while also building community around the shared activities.

“Our spaces are really large scale, so one of the nice things is that everybody kind of feels like a background actor on set, where there’s just so many people moving around,” Talmadge said. “You can have this really personal time, either by yourself or with somebody else, but then you’re in this environment with a lot of people doing the same thing.”

Talmadge said the company has seen a “surplus of demand” and runs at a “very healthy margin,” with plans to open seven more locations through 2027.

It’s just one of many wellness spaces growing in popularity.

Othership is also tapping into a wellness mindset, incorporating practices from various cultures to address the “physical, mental emotional and spiritual.” It has locations in New York and Canada, with plans for more growth.

At Othership, members can choose between three options: a free-flow session, designed to allow members to use the space however they want; classes, which alternate between saunas and cold plunges with group-led activities; and socials, imitating clubs without the alcohol in an effort to be present.

Co-founder Taylor said through Othership, he’s seen customers form new friend groups, propose to their partners in the sauna and find belonging with others while also fueling their own health.

Creating alcohol-free spaces was one of the Othership founders’ aims when creating the vision. Othership now hosts comedians, live musicians and more at its saunas to mimic similar spaces seen in big cities that are often associated with alcohol.

“There’s so much social media, which gives us the false perception that there’s social engagement and interaction, but so many of us have experienced when we’re doomscrolling, it almost even does the opposite,” Taylor said. “There’s a void in the wake of that social satiation that we all require as humans, so it’s that coming together and just being so real with one another that really creates a deep sense of belonging.”

Building community

Glo30 skincare studio.

Courtesy: Arleen Lamba

Wellness communities can form in other ways, too. Glo30, a membership studio founded 13 years ago with locations across the country, offers personalized skincare treatments for members every 30 days, creating a schedule aligned with other members to foster community.

“Community building is a lot about not just getting the results and [feeling] good, but also being able to have a commonality on their experiences and share what they feel,” Glo30’s founder and CEO Arleen Lamba told CNBC.

While urban cities like New York and Los Angeles have seen a boom in wellness clubs, Lamba said her more than 100 locations represent the in-between, in places like Texas, Arizona, North Carolina and more.

Every Glo30 appointment is scheduled on the hour in each location to create more opportunities for social connection, Lamba said.

“As people come into the studio, people are also leaving the studio, and we recognize that they recognize each other, they would actually make new friends,” she said, adding that especially post-pandemic, the company has seen a growing number of social groups form in the treatment rooms.

Lamba said she’s seen the craving for social connection increase with the rise of social media, but that creating community can often happen in untraditional places, like Glo30. At the same time, that social interaction isn’t as “overwhelming” as other places like parties or big group events, allowing for intimate socializing, she said.

In the past two years, Lamba said the number of Glo30’s franchise units in development has grown 67.5% as it sees more demand for its services.

The boom of third spaces goes beyond wellness, too. Exclusive restaurant memberships, gyms, creative spaces, social clubs and more are gaining more popularity as consumers search for ways to build community outside of their houses and offices.

At Glo30, Lamba said she’s seen every type of customer base at the company’s locations, from families to girl groups to couples.

“The third space is interesting because it creates a true connection,” she said. “We get to be witness to someone’s life — their highs, their lows, their middles — and we are the constant, and that, to me, is what the third space is about: No matter what kind of day you had out there, good or bad or medium, this space belongs to you. And when you come to this space, people will know you, see you, appreciate you and be glad you’re there.”

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Fashion1 week ago

Fashion1 week agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026

-

Entertainment1 week ago

Entertainment1 week agoPakistan’s semi-final qualification scenario after England defeat New Zealand

-

Business1 week ago

Business1 week agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Politics1 week ago

Politics1 week agoIran launches retaliation against Israel, launches ballistic missiles