Business

Indian Stock Markets Dip 2.2% Amid Tariff Concerns; Q1 GDP Growth To Provide Buffer

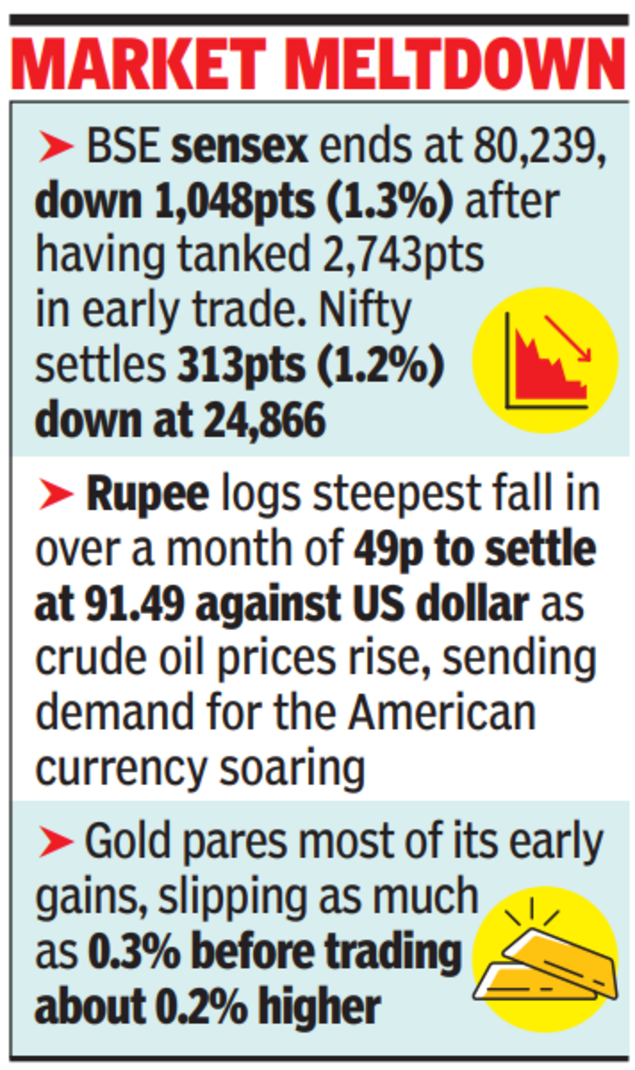

Mumbai: The Indian equities closed sharply lower this week, as initial optimism in markets faded due to ongoing selling pressure from FII outflows amid US tariff concerns.

Benchmark indices Nifty and Sensex ended the week with a loss of over 2.2 per cent. Profit-booking was evident in metals, IT, realty, and auto, which shed between 0.5 per cent and 1.5 per cent.

In contrast, Capital Goods, Consumer Durables, Media, and FMCG, posted gains between 0.4 per cent and 1 per cent. Broader markets underperformed, with the Nifty Midcap 100 and Nifty Small cap 100 indices declining by 0.57 per cent and 0.39 per cent, respectively.

(Also Read: Key Financial Rules Changing From September 2025)

Markets opened positively this week, driven by a proposed GST rationalisation, a favourable monsoon outlook, and global factors like easing US bond yields and potential Fed rate cuts in September.

However, caution set in ahead of the US penalty tariff deadline, sparking broad-based selling which led to three consecutive sessions in red zone. Analysts said that subsequent imposition of tariffs on Indian goods further dented confidence, driving profit booking across sectors.

“Large caps declined, while mid- and small caps saw sharper losses on stretched valuations and heightened uncertainty,” said Vinod Nair, Head of Research, Geojit Investments Limited.

(Also Read: What Is GST Compensation Cess? GST Council May End It By October 31)

Looking ahead, India’s strong Q1 GDP print driven by government spending and policy measures, may provide a buffer against external headwinds, though fiscal concerns remain. A resolution of tariff disputes may boost market sentiment, but the reciprocal 25 per cent tariff is likely to stay in effect in the near to medium term, he added.

Sectors likely to be affected include textiles, equipment manufacturers, metals, auto, and seafood. IT and Pharma may experience sentiment pressure, although they are not directly impacted by the tariffs.

India’s economy shattered expectations in the April-June 2025 quarter, racing ahead with a remarkable 7.8 per cent real GDP growth.

“Investors should keep a close watch on upcoming domestic and US macro data, including PMI prints, jobless claims, payrolls, and unemployment figures, for further insights,” Nair added.

“Nifty has an immediate support base placed at 24,400-24,350 levels, being the confluence of the recent lows and the key retracement area. Index holding above this level will lead to a consolidation in the range of 24,400-24,900,” Bajaj Broking research said in a release.

Markets are epected to show a mixed trend in near term. Analysts said that sectors focused on consumption and domestic growth, including FMCG, Durables, Discretionary, Cement, and Infrastructure, are likely to benefit from GST cuts, strong demand, and increased government spending.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

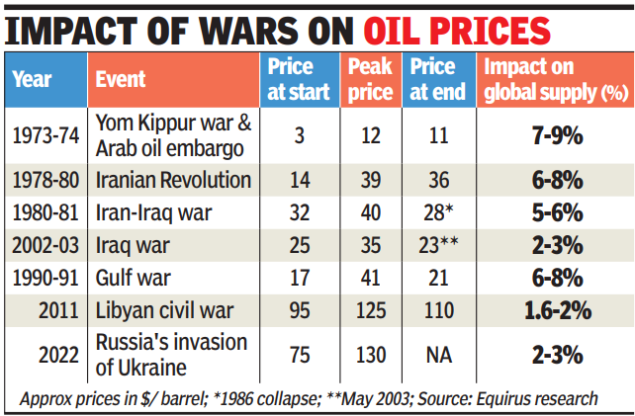

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%

-

Sports1 week ago

Sports1 week agoSouth Africa thrash India by 76 runs in T20 World Cup Super 8 – SUCH TV

-

Business1 week ago

Business1 week agoGovt to return unclaimed EPFO deposits, expand scholarships for unorganised workers’ children – The Times of India