Business

Female artists (and Oasis) drove UK music sales in 2025

Mark SavageMusic correspondent

Getty Images

Getty ImagesTo almost no-one’s surprise, Taylor Swift dominated the UK music charts in 2025.

The star’s 12th album, The Life of a Showgirl, was the year’s biggest seller, shifting an impressive 642,000 copies since its release in October.

Women led the way all year, with breakout Brits like Olivia Dean and Lola Young powering the music industry to a record-breaking year, as combined sales rose by nearly 5% to 201 million albums sold or streamed.

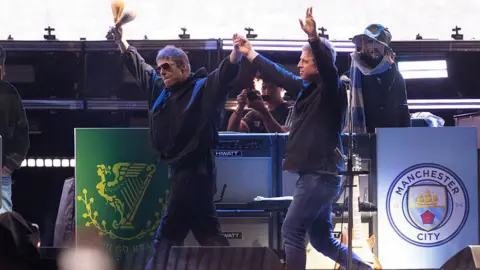

There was also a huge resurgence for Oasis, whose blockbuster reunion tour helped them shift more than one million albums during 2025.

The band’s greatest hits compilation, Time Flies, was the fourth biggest album of the year, while (What’s The Story) Morning Glory, was seventh.

Getty Images

Getty ImagesThe figures were revealed by the British Phonographic Industry (BPI), which said streaming now accounts for 89% of the overall music market.

Fans streamed 210.3 billion songs over the course of the year, with US singer Alex Warren’s Ordinary the year’s most-played track.

However, Warren’s song was one of the only new releases to make a major impact – as older songs clogged up the charts.

Six of the Top 10 best-selling tracks came out in 2024. Chappell Roan’s Pink Pony Club was even older: It was originally released in 2020.

It was a banner year for new female talent in the UK, with Lola Young landing the year’s second-biggest single, with Messy.

Olivia Dean also became the first woman in UK chart history to achieve her first number one single (Man I Need) and album (The Art Of Loving) in the same week.

Asked why her songs had resonated with so many people, Dean said she’d tried to make her album an antidote to troubling times.

“I wanted it to feel just like a hug – comforting,” she told the BBC’s Sidetracked podcast.

“I just said everything needs to feel warm and intimate.”

Dean will cap off her incredible year – which also saw her achieve four simultaneous top 10 hits – by appearing on Jools Holland’s Hootenanny.

There were also breakthroughs for confessional songwriters Skye Newman and Sienna Spiro; while artists like Raye, PinkPantheress and Wet Leg all consolidated their first wave of success at home and abroad.

On the singles chart, female artists accounted for two-thirds of 2025’s number one hits; and former Little Mix star Jade achieved the biggest opening week for a debut album with her critically-acclaimed That’s Showbiz, Baby!

Getty Images

Getty ImagesVinyl sales have risen for 18 successive years and increased rapidly again, up 13% year-on-year to 7.6 million units.

Swift’s Life Of A Showgirl led the pack, and the star scored another entry in the Top 10 with Lover (Live From Paris) – a limited edition release which was only available for 72 hours on Swift’s website.

According to the Official Charts Company, it sold 47,000 copies in that short stretch of time; and subsequently became the first album to reach number one on pure sales (with no streams contributing to its total) in eight years.

Overall, vinyl sales have doubled in the last decade, and are on course to overtake CDs for the first time since the 1990s.

The two formats are now separated by just 2 million sales, with 9.7 million Compact Discs sold in 2025. Ten years ago, that figure was 47.3 million.

Although it’s very much a niche market, cassettes also saw a 53.8% sales increase to 164,491 units in 2025.

The soundtrack to Robbie Williams’ biopic Better Man was, for reasons that remain unclear, the year’s best seller on tape.

In its report, the BPI highlighted that a new generation of British talent had achieved international success in 2025.

Olivia Dean and Lola Young both broke into the US Billboard charts, and scored nominations for best new artist at next year’s Grammy Awards.

Rock acts including Yungblud, Sleep Token, Wolf Alice and Florence + The Machine also made waves abroad; while Ed Sheeran became the first overseas artist to top India’s Spotify Charts since 2021 with his single Sapphire.

These achievements were “an impressive feat, given more acts than ever are vying for audience attention”, said Dr Jo Twist, CEO of the BPI.

“The UK is still the second largest exporter of music globally, which is amazing, but we can’t be complacent because streaming has opened the floodgates to every bit of recorded music that’s ever been made,” she told BBC News.

“Luckily, we have a brilliant ecosystem in the UK which helps those artists reach global success – but it’s a tough competitive environment and that’s why we need the continued support of the British government.”

Business

FDA chief Marty Makary says ‘everything should be over the counter’ unless drug is unsafe or addictive

Food and Drug Administration Commissioner Marty Makary told CNBC that he believes “everything should be over the counter” unless a drug is unsafe, addictive or requires monitoring – doubling down on a push that some in the pharmaceutical industry have questioned.

In an interview Wednesday in Washington, D.C., Makary said the FDA aims to make changes this year that allow more companies to offer their prescription medicines over the counter, or OTC. He noted that the agency is going through “the proper regulatory processes” to update OTC monographs – the rulebooks that determine which drugs can be sold without a prescription.

Makary said the FDA is looking at “basic, safe” prescription drugs like nausea medications and vaginal estrogen, which is used to treat menopausal symptoms like dryness and pain.

“In my opinion, everything should be over the counter and not requiring a prescription, unless it’s unsafe, unless you need laboratory tests to monitor how it’s being received by your body, or if it could be used for some nefarious purpose or it’s addictive,” Makary told CNBC after the PhRMA Forum, a one-day event organized by the pharmaceutical industry’s largest lobbying group.

“If it doesn’t meet those criteria, why shouldn’t a drug be over the counter? So we should be asking, why not? Instead of, ‘Oh, you want to move over the counter, you got to go through a long, tedious process,'” he added.

Marty Makary, U.S. President Donald Trump’s nominee to be U.S. Food and Drug Administration (FDA) commissioner, testifies before a Health, Education, Labor, and Pensions (HELP) Senate Committee confirmation hearing on Capitol Hill in Washington, D.C., U.S., March 6, 2025.

Kent Nishimura | Reuters

The FDA has long considered making some prescription drugs available OTC to improve accessibility, reduce health-care costs and help patients stay on their medications. For example, patients wouldn’t have to take time off work to see a doctor for a prescription or could refill a drug without delay.

Congress boosted the effort through legislation in November that streamlines the regulatory process for prescription-to-OTC transitions, including full, conditional and partial “switch” pathways.

Makary framed the FDA’s latest push to expand OTC access as another way to lower drug costs, a key priority of the Trump administration. He argued that placing medications directly on store shelves would bypass insurers and pharmacy benefit managers, eliminating the rebate-driven system that often obscures a drug’s true price.

He also said selling drugs over the counter promotes transparency that “keeps prices in check.” In some cases, Makary said cash prices for OTC medicines are lower than patients’ copays for prescription drugs “when there’s a money game going on behind the pharmacy counter,” with employers and insurers sharing the cost.

Pharma questions OTC push

Some in the pharmaceutical industry have pushed back on that argument. Most OTC drugs are not covered by insurance, meaning their prices could eclipse those of generic prescription medicines and potentially make them less affordable for patients who rely on coverage.

In comments to the FDA earlier this month, the Association for Accessible Medicines argued that “the shift of many prescription drugs to nonprescription status could actually increase costs to patients, thereby decreasing patient access to treatments.” That organization represents manufacturers and distributors of generic prescription medicines.

The FDA also doesn’t have the authority to regulate drug prices. In its own comments this month, PhRMA said the agency must respect “the core principle that pricing considerations may not factor into FDA regulatory decision-making.”

The Pharmaceutical Research and Manufacturers of America added that the FDA should not attempt to transition any prescription drugs to OTC without first consulting manufacturers. But the group emphasized that it supports the FDA’s effort to expand access to crucial medicines.

In its own comment this month, AstraZeneca said several previous attempts to transition cholesterol-cutting statins to OTC status have been “unsuccessful, with consumers consistently having difficulty making proper self-selection decisions.”

Meanwhile, Makary told CNBC on Wednesday that “we have to trust people to make their decisions. We’ve got to get away from this paternalistic mindset.”

The FDA removed the longtime director of the office of over-the-counter drugs, Theresa Michele, from her position in December, STAT news reported at the time.

Business

Stock market today: Which are top gainers and losers on NSE and BSE on February 18? Check list – The Times of India

Market ended in green for the third straight session on Wednesday, with benchmark equity indices rising on the back of last-hour buying in banking, metal and FMCG stocks.The 30-share BSE Sensex jumped 283.29 points, or 0.34 per cent, to settle at 83,734.25 in a volatile trade. The 50-share NSE Nifty gained 93.95 points, or 0.37 per cent, to close at 25,819.35.Among the Sensex constituents, Tata Steel, ITC and Kwality Walls were the major gainers. On the other hand, Eternal, Tech Mahindra and Infosys were the laggards.“Indian markets witnessed a late surge driven by broad-based buying after a cautious start, as positive domestic sectoral cues helped offset lingering global uncertainties,” Vinod Nair, Head of Research, Geojit Investments Ltd, said.He added that banking and financial stocks remained resilient on the back of steady asset-quality expectations, while selective buying in FMCG names contributed to relative outperformance.Broader indices also traded firm, with the BSE Smallcap Select Index rising 1.02 per cent and the Midcap Select Index gaining 0.40 per cent.“Indian equity markets extended gains for the third consecutive session staging a gradual recovery, with the Nifty rising 0.4 per cent, supported by strength in PSU and metal stocks. On the flows front, FIIs remained net buyers on Tuesday, purchasing equities worth Rs 995 crore, while DIIs also bought shares worth Rs 187 crore, providing support to sentiment,” Siddhartha Khemka, Head of Research, Wealth Management, Motilal Oswal Financial Services Ltd, said.

Nifty50 top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| Kwality Wall’s | 29.33 | 1.38 ↑ | 4.94% ↑ |

| HDFC Life | 729.60 | 23.80 ↑ | 3.38% ↑ |

| Tata Steel | 209.03 | 5.95 ↑ | 2.93% ↑ |

| ITC | 332.45 | 7.00 ↑ | 2.16% ↑ |

| Tata Consumer | 1,170 | 21.20 ↑ | 1.85% ↑ |

| Bajaj Auto | 9,980 | 154.00 ↑ | 1.57% ↑ |

| Axis Bank | 1,377 | 19.80 ↑ | 1.46% ↑ |

| Reliance Industries | 1,441 | 18.30 ↑ | 1.29% ↑ |

| Nestle India | 1,301 | 15.60 ↑ | 1.22% ↑ |

| M&M | 3,531 | 41.30 ↑ | 1.19% ↑ |

Nifty50 top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| ONGC | 264.60 | -7.25 ↓ | -2.67% ↓ |

| Wipro | 211.95 | -3.75 ↓ | -1.74% ↓ |

| Eternal | 277.35 | -4.15 ↓ | -1.48% ↓ |

| Adani Enterprises | 2,211 | -31.71 ↓ | -1.42% ↓ |

| Infosys | 1,374 | -17.50 ↓ | -1.26% ↓ |

| Tech Mahindra | 1,505 | -19.00 ↓ | -1.25% ↓ |

| HCL Technologies | 1,467 | -15.40 ↓ | -1.04% ↓ |

| Adani Ports & SEZ | 1,551 | -15.50 ↓ | -0.99% ↓ |

| Coal India | 418.00 | -3.56 ↓ | -0.85% ↓ |

| TCS | 2,695 | -22.50 ↓ | -0.83% ↓ |

Sensex top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| Kwality Wall’s | 29.33 | 1.38 ↑ | 4.94% ↑ |

| Tata Steel | 209.03 | 5.95 ↑ | 2.93% ↑ |

| ITC | 332.45 | 7.00 ↑ | 2.16% ↑ |

| Axis Bank | 1,377 | 19.80 ↑ | 1.46% ↑ |

| Reliance Industries | 1,441 | 18.30 ↑ | 1.29% ↑ |

| M&M | 3,531 | 41.30 ↑ | 1.19% ↑ |

| Larsen & Toubro | 4,326 | 46.10 ↑ | 1.08% ↑ |

| Bajaj Finance | 1,024 | 9.65 ↑ | 0.96% ↑ |

| Bajaj Finserv | 2,061 | 16.20 ↑ | 0.80% ↑ |

| UltraTech Cement | 13,052 | 68.00 ↑ | 0.53% ↑ |

Sensex top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| Eternal | 277.35 | -4.15 ↓ | -1.48% ↓ |

| Infosys | 1,374 | -17.50 ↓ | -1.26% ↓ |

| Tech Mahindra | 1,505 | -19.00 ↓ | -1.25% ↓ |

| HCL Technologies | 1,467 | -15.40 ↓ | -1.04% ↓ |

| Adani Ports & SEZ | 1,551 | -15.50 ↓ | -0.99% ↓ |

| TCS | 2,695 | -22.50 ↓ | -0.83% ↓ |

| Asian Paints | 2,432 | -5.31 ↓ | -0.22% ↓ |

| NTPC | 368.00 | -0.40 ↓ | -0.11% ↓ |

| HDFC Bank | 924.70 | -1.00 ↓ | -0.11% ↓ |

| Maruti Suzuki | 15,164 | -15.00 ↓ | -0.10% ↓ |

In Asian markets, Japan’s Nikkei 225 benchmark closed 1 per cent higher, while markets in China, Hong Kong and South Korea remained closed due to Lunar New Year holidays. European markets were trading higher in mid-session deals, and US equities had settled in positive territory on Tuesday.Foreign institutional investors bought equities worth Rs 995.21 crore on Tuesday, while domestic institutional investors purchased stocks worth Rs 187.04 crore, according to exchange data. Brent crude, the global oil benchmark, rose 0.33 per cent to USD 67.64 per barrel.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Barry nurse who overpaid thousands in income tax issues warning to others

Belby, a district nurse, had hoped to get the money returned in time for Christmas but found the process of trying to secure her refund slow and stressful, especially because she said she was given conflicting information and was quoted two vastly different figures of how much she was owed.

-

Business1 week ago

Business1 week agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion1 week ago

Fashion1 week agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoGold price today: How much 18K, 22K and 24K gold costs in Delhi, Mumbai & more – Check rates for your city – The Times of India

-

Business6 days ago

Business6 days agoTop stocks to buy today: Stock recommendations for February 13, 2026 – check list – The Times of India

-

Fashion6 days ago

Fashion6 days agoIndia’s PDS Q3 revenue up 2% as margins remain under pressure

-

Tech1 week ago

Tech1 week agoRemoving barriers to tech careers

-

Fashion1 week ago

Fashion1 week agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Fashion6 days ago

Fashion6 days ago$10→ $12.10 FOB: The real price of zero-duty apparel