Business

India-US Trade Framework To Accelerate India’s Semiconductor, Data Centre Push: Pan IIT Alumni India

Last Updated:

Pan IIT Alumni India says the framework signals deeper cooperation in critical and emerging technologies at a time when India is expanding its manufacturing base and digital infra.

This framework strengthens India’s position as a trusted manufacturing and innovation partner under the evolving China+1 strategy, the chairman of Pan IIT Alumni India said.

The interim India-US trade framework could significantly speed up India’s ambitions in semiconductors, data centres and advanced technology manufacturing, Pan IIT Alumni India has said. It added that the Union Budget 2026-27 has provided complementary domestic support to leverage the agreement.

Welcoming the joint statement issued by New Delhi and Washington, Pan IIT Alumni India said the framework signals deeper cooperation in critical and emerging technologies at a time when India is expanding its manufacturing base and digital infrastructure.

“The trade framework and the Union Budget together reflect a clear strategic alignment. India is building domestic capacity while expanding global technology partnerships,” said Prabhat Kumar, chairman of Pan IIT Alumni India.

The alumni body said improved access to advanced components and technologies comes at a crucial moment as India pushes semiconductor fabrication, packaging and design through production-linked incentive schemes and related manufacturing programmes.

“Today, everything runs on chips — from data centres and telecom networks to electric vehicles and defence systems. Stronger engagement with the US can help India move faster from design to manufacturing and packaging, while reducing supply chain risks,” Kumar said.

Pan IIT Alumni India noted that the Union Budget has reinforced the domestic ecosystem by continuing support for semiconductor manufacturing and accelerating digital infrastructure expansion. It pointed in particular to the proposed tax holiday until 2047 for foreign cloud service providers using Indian data centre infrastructure, a move aimed at attracting long-term global investment.

According to the alumni body, the trade framework improves access to advanced technology and markets, while the Budget strengthens India’s internal capabilities, together creating momentum for sustained growth in advanced manufacturing and digital infrastructure.

It added that startups and MSMEs stand to benefit from smoother cross-border collaboration, improved access to capital and deeper integration into global value chains. India’s large base of IIT alumni working across US technology companies, research institutions and venture funds could play a key role in facilitating partnerships, mentoring and market access.

“From electronics and EV components to defence and aerospace, reliability matters. This framework strengthens India’s position as a trusted manufacturing and innovation partner under the evolving China+1 strategy,” Kumar said.

Pan IIT Alumni India said its global network is well placed to translate the policy momentum into tangible outcomes by facilitating connections between industry, academia and policymakers, and by supporting technology partnerships and cross-border investments.

February 08, 2026, 14:49 IST

Read More

Business

Rooftops could turn into landing pads as India eyes air taxis to beat traffic

New Delhi: A new report by the Confederation of Indian Industry (CII) suggests that setting up a pilot air corridor connecting Gurugram, Connaught Place, and Jewar International Airport could help India reduce travel time from hours to minutes. The model is seen as a high-impact solution to urban traffic congestion and could be scaled up across the country.

The report, titled Navigating the Future of Advanced Air Mobility in India, was launched by Civil Aviation Minister Rammohan Naidu Kinjarapu. He said India’s aviation sector is moving toward a “high-tech, multi-dimensional mobility ecosystem.”

One of the key highlights of the report is the use of rooftops as landing and parking sites for electric air taxis, known as eVTOLs. This approach could turn existing buildings into revenue-generating assets. As acquiring land for ground-based landing pads is costly, rooftops offer a faster and more affordable way to launch such services in cities like Delhi, Mumbai, and Bengaluru.

“The integration of Advanced Air Mobility reflects our commitment to innovation, sustainability, and world-class urban connectivity,” said Union Minister Kinjarapu. He added that the report provides a “timely and practical blueprint to realise a faster, cleaner, and more connected India.”

However, the report notes that current regulations do not permit regular commercial rooftop operations. To address this, it recommends forming a dedicated team within the Directorate General of Civil Aviation (DGCA) to develop safety and operational standards for these emerging technologies.

Amit Dutta, Chairman of the CII Task Force on Advanced Air Mobility, said the study helps turn the concept into reality. “By analysing a hypothetical Delhi-NCR corridor through structured modelling and regulatory scenario testing, this study moves from concept to operational assessment,” he said, adding that it addresses key regulatory, infrastructure, and airspace challenges linked to early AAM pilots.

The report also recommends initially using drones to transport cargo and medical supplies over distances of 50–100 km. It suggests regions such as GIFT City and Andhra Pradesh as testing zones, where relaxed regulations could support faster adoption. To enable this growth, CII has urged banks and government agencies to create dedicated funding mechanisms for air mobility infrastructure.

Business

Gold, iPhone, Laptop From Dubai: How Much Can You Bring To India Without Paying Customs Duty?

Last Updated:

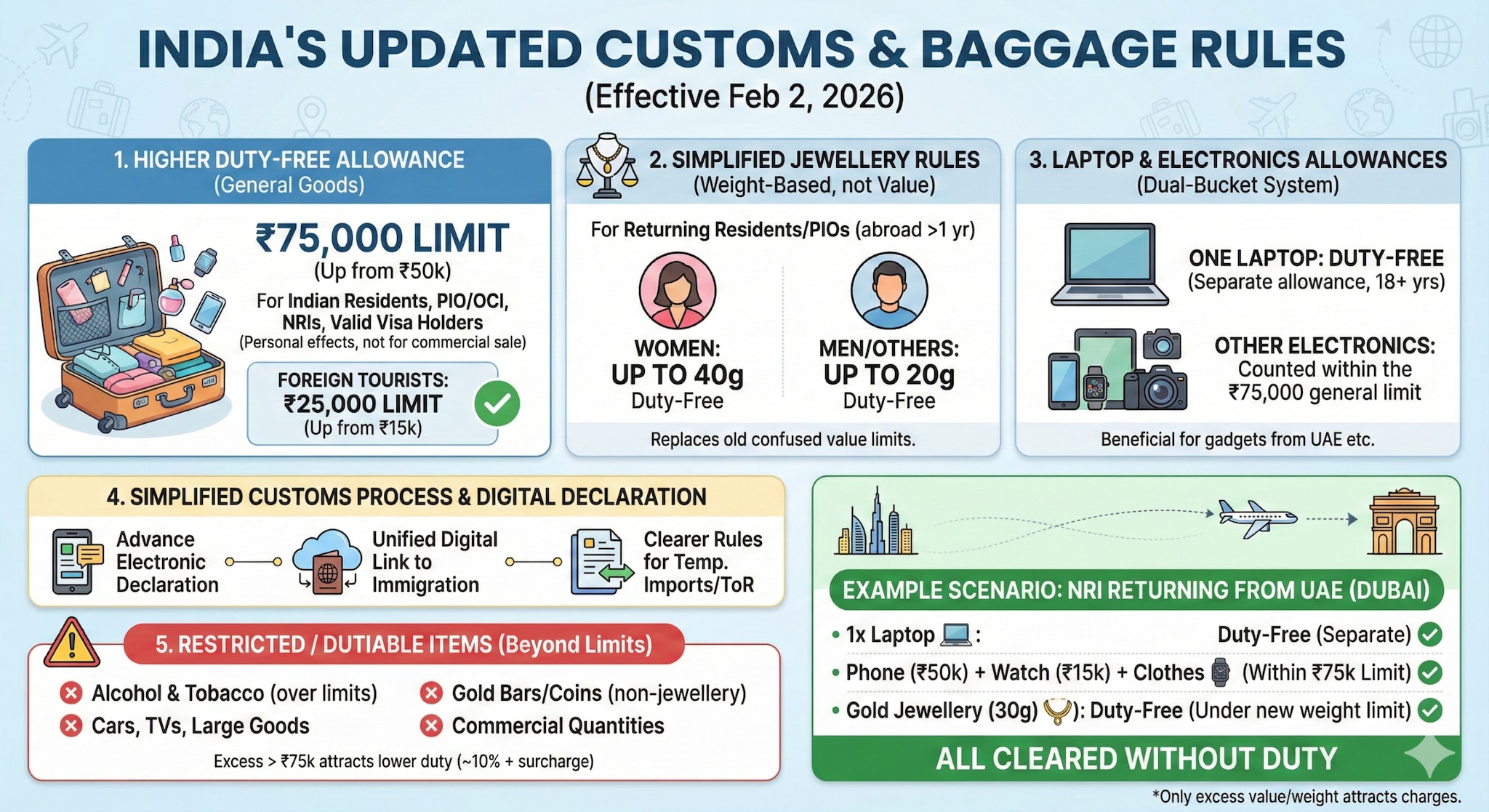

India’s Baggage Rules 2026 raise duty-free limits to Rs 75,000, introduce weight-based jewellery allowances, allow one laptop duty-free, and simplify customs for arrivals.

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

India has updated its customs and baggage rules affecting what international passengers, including people arriving from the UAE, can bring into the country without paying duty. These changes are part of the Baggage Rules, 2026, and the Customs Baggage (Declaration & Processing) Regulations, 2026, which came into effect from February 2, 2026, following announcements in the Union Budget 2026.

Here’s a detailed breakdown of what’s changed and what it means:

1. Higher Duty-Free Allowance for Personal Items

Passengers arriving by air or sea can now bring goods worth up to Rs 75,000 duty-free, higher than the Rs 50,000 limit earlier.

This limit applies to Indian residents, people of Indian origin (PIO/OCI), NRIs, and foreign nationals with valid visas. It covers personal effects and items carried in bona fide accompanied baggage — personal use items, not for commercial sale.

Foreign tourists have a separate duty-free cap of Rs 25,000 (up from Rs 15,000 earlier).

For crew members, the limit is Rs 2,500.

2. Simplified Jewellery Rules

The old value-based limits on jewellery imports have been replaced with weight-based allowances for returning residents/PIOs:

• Women: up to 40 grams of jewellery duty-free

• Men/Others: up to 20 grams duty-free

This applies to passengers who have stayed abroad for at least a year and are bringing jewellery in bona fide baggage.

Earlier, jewellery allowances were defined by value rather than weight, which often caused confusion and disputes at customs.

3. Laptop and Electronics Allowances

• One laptop can be brought in duty-free, separate from the Rs 75,000 general limit, for travellers aged over 18 years (excluding airline crew).

• Other electronics (smartphones, watches, cameras, etc.) are counted within the Rs 75,000 allowance.

This dual-bucket system (laptop + Rs 75,000 limit) is particularly beneficial for travellers bringing gadgets from the UAE, where prices are often lower.

4. Simplified Customs Process

The new regulations also introduce:

• Advance and electronic baggage declaration to streamline arrival processing.

• Unified digital declaration linked to immigration systems, reducing paperwork.

• Clearer rules around temporary imports / re-imports and Transfer of Residence (ToR) benefits for long-term expatriates.

5. What Still Requires Duty or Has Restrictions

Even under the new rules, certain items remain outside duty-free allowances and must be declared:

• Alcohol beyond allowed limits

• Tobacco products above the limits

• Cars, TVs, and other large goods

• Gold bars/coins or precious metals in non-jewellery form

• Commercial quantities of any item

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

Example (From UAE To India)

If an NRI returning from Dubai brings:

• One laptop: duty-free separate allowance

• A phone (Rs 50,000), watch (Rs 15,000) & clothes: these total Rs 65,000 — all duty-free within the Rs 75,000 limit

• Gold jewellery (30 g): duty-free under the new weight limits

The above would be cleared without duty. Only items or values above these thresholds may attract charges. However, for updated and item-specific rules, check customs rules from official government website.

February 08, 2026, 16:01 IST

Read More

Business

PM Kisan 22nd instalment update: Is farmer ID mandatory to receive Rs 2,000 payment?

New Delhi: Farmers across India are waiting for the 22nd instalment of the PM Kisan Samman Nidhi scheme, under which eligible beneficiaries receive Rs 2,000 directly in their bank accounts. While the government has not officially announced the release date, the next payment is expected between February and March 2026, based on the scheme’s usual schedule.

The PM Kisan scheme provides Rs 6,000 per year in three equal instalments to landholding farmer families through direct benefit transfer.

Farmer ID Requirement

A key update this year is the growing importance of the Farmer ID, which is being introduced as part of the government’s farmer-registry initiative. The ID is mandatory for new registrations in several states where the registry system has already started, though it may not yet be required everywhere in the country.

Authorities say the Farmer ID will help verify beneficiaries, prevent duplication, and ensure that financial assistance reaches genuine farmers.

e-KYC Still Essential

Along with the Farmer ID, e-KYC remains compulsory for all registered PM Kisan beneficiaries. Farmers who fail to complete e-KYC or update their records may face delays in receiving the next instalment.

The government has also introduced new methods such as OTP-based and facial-authentication e-KYC to make the process easier for farmers.

What Farmers Should Do

To avoid missing the next instalment, farmers should:

Complete e-KYC verification

Ensure Aadhaar is linked to their bank account

Update land and registration details

Obtain a Farmer ID if required in their state

-

Tech6 days ago

Tech6 days agoHow to Watch the 2026 Winter Olympics

-

Business7 days ago

Business7 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion6 days ago

Fashion6 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Entertainment7 days ago

Entertainment7 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Entertainment2 days ago

Entertainment2 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business7 days ago

Business7 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV