Business

Here’s what Paramount Skydance would be buying in a deal for Warner Bros. Discovery

Paramount+ signage in the Times Square neighborhood of New York, US, on Thursday, Dec. 21, 2023.

Gabby Jones | Bloomberg | Getty Images

David Ellison looks to be buying up a media empire.

The CEO and chairman of the newly minted Paramount Skydance has tapped an investment bank to help prepare a takeout offer for Warner Bros. Discovery, according to people familiar with the matter who spoke on the condition of anonymity to discuss nonpublic dealings.

Warner Bros. Discovery had yet to receive an offer as of Thursday, according to people familiar. However, shares of the company soared almost 30% Thursday afternoon, notching the stock’s best day of trading on record.

Representatives for Paramount and Warner Bros. Discovery declined to comment.

Bringing Warner Bros. Discovery into the fold would add to Ellison’s growing list of franchise acquisitions and sports media rights. WBD, which announced in June it plans to separate into two entities, has a suite of desirable assets. Add those to Paramount’s collection of intellectual properties and Ellison could have a content behemoth on his hands.

“A bid for WBD would solidify the overlooked value of its portfolio of assets that was weighed down by its balance sheet,” Robert Fishman, analyst at MoffettNathanson, told CNBC Thursday.

A mountain of content

Already in house, Paramount boasts movies and television shows from franchises like Star Trek, Transformers, SpongeBob SquarePants, Teenage Mutant Ninja Turtles, Paw Patrol, Scream and Mission Impossible.

More recently, it has expanded its video game-based IP beyond Sonic the Hedgehog, which is a billion-dollar franchise in its own right, to snag the rights to make a Call of Duty theatrical film and the distribution rights to Legendary’s Street Fighter adaptation.

Warner Bros. Discovery has a massive library of major franchises including DC superheroes, Lord of the Rings, Game of Thrones and Harry Potter. It also has legacy cartoons like Scooby-Doo, Looney Tunes and Tom and Jerry. It is also the distributor of Legendary’s Dune franchise and Godzilla and King Kong films.

Last year, Warner Bros. was the second-highest grossing studio at the global box office and Paramount was the fifth-highest, according to data from Comscore.

In addition to bolstering Paramount’s theatrical slate, Warner Bros. Discovery’s streaming service HBO Max counts more than 125 million subscribers as of the end of the second quarter. Paramount+ currently has around 77 million streaming users.

Chasing ESPN

In the wake of the Paramount-Skydance merger, Ellison also secured a $7.7 billion, seven-year deal to make Paramount the exclusive U.S. home for TKO Group’s UFC mixed martial arts organization. The agreement means UFC will stop its pay-per-view model and events will be available directly to Paramount+ subscribers and, in some cases, on CBS.

Sports rights are scarce and only become available when previous deals expire. Apple is already expected to be the home of Formula 1, and Major League Baseball is waiting until its deals expire after the 2028 season to reorganize its media packages. That means that Paramount will have few other top-shelf sports assets to bid on and acquire in the mid-term.

Meanwhile, Warner Bros. Discovery has the rights to broadcast games from the National Hockey League, Major League Baseball and March Madness basketball along with the French Open and Nascar.

A potential tie-up between Paramount Skydance and WBD would exponentially expand Paramount’s library of intellectual property and an arsenal of sports content that could help it compete with Disney’s ESPN.

Business

Zee Real Heroes Awards 2026: ‘The world will have to yield before India…’ Baba Ramdev calls US trade deal a reflection of India’s strength

The fourth edition of ‘Zee Samvaad with Real Heroes’ is being held in Mumbai today, February 6, 2026. The event saw the presence of several prominent personalities from politics, entertainment and sports. It was hosted by lyricist Manoj Muntashir.

Yoga guru Baba Ramdev also joined him on stage, where they discussed a range of topics including the India–US trade agreement and the changing global order. During the conversation, Baba Ramdev also targeted the Opposition.

‘The World Will Have to Yield Before India…’

Manoj Muntashir asked Baba Ramdev about the recent India–US trade agreement. Responding to the question, Baba Ramdev said, “I don’t see it merely as India’s achievement, but as India’s strength. Whether it is Trump or any other global power, they will ultimately have to yield before India. This is the power of India’s market. It is the strength of India’s millions of people — and also America’s compulsion.”

He added that if Trump wants to control inflation in the United States, reducing tariffs becomes a necessity. According to him, that necessity reflects India’s growing strength. Baba Ramdev further said that no country can become a superpower by ignoring India, and that India itself is the next superpower. He remarked that if others choose to approach India first, they would be welcomed respectfully.

Is the Reduction from 50% to 18% Tariff India’s Victory?

Responding to the question, Baba Ramdev said that as India moves forward, some people — whom he described as immature in their political thinking and lacking a clear vision for the country — continue to question such developments. However, he stressed that India is progressing rapidly across sectors, whether it is agriculture, manufacturing, science and technology, innovation and invention-driven creation, healthcare, education, or future research initiatives.

He added that India is strong in terms of natural resources, land, scientific capability, climate, knowledge, cultural depth, and the spirit of hard work and determination. According to him, with this strength and momentum, not just Trump or America, but the entire world will eventually have to acknowledge and bow before India’s rise.

Opposition Says India Has ‘Knelt Down’

Manoj Muntashir asked Baba Ramdev about the Opposition’s claim that India had “knelt down” and that key decisions related to India would now be taken by Trump. Responding to this, Ramdev said that if Trump raises tariffs, he can also reduce them. He added that Prime Minister Modi is acting with patience, as Trump can change his stance at any time.

Ramdev further remarked that Trump has a tendency to stay in the headlines. He said the global order is now changing and that India will have to maintain a balance in its relations with China. He also stated that although some Muslims in India may criticise Prime Minister Modi, many of the world’s most influential Muslim leaders respect him — which, according to Ramdev, reflects the Prime Minister’s diplomatic success.

Business

India likely to add 2.7 billion sq ft of academic space, see $100 bn investment by 2035

New Delhi: Nearly 30,000 acres of new campus land and about 2.7 billion square feet of academic infrastructure are expected in India by 2035 to meet surging student demand, marking world’s largest institutional real estate opportunities over the next decade, a report said on Thursday.

The report from ANAROCK Capital said that meeting the National Education Policy (NEP) 2020 target of a gross enrolment ratio (GER) of 50 per cent by 2035 will require roughly 25 million additional seats and about $100 billion in construction-led investment for academic facilities alone, excluding land acquisition and student accommodation infrastructure.

“This scale of expansion, underpinned by demographic momentum, rising enrolments, globalisation of education, and landmark regulatory reforms, represents arguably the largest higher-education build-out market globally,” the report mentioned.

The real estate services firm highlighted India’s higher-education enrolments rose from 27 million in 2010-11 to 45 million in 2022-23, driven by powerful demographic engines and rising household aspirations, and universities increased from 760 in 2015 to 1,338 in 2025, while total higher education institutions grew from 51,534 to 70,018.

“We believe the provision in the Union Budget 2026 to support the creation of five university townships reflects a recognition of the gap in academic infrastructure,” said Shobhit Agarwal, CEO-ANAROCK Capital.

After the FHEI Regulations foreign higher-education institutions ranked within the top 500 globally can now establish campuses without affiliating with Indian universities, noted Aashiesh Agarwaal, SVP-Investment Advisory, ANAROCK Capital.

In addition to the three global university campuses that have already opened, thirteen institutions have announced upcoming campuses, such as Lancaster (UK), Liverpool (UK), Illinois Institute of Technology (US), and Instituto Europeo di Design (Italy), signalling strong international confidence in India’s education market, Agarwaal added.

Uttar Pradesh has rolled out stamp duty exemptions and capital subsidies for higher education institutions.

GIFT City in Gujarat has created a dedicated international campus framework with shared academic infrastructure. Maharashtra has anchored its strategy around a 250-acre ‘Educity’ near Navi Mumbai International Airport, securing commitments from five foreign higher education institutions, said the report.

Business

Stellantis shares plunge 27% after automaker announces $26 billion hit from business overhaul

Stellantis logo is pictured at one of its assembly plants following a company’s announcement saying it will pause production there, in Toluca, state of Mexico, Mexico April 4, 2025.

Henry Romero | Reuters

Shares of automaker Stellantis plunged 27% in European trading on Friday, after the company said it expects to take a 22-billion-euro ($26 billion) hit from a business reset and hinted at a pull-back from its electrification push.

In Milan, the company’s Italian shares were 26% lower. In early trading on Wall Street, the transatlantic firm’s New York-listed stock plummeted 25%.

Other French auto stocks also fell Friday morning, with Valeo and Forvia both down more than 1.2% and Renault sliding 2%.

“The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires,” said Stellantis CEO Antonio Filosa in a statement.

“They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new Team.”

Going forward, Stellantis said it would remain at the forefront of EV development, but said its own electrification journey would continue at “a pace that needs to be governed by demand rather than command.”

Stellantis also pre-released some figures for the fourth quarter on Friday, saying it anticipates a net loss for 2025. In recognition of that net loss, it has suspended its dividend for 2026 and plans to raise up to 5 billion euros by issuing hybrid bonds.

For 2026, the auto giant is targeting a mid-single-digit percentage increase in net revenue and a low-single-digit increase in its adjusted operating income margin.

The company said its dividend pause and bond issuance would help preserve its balance sheet, and outlined the actions it had taken last year as part of its reset strategy.

These included announcing “the largest investment in Stellantis’ U.S. history” — totalling $13 billion over four years — as well as launching 10 new products, canceling products that could not achieve profit at scale, and restructuring its global manufacturing and quality management capabilities.

Under the U.S. investment drive, the transatlantic automaker has said it will add 5,000 jobs to its American workforce.

While these moves had resulted in costs of 22.2 billion euros, the company said they had collectively delivered a return to positive volume growth in 2025.

In the second half of the year, Stellantis’ U.S. market share rose to 7.9%, while the company said it retained its overall second-place market share position in the enlarged Europe.

Stellantis’ writedown follows multibillion-dollar hits at rivals Ford and GM, which recently announced their own hits worth $19.5 billion and $7.1 billion, respectively — both being related to EV pullbacks.

Given the “magnitude of the kitchen sinking” and the soft 2026 guidance, UBS analysts said the negative share-price reaction was expected. They added, however, that new management’s “decisive” clean-up and solid regional market fundamentals leave the stock attractive as a potential U.S. “comeback” play.

‘Year of execution’

Friday’s writedown announcement came alongside news that Stellantis will offload its stake in NextStar Energy, a joint venture with LG Energy Solution that built and operated a Canadian battery manufacturing facility. LG Energy Solution will take over Stellantis’ 49% stake, the firms said on Friday morning.

The joint venture was part of Stellantis’ broader electrification strategy. In 2022, former CEO Carlos Tavares set a goal for 100% of sales in Europe and 50% of sales in the U.S. to be battery electric vehicles by the end of the decade.

The company is set to present an updated long-term strategy at its Capital Markets Day in May.

Stellantis’ stock has been under pressure for some time, with its Italian shares slumping nearly 25% last year and 40.5% the previous year. Shares are currently down more than 13% since the beginning of 2026.

Stellantis share price

Filosa previously dubbed 2026 the “year of execution” for the embattled automaker, which has been grappling with falling sales, leadership changes and disappointing earnings for several years. In July, the company said it expected to take a tariffs hit of around 1.5 billion euros in 2025, as it reported a first-half net loss of 2.3 billion euros.

In a Friday note, Russ Mould, investment director at AJ Bell, said Stellantis had placed a “miscalculated bet” on electric vehicles – but said the broader picture on EV adoption raised questions about Stellantis’ marketability.

“The long-held argument about why many drivers won’t go electric yet are concerns about price, access to charging infrastructure, and how long a battery will last during their journey,” he said.

“However, prices are coming down, more chargers are being installed, and battery range is improving. The success of companies like BYD suggests there are plenty of people willing to take the leap. That begs the question as to whether Stellantis’ frustration over its EV sales is linked to market issues or that drivers simply don’t like its vehicles.”

Stellantis is scheduled to publish its 2025 earnings in full on Feb. 26.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech1 week ago

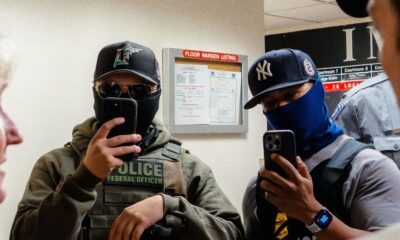

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Business4 days ago

Business4 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000