Business

Here’s how much weight loss drugs could cost you under Trump’s deals with Eli Lilly, Novo Nordisk

Wegovy injection pens arranged in Waterbury, Vermont, US, on Monday, April 28, 2025.

Shelby Knowles | Bloomberg | Getty Images

President Donald Trump on Thursday struck landmark deals with Eli Lilly and Novo Nordisk to slash the prices of their blockbuster weight loss drugs.

Under the agreements, the monthly out-of-pocket cost of popular injections and upcoming pills could range from $50 to $350 starting next year, depending on the dosage and insurance coverage a patient has, Trump administration officials said.

Existing GLP-1s, including Eli Lilly’s obesity injection Zepbound and Novo Nordisk’s competitor Wegovy, carry list prices above $1,000 a month, which has prevented many patients from taking them. Both companies have introduced lower cost options for people paying in cash and purchasing the drugs directly through their websites.

But the deals with Trump, as part of his “most favored nation” policy, take those efforts to expand access even further. Here’s how much weight loss drugs could cost for patients under the new agreements, based on the details shared so far.

Medicare

Medicare has covered GLP-1 drugs for diabetes and some other medical conditions: for example, Wegovy for slashing cardiovascular risks. But under the new deals, Medicare will start covering the drugs for obesity for the first time starting in mid-2026, which could allow more seniors to qualify for them and spur more private insurers to cover them.

Certain Medicare patients will pay a copay of $50 per month for all approved uses of GLP-1 drugs, including diabetes and obesity treatment.

But the Trump administration is putting some constraints on which Medicare beneficiaries will be eligible to receive GLP-1s for obesity and cardiovascular and metabolic benefits.

Patients are eligible if they fall into these three cohorts:

- The first includes those who are overweight — with a body mass index greater than 27 — or with prediabetes or established cardiovascular disease.

- The second group is people with obesity – with a BMI greater than 30 – and uncontrolled hypertension, kidney disease or heart failure.

- The third group is patients with severe obesity, or anyone with a BMI greater than 35.

Eli Lilly and Novo Nordisk voluntarily agreed to reduce the prices the government pays for existing GLP-1 drugs already approved for diabetes and other uses to $245 a month, across all non-starting doses. Savings generated by those price reductions will allow Medicare to start paying that same price point for GLP-1s for patients with obesity and a high metabolic or cardiovascular risk.

Direct-to-consumer

The agreement will also allow patients to get GLP-1s on direct-to-consumer platforms at steeper discounts than they already receive through drugmakers’ existing sites.

On TrumpRx – the government’s direct-to-consumer platform for buying prescription drugs with cash expected to launch next year – the average monthly cost for Wegovy, Zepbound and other injectable GLP-1s will start at $350 and drop to $250 within the next two years, according to senior administration officials.

Starting doses of upcoming obesity pills from Eli Lilly and Novo Nordisk, pending approvals, will be $149 per month on TrumpRx, Medicare and Medicaid. Under the deals announced Thursday, Eli Lilly will get fast-track reviews of its forthcoming pill.

Eli Lilly on Thursday said it would lower prices by $50 on its own direct-to-consumer platform, LillyDirect, which already offers Zepbound and other drugs at a discount to cash-paying patients. The multidose pen of Zepbound will be available for $299 per month at the lowest dose, with additional doses being priced up to $449 per month.

Eli Lilly’s pill, once approved, will be available at the lowest dose starting at $149 per month

Medicaid

State Medicaid coverage of GLP-1 drugs for obesity is spotty.

But Novo Nordisk and Eli Lilly agreed to extend lower government pricing for their GLP-1 drugs – $245 per month across all other non-starting doses – to all 50 Medicaid programs for all covered uses.

States will have to opt into those prices, meaning some may not. Check with your state government about coverage.

Business

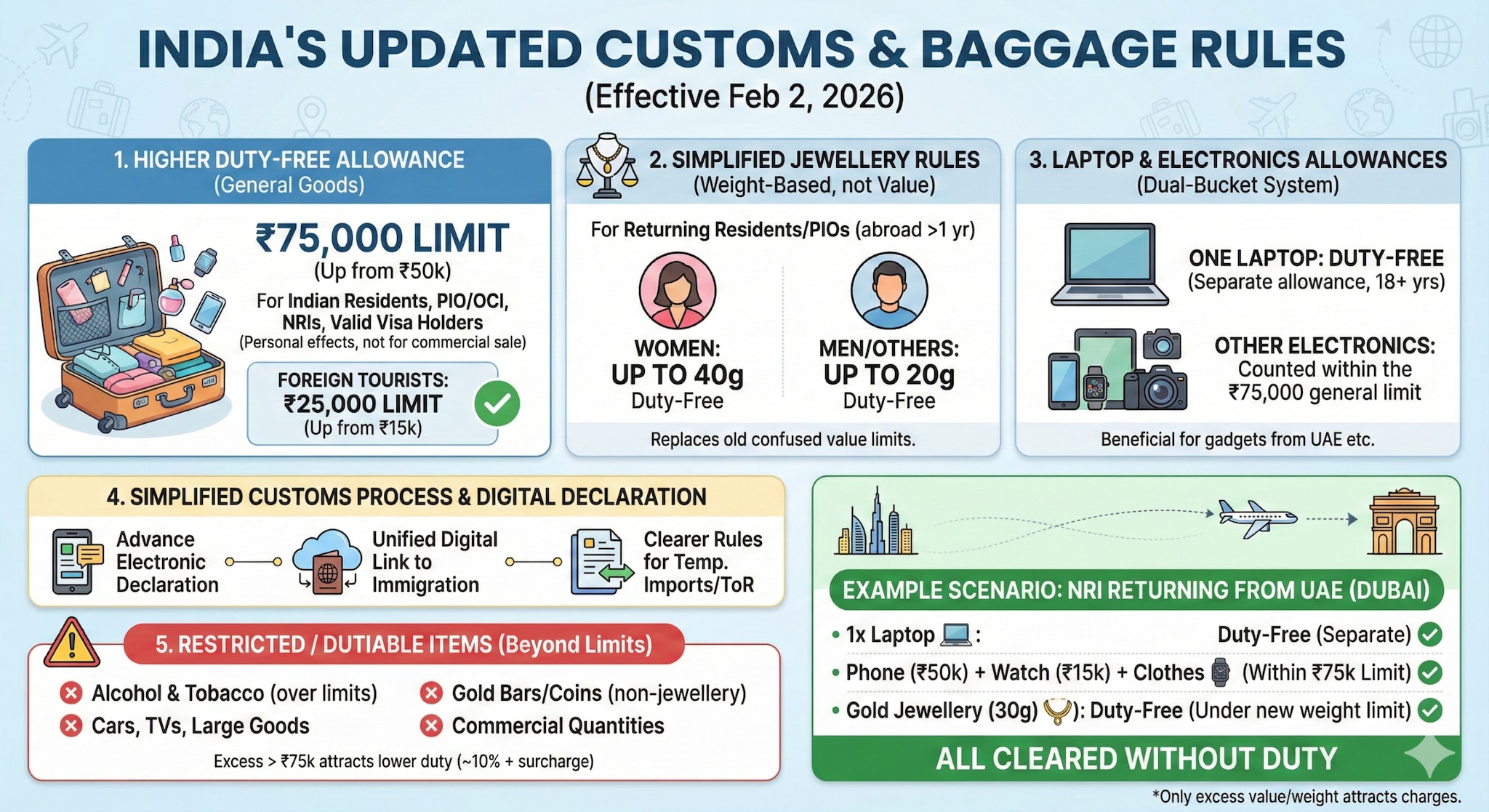

Gold, iPhone, Laptop From Dubai: How Much Can You Bring To India Without Paying Customs Duty?

Last Updated:

India’s Baggage Rules 2026 raise duty-free limits to Rs 75,000, introduce weight-based jewellery allowances, allow one laptop duty-free, and simplify customs for arrivals.

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

India has updated its customs and baggage rules affecting what international passengers, including people arriving from the UAE, can bring into the country without paying duty. These changes are part of the Baggage Rules, 2026, and the Customs Baggage (Declaration & Processing) Regulations, 2026, which came into effect from February 2, 2026, following announcements in the Union Budget 2026.

Here’s a detailed breakdown of what’s changed and what it means:

1. Higher Duty-Free Allowance for Personal Items

Passengers arriving by air or sea can now bring goods worth up to Rs 75,000 duty-free, higher than the Rs 50,000 limit earlier.

This limit applies to Indian residents, people of Indian origin (PIO/OCI), NRIs, and foreign nationals with valid visas. It covers personal effects and items carried in bona fide accompanied baggage — personal use items, not for commercial sale.

Foreign tourists have a separate duty-free cap of Rs 25,000 (up from Rs 15,000 earlier).

For crew members, the limit is Rs 2,500.

2. Simplified Jewellery Rules

The old value-based limits on jewellery imports have been replaced with weight-based allowances for returning residents/PIOs:

• Women: up to 40 grams of jewellery duty-free

• Men/Others: up to 20 grams duty-free

This applies to passengers who have stayed abroad for at least a year and are bringing jewellery in bona fide baggage.

Earlier, jewellery allowances were defined by value rather than weight, which often caused confusion and disputes at customs.

3. Laptop and Electronics Allowances

• One laptop can be brought in duty-free, separate from the Rs 75,000 general limit, for travellers aged over 18 years (excluding airline crew).

• Other electronics (smartphones, watches, cameras, etc.) are counted within the Rs 75,000 allowance.

This dual-bucket system (laptop + Rs 75,000 limit) is particularly beneficial for travellers bringing gadgets from the UAE, where prices are often lower.

4. Simplified Customs Process

The new regulations also introduce:

• Advance and electronic baggage declaration to streamline arrival processing.

• Unified digital declaration linked to immigration systems, reducing paperwork.

• Clearer rules around temporary imports / re-imports and Transfer of Residence (ToR) benefits for long-term expatriates.

5. What Still Requires Duty or Has Restrictions

Even under the new rules, certain items remain outside duty-free allowances and must be declared:

• Alcohol beyond allowed limits

• Tobacco products above the limits

• Cars, TVs, and other large goods

• Gold bars/coins or precious metals in non-jewellery form

• Commercial quantities of any item

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

Example (From UAE To India)

If an NRI returning from Dubai brings:

• One laptop: duty-free separate allowance

• A phone (Rs 50,000), watch (Rs 15,000) & clothes: these total Rs 65,000 — all duty-free within the Rs 75,000 limit

• Gold jewellery (30 g): duty-free under the new weight limits

The above would be cleared without duty. Only items or values above these thresholds may attract charges. However, for updated and item-specific rules, check customs rules from official government website.

February 08, 2026, 16:01 IST

Read More

Business

PM Kisan 22nd instalment update: Is farmer ID mandatory to receive Rs 2,000 payment?

New Delhi: Farmers across India are waiting for the 22nd instalment of the PM Kisan Samman Nidhi scheme, under which eligible beneficiaries receive Rs 2,000 directly in their bank accounts. While the government has not officially announced the release date, the next payment is expected between February and March 2026, based on the scheme’s usual schedule.

The PM Kisan scheme provides Rs 6,000 per year in three equal instalments to landholding farmer families through direct benefit transfer.

Farmer ID Requirement

A key update this year is the growing importance of the Farmer ID, which is being introduced as part of the government’s farmer-registry initiative. The ID is mandatory for new registrations in several states where the registry system has already started, though it may not yet be required everywhere in the country.

Authorities say the Farmer ID will help verify beneficiaries, prevent duplication, and ensure that financial assistance reaches genuine farmers.

e-KYC Still Essential

Along with the Farmer ID, e-KYC remains compulsory for all registered PM Kisan beneficiaries. Farmers who fail to complete e-KYC or update their records may face delays in receiving the next instalment.

The government has also introduced new methods such as OTP-based and facial-authentication e-KYC to make the process easier for farmers.

What Farmers Should Do

To avoid missing the next instalment, farmers should:

Complete e-KYC verification

Ensure Aadhaar is linked to their bank account

Update land and registration details

Obtain a Farmer ID if required in their state

Business

Gold rally pauses: Investors brace for volatile week in MCX gold & silver

New Delhi: India’s bullion market saw a pause in its recent rally on February 8, with gold prices easing slightly after touching record highs in late January. The price of 24-carat gold was around Rs 1.56 lakh per 10 grams, while 22-carat gold traded close to Rs 1.43 lakh per 10 grams in major markets across the country.

Silver prices remained volatile but stable compared to recent swings, trading at about Rs 2.85 lakh per kilogram. The metal has seen sharp movements in recent weeks, reflecting changing global demand and investor sentiment.

The correction in gold prices comes after the metal reached an all-time high of nearly Rs 1.79 lakh per 10 grams last month, driven by strong global demand for safe-haven assets. Since then, some investors have booked profits, leading to a decline in prices.

Market experts say precious-metal prices are currently being influenced by international economic conditions, currency fluctuations, and expectations around interest-rate decisions by major central banks. These factors often affect global bullion prices, which in turn impact domestic rates in India.

Despite the recent dip, demand for gold remains steady, especially with the wedding season and festive purchases supporting jewellery sales. Analysts believe gold and silver prices may continue to move cautiously in the coming weeks as global markets remain uncertain.

Overall, the bullion market is entering a phase of consolidation after a strong rally, with investors closely watching global trends for the next direction in prices.

-

Tech6 days ago

Tech6 days agoHow to Watch the 2026 Winter Olympics

-

Business6 days ago

Business6 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion6 days ago

Fashion6 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Tech6 days ago

Tech6 days agoThe Best Floodlight Security Cameras for Your Home

-

Business1 week ago

Business1 week agoVideo: Who Is Trump’s New Fed Chair Pick?

-

Entertainment6 days ago

Entertainment6 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne