Business

How nervous are investors about the stock market?

Every week it seems US financial markets are hit by another bout of fear.

The latest worries spread this week from the banking sector in the US, after two regional lenders warned they would be hit by losses from alleged fraud.

But before that, markets swooned over signs of rekindled US-China tensions, as the two superpowers face off over tariffs, advanced technology and access to rare earths.

The bankruptcies of car parts supplier First Brands and subprime car lender Tricolor acted as a trigger for nervous chatter in September.

Over the last month, US shares, which had been climbing since their tariff-induced rout in April, have flattened.

But in many ways the market swings so far – down roughly 3% at the steepest – are not unusual.

Zooming out, the major indexes have still posted gains since the start of the year, with the S&P 500 up roughly 13%. That’s smaller than 2024 but still solid.

“The market has done surprisingly well so far this year … driven by an improvement in corporate profits and the enthusiasm surrounding AI,” says Sam Stovall, chief investment strategist at CFRA Research.

The resilience of the stock market is, ironically, exactly what is driving some of the jitters.

Put simply, when set against other standard metrics like profits, share prices in the US are very high.

Meanwhile, concerns about a possible bubble emerging in the artificial intelligence (AI) industry have generated a steady undercurrent of talk since the start of the year – discussions that have ramped up as analysts struggle to see how the vast sums of money the biggest players are throwing at one another all fit together.

The Bank of England warned recently of “stretched valuations” and rising risk of a “sharp market correction”.

Those concerns were echoed in remarks from JP Morgan Chase boss Jamie Dimon and to some extent US central bank chair Jerome Powell.

The International Monetary Fund was the latest to chime in this week.

“Markets appear complacent as the ground shifts,” it said in its financial stability report, which noted risks from trade tensions, geopolitical uncertainty and rising sovereign indebtedness.

James Reilley, senior markets economist at Capital Economics, said the market falls triggered by the regional banks were a sign of investors alert to risk and moving quickly to reduce exposure amid uncertainty about whether the losses were indicative of wider issues.

But he said the brief nature of the drops showed how quickly such worries could clear.

Many investors remain optimistic, with analysts at firms such as Goldman Sachs and Wells Fargo in recent weeks boosting their forecasts for where the S&P 500 might climb by the end of the year.

David Lefkowitz, head of US equities at UBS Global Wealth Management, said he thought a sharp sell-off was unlikely at a time when growth in the US remains solid and the US central bank is lowering borrowing costs.

He is expecting the S&P 500 to end the year hovering around 6,900 points, about 4% higher than where it sits on Friday.

While he acknowledged the troubles popping up at banks, he noted that the lenders involved have alleged fraud.

He said the overall picture, when looking at default levels, appears healthy, and he saw little risk that demand for AI would suddenly decline, puncturing valuations.

“I’m not saying we’re in a bubble. I’m not saying we’re not in a bubble. The question is what’s going to drive the downside,” he said. “Things don’t usually spontaneously decline.”

A typical bull market – when shares are rising – lasts about four and a half years, said Mr Stovall.

With inflation still sticky, and investors wary of events in Washington, like the government shutdown and Trump administration’s efforts to influence the US central bank, this year’s market rally has been “unloved”, said Mr Stovall.

On the other hand, he noted: “It’s just a matter of time. Corrections and bear markets have not been repealed. They might simply be delayed.”

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

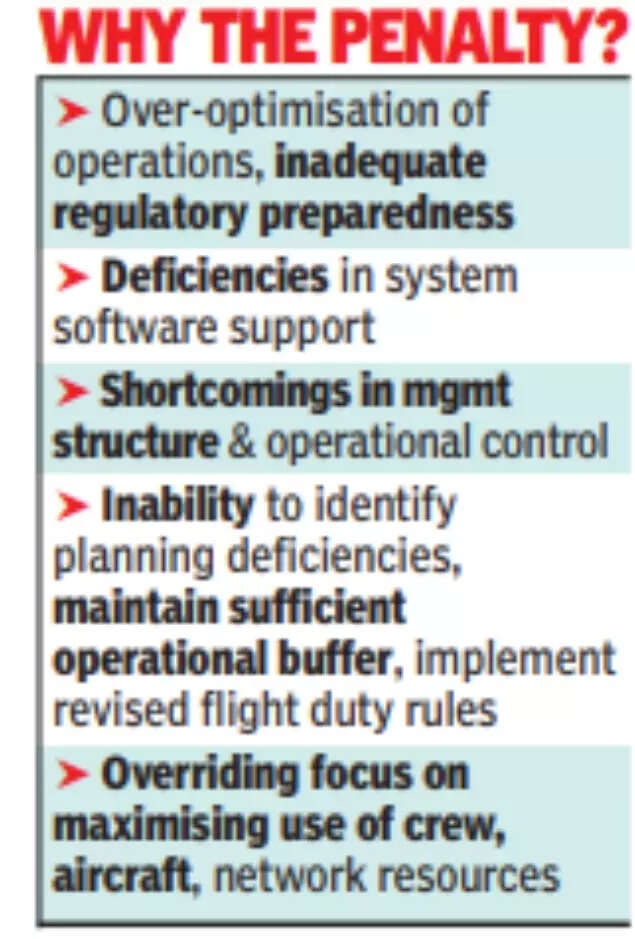

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

Business

Number of SMEs in Scotland down since 2020, figures from Lib Dems show

New figures from the Scottish Liberal Democrats show that small businesses have declined in Scotland since 2020.

The party’s economy spokesman, Jamie Greene MSP, has called on the SNP Government to urgently boost support for small businesses as he revealed significant drops in the number of small or medium-sized enterprises (SMEs) across Scotland.

Mr Greene asked the Scottish Government to provide the number of SMEs in every Scottish parliamentary constituency in each year since 2015.

The data showed that since 2020, the number of SMEs in Scotland has fallen from 177,020 to 171,660 – a decline of 5,360.

Over the past decade, 24 parliamentary constituencies have seen a fall in the number of SMEs, with notable declines in more rural parts of the country, according to the Scottish Liberal Democrats.

This includes a 13.8% fall in SMEs in constituencies across Aberdeen and Aberdeenshire since 2015, and an 8% fall in Caithness, Sutherland and Ross.

The Scottish Liberal Democrats have secured tens of millions in support for business in this year’s draft Scottish budget, including a new £2.5 million package backing young entrepreneurs and an initial £36 million for business rates relief.

Mr Greene said: “These figures show concerning drops in the number of small and medium-sized businesses across Scotland.

“I’ve spoken to lots of skilled and entrepreneurial people who feel there are too many barriers to starting their own business, from the SNP’s economic incompetence to the crushing burden of red tape.

“I am pleased that Scottish Liberal Democrats secured some support for businesses in the draft budget, but we think the Scottish Government can go further.

“That’s why, in the coming weeks, we will be squeezing the Scottish budget for every penny to deliver for businesses.”

Deputy First Minister Kate Forbes said: “Entrepreneurs and start-up companies are the backbone of our economy and the Scottish Government has been working systematically to develop the pipeline of support required to help them develop, grow and prosper.

“The facts show that we are making clear progress in establishing the right conditions to help business founders succeed.

“There was a 17.9% increase in Scottish start-up businesses in the first half of 2025, while investment deals in Scotland grew by 24% in the first half of 2025 compared to the second half of 2024.

“The Scottish Budget 2026-27 continues to support business, investment and a skilled workforce to accelerate economic growth, including record funding for our entrepreneurs and start-ups as we act to harness Scotland’s strengths and opportunities to drive long-term prosperity.”

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment5 days ago

Entertainment5 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship