Business

Five ways weight-loss jabs are changing spending habits

Esyllt CarrBusiness reporter

BBC

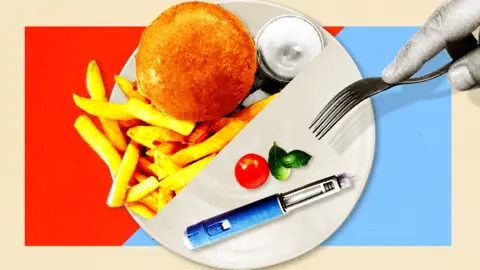

BBCThey’re the injections helping some people shed pounds, but weight-loss drugs are also transforming the way people spend.

About 1.6 million people in the UK used weight-loss jabs in 2024, the latest research from University College London suggests, with millions more saying they’d be interested in trying them.

For those paying privately, they can cost more than £300 a month – but with their popularity only expected to rise, how are businesses adapting to a new type of consumer?

Buying groceries: The rise of more nutrient-dense foods

Sam Gillson

Sam GillsonWeight-loss injections work by mimicking a natural hormone, GLP-1, which regulates hunger, and those who use them find their appetite is reduced.

“My weekly food shop’s really gone down,” says Sam Gillson, 38, from Shropshire, who got in touch with BBC Your Voice. He’s lost more than four stone using weight-loss jabs since June.

“I’m definitely buying more fresh foods, and fewer unhealthy ready meal/easy dinner options like pizza, chips and nuggets.”

In the last few weeks, supermarkets The Co-op, Morrisons and Marks and Spencer have brought out nutrient-dense ranges of ready meals, and Ocado now sells a 100g steak, which it said was in response to the growing number of customers seeking smaller portions.

Sam says eating less means he wants to make sure that “the smaller quantity does contain all those nutrients and vitamins you need”.

And it’s not just portion size. It’s also the kinds of foods.

Protein-rich products have been appearing on the shelves as smoothies and snacks.

Jonny Forsyth, food and drink strategist at consumer research group Mintel, says many of these trends are part of a wider shift, with health becoming more important, particularly for younger consumers.

He thinks GLP-1 drugs are “changing the culture”, making it fashionable to eat more nutrient-dense foods and “adding oxygen to existing trends”.

Dining out: ‘I used to go to a restaurant once a week. Now I don’t’

A survey by research consultancy KAM Insight last year found that nearly a third of people using GLP-1 drugs were going out to eat and drink less often.

Annie Haslam, 70, from Cornwall, has been using weight-loss injections since last March, and is currently spending around £186 a month on the jabs.

“Instead of having takeaways once or twice a month, I haven’t had one for months,” she says. “I used to eat out at a restaurant once a week maybe, I don’t do that any more.”

Sam also says he’s cut down on the number of takeaways he gets, but adds that while he feels healthier, he’s not actually saving any money given the cost of the injections themselves.

Earlier this month the boss of the bakery chain Greggs said there was “no doubt” that weight-loss drugs have led to people looking for “smaller portions”.

And it’s happening in fine dining too. The Michelin-starred restaurant The Fat Duck in Berkshire, run by celebrity chef Heston Blumenthal, has brought out a new menu, which Blumenthal said was for people looking to eat more “mindfully”, including those who are on appetite suppressants.

Drinking: ‘A strong trend towards sobriety’

There’s evidence too that those taking weight-loss drugs drink less alcohol.

A study carried out in February 2025 by consumer research firm Worldpanel by Numerator found a 15-percentage point drop in alcohol volume purchases among households with GLP-1 users compared to a controlled benchmark.

The Co-Op’s food trading director Nicole Tallant told the BBC the supermarket’s members who take weight-loss drugs are “reducing their alcohol intake alongside their consumption intake from food,” adding that “they’re much more concerned with overall health and holistic well-being”.

Recent years have also seen a surge in non-alcoholic drinks options hitting shelves and bars. The British Beer and Pub Association expects a record 200 million pints of low and no-alcohol beer to have been consumed in 2025.

“There’s already quite a strong trend towards sobriety,” says Mintel’s Jonny Forsyth.

“If I was an alcohol company, I’d be a bit worried about this. GLP-1 drugs could give that trend another boost.”

Fashion: A wardrobe that no longer fits

For Annie, one area she couldn’t avoid spending on was clothing. After going from a size 18 to a size 12, she says her old clothes were “literally falling off”.

She estimates that replacing everything, including underwear, probably cost her “a couple of thousand pounds”.

Dan Coatsworth, head of markets at AJ Bell, says that while none of the big fashion retailers on the stock market have explicitly talked about weight-loss drugs in their financial results commentary, in his view, the direction of travel is clear.

The popularity of weight-loss drugs will provide “a massive tailwind (boost) for the fashion sector”, he says.

While it’s unclear how this will present itself, Coatsworth believes second-hand platforms like Vinted, which are already popular, could see even more growth, for people who quite quickly find their wardrobe no longer fits.

Annie Haslam

Annie HaslamPeople who have lost a lot of weight quickly may also find a new sense of confidence and be inspired to “reinvent” themselves by trying new clothes that they wouldn’t have before, says Simone Konu-Rae, a senior lecturer in fashion communication at Central Saint Martins, University of the Arts in London.

“You may not have felt that any of these trends or fashion outlets have been speaking to you, if you were a bigger size,” she says. “So you might shop completely differently.”

Beauty, health and fitness: More people going to the gym

That desire for a new look is also being felt in the beauty and fitness sector.

Market research firm Worldpanel by Numerator’s survey last year suggested a boost in spending on healthcare, toiletries and supplements among people taking weight-loss injections.

Some companies – in the US and now in the UK too – that offer wellness breaks are now advertising specific “retreats” targeting GLP-1 users.

Will Orr, chief executive of The Gym Group, says weight-loss drugs are leading to a greater demand for fitness services as people taking them look to keep the weight off and build muscle mass.

“We have begun educating our trainers on how best to support members on these treatments,” he says.

But he also notes a broader pattern of behaviour that pre-dates weight-loss drugs, calling health, fitness and wellness “juggernaut trends that are not going anywhere”.

That view is echoed by Georgia Stafford, research analyst in the beauty and personal care team at Mintel, who says while GLP-1s are “definitely something on most brands’ radars”, unlike the food industry, beauty brands are yet to launch products in the UK aimed specifically at users of weight-loss drugs.

“There have been some launches in the US,” she says, “but they’re very niche and very expensive,” pointing out that the cost of weight-loss drugs may also lead to people cutting back on spending in other areas.

Instead, she says many products on offer promising plumper skin and fuller hair, often marketed as anti-ageing, will already be aligned with what may appeal to those on weight-loss drugs.

Meanwhile, data from the British Association of Aesthetic Plastic Surgeons indicated there was an 8% rise in demand for facelifts in 2024, with the group’s president saying it was “an extension of a pattern we’ve always observed in post-weight-loss patients” that was “now amplified by the wider use of these medications”.

Additional reporting by Emer Moreau and Kris Bramwell

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season