Business

How America’s EV retreat is increasing China’s control of global markets

Employees work on the assembly line of new energy vehicles (NEVs) at a workshop of China FAW Group’s Hongqi Fanrong Plant on July 5, 2023 in Changchun, Jilin Province of China.

Zhang Yao | China News Service | Getty Images

DETROIT — The unraveling of the U.S. electric vehicle push is increasingly raising concerns of an existential crisis for the American auto industry, as Chinese carmakers surge ahead in the technologies that many still believe will define the next era of cars.

The latest warning sign came Friday, when Stellantis disclosed a $26 billion charge from a major business overhaul, including a pullback in EVs, triggering a more than 20% plunge in its stock. CEO Antonio Filosa blamed the hit on overestimating the pace of the energy transition.

It follows other automakers in the U.S. significantly pulling back from pure EVs in favor of large gas-guzzling trucks such as the Ford F-150 and SUVs like the Chevrolet Suburban. Chinese automakers are taking the opposite approach and are growing globally, led by EVs.

Legacy automakers General Motors and Ford Motor have lost billions of dollars on EVs and are pulling back partly because of the loss of a federal tax credit and lackluster consumer demand.

Even Tesla, which pioneered the EV industry, is facing pressure. It was surpassed by Chinese automaker BYD in EV sales as the Elon Musk-led brand lost its appeal and market share in Europe this year, while BYD ramped up exports there and around the world. Tesla also last week canceled its two oldest, lowest-selling electric vehicles to repurpose an American plant for humanoid robots.

After helming the electrification movement for years, Musk increasingly appears focused elsewhere, especially on robots, driverless taxis and his artificial intelligence company, which he combined with Space X in what was the biggest merger in history.

Meanwhile, global market share for Chinese brands has jumped nearly 70% in five years, and many experts see a threat to U.S. automakers, including the anticipated entrance of Chinese brands into America.

There’s fear among global automakers that Chinese rivals like BYD and Geely could flood global markets, undercutting domestic production and vehicle prices. The U.S. has taken a protectionist approach by implementing 100% tariffs on imported EVs from China, but Chinese automakers have made inroads across Europe, South America and elsewhere.

Companies in the U.S., where the automotive industry represents about 5% of the country’s gross domestic product, are worried about long-term implications.

“The Chinese auto industry presents an existential threat to the traditional [automakers],” said Terry Woychowski, a former GM executive who serves as president of automotive at engineering consulting firm Caresoft Global.

Several automotive experts used the word “existential” when discussing the growth of Chinese automakers.

“The existential risk to the U.S. auto industry isn’t Chinese EVs alone, it’s the combination of sustained government support, vertically integrated supply chains and speed,” said Elizabeth Krear, CEO of the Center for Automotive Research. “Those advantages lower costs and accelerate execution. Concurrently, saturation in China’s domestic market is driving automakers to expand aggressively into global markets.”

China’s growth

The Chinese automotive sector has rapidly changed from an insular industry to the largest exporter of vehicles globally since 2023.

China’s growth has been fueled by government funding for companies as well as a culture of innovation and speed the country has instilled in its workers, experts said. A slowing Chinese market and plant underutilization have also forced companies to begin exporting to major auto markets globally.

China’s expansion of EVs has been particularly impressive, with a nearly 800% increase globally, largely fueled by sales in China growing from roughly 572,300 in 2020 to 4.95 million in 2025, according to GlobalData. Outside of China, EV sales have surged by more than 1,300%, from less than 33,000 to more than 474,000, according to the firm.

While China has grown, Detroit’s “Big Three” automakers — GM, Ford and Chrysler parent Stellantis, which is no longer based in the U.S. — have collectively fallen from a global market share of 21.4% in 2019 to an estimated 15.7% in 2025, according to S&P Global Mobility.

That compares with China’s largest automakers BYD and Geely, which have grown from a less than 3% market share to an estimated 11.1%, according to S&P Global Mobility.

HONG KONG, CHINA – JANUARY 05: A general view of the BYD Auto showroom on January 5, 2026, in Hong Kong, China. (Photo by Sawayasu Tsuji/Getty Images)

Sawayasu Tsuji | Getty Images News | Getty Images

China’s most recent announced expansion is to Canada, a relatively small vehicle market that removed 100% tariffs on imported vehicles from China amid a trade dispute with the Trump administration.

That follows the rapid growth of Chinese automakers in lower-income, less established regions that have historically been growth markets for U.S. automakers, such as South America, India and Mexico. They’re also making inroads in Europe, where the share of sales has risen from virtually nothing in 2020 to nearly 10% in December, according to Germany-based Dataforce.

“The shift to electric has made it easier for them, because they’ve got the right products,” said Al Bedwell, U.K.-based expert and director of global automotive powertrain for GlobalData. “The fact that it is electric has really opened the doors, and it wouldn’t have happened otherwise.”

Bedwell said China wanted to wean itself off oil since it doesn’t have vast amounts on its own. “It saw an opportunity to be a leader,” he added.

GlobalData forecasts Chinese EVs will continue to grow globally to roughly 6.5 million units by 2030, followed by nearly 8.5 million in 2035. That includes continued expansion in the U.S., where a few China-made vehicles such as the Buick Envision have been imported in recent years.

“Breaking into the U.S. market successfully and sustainably is not an easy accomplishment; it takes time, investment, patience and the willingness to make product mistakes but improve them until you get it right. It is expected that some Chinese automakers will have that blend and eventually look to participate in the U.S. market,” said Stephanie Brinley, a principal automotive analyst at S&P Global Mobility.

Brinley noted it took Japan’s Toyota Motor from 1957 to 2001 to reach a 10% market share, while South Korea’s Hyundai Motor reached 10% after 26 years in 2022.

US President Donald Trump speaks alongside Ford executive chairman Bill Ford as he tours Ford Motor Company’s River Rouge complex in Dearborn, Michigan, on January 13, 2026.

Mandel Ngan | Afp | Getty Images

“Because the U.S. is a mature market and sales are forecast to remain between 16 million and 16.5 million units through at least 2035, newcomers will take share from existing brands and automakers,” Brinley said. “How quickly they connect with consumers and which automakers lose volume or share to the new competitor remains to be seen.”

The Alliance for Automotive Innovation, a lobbying group representing nearly every automaker in the U.S., wants to prevent that from happening. It called on Congress and the Trump administration in December to prevent Chinese government-backed auto and advanced battery manufacturers from gaining entry to produce in the U.S.

“Automakers doing business inside the United States face geopolitical and market pressures from China that are a direct threat to America’s global competitiveness and national security,” John Bozzella, CEO of the alliance, said in a message to a U.S. House of Representatives select committee, citing unfair, anticompetitive trade practices and intellectual property theft.

State of U.S. EV industry

U.S. automakers spent billions of dollars developing and launching EVs under regulations and incentives from the Biden administration that have largely been undone by the Trump administration.

That deregulation opened the doors for automakers to de-emphasize all-electric vehicle plans.

GM and Ford alone have announced more than $27 billion in write-downs recently due to their retreat on EVs, including canceling new models and lowering production of current ones.

Jeep maker Stellantis on Friday announced a 22 billion euro ($26 billion) hit from a business turnaround plan that includes pulling back on electrification and reintroducing V8 engines to U.S. models.

U.S. EV sales peaked in September, ahead of the federal incentives ending, at 10.3% of the new vehicle market, according to Cox Automotive. That demand plummeted to preliminary estimates of 5.2% during the fourth quarter.

GM CFO Paul Jacobson said Wednesday that the Detroit automaker, which has largely become a regional player in North America, isn’t abandoning EVs but is right-sizing to natural demand instead of attempting to appease regulators.

When asked about the expansion of Chinese automakers, Jacobson said GM “can hold our own” but that it needs to be on a level playing field — rehashing that he thinks U.S. tariffs should work to offset subsidies Chinese companies get from Beijing.

“You can see the type of intensity and competitiveness that those vehicles bring to the marketplace. And therefore, we’ve got to be ready,” he said during a Chicago Federal Reserve automotive conference in Detroit.

GM wasn’t ready for the rise of the domestic auto industry in China, which was the company’s top sales market from 2010 to 2023. The automaker’s earnings from China fell from around $2 billion annually in 2018 to a second consecutive year of losses in 2025 as China grew its own auto manufacturing.

GM’s crosstown rival Ford is taking a different approach. It has largely scrapped plans for large EVs in exchange for a next generation of smaller models that CEO Jim Farley believes will be the company’s saving grace against Chinese automakers.

Farley, who has been complimentary of Chinese automakers at times, said the new platform will be a simple, efficient, flexible ecosystem to deliver a family of affordable, electric, software-defined vehicles.

“This is a Model T moment for the company,” Farley said last year. “We really see, not the global [automakers] as a competitive set for our next generation of EVs, we see the Chinese. Companies like Geely and BYD … and that’s how we built our vehicle.”

From autos to autonomy

Domestic EV startups such as Rivian Automotive and Saudi-backed Lucid Group — both exclusively producing vehicles in the U.S. — are facing profitability and sales challenges.

Amid the demand issues, the EV startups have tried to appeal to investors by touting themselves as technology plays rather than automakers, following in the footsteps of U.S. EV industry leader Tesla.

Tesla’s Musk has been warning about Chinese automakers for years, saying in 2023 after the rise of BYD that such companies will “demolish” global rivals without trade barriers.

Musk has historically positioned Tesla as a technology company that also sells cars despite that the vast majority of its revenue comes from car sales, leasing and repairs. He took it a step further on the company’s most recent quarterly earnings call, saying that Tesla is ending production of its Model S and X vehicles and will use the factory in Fremont, California, to instead build Optimus humanoid robots.

After the original Roadster, the two models are Tesla’s oldest vehicles. The EV maker started selling the Model S sedan in 2012, and the Model X SUV three years later. They only represented about 3% of Tesla’s sales in 2025, with the company continuing to offer the Model Y, Model 3 and Cybertruck.

In recent, years the company has slashed prices for those vehicles as global competition for electric vehicles has soared.

Musk believes China will once again be the company’s main competition in its newest humanoid robot venture.

“China will definitely be the tough competition as there’s no two ways about it,” Musk said on the company’s fourth-quarter earnings call. “So I always think people outside of China kind of underestimate China. China’s an ass-kicker, next level.”

Business

Rooftops could turn into landing pads as India eyes air taxis to beat traffic

New Delhi: A new report by the Confederation of Indian Industry (CII) suggests that setting up a pilot air corridor connecting Gurugram, Connaught Place, and Jewar International Airport could help India reduce travel time from hours to minutes. The model is seen as a high-impact solution to urban traffic congestion and could be scaled up across the country.

The report, titled Navigating the Future of Advanced Air Mobility in India, was launched by Civil Aviation Minister Rammohan Naidu Kinjarapu. He said India’s aviation sector is moving toward a “high-tech, multi-dimensional mobility ecosystem.”

One of the key highlights of the report is the use of rooftops as landing and parking sites for electric air taxis, known as eVTOLs. This approach could turn existing buildings into revenue-generating assets. As acquiring land for ground-based landing pads is costly, rooftops offer a faster and more affordable way to launch such services in cities like Delhi, Mumbai, and Bengaluru.

“The integration of Advanced Air Mobility reflects our commitment to innovation, sustainability, and world-class urban connectivity,” said Union Minister Kinjarapu. He added that the report provides a “timely and practical blueprint to realise a faster, cleaner, and more connected India.”

However, the report notes that current regulations do not permit regular commercial rooftop operations. To address this, it recommends forming a dedicated team within the Directorate General of Civil Aviation (DGCA) to develop safety and operational standards for these emerging technologies.

Amit Dutta, Chairman of the CII Task Force on Advanced Air Mobility, said the study helps turn the concept into reality. “By analysing a hypothetical Delhi-NCR corridor through structured modelling and regulatory scenario testing, this study moves from concept to operational assessment,” he said, adding that it addresses key regulatory, infrastructure, and airspace challenges linked to early AAM pilots.

The report also recommends initially using drones to transport cargo and medical supplies over distances of 50–100 km. It suggests regions such as GIFT City and Andhra Pradesh as testing zones, where relaxed regulations could support faster adoption. To enable this growth, CII has urged banks and government agencies to create dedicated funding mechanisms for air mobility infrastructure.

Business

Gold, iPhone, Laptop From Dubai: How Much Can You Bring To India Without Paying Customs Duty?

Last Updated:

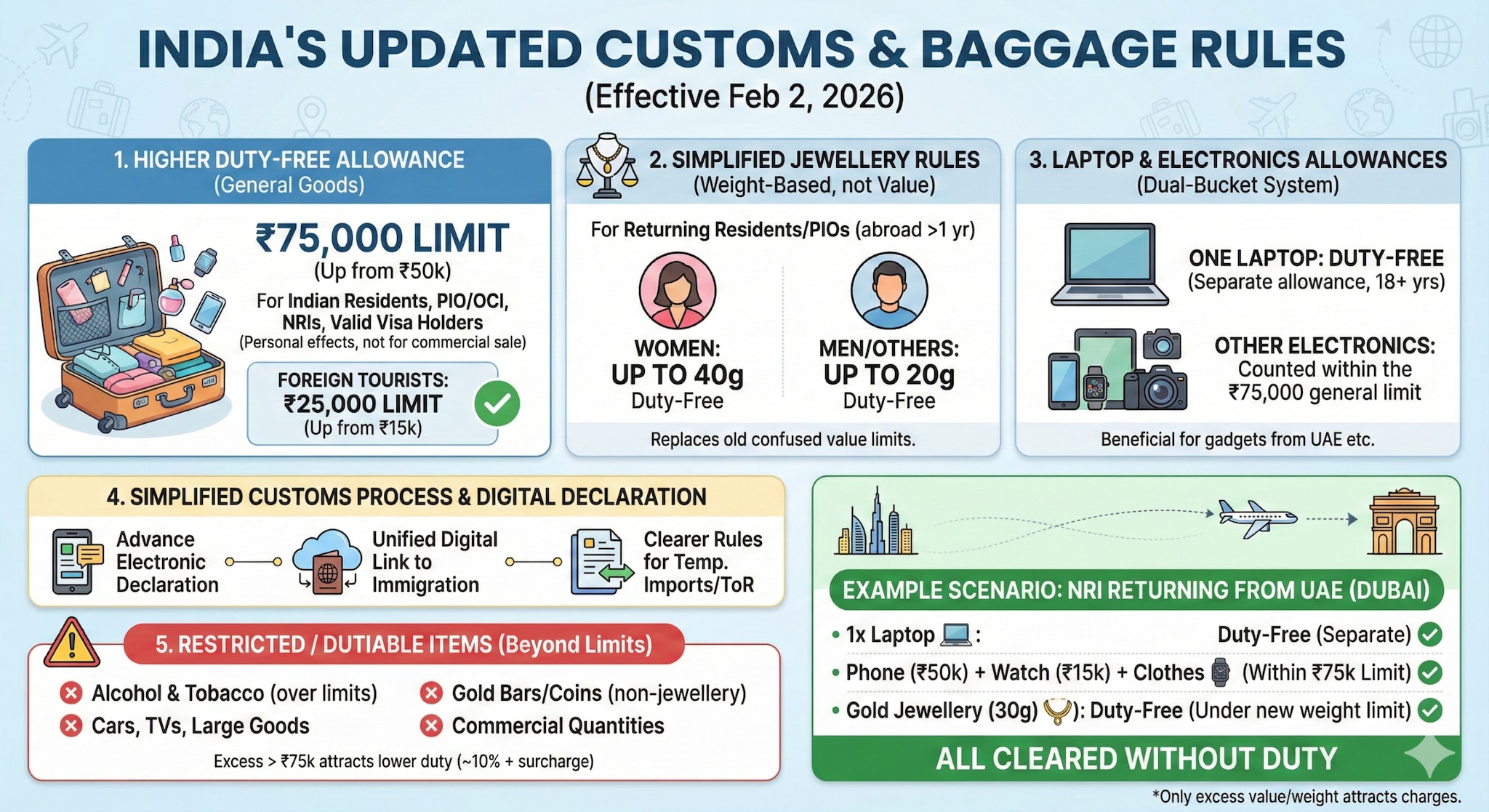

India’s Baggage Rules 2026 raise duty-free limits to Rs 75,000, introduce weight-based jewellery allowances, allow one laptop duty-free, and simplify customs for arrivals.

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

India has updated its customs and baggage rules affecting what international passengers, including people arriving from the UAE, can bring into the country without paying duty. These changes are part of the Baggage Rules, 2026, and the Customs Baggage (Declaration & Processing) Regulations, 2026, which came into effect from February 2, 2026, following announcements in the Union Budget 2026.

Here’s a detailed breakdown of what’s changed and what it means:

1. Higher Duty-Free Allowance for Personal Items

Passengers arriving by air or sea can now bring goods worth up to Rs 75,000 duty-free, higher than the Rs 50,000 limit earlier.

This limit applies to Indian residents, people of Indian origin (PIO/OCI), NRIs, and foreign nationals with valid visas. It covers personal effects and items carried in bona fide accompanied baggage — personal use items, not for commercial sale.

Foreign tourists have a separate duty-free cap of Rs 25,000 (up from Rs 15,000 earlier).

For crew members, the limit is Rs 2,500.

2. Simplified Jewellery Rules

The old value-based limits on jewellery imports have been replaced with weight-based allowances for returning residents/PIOs:

• Women: up to 40 grams of jewellery duty-free

• Men/Others: up to 20 grams duty-free

This applies to passengers who have stayed abroad for at least a year and are bringing jewellery in bona fide baggage.

Earlier, jewellery allowances were defined by value rather than weight, which often caused confusion and disputes at customs.

3. Laptop and Electronics Allowances

• One laptop can be brought in duty-free, separate from the Rs 75,000 general limit, for travellers aged over 18 years (excluding airline crew).

• Other electronics (smartphones, watches, cameras, etc.) are counted within the Rs 75,000 allowance.

This dual-bucket system (laptop + Rs 75,000 limit) is particularly beneficial for travellers bringing gadgets from the UAE, where prices are often lower.

4. Simplified Customs Process

The new regulations also introduce:

• Advance and electronic baggage declaration to streamline arrival processing.

• Unified digital declaration linked to immigration systems, reducing paperwork.

• Clearer rules around temporary imports / re-imports and Transfer of Residence (ToR) benefits for long-term expatriates.

5. What Still Requires Duty or Has Restrictions

Even under the new rules, certain items remain outside duty-free allowances and must be declared:

• Alcohol beyond allowed limits

• Tobacco products above the limits

• Cars, TVs, and other large goods

• Gold bars/coins or precious metals in non-jewellery form

• Commercial quantities of any item

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

Example (From UAE To India)

If an NRI returning from Dubai brings:

• One laptop: duty-free separate allowance

• A phone (Rs 50,000), watch (Rs 15,000) & clothes: these total Rs 65,000 — all duty-free within the Rs 75,000 limit

• Gold jewellery (30 g): duty-free under the new weight limits

The above would be cleared without duty. Only items or values above these thresholds may attract charges. However, for updated and item-specific rules, check customs rules from official government website.

February 08, 2026, 16:01 IST

Read More

Business

PM Kisan 22nd instalment update: Is farmer ID mandatory to receive Rs 2,000 payment?

New Delhi: Farmers across India are waiting for the 22nd instalment of the PM Kisan Samman Nidhi scheme, under which eligible beneficiaries receive Rs 2,000 directly in their bank accounts. While the government has not officially announced the release date, the next payment is expected between February and March 2026, based on the scheme’s usual schedule.

The PM Kisan scheme provides Rs 6,000 per year in three equal instalments to landholding farmer families through direct benefit transfer.

Farmer ID Requirement

A key update this year is the growing importance of the Farmer ID, which is being introduced as part of the government’s farmer-registry initiative. The ID is mandatory for new registrations in several states where the registry system has already started, though it may not yet be required everywhere in the country.

Authorities say the Farmer ID will help verify beneficiaries, prevent duplication, and ensure that financial assistance reaches genuine farmers.

e-KYC Still Essential

Along with the Farmer ID, e-KYC remains compulsory for all registered PM Kisan beneficiaries. Farmers who fail to complete e-KYC or update their records may face delays in receiving the next instalment.

The government has also introduced new methods such as OTP-based and facial-authentication e-KYC to make the process easier for farmers.

What Farmers Should Do

To avoid missing the next instalment, farmers should:

Complete e-KYC verification

Ensure Aadhaar is linked to their bank account

Update land and registration details

Obtain a Farmer ID if required in their state

-

Tech6 days ago

Tech6 days agoHow to Watch the 2026 Winter Olympics

-

Business6 days ago

Business6 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion6 days ago

Fashion6 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Entertainment6 days ago

Entertainment6 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Business1 week ago

Business1 week agoVideo: Who Is Trump’s New Fed Chair Pick?

-

Entertainment2 days ago

Entertainment2 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend