Business

Is Pakistan ready to seize US export opportunity? | The Express Tribune

ISLAMABAD:

The United States is undergoing a major overhaul of its trade policies, triggering a broader reshaping of global supply chains. Steep tariff hikes on key exporters like China, India and Brazil are forcing US importers to rethink their sourcing strategies.

This disruption presents a rare and valuable opening for countries like Pakistan to step in and gain market share. With Chinese and Indian exports facing average tariffs of 50% or more, Pakistan’s comparatively low 19% tariff offers a clear competitive edge. The critical question is whether Pakistan is prepared to seize this moment.

American importers are already shifting supply chains away from high-tariff countries, creating new opportunities for agile exporters. Pakistan, with its recent economic reforms reducing input costs and facilitating capital goods imports, is uniquely positioned to capitalise on this trade realignment.

After years of stagnant exports, this market disruption presents a critical window to gain foothold in vacated market segments, particularly where Pakistan’s newly enhanced cost competitiveness can deliver immediate advantages.

Pakistan’s current strongest export position in the US lies in textiles and apparel, where it ships over $5 billion of goods annually. By comparison, China exports $40 billion — apparel about $24 billion and textiles $16 billion — and India $9 billion with a balanced 50-50 split between apparel and textiles.

Even a modest redirection of orders from these countries to Pakistan could generate significant gains. The textile sector, given its existing base and infrastructure, remains the most immediate area where Pakistan could scale up exports quickly.

In addition to textiles and clothing, several other sectors show promise. Pakistan’s leather exports to the US currently stand at $171 million, while its global leather exports total $710 million, highlighting that the country is competitive in this sector.

Similarly, the sports goods industry, known for its world-class football manufacturing, has exports nearing $400 million and is well-positioned to grow with improved branding and market access. The recent emergence of truck and bus radial tyres as an export item to the US is another bright spot. With exports surpassing $100 million last year and over 20% year-on-year growth, it reflects the kind of momentum that can be built with the right focus.

Pakistan’s mobile assembly sector represents one of its most glaring missed industrial opportunities. While India’s mobile exports to the US surged to $7.5 billion in FY 2024-25, fuelled by China tariff diversions, Pakistan’s $160 million in annual exports remain confined to low-end markets, despite sharing similar starting conditions.

The 2020 Mobile Device Manufacturing Policy attracted 26 assemblers through component duty exemptions and local market protection, driving import substitution (90% of domestic demand). However, this inward-focused model, which failed spectacularly in the auto sector, continues to stifle export potential. Component imports now consume $1.5-2 billion annually without generating meaningful foreign exchange as assemblers prioritise lucrative domestic sales over competitive global integration.

The need for change is particularly critical in the engineering goods sector where Indian exports to the US are about $18 billion, or 28% of their exports, as compared to Pakistan’s less than $0.5 billion, or about 7% of its exports. This sector must be freed from the outdated import substitution mindset still embedded within the relevant government institutions.

This is a missed opportunity not just economically but also strategically, as engineering-led exports can help Pakistan diversify its trade base and reduce over-reliance on traditional low value-added sectors. If this sector is freed from micromanagement of government agencies, it could become a key driver of export growth and industrial upgrading.

The global trade order is experiencing its most profound transformation in a generation, presenting Pakistan with a critical opportunity to reshape its economic future. Bold reforms in this year’s budget, particularly tariff rationalisation, are already yielding promising results: a record 17% monthly export surge and 42% growth in customs and other taxes on imports, marking the highest single-month gains in recent history.

While it’s premature to draw long-term conclusions from one month’s data, these early indicators align with economic modelling that predicted benefits from greater openness, validating the reform direction. Critics who focus narrowly on deficits overlook a fundamental truth of development economics: strategic short-term deficits have consistently served as necessary investments for emerging economies to achieve lasting prosperity, as demonstrated by the trajectories of China, Vietnam and other success stories.

The writer is a member of the steering committee on US tariffs. Previously he served as Pakistan’s ambassador to WTO and FAO’s representative to the United Nations

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

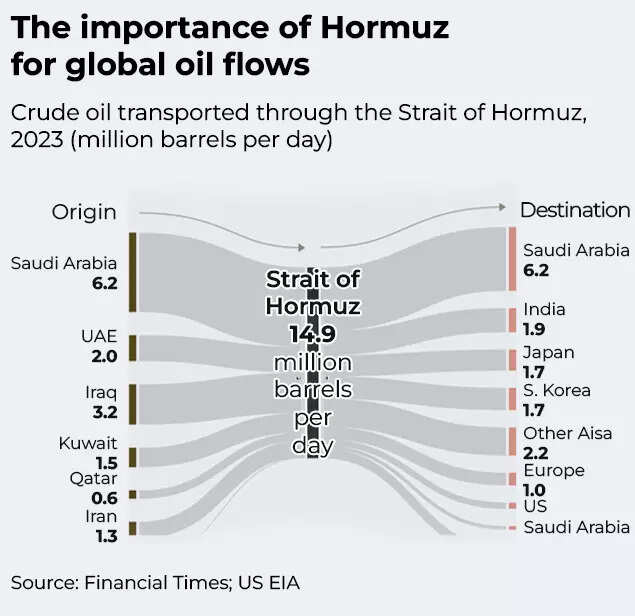

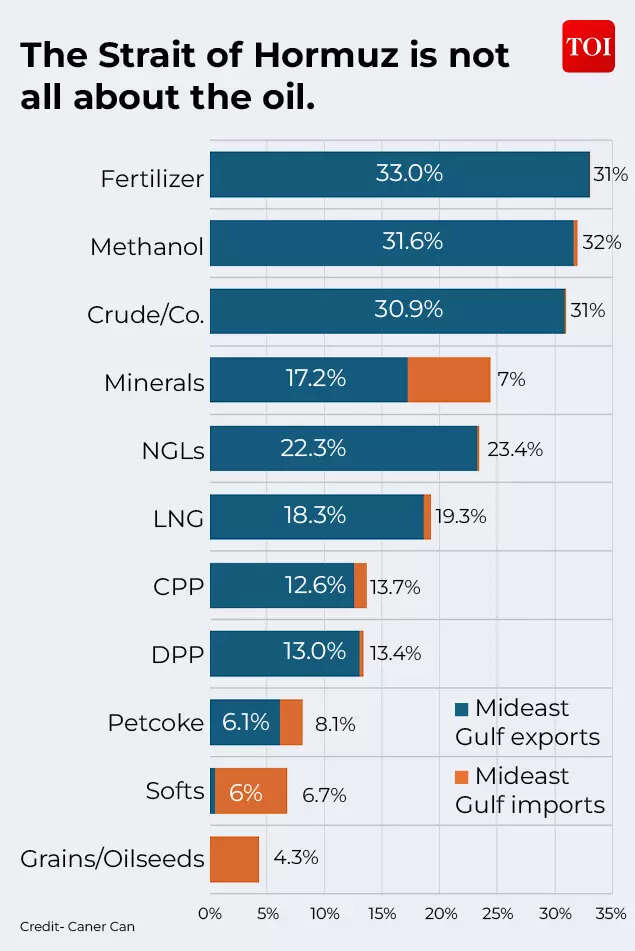

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

Business

Asian stocks today: Markets inch higher mirroring Wall Street gains; Kospi jumps 10%, Nikkei up 1,400 points – The Times of India

Asian stocks inched higher on Thursday, after days of trading in red amid ongoing Middle East tensions. This comes as equities were lifted by a rebound on Wall Street as oil prices paused their recent spike and economic updates painted a more positive picture of the American economy. In South Korea, Kospi hit a pause on its downward rally to add a whopping 10% or 513 points, to reach 5,606. Japan’s Nikkei 225 also climbed 2.7% to 55,713. Hong Kong’s HSI also traded in green, rising 353 points to 25,603 as of 9:10 am. Shanghai and Shenzhen added 0.9% and 1.7% respectively. Gains elsewhere in the region were more modest. Australia’s S&P/ASX 200 added 0.3% to 8,927.20, while New Zealand’s benchmark index moved 0.9% higher. In contrast, US futures indicated a subdued start ahead. Futures linked to the Dow Jones Industrial Average were almost unchanged, while S&P 500 futures ticked up 0.2%. The S&P 500 advanced 0.8% on Wednesday, clawing back much of the decline seen since the onset of the Iran conflict. The Dow Jones Industrial Average rose 0.5%, and the Nasdaq Composite outperformed with a 1.3% gain. Globally, market sentiment has remained sensitive to developments in the Middle East, with oil price swings continuing to steer trading direction. Crude prices eased during Wednesday’s session. Brent crude briefly moved above $84 a barrel before settling at $81.40, roughly matching the previous day’s level. US benchmark crude edged up 0.1% to finish at $74.66 per barrel. By early Thursday, however, oil was on the rise again. Brent crude climbed 2.4% to $83.32 per barrel, while U.S. benchmark crude jumped 2.5% to $76.53 per barrel.

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026