Business

Here’s what Paramount Skydance would be buying in a deal for Warner Bros. Discovery

Paramount+ signage in the Times Square neighborhood of New York, US, on Thursday, Dec. 21, 2023.

Gabby Jones | Bloomberg | Getty Images

David Ellison looks to be buying up a media empire.

The CEO and chairman of the newly minted Paramount Skydance has tapped an investment bank to help prepare a takeout offer for Warner Bros. Discovery, according to people familiar with the matter who spoke on the condition of anonymity to discuss nonpublic dealings.

Warner Bros. Discovery had yet to receive an offer as of Thursday, according to people familiar. However, shares of the company soared almost 30% Thursday afternoon, notching the stock’s best day of trading on record.

Representatives for Paramount and Warner Bros. Discovery declined to comment.

Bringing Warner Bros. Discovery into the fold would add to Ellison’s growing list of franchise acquisitions and sports media rights. WBD, which announced in June it plans to separate into two entities, has a suite of desirable assets. Add those to Paramount’s collection of intellectual properties and Ellison could have a content behemoth on his hands.

“A bid for WBD would solidify the overlooked value of its portfolio of assets that was weighed down by its balance sheet,” Robert Fishman, analyst at MoffettNathanson, told CNBC Thursday.

A mountain of content

Already in house, Paramount boasts movies and television shows from franchises like Star Trek, Transformers, SpongeBob SquarePants, Teenage Mutant Ninja Turtles, Paw Patrol, Scream and Mission Impossible.

More recently, it has expanded its video game-based IP beyond Sonic the Hedgehog, which is a billion-dollar franchise in its own right, to snag the rights to make a Call of Duty theatrical film and the distribution rights to Legendary’s Street Fighter adaptation.

Warner Bros. Discovery has a massive library of major franchises including DC superheroes, Lord of the Rings, Game of Thrones and Harry Potter. It also has legacy cartoons like Scooby-Doo, Looney Tunes and Tom and Jerry. It is also the distributor of Legendary’s Dune franchise and Godzilla and King Kong films.

Last year, Warner Bros. was the second-highest grossing studio at the global box office and Paramount was the fifth-highest, according to data from Comscore.

In addition to bolstering Paramount’s theatrical slate, Warner Bros. Discovery’s streaming service HBO Max counts more than 125 million subscribers as of the end of the second quarter. Paramount+ currently has around 77 million streaming users.

Chasing ESPN

In the wake of the Paramount-Skydance merger, Ellison also secured a $7.7 billion, seven-year deal to make Paramount the exclusive U.S. home for TKO Group’s UFC mixed martial arts organization. The agreement means UFC will stop its pay-per-view model and events will be available directly to Paramount+ subscribers and, in some cases, on CBS.

Sports rights are scarce and only become available when previous deals expire. Apple is already expected to be the home of Formula 1, and Major League Baseball is waiting until its deals expire after the 2028 season to reorganize its media packages. That means that Paramount will have few other top-shelf sports assets to bid on and acquire in the mid-term.

Meanwhile, Warner Bros. Discovery has the rights to broadcast games from the National Hockey League, Major League Baseball and March Madness basketball along with the French Open and Nascar.

A potential tie-up between Paramount Skydance and WBD would exponentially expand Paramount’s library of intellectual property and an arsenal of sports content that could help it compete with Disney’s ESPN.

Business

Stellantis shares plunge 27% after automaker announces $26 billion hit from business overhaul

Stellantis logo is pictured at one of its assembly plants following a company’s announcement saying it will pause production there, in Toluca, state of Mexico, Mexico April 4, 2025.

Henry Romero | Reuters

Shares of automaker Stellantis plunged 27% in European trading on Friday, after the company said it expects to take a 22-billion-euro ($26 billion) hit from a business reset and hinted at a pull-back from its electrification push.

In Milan, the company’s Italian shares were 26% lower. In early trading on Wall Street, the transatlantic firm’s New York-listed stock plummeted 25%.

Other French auto stocks also fell Friday morning, with Valeo and Forvia both down more than 1.2% and Renault sliding 2%.

“The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires,” said Stellantis CEO Antonio Filosa in a statement.

“They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new Team.”

Going forward, Stellantis said it would remain at the forefront of EV development, but said its own electrification journey would continue at “a pace that needs to be governed by demand rather than command.”

Stellantis also pre-released some figures for the fourth quarter on Friday, saying it anticipates a net loss for 2025. In recognition of that net loss, it has suspended its dividend for 2026 and plans to raise up to 5 billion euros by issuing hybrid bonds.

For 2026, the auto giant is targeting a mid-single-digit percentage increase in net revenue and a low-single-digit increase in its adjusted operating income margin.

The company said its dividend pause and bond issuance would help preserve its balance sheet, and outlined the actions it had taken last year as part of its reset strategy.

These included announcing “the largest investment in Stellantis’ U.S. history” — totalling $13 billion over four years — as well as launching 10 new products, canceling products that could not achieve profit at scale, and restructuring its global manufacturing and quality management capabilities.

Under the U.S. investment drive, the transatlantic automaker has said it will add 5,000 jobs to its American workforce.

While these moves had resulted in costs of 22.2 billion euros, the company said they had collectively delivered a return to positive volume growth in 2025.

In the second half of the year, Stellantis’ U.S. market share rose to 7.9%, while the company said it retained its overall second-place market share position in the enlarged Europe.

Stellantis’ writedown follows multibillion-dollar hits at rivals Ford and GM, which recently announced their own hits worth $19.5 billion and $7.1 billion, respectively — both being related to EV pullbacks.

Given the “magnitude of the kitchen sinking” and the soft 2026 guidance, UBS analysts said the negative share-price reaction was expected. They added, however, that new management’s “decisive” clean-up and solid regional market fundamentals leave the stock attractive as a potential U.S. “comeback” play.

‘Year of execution’

Friday’s writedown announcement came alongside news that Stellantis will offload its stake in NextStar Energy, a joint venture with LG Energy Solution that built and operated a Canadian battery manufacturing facility. LG Energy Solution will take over Stellantis’ 49% stake, the firms said on Friday morning.

The joint venture was part of Stellantis’ broader electrification strategy. In 2022, former CEO Carlos Tavares set a goal for 100% of sales in Europe and 50% of sales in the U.S. to be battery electric vehicles by the end of the decade.

The company is set to present an updated long-term strategy at its Capital Markets Day in May.

Stellantis’ stock has been under pressure for some time, with its Italian shares slumping nearly 25% last year and 40.5% the previous year. Shares are currently down more than 13% since the beginning of 2026.

Stellantis share price

Filosa previously dubbed 2026 the “year of execution” for the embattled automaker, which has been grappling with falling sales, leadership changes and disappointing earnings for several years. In July, the company said it expected to take a tariffs hit of around 1.5 billion euros in 2025, as it reported a first-half net loss of 2.3 billion euros.

In a Friday note, Russ Mould, investment director at AJ Bell, said Stellantis had placed a “miscalculated bet” on electric vehicles – but said the broader picture on EV adoption raised questions about Stellantis’ marketability.

“The long-held argument about why many drivers won’t go electric yet are concerns about price, access to charging infrastructure, and how long a battery will last during their journey,” he said.

“However, prices are coming down, more chargers are being installed, and battery range is improving. The success of companies like BYD suggests there are plenty of people willing to take the leap. That begs the question as to whether Stellantis’ frustration over its EV sales is linked to market issues or that drivers simply don’t like its vehicles.”

Stellantis is scheduled to publish its 2025 earnings in full on Feb. 26.

Business

Mandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout

A lobbying firm co-founded by Peter Mandelson has severed all connections with the peer.

Its chief executive, Benjamin Wegg-Prosser, has also announced his departure.

The decision follows mounting pressure on Global Counsel over Lord Mandelson’s association with convicted sex offender Jeffrey Epstein.

The firm confirmed that the former US ambassador no longer holds a stake in the business nor exerts any influence.

Mr Wegg-Prosser said he was stepping down as it was “time to draw a line” between the firm and Lord Mandelson’s “actions”.

Global Counsel added in a statement that it had reached an agreement to fully divest the peer’s shares, thereby ending all connections with him.

Its chair, Archie Norman, said: “With the completion of this process today, Peter Mandelson no longer has any shareholding, role or association with Global Counsel and has no influence over the firm in any capacity.”

Mr Wegg-Prosser said: “With the completion of the divestment of Peter Mandelson’s stake in the business, I feel that now is the time to draw a line between Global Counsel and his actions.

“I have nothing but immense pride in the business I founded and the work our amazing team deliver every day.”

He has been replaced as head of the firm by its managing director Rebecca Park, and his page on the company’s website has already been taken down.

Ms Park has also acquired the remaining shares that were held by Lord Mandelson.

Lord Mandelson co-founded the London-based firm with Mr Wegg-Prosser in 2010 after Labour lost the general election.

It is understood that Barclays has cut ties with Global Counsel amid the scrutiny.

Lord Mandelson was sacked as US ambassador in late 2025 after it emerged that he had maintained ties with Epstein after the financier was jailed for a child sex offence.

Epstein killed himself in a prison cell in 2019 while awaiting trial on further child sex charges.

Business

Stock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

Equity markets ended slightly higher on Friday after the Reserve Bank of India left interest rates unchanged, a move that was widely expected, and announced a proposal to allow banks to lend to Real Estate Investment Trusts (REITs) under prudential safeguards.The 30-share BSE Sensex rose 266.47 points, or 0.32 per cent, to close at 83,580.40. The index recovered sharply in the final hour, jumping over 650 points from the day’s low of 82,925.35, helped by late buying in select stocks. The NSE Nifty also finished higher, gaining 50.90 points, or 0.20 per cent, to settle at 25,693.70 after a volatile session.

Nifty50 top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| ITC | 326.35 | +16.20 | +5.21% |

| Kotak Bank | 422.35 | +13.60 | +3.33% |

| HUL | 2,424 | +69.80 | +2.97% |

| Bajaj Finance | 982.00 | +17.30 | +1.79% |

| Bharti Airtel | 2,023 | +30.60 | +1.54% |

| Power Grid | 292.80 | +3.45 | +1.20% |

| Titan Company | 4,141 | +43.20 | +1.06% |

| Bajaj Finserv | 2,021 | +20.70 | +1.04% |

| Shriram Finance | 1,001 | +9.00 | +0.91% |

| ICICI Bank | 1,408 | +11.50 | +0.83% |

Nifty50 top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| HDFC Life | 703.50 | -17.21 | -2.39% |

| Tech Mahindra | 1,616 | -30.21 | -1.84% |

| TCS | 2,940 | -51.20 | -1.72% |

| SBI Life | 1,987 | -31.00 | -1.54% |

| Tata Motors PV | 368.90 | -5.25 | -1.41% |

| Bajaj Auto | 9,519 | -129.00 | -1.34% |

| Adani Ports SEZ | 1,550 | -20.71 | -1.32% |

| Wipro | 230.40 | -2.99 | -1.29% |

| Eternal | 283.55 | -3.31 | -1.16% |

| Asian Paints | 2,405 | -27.10 | -1.12% |

Sensex top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| ITC | 326.35 | +16.20 | +5.21% |

| Kotak Bank | 422.35 | +13.60 | +3.33% |

| HUL | 2,424 | +69.80 | +2.97% |

| Bajaj Finance | 982.00 | +17.30 | +1.79% |

| Bharti Airtel | 2,023 | +30.60 | +1.54% |

| Power Grid | 292.80 | +3.45 | +1.20% |

| Titan Company | 4,141 | +43.20 | +1.06% |

| Bajaj Finserv | 2,021 | +20.70 | +1.04% |

| ICICI Bank | 1,408 | +11.50 | +0.83% |

| Axis Bank | 1,342 | +11.00 | +0.83% |

Sensex top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| Tech Mahindra | 1,616 | -30.21 | -1.84% |

| TCS | 2,940 | -51.20 | -1.72% |

| Adani Ports SEZ | 1,550 | -20.71 | -1.32% |

| Eternal | 283.55 | -3.31 | -1.16% |

| Asian Paints | 2,405 | -27.10 | -1.12% |

| HCL Tech | 1,594 | -16.30 | -1.02% |

| Infosys | 1,506 | -14.50 | -0.96% |

| HDFC Bank | 941.00 | -8.71 | -0.92% |

| Trent | 4,095 | -36.31 | -0.88% |

| SBI | 1,066 | -7.50 | -0.70% |

Earlier in the day, markets had opened cautiously and slipped into the red before staging a modest recovery.On the policy front, the RBI’s six-member Monetary Policy Committee unanimously voted to keep the repo rate unchanged at 5.25 per cent. The central bank also retained its neutral stance, indicating it may stay on hold for now. The decision came as inflation remained under control and growth concerns eased following higher government spending in the Budget and reduced tariff pressures after a trade deal with the United States, news agency PTI reported.Announcing the policy, RBI Governor Sanjay Malhotra said, “To further promote financing to the real estate sector, it is proposed to allow banks to lend to REITs with certain prudential safeguards.” Market participants said this move could improve long-term funding visibility for the real estate sector and the broader credit ecosystem.Among Sensex stocks, ITC was the top gainer, jumping over 5 per cent. Kotak Mahindra Bank, Hindustan Unilever, Bharti Airtel, Bajaj Finance, Power Grid and Bajaj Finserv also ended higher. On the other hand, Tata Consultancy Services, Tech Mahindra, Adani Ports, Asian Paints, Eternal and HCL Tech were among the laggards.Commenting on the session, Vinod Nair, head of research at Geojit Investments Limited, said domestic markets remained subdued for most of the day before recovering on the back of buying in FMCG and private banking stocks.“The RBI’s policy announcement was broadly in line with expectations, maintaining status quo on interest rates while reiterating a constructive growth outlook,” he said, as quoted by news agency ANI.However, he added that markets had expected a slightly more dovish tone. The RBI’s decision to retain a neutral stance led to a rise in India’s 10-year bond yields. Nair also pointed out that global investors remain focused on US-Iran negotiations, crude oil prices, and developments in artificial intelligence and technology.Foreign institutional investors sold shares worth Rs 2,150.51 crore on Thursday, according to exchange data.In global markets, Asian indices such as South Korea’s Kospi, Shanghai’s SSE Composite and Hong Kong’s Hang Seng ended lower, while Japan’s Nikkei closed higher. European markets were mostly trading in the green. In the US, stocks had ended sharply lower overnight, with the Nasdaq falling 1.59 per cent.Meanwhile, Brent crude rose 1.20 per cent to $68.34 per barrel. On Thursday, the Sensex had dropped over 500 points, while the Nifty had declined more than half a per cent.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech1 week ago

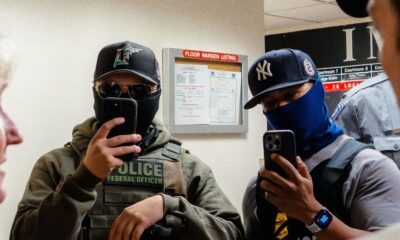

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami

-

Business4 days ago

Business4 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Business7 days ago

Business7 days agoLabubu to open seven UK shops, after PM’s China visit